Hawaii Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

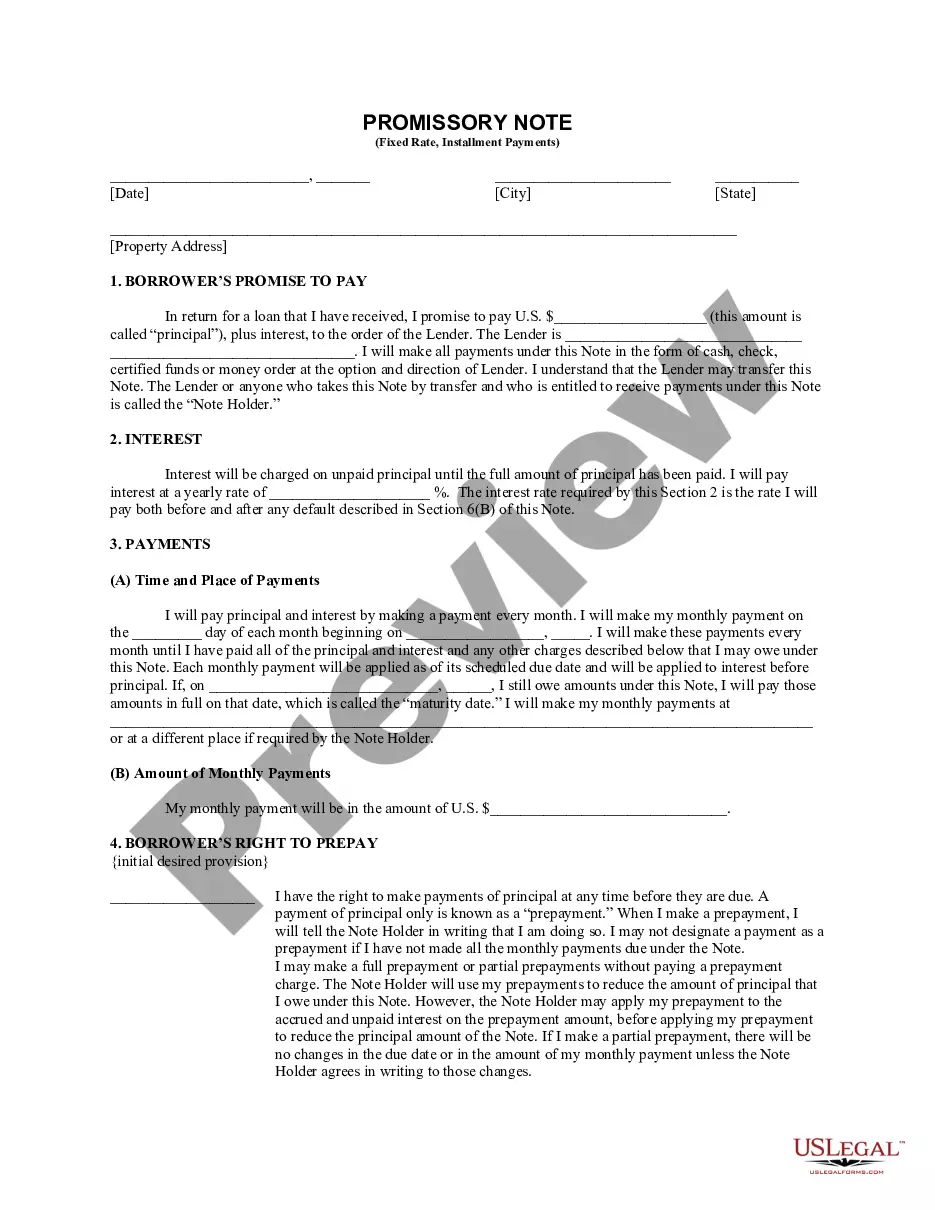

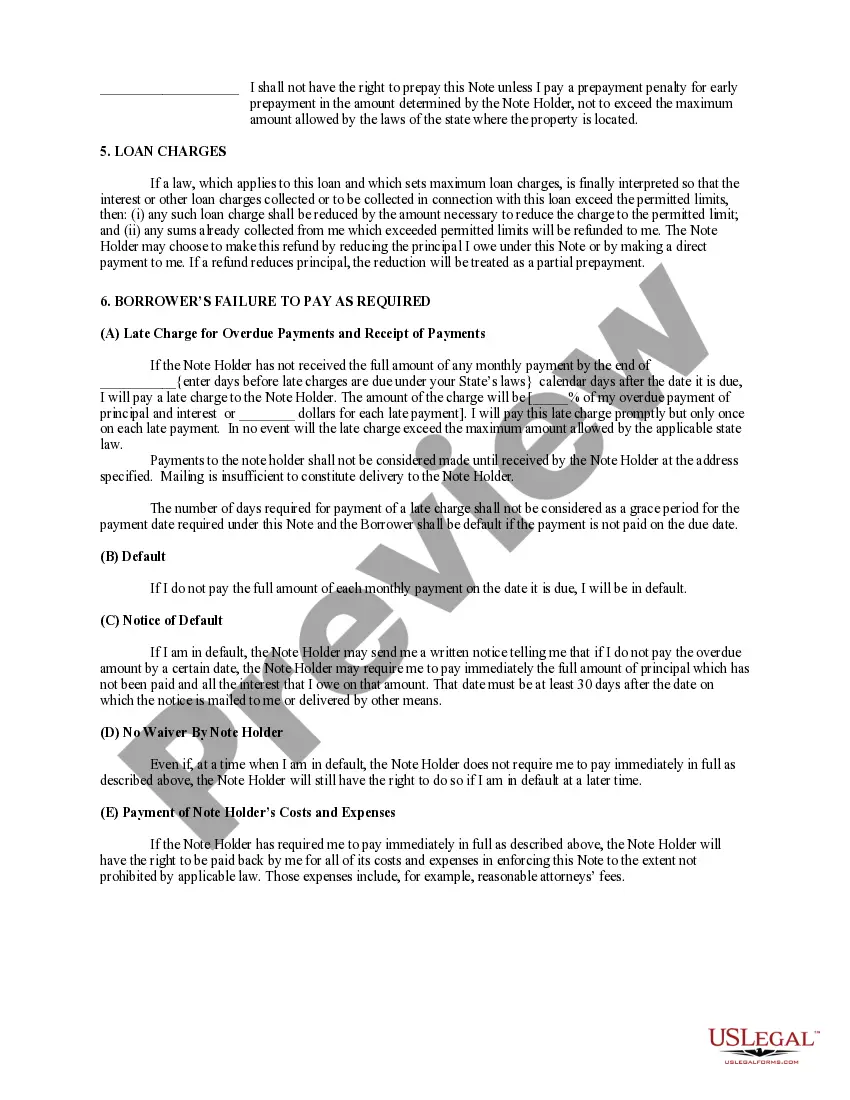

How to fill out Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Get access to the most holistic library of legal forms. US Legal Forms is a solution to find any state-specific document in clicks, including Hawaii Installments Fixed Rate Promissory Note Secured by Residential Real Estate examples. No reason to waste hours of your time seeking a court-admissible form. Our qualified specialists ensure that you receive up-to-date samples all the time.

To make use of the documents library, pick a subscription, and create an account. If you already registered it, just log in and then click Download. The Hawaii Installments Fixed Rate Promissory Note Secured by Residential Real Estate file will immediately get kept in the My Forms tab (a tab for every form you download on US Legal Forms).

To create a new account, follow the simple recommendations listed below:

- If you're going to utilize a state-specific sample, make sure you indicate the proper state.

- If it’s possible, go over the description to understand all the ins and outs of the form.

- Use the Preview option if it’s accessible to check the document's information.

- If everything’s right, click Buy Now.

- Right after choosing a pricing plan, register an account.

- Pay by credit card or PayPal.

- Save the sample to your computer by clicking on Download button.

That's all! You ought to fill out the Hawaii Installments Fixed Rate Promissory Note Secured by Residential Real Estate template and double-check it. To ensure that everything is accurate, contact your local legal counsel for assist. Sign up and simply look through more than 85,000 helpful forms.

Form popularity

FAQ

Once you have signed the Promissory Note, the bank will make a book entry of a deposit into a bank Demand Deposit Account in the amount of your note, and show that amount as an "asset" to the bank. Remember there must be a corresponding and matching ledger entry as a liability. The loan is for $100,000.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

Enforcing a secured promissory note is simply a matter of either repossessing the secured asset through your own efforts, or hiring a professional agency to accomplish the task on your behalf. These agencies will charge a set fee for their services, but they usually have a very high rate of success.

A Promissory Note with Installment Payments specifies and documents the terms of a loan that will be paid back with consistent, equal, payments.You're a borrower and are agreeing to a loan with installments. You're in the business of loans or manage a loan company.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Small businesses frequently borrow money, or extend credit, in the course of their operations. A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.