Hawaii Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Hawaii Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Get the most holistic catalogue of authorized forms. US Legal Forms is a platform where you can find any state-specific file in a few clicks, even Hawaii Installments Fixed Rate Promissory Note Secured by Commercial Real Estate samples. No need to waste hours of the time looking for a court-admissible form. Our accredited specialists ensure you receive up-to-date examples every time.

To leverage the documents library, choose a subscription, and sign-up your account. If you already registered it, just log in and click Download. The Hawaii Installments Fixed Rate Promissory Note Secured by Commercial Real Estate template will instantly get kept in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new profile, look at simple guidelines listed below:

- If you're proceeding to utilize a state-specific documents, be sure you indicate the correct state.

- If it’s possible, look at the description to know all the ins and outs of the document.

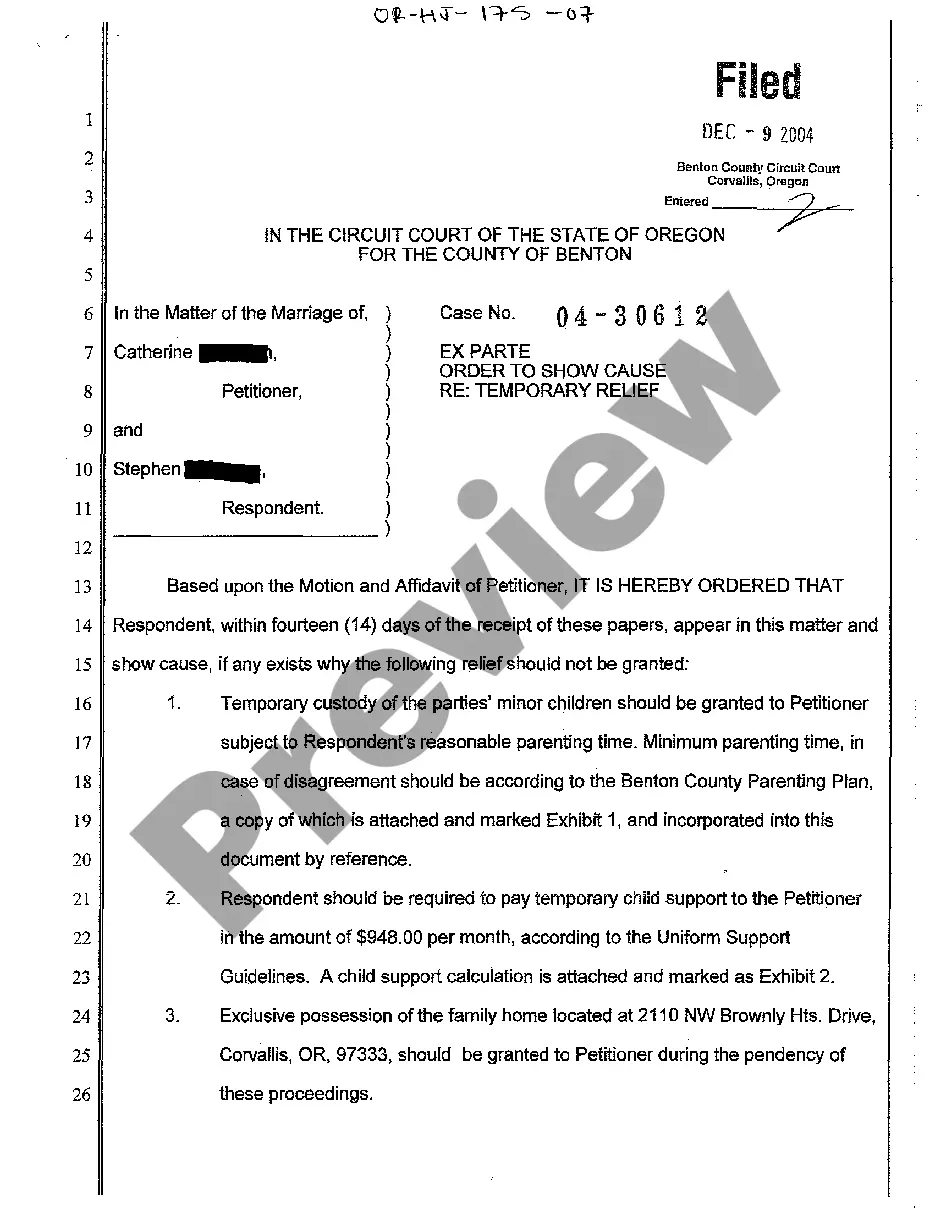

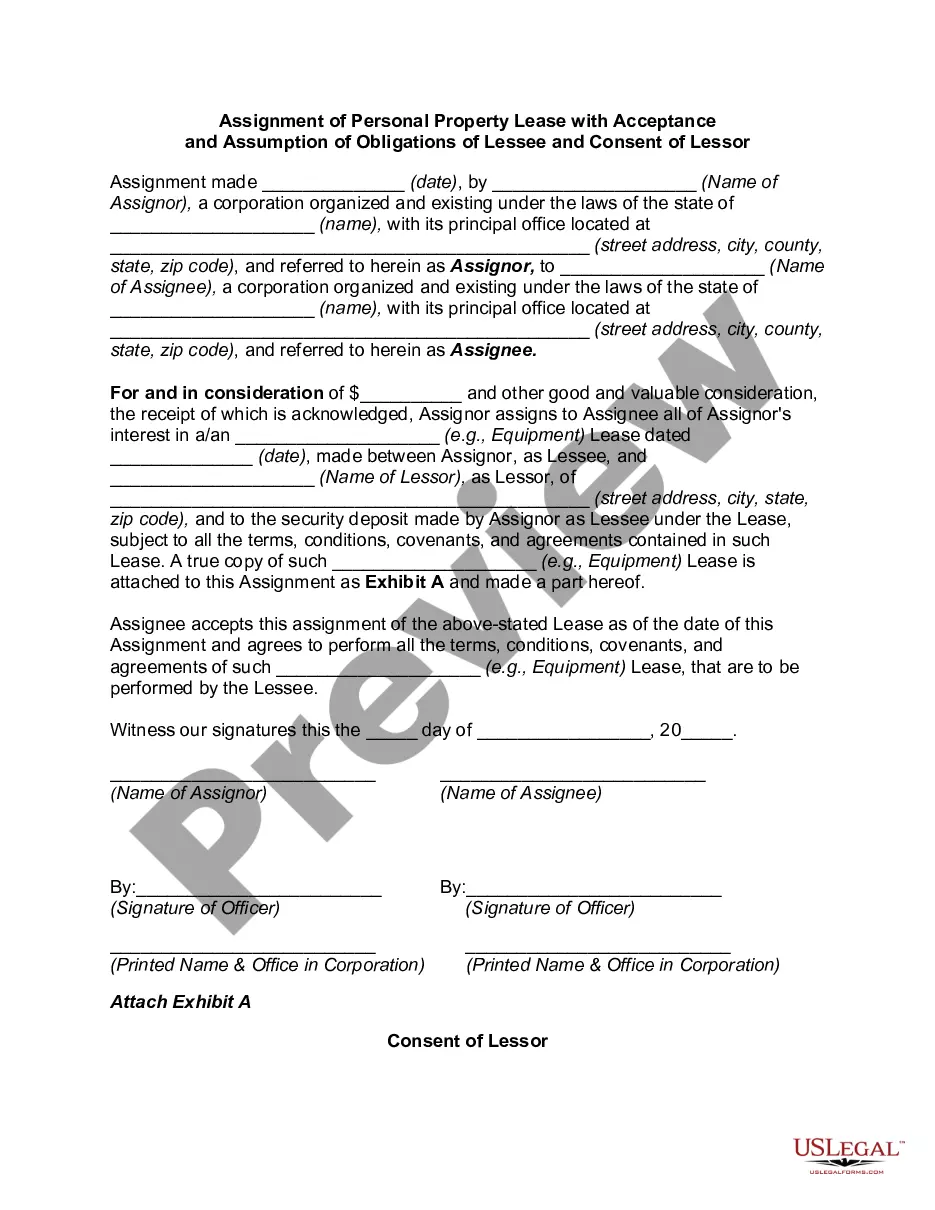

- Utilize the Preview option if it’s offered to take a look at the document's content.

- If everything’s proper, click Buy Now.

- After picking a pricing plan, create an account.

- Pay by card or PayPal.

- Downoad the example to your device by clicking Download.

That's all! You should submit the Hawaii Installments Fixed Rate Promissory Note Secured by Commercial Real Estate form and double-check it. To make certain that everything is correct, call your local legal counsel for assist. Sign up and simply find over 85,000 valuable templates.

Form popularity

FAQ

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

The owner of the promissory note can file a civil lawsuit against the signer of the note if the signer refuses to pay. The purpose of the lawsuit is to obtain a judgment against the note's signer, which will give the owner of the note the ability to pursue the signer's assets.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

All Promissory Notes are valid only for a period of 3 years starting from the date of execution, after which they will be invalid. There is no maximum limit in terms of the amount which can be lent or borrowed. The issuer / lender of the funds is normally the one who will hold the Promissory Note.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid.The value of the amount of debt forgiven may be deemed either taxable income, or a gift subject to the federal estate and gift tax.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.