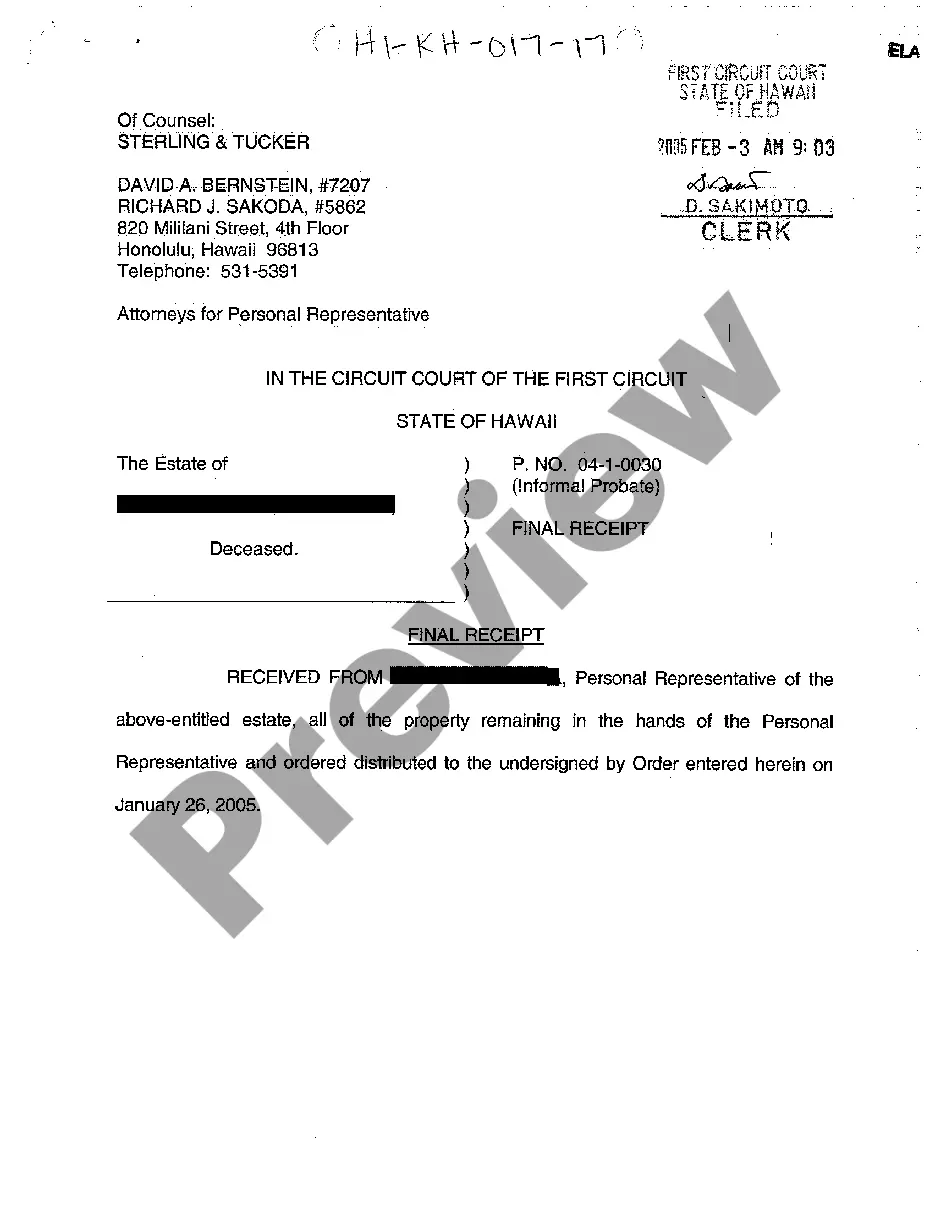

Hawaii Final Receipt

Description

How to fill out Hawaii Final Receipt?

Among numerous paid and free examples that you can get on the web, you can't be sure about their accuracy and reliability. For example, who created them or if they’re skilled enough to take care of what you require these people to. Always keep calm and utilize US Legal Forms! Get Hawaii Final Receipt samples made by professional legal representatives and get away from the costly and time-consuming process of looking for an attorney and then paying them to write a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button next to the form you are looking for. You'll also be able to access your earlier saved samples in the My Forms menu.

If you are making use of our platform the very first time, follow the guidelines listed below to get your Hawaii Final Receipt easily:

- Make sure that the file you discover is valid in the state where you live.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or look for another template using the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

Once you’ve signed up and bought your subscription, you can use your Hawaii Final Receipt as often as you need or for as long as it continues to be active in your state. Change it in your favored editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

To file online, use Hawaii Unemployment Insurance (HUI) Express. To file on paper, use Form UC-B6, Employer's Quarterly Wage, Contribution and Employment and Training Assessment Report. DLIR mails four of these forms, one for each quarter, at the beginning of each year to employers who file on paper.

Hawaii does not have a sales tax; instead, we have the GET, which is assessed on all business activities. The tax rate is 0.15% for Insurance Commission, 0.5% for Wholesaling, Manufacturing, Producing, Wholesale Services, and Use Tax on Imports For Resale, and 4% for all others.

In addition to form G-45, Hawaii General Excise Taxpayers must complete form G-49 (Annual Return & Reconciliation of General Excise / Use Tax Return) once a year.Form G49 is designed to give you credit for all of the taxes you paid, so if your gross income number is smaller than as expected, you may even get a refund.

Gross receipts are broadly defined in division (F) of section 5751.01 of the Revised Code as the total amount realized by a person, without deduction for the cost of goods sold or other expenses incurred, that contributes to the production of gross income of the person, including the fair market value of any

General Excise Tax (GET) Businesses are subject to GET on their gross receipts from doing business in Hawaii. Gross receipts are total business income before any business expenses are deducted.

State Releases Updated Unemployment Insurance Information Claimants can review the correct way to do this at https://labor.hawaii.gov/ui/main/reactivate-your-claim-and-report-job-seperation/ before filing their weekly claim certification, said Acting Director Anne Eustaquio.

Call Center: (833) 901-2272 or (808)-762-5751. CAll Center: (833) 901-2275 or (808)-762-5752.

Introduction. Gross receipts taxes are applied to receipts from a firm's total sales. Unlike a corporate income tax, these taxes apply to the firm's sales without deductions for a firm's costs. They are not adjusted for a business' profit levels or expenses and apply to all transactions a business makes.

File a new claim, additional claim or reactivate an existing claim. File weekly claim certifications. Change your mailing address. View payment history. Claim inquiry. Receive email confirmation, instructions and important notices.