This official form should be completed by the process server once service on a party is complete. The Return of Service will identify the person served, the date and time of service, and the method of service.

Hawaii Return of Service

Description

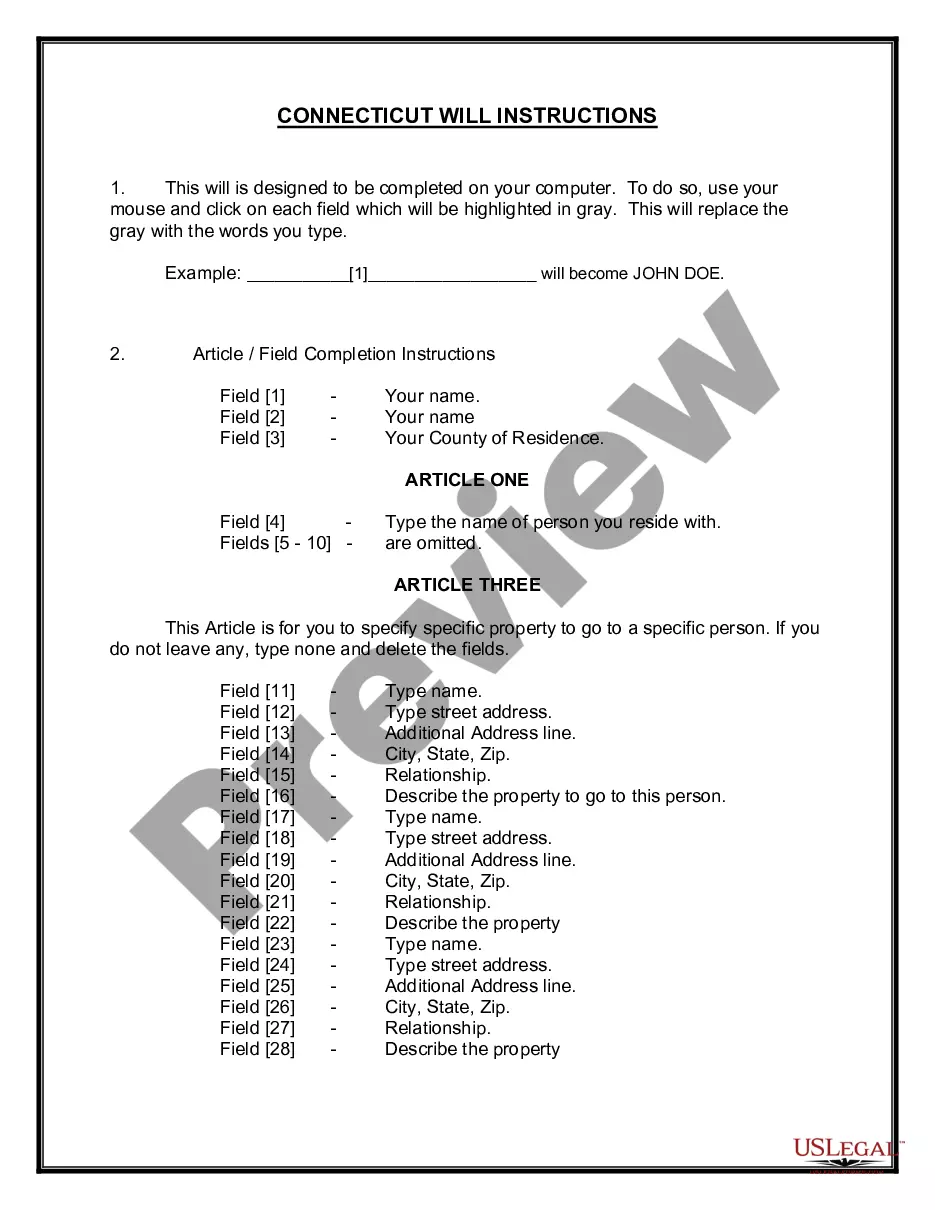

How to fill out Hawaii Return Of Service?

Get access to one of the most extensive library of legal forms. US Legal Forms is really a platform to find any state-specific form in a few clicks, such as Hawaii Return of Service examples. No reason to waste several hours of your time trying to find a court-admissible sample. Our licensed professionals ensure you get up-to-date samples every time.

To take advantage of the documents library, choose a subscription, and sign-up an account. If you already did it, just log in and then click Download. The Hawaii Return of Service sample will automatically get kept in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new profile, look at short instructions below:

- If you're going to utilize a state-specific sample, make sure you indicate the proper state.

- If it’s possible, review the description to understand all of the ins and outs of the form.

- Utilize the Preview function if it’s available to check the document's content.

- If everything’s correct, click on Buy Now button.

- After choosing a pricing plan, create an account.

- Pay by credit card or PayPal.

- Downoad the document to your device by clicking Download.

That's all! You should fill out the Hawaii Return of Service form and check out it. To ensure that things are correct, speak to your local legal counsel for assist. Sign up and simply browse more than 85,000 beneficial samples.

Form popularity

FAQ

The Department of Taxation offers e-filing services for individual income tax returns via its DOTAX.eHawaii.gov portal. You can also file your Hawaii income tax and federal tax returns by using a tax professional or any tax-preparation software listed on the department's website.

If you claimed the earned income credit in 2019 but had lower income in 2020, you can use your 2019 income again to claim the credit. There are other credits that families may be eligible for or can use their 2019 income to claim in 2020, such as the child tax credit.

Hawaii Tax Online (HTO)Hawaii Tax Online is the convenient and secure way to e-file tax returns, make payments, review letters, manage your accounts, and conduct other common transaction online with DOTAX. Filing taxes and making debit payments through this system is free.

You must attach a completed copy of your federal return. (Deductions and exemptions are limited.)Hawaii source deductions are allowed in full; other deductions are prorated.

Hawaii Tax Online is the convenient and secure way to e-file tax returns, make payments, view letters, manage your accounts, and conduct other common transactions online with the Hawaii Department of Taxation.

The Department of Taxation offers e-filing services for individual income tax returns via its DOTAX.eHawaii.gov portal. You can also file your Hawaii income tax and federal tax returns by using a tax professional or any tax-preparation software listed on the department's website.

Please address your written suggestions to the Department of Taxation, P.O. Box 259, Honolulu, HI, 96809-0259, or email them to Tax.Directors.Office@hawaii.gov. Each year, thousands of individuals file and pay their taxes electronically.

You must attach a completed copy of your federal return. (Deductions and exemptions are limited.)Hawaii source deductions are allowed in full; other deductions are prorated.

Hawaii State Income Taxes for Tax Year 2020 (January 1 - Dec. 31, 2020) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a HI state return). The Hawaii tax filing and tax payment deadline is April 15, 2021.