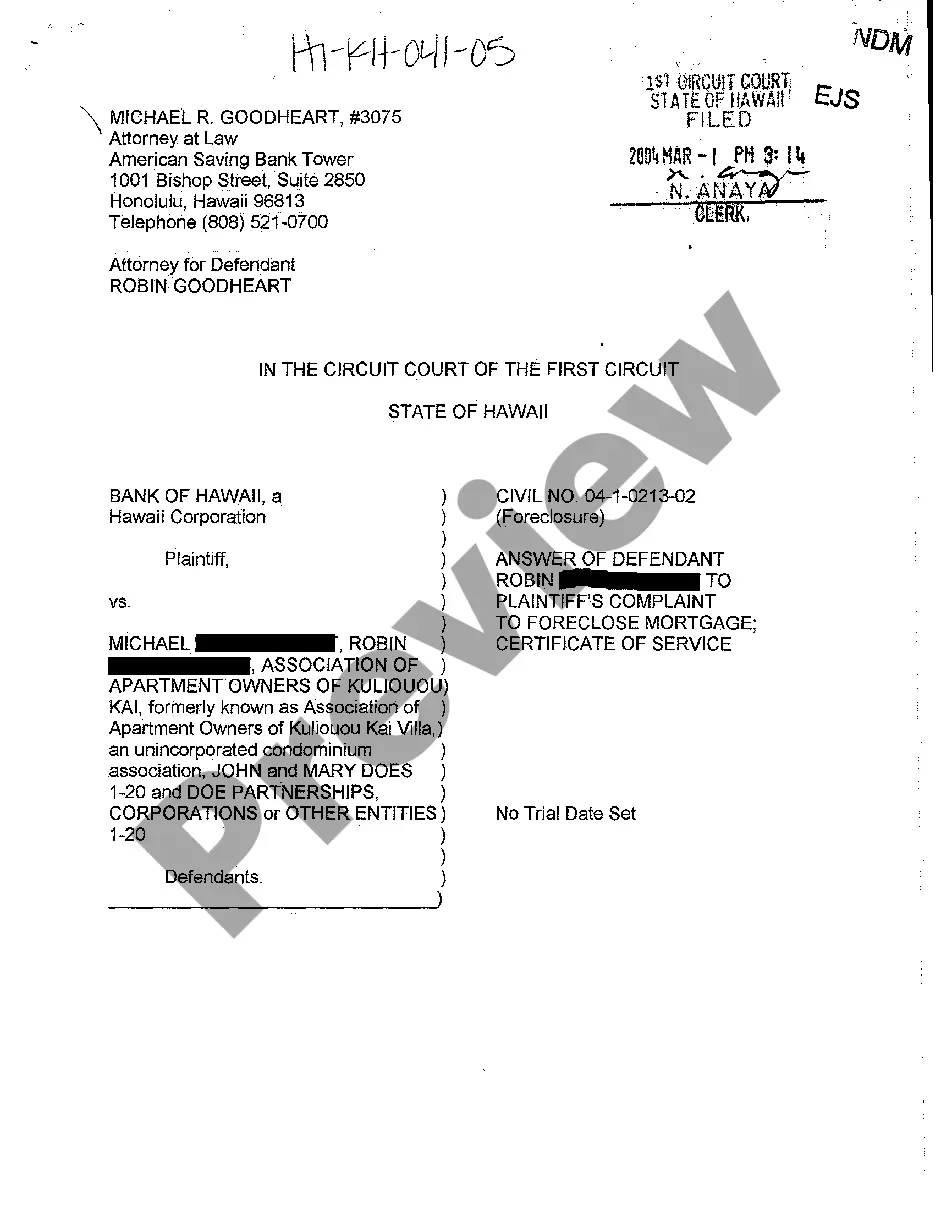

Hawaii Answer of Defendant to Plaintiff's Complaint to Foreclose Mortgage

Description

How to fill out Hawaii Answer Of Defendant To Plaintiff's Complaint To Foreclose Mortgage?

Among lots of paid and free examples that you find online, you can't be certain about their accuracy. For example, who made them or if they’re skilled enough to take care of the thing you need those to. Always keep relaxed and utilize US Legal Forms! Get Hawaii Answer of Defendant to Plaintiff's Complaint to Foreclose Mortgage templates created by skilled attorneys and avoid the costly and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to write a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you’re seeking. You'll also be able to access your previously saved files in the My Forms menu.

If you’re using our service the very first time, follow the guidelines listed below to get your Hawaii Answer of Defendant to Plaintiff's Complaint to Foreclose Mortgage fast:

- Make sure that the file you find applies where you live.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another template utilizing the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

As soon as you have signed up and purchased your subscription, you can utilize your Hawaii Answer of Defendant to Plaintiff's Complaint to Foreclose Mortgage as often as you need or for as long as it remains valid where you live. Change it with your favorite editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Reinstatement. Ask the lender to reinstate the loan. Forbearance Agreement. Ask the lender to forgive the debt. Refinance. Sell your home. Short Sale. LLoan modification. Deed in Lieu of Foreclosure. Rescission of loan.

In rare circumstances, you can get a court to set aside (invalidate) a foreclosure sale. Sometimes homeowners aren't aware that a foreclosure sale has been scheduled until after it's already been completed. Even if your home has been sold, you might, in rare circumstances, be able to invalidate the sale.

Negotiate With Your Lender. If you are having financial difficulties, the worst thing that you can do is bury your head in the sand. Request a Forbearance. Modify Your Loan. Make a Claim. Get a Housing Counselor. Declare Bankruptcy. Use A Foreclosure Defense Strategy. Make Them Produce The Not.

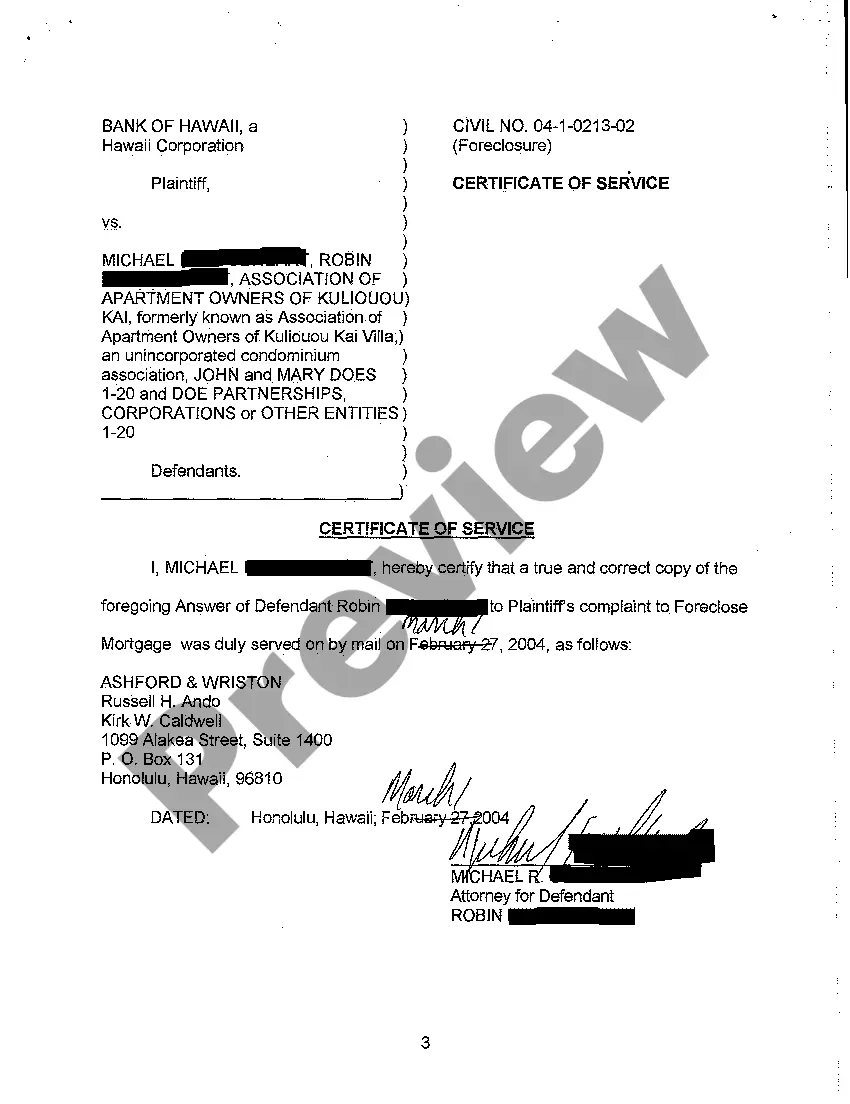

In 22 states, foreclosures are typically accomplished through civil lawsuits and judicial foreclosure orders. The borrower receives a foreclosure complaint and notice of a hearing. In most cases, the hearing is very short because the judge need only determine that the debt is valid and that the borrower is in default.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

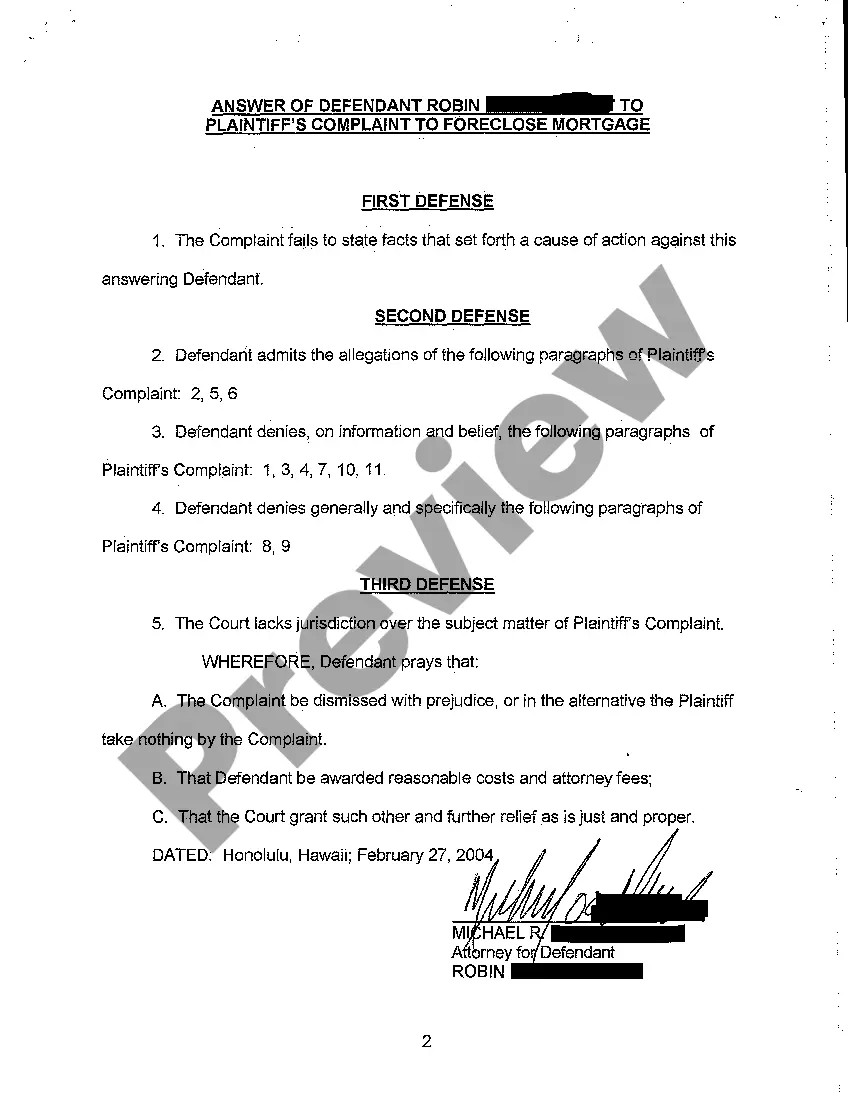

To contest a judicial foreclosure, you have to file a written answer to the complaint (the lawsuit). You'll need to present your defenses and explain the reasons why the lender shouldn't be able to foreclose. You might need to defend yourself against a motion for summary judgment and at trial.

In a judicial foreclosure, the lender files a lawsuit against you in court.So, you'll get the chance to file an answer in a judicial foreclosure, but not in a nonjudicial one. If you want to fight a nonjudicial foreclosure in court, you'll have to start your own lawsuit.

Deficiency Judgments and Nonjudicial Foreclosures in California.Because almost all residential foreclosures in California are nonjudicial, most borrowers won't face a deficiency judgment after the foreclosure.

To get the deficiency judgment, the bank has to file an application with the court within three months of the foreclosure sale. The judge will then hold a fair value hearing to determine the property's value.