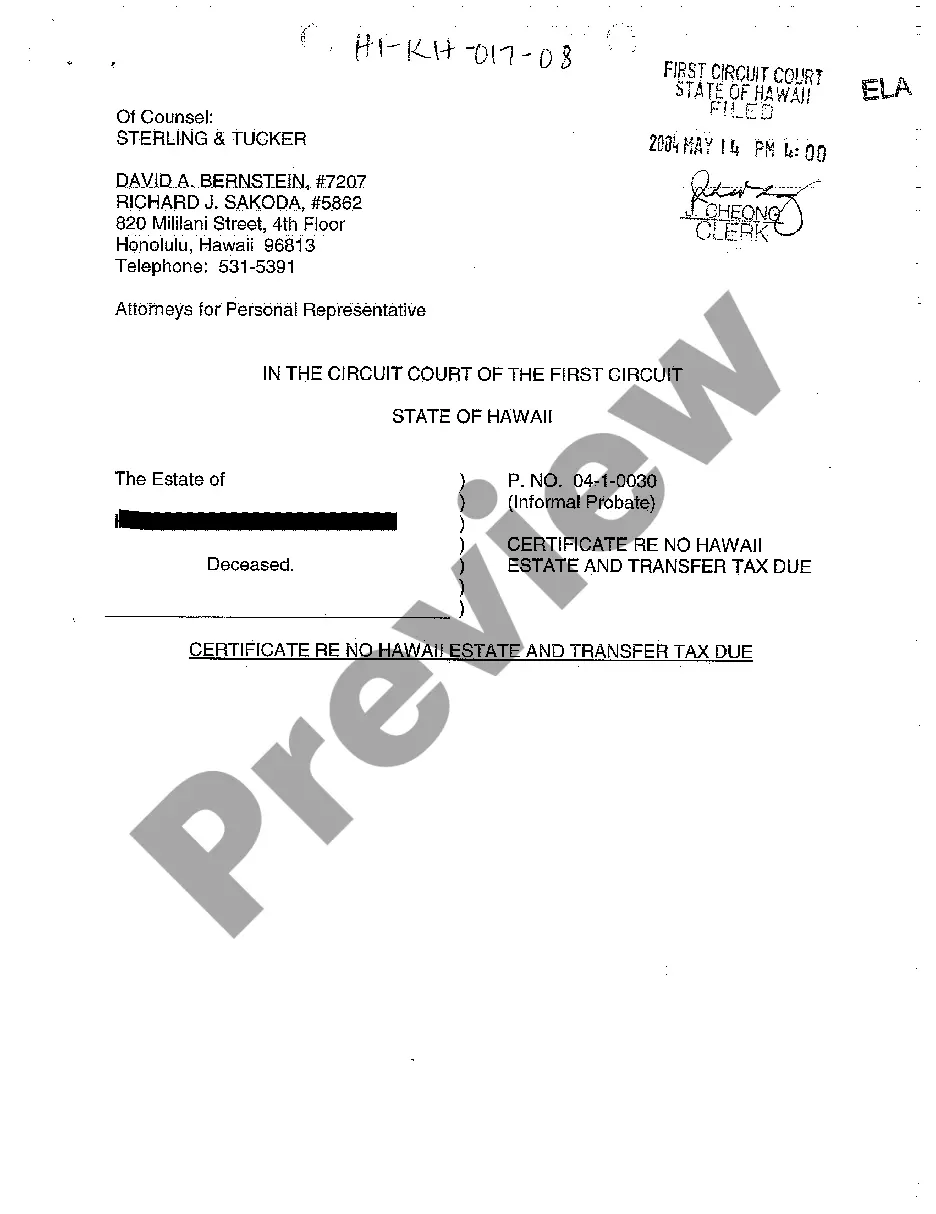

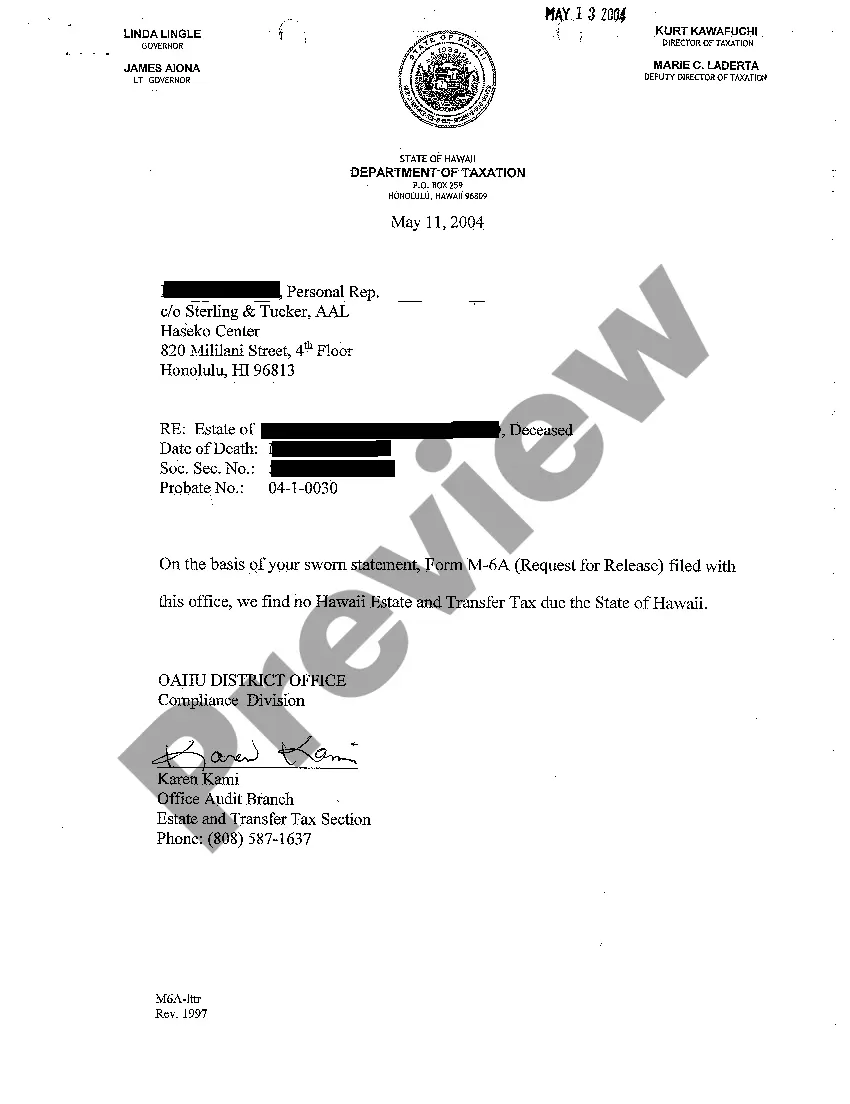

Certificate Re No Hawaii Estate and Transfer Tax Due

Description

How to fill out Certificate Re No Hawaii Estate And Transfer Tax Due?

Among countless free and paid templates that you’re able to find on the net, you can't be certain about their accuracy. For example, who made them or if they’re competent enough to take care of the thing you need them to. Always keep calm and use US Legal Forms! Find Certificate Re No Hawaii Estate and Transfer Tax Due samples made by professional lawyers and avoid the costly and time-consuming process of looking for an attorney and after that paying them to draft a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button near the file you are trying to find. You'll also be able to access all your earlier saved documents in the My Forms menu.

If you’re using our platform for the first time, follow the guidelines below to get your Certificate Re No Hawaii Estate and Transfer Tax Due fast:

- Make sure that the file you discover is valid where you live.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another sample using the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

As soon as you’ve signed up and paid for your subscription, you may use your Certificate Re No Hawaii Estate and Transfer Tax Due as many times as you need or for as long as it continues to be active where you live. Change it with your favorite editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

You must file Form 1041 (U.S. Income Tax Return for Estates and Trusts) by the 15th day of the fourth month after the tax year-end (adjusted for weekends and holidays). So for a person who died in 2018, the deadline is April 15, 2019, when the standard Dec. 31 tax year-end is chosen.

Generally, taxpayers file Form 706 to report estate and/or Generation Skipping Tax (GST) within 9 months after the date of the decedent's death. If unable to file Form 706 by the due date, the taxpayer may request a 6-month extension of time to file by filing Form 4768.

The due date of the estate tax return is nine months after the decedent's date of death, however, the estate's representative may request an extension of time to file the return for up to six months.

Form 706 must generally be filed along with any tax due within nine months of the decedent's date of death.

The IRS issues estate tax closing letters upon request of an authorized person only after an estate tax return (generally, Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return) has been accepted by the IRS (1) as filed, (2) after an adjustment to which the estate has agreed, or (3) after an

If the decedent is a U.S. citizen or resident and decedent's death occurred in 2016, an estate tax return (Form 706) must be filed if the gross estate of the decedent, increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the

While the change provides a major opportunity to pass on a substantial part of your wealth tax-free, there is a catch: It is a limited-time offer. This increase in the estate tax exemption is set to sunset at the end of 2025, meaning the exemption will likely drop back to what it was prior to 2018.

Is the new, higher estate tax exemption permanent? No, in 2026 the estate tax exemption reverts to $5 million again, adjusted for inflation, unless politicians adjust the law.

Hawaii is has no inheritance tax, but it is one of 12 states with an estate tax.