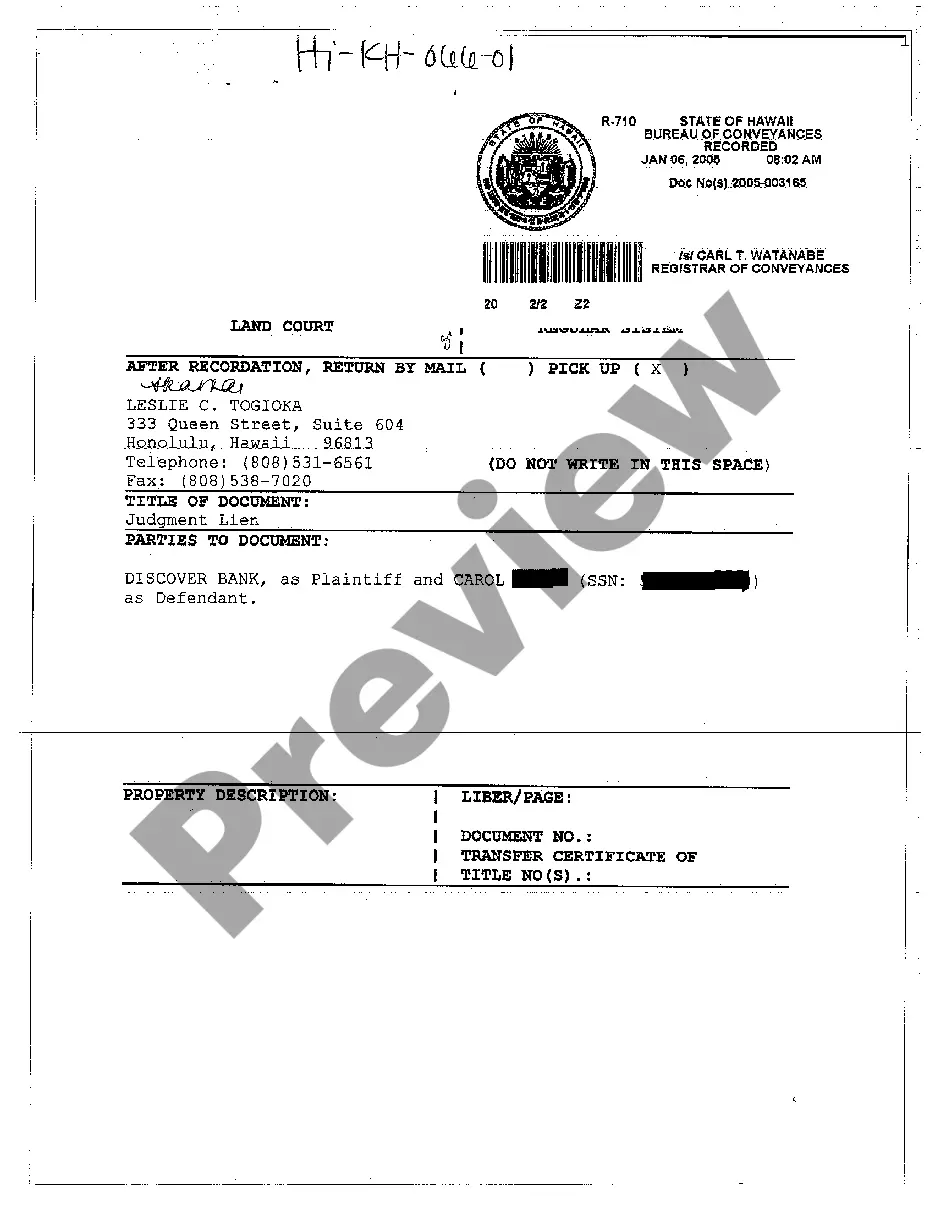

Hawaii Judgment Lien for Credit Card Debt

Description

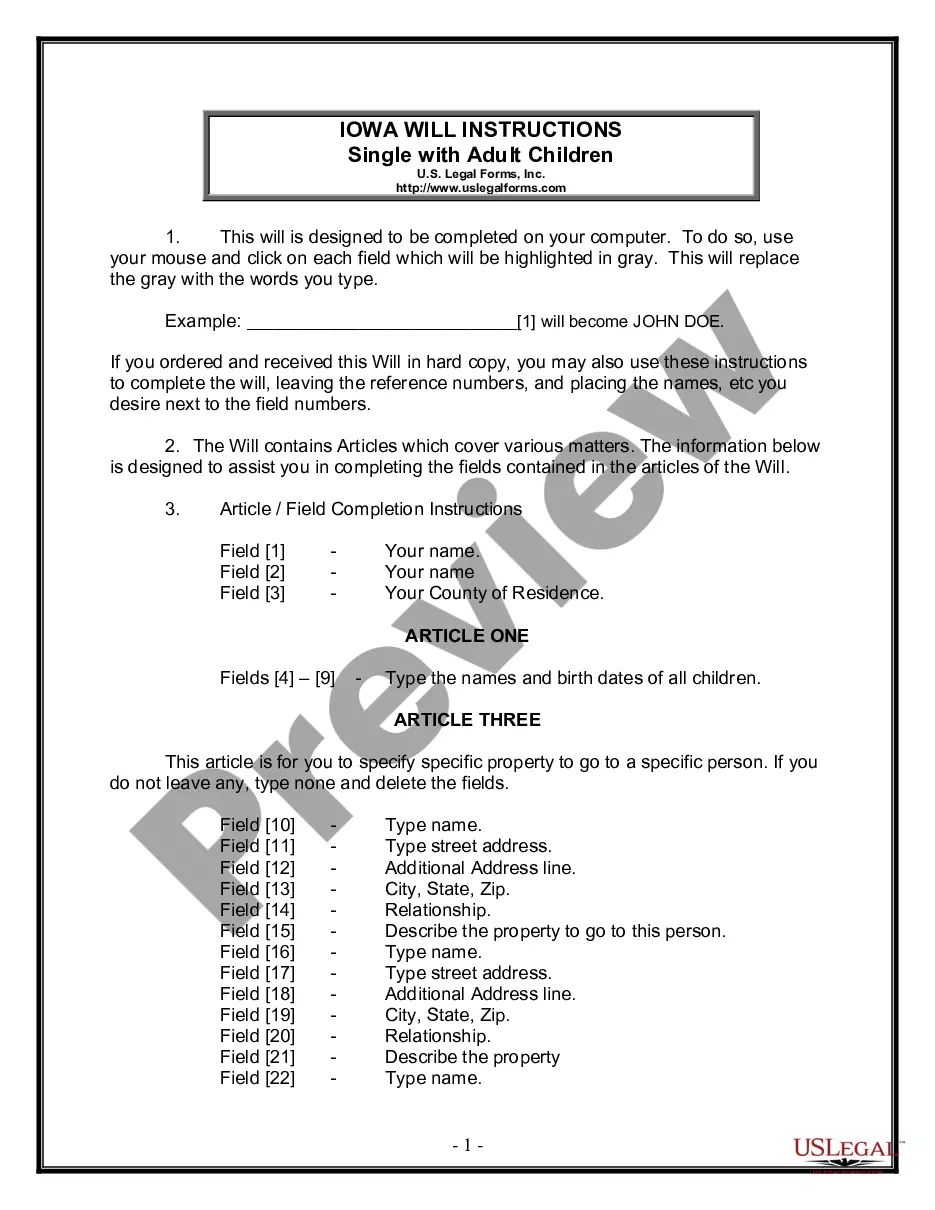

How to fill out Hawaii Judgment Lien For Credit Card Debt?

Among hundreds of free and paid samples which you get on the net, you can't be certain about their reliability. For example, who created them or if they are qualified enough to take care of what you need them to. Keep calm and use US Legal Forms! Find Hawaii Judgment Lien for Credit Card Debt templates created by skilled attorneys and prevent the expensive and time-consuming process of looking for an lawyer or attorney and after that having to pay them to draft a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button near the form you are looking for. You'll also be able to access all of your earlier downloaded files in the My Forms menu.

If you’re making use of our website for the first time, follow the guidelines below to get your Hawaii Judgment Lien for Credit Card Debt fast:

- Ensure that the file you discover applies in the state where you live.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing process or look for another sample utilizing the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

As soon as you have signed up and paid for your subscription, you may use your Hawaii Judgment Lien for Credit Card Debt as many times as you need or for as long as it continues to be valid where you live. Revise it with your favorite offline or online editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

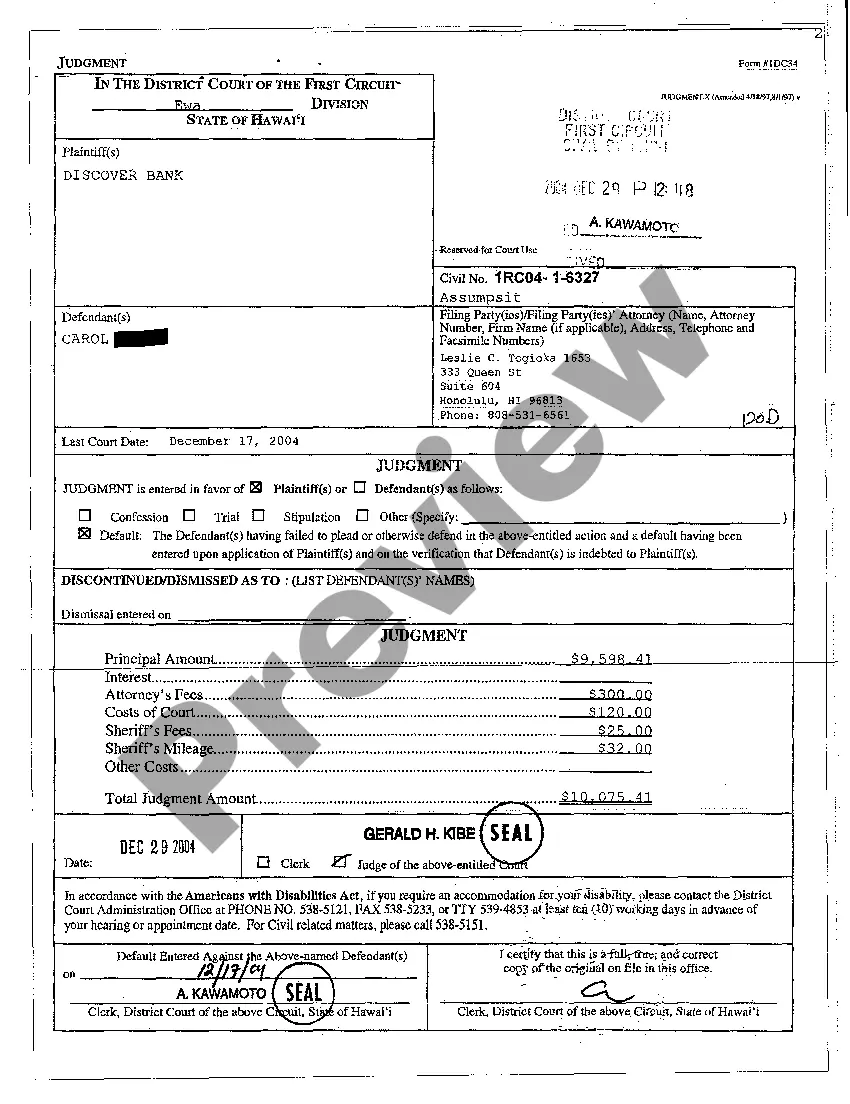

A judgment gives the creditor the right to use additional collection methods to collect the debt owed to them. For example, if the credit card company proves to the court that you owe $5,000, a court may enter a judgment saying that you owe $5,000 (plus costs and interest).

Civil judgments and your credit reportJudgments are no longer factored into credit scores, though they are still public record and can still impact your ability to qualify for credit or loans. Lenders may still check to see whether any outstanding judgments against a potential borrower exist.

Keep in mind that if you do NOT pay the judgment: The amount you owe will increase daily, since the judgment accumulates interest at the rate of 10% per year. The creditor can get an order telling you to reimburse him or her for any reasonable and necessary costs of collection.

A judgment entered in the State of Hawaii is generally enforceable for period of seven (7) years (Section 9-12-60), and may be renewed by an action or by scire facias, at the option of the holder of the judgment, within three years from the time it becomes dormant (Section 9-12-61).

What Happens After a Judgment Is Entered Against You? The court enters a judgment against you if your creditor wins their claim or you fail to show up to court. You should receive a notice of the judgment entry in the mail. The judgment creditor can then use that court judgment to try to collect money from you.

What Is a Judgment?A judgment gives the creditor the right to use additional collection methods to collect the debt owed to them. For example, if the credit card company proves to the court that you owe $5,000, a court may enter a judgment saying that you owe $5,000 (plus costs and interest).

When a creditor sues you and wins, the court issues a money judgment against you. Once the creditor has a money judgment, it can use various methods to collect on that judgment. It can garnish your wages, place a levy on your bank account, or place a lien against any real estate that you own.

If a person is deemed judgment proof, it likely means that they have no assets and no job. Creditors cannot seize the assets of someone who the court names judgment proof. Social security, disability, and unemployment benefits do not count as assets that can be taken by creditors.

Even after a judgment is entered against you, it is still possible to settle a debt for less than the court-approved amount.However, you may be able to negotiate a discount to the debt, in return for a lump sum payment.