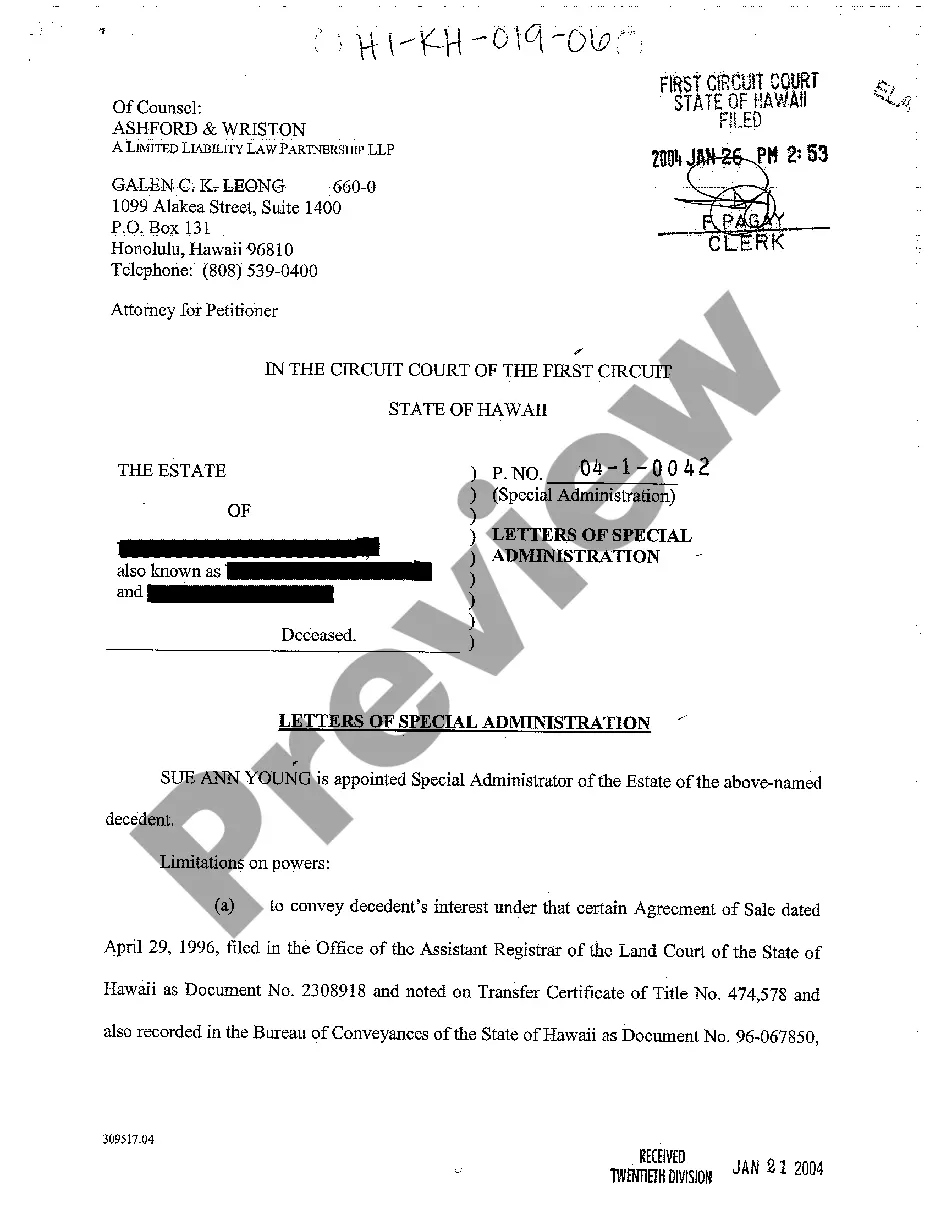

Hawaii Letters of Special Administration

Description Letter Of Testamentary Example

How to fill out Hawaii Letters Of Special Administration?

Among lots of free and paid samples that you can find on the internet, you can't be certain about their accuracy and reliability. For example, who made them or if they’re skilled enough to deal with the thing you need these people to. Always keep relaxed and use US Legal Forms! Get Hawaii Letters of Special Administration templates developed by skilled legal representatives and prevent the expensive and time-consuming process of looking for an lawyer or attorney and after that having to pay them to draft a document for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the file you are looking for. You'll also be able to access your earlier acquired templates in the My Forms menu.

If you are using our website the first time, follow the instructions below to get your Hawaii Letters of Special Administration with ease:

- Make sure that the file you discover applies in your state.

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another template using the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

When you’ve signed up and bought your subscription, you can utilize your Hawaii Letters of Special Administration as many times as you need or for as long as it stays valid in your state. Edit it with your favored offline or online editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Subject to the provisions of this article, a person in the following relation to the decedent is entitled to appointment as administrator in the following order of priority: (a) Surviving spouse or domestic partner as defined in Section 37. (b) Children. (c) Grandchildren.

A Special administrator is a court-appointed person who administrates a court-defined part of an estate during probate.A special administrator can also oversee an entire estate, albeit for a limited time (in case of emergency).

The appointment of a special administrator is a special, temporary situation where a person is appointed to do the limited tasks of checking into a decedent's assets, accounting the assets, marshaling the assets, protecting the assets, and/or acting as a real party in interest in lawsuits involving the estate.

How long does probate take? California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.

Letters of Administration are granted by a Surrogate Court or probate registry to appoint appropriate people to deal with a deceased person's estate where property will pass under Intestacy Rules or where there are no executors living (and willing and able to act) having been validly appointed under the deceased's will

To do this, you must file a Petition for Probate (form DE-111. NOTE: If there is no will and a court case is needed, the court will appoint an administrator to manage the estate during the probate process.