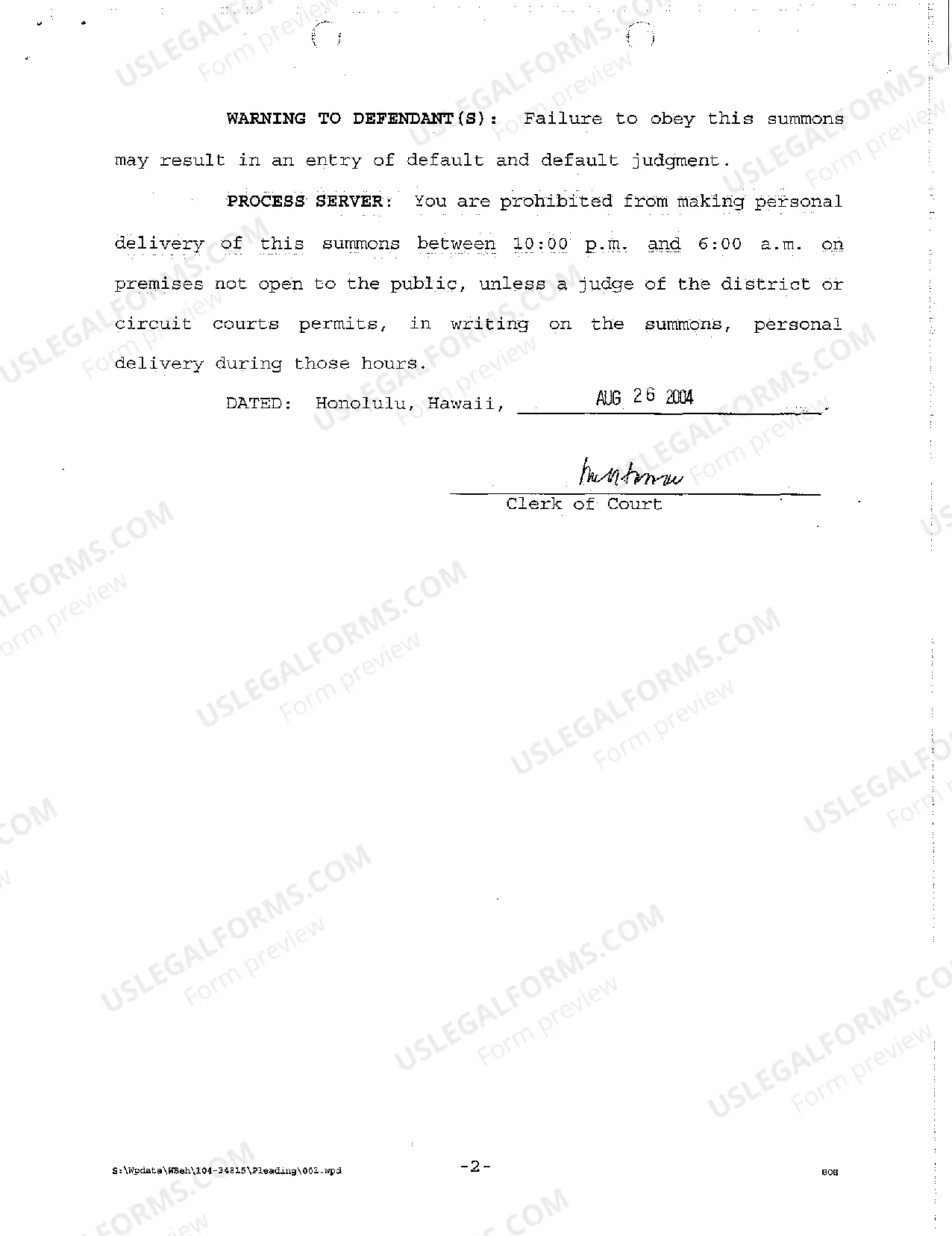

Hawaii Complaint to Foreclose Mortgage

Description

How to fill out Hawaii Complaint To Foreclose Mortgage?

Among lots of free and paid samples which you find on the web, you can't be certain about their accuracy. For example, who made them or if they’re competent enough to take care of the thing you need these to. Always keep calm and make use of US Legal Forms! Get Hawaii Complaint to Foreclose Mortgage templates made by skilled lawyers and get away from the high-priced and time-consuming procedure of looking for an lawyer and after that having to pay them to write a papers for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button near the form you are searching for. You'll also be able to access your previously saved samples in the My Forms menu.

If you’re utilizing our website for the first time, follow the instructions below to get your Hawaii Complaint to Foreclose Mortgage quick:

- Make sure that the document you see is valid in the state where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another example utilizing the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

Once you have signed up and paid for your subscription, you may use your Hawaii Complaint to Foreclose Mortgage as many times as you need or for as long as it remains active in your state. Revise it in your favored editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

In most states, lenders are required to provide a homeowner with sufficient notice of default. The lender must also provide notice of the property owner's right to cure the default before the lender can initiate a foreclosure proceeding. Written proof of money owed under the mortgage.

Home mortgagesthough generally recourseare non-recourse in 12 states: Alaska, Arizona, California, Connecticut, Idaho, Minnesota, North Carolina, North Dakota, Oregon, Texas, Utah and Washington.

In Hawaii, most homeowners who stop making their mortgage payments will face a judicial foreclosure. In the past, the majority of foreclosures in Hawaii were nonjudicial. But lenders switched to judicial foreclosures to bypass Hawaii's Mortgage Foreclosure Dispute Resolution (MFDR) program.

Keep in mind, your mortgage company doesn't want to foreclose on your home. Just like there are consequences for you, the foreclosure process is time-consuming and expensive for them. They want to work with you to resolve the situation.

There are currently 12 non-recourse states: Alaska, Arizona, California, Connecticut, Hawaii Idaho, Minnesota, North Carolina, North Dakota, Texas, Utah, and Washington.