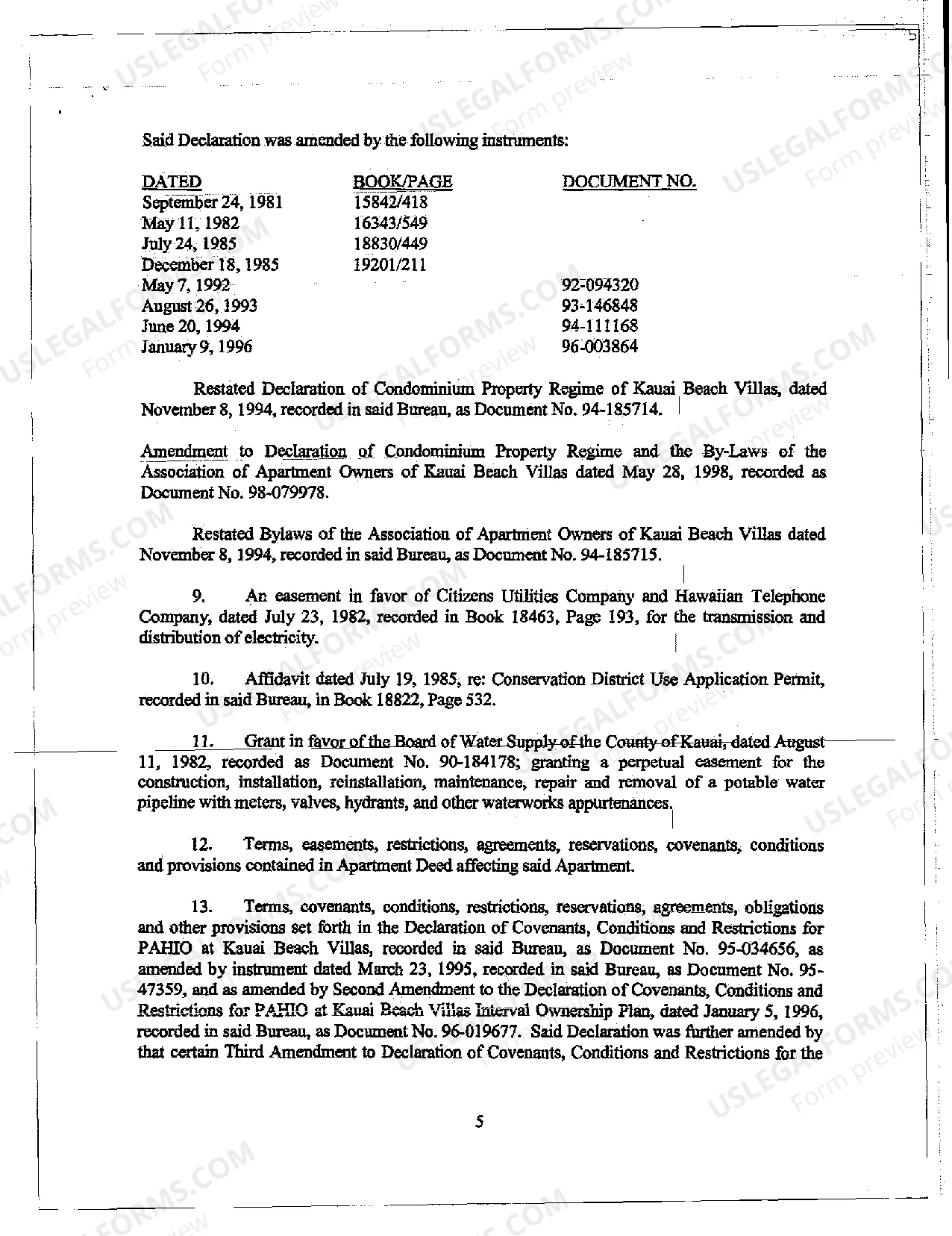

Hawaii Deed regarding Foreclosure Sale

Description Hawaii Foreclosure Laws

How to fill out Hawaii Deed Regarding Foreclosure Sale?

Among hundreds of free and paid samples that you can get on the internet, you can't be certain about their reliability. For example, who created them or if they are qualified enough to take care of the thing you need those to. Keep relaxed and make use of US Legal Forms! Locate Hawaii Deed regarding Foreclosure Sale samples made by professional legal representatives and avoid the costly and time-consuming process of looking for an lawyer and after that paying them to draft a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button near the form you’re trying to find. You'll also be able to access your previously downloaded samples in the My Forms menu.

If you’re making use of our website the very first time, follow the instructions below to get your Hawaii Deed regarding Foreclosure Sale easily:

- Make certain that the document you see applies in your state.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another template using the Search field located in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

As soon as you’ve signed up and paid for your subscription, you can use your Hawaii Deed regarding Foreclosure Sale as many times as you need or for as long as it remains valid where you live. Change it in your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

§ 33-727. This statute generally provides that proceeds from a mortgage foreclosure sale go first to creditors according to their priority, and only to the owner after creditors are paid in full.

Will I Get Money Back After a Foreclosure Sale? If a foreclosure sale results in excess proceeds, the lender doesn't get to keep that money. The lender is entitled to an amount that's sufficient to pay off the outstanding balance of the loan plus the costs associated with the foreclosure and salebut no more.

The auction notice, or Notice of Sale, is your final notice that the lender intends to sell the property at auction. The county prints the location, time and date of the trustee's auction on the Notice of Sale. It also contains the name and contact information for the trustee in charge of the sale.

The following states have anti-deficiency laws: Alaska, Arizona, California, Connecticut, Hawaii Iowa, Minnesota, Montana, Nevada, New Mexico, North Carolina, North Dakota, Oregon, Washington, and Wisconsin.

How much is your home worth? Regardless of your state's deficiency laws, if your home will sell at a foreclosure sale for more than what you owe, you will not be obligated to pay anything to your lender after foreclosure. Your lender is obligated to apply the sale price of your home to the mortgage debt.

In Hawaii, most homeowners who stop making their mortgage payments will face a judicial foreclosure. In the past, the majority of foreclosures in Hawaii were nonjudicial. But lenders switched to judicial foreclosures to bypass Hawaii's Mortgage Foreclosure Dispute Resolution (MFDR) program.

To redeem, you have to pay off the full amount of the loan before the foreclosure sale. Some states also provide foreclosed borrowers with a redemption period after the foreclosure sale, during which they can buy back the home. Hawaii law, however, doesn't provide a post-sale right of redemption.

There are currently 12 non-recourse states: Alaska, Arizona, California, Connecticut, Hawaii Idaho, Minnesota, North Carolina, North Dakota, Texas, Utah, and Washington.

Home mortgagesthough generally recourseare non-recourse in 12 states: Alaska, Arizona, California, Connecticut, Idaho, Minnesota, North Carolina, North Dakota, Oregon, Texas, Utah and Washington.