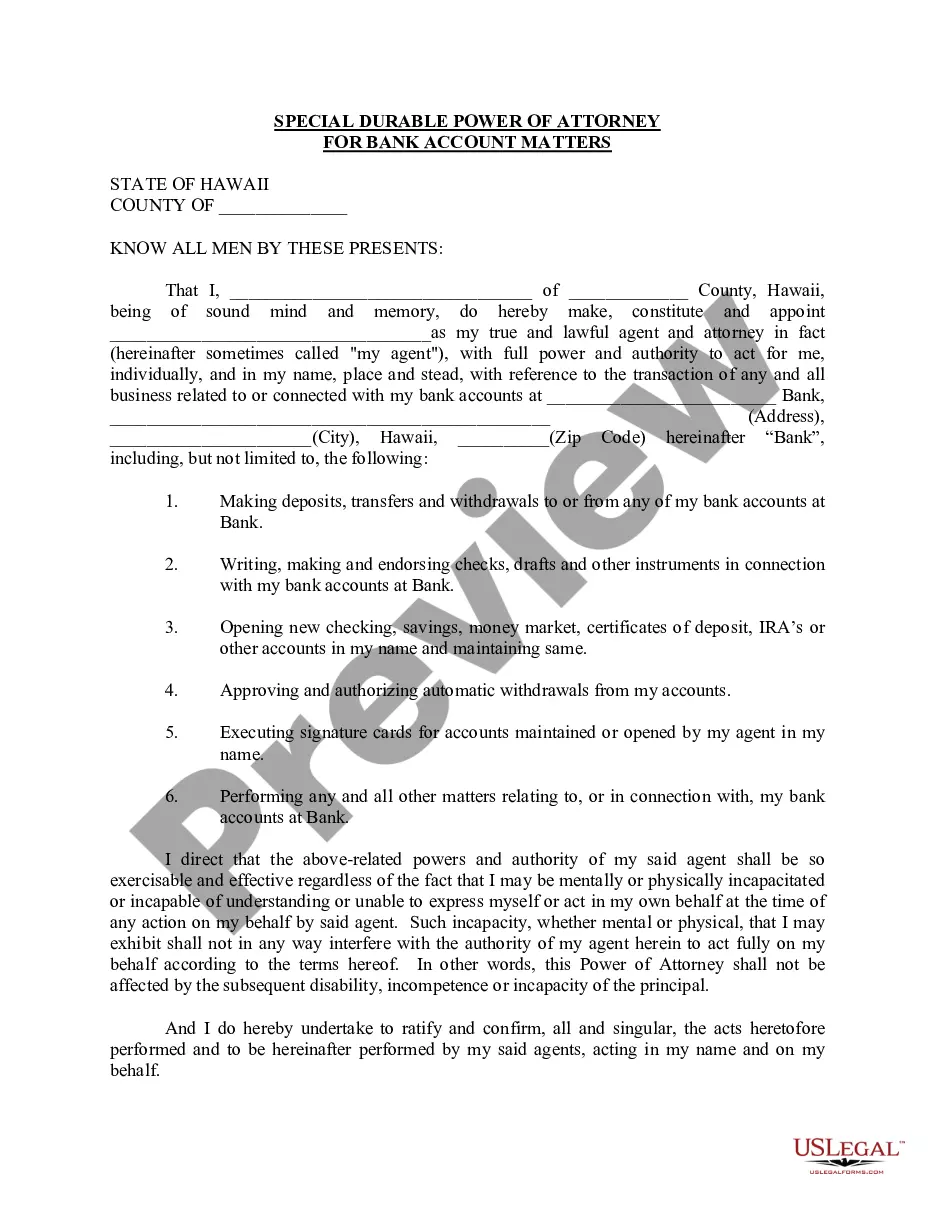

Hawaii Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Hawaii Special Durable Power Of Attorney For Bank Account Matters?

Get access to the most extensive catalogue of legal forms. US Legal Forms is a system where you can find any state-specific file in couple of clicks, even Hawaii Special Durable Power of Attorney for Bank Account Matters samples. No need to spend several hours of the time searching for a court-admissible example. Our certified pros ensure you receive updated examples every time.

To make use of the forms library, choose a subscription, and register your account. If you did it, just log in and click Download. The Hawaii Special Durable Power of Attorney for Bank Account Matters file will immediately get kept in the My Forms tab (a tab for all forms you save on US Legal Forms).

To register a new profile, look at brief guidelines below:

- If you're proceeding to use a state-specific example, make sure you indicate the proper state.

- If it’s possible, review the description to understand all of the ins and outs of the document.

- Utilize the Preview function if it’s available to take a look at the document's information.

- If everything’s appropriate, click Buy Now.

- Right after choosing a pricing plan, make your account.

- Pay by card or PayPal.

- Save the sample to your device by clicking Download.

That's all! You should complete the Hawaii Special Durable Power of Attorney for Bank Account Matters form and check out it. To ensure that things are correct, speak to your local legal counsel for help. Sign up and easily browse around 85,000 useful forms.

Form popularity

FAQ

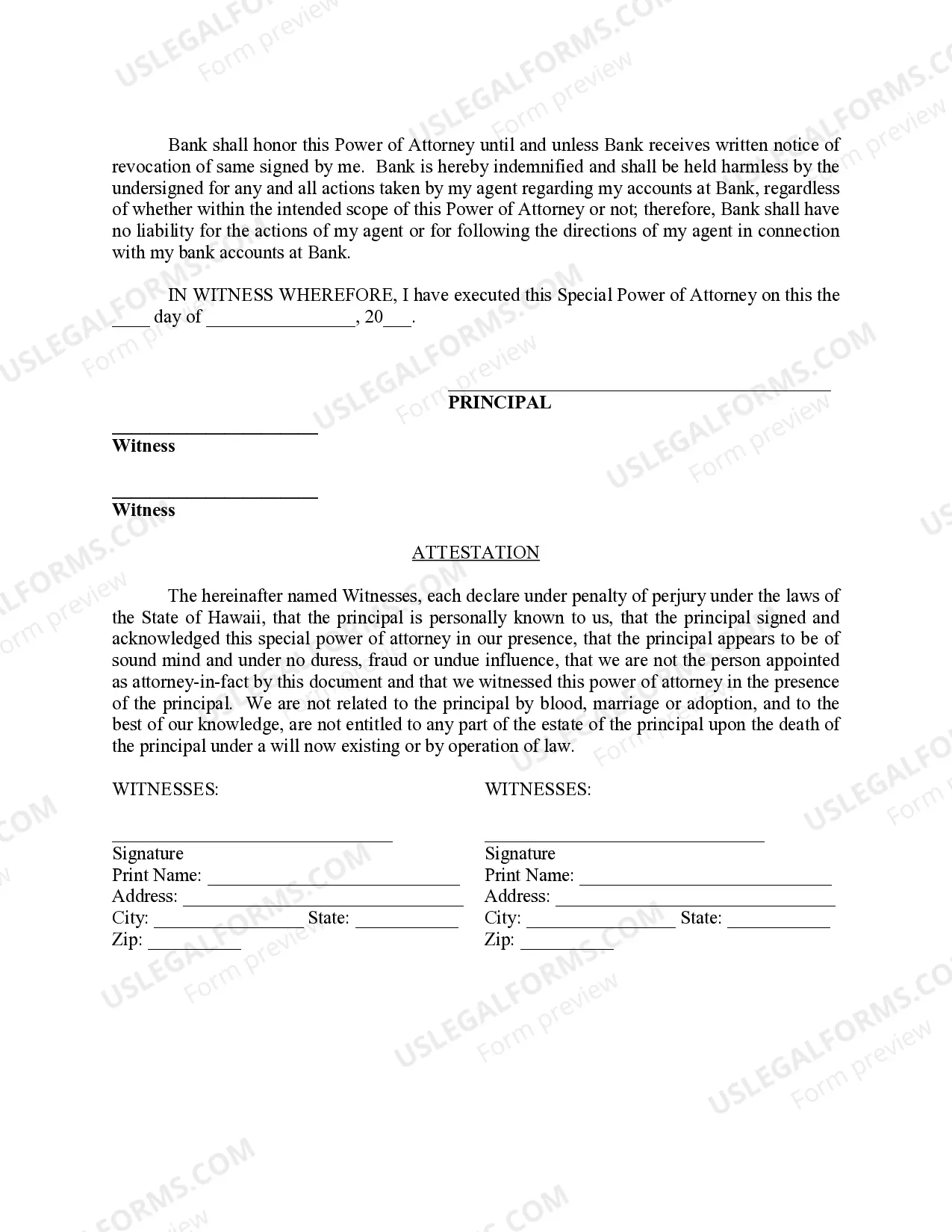

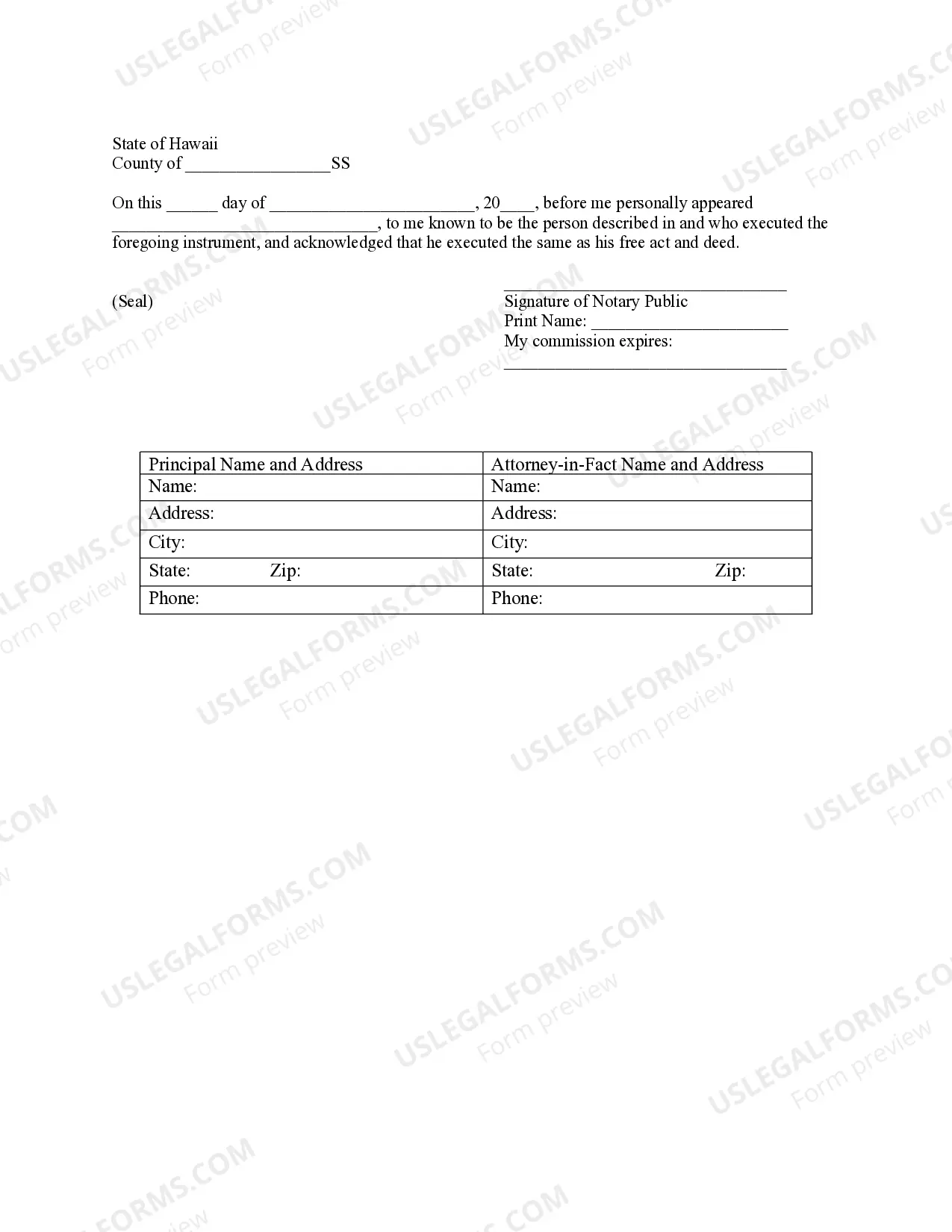

Most states offer simple forms to help you create a power of attorney for finances. Generally, the document must be signed, witnessed and notarized by an adult. If your agent will have to deal with real estate assets, some states require you to put the document on file in the local land records office.

While laws vary between states, a POA can't typically add or remove signers from your bank account unless you include this responsibility in the POA document.If you don't include a clause giving the POA this authority, then financial institutions won't allow your POA to make ownership changes to your accounts.

While laws vary between states, a POA can't typically add or remove signers from your bank account unless you include this responsibility in the POA document.If you don't include a clause giving the POA this authority, then financial institutions won't allow your POA to make ownership changes to your accounts.

Choose an agent. Before you begin to fill out the form, you have some decisions to make. Decide on the type of authority. You can choose whether you want your POA to be broad or narrow. Identify the length of time the POA will be in effect. Fill out the form. Execute the document.

But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.The agent fought back in court and won a $64,000 judgment against the bank.

While almost any document can be notarized, some of the most common ones include sworn statements, powers of attorney, deeds of trust, rental agreements, copy certifications, beneficiary designations for retirement accounts, promissory notes, and motor vehicle bills of sale.

Before you can manage the donor's account, you must show the bank the original registered lasting power of attorney ( LPA ) or a copy of it signed on every page by the donor, a solicitor or notary.

Determine if one is needed. Under a few circumstances, a power of attorney isn't necessary. Identify an agent. Take a look at the standard forms. Notarize the written POA, keep it stored safely, and provide copies to important people. Review the POA periodically.

Contact the bank before having a financial power of attorney drafted by a lawyer. Send or deliver your previously drafted financial power of attorney document to the bank. Provide identification and a copy of the financial power of attorney to the bank teller when you ready to complete a transaction.