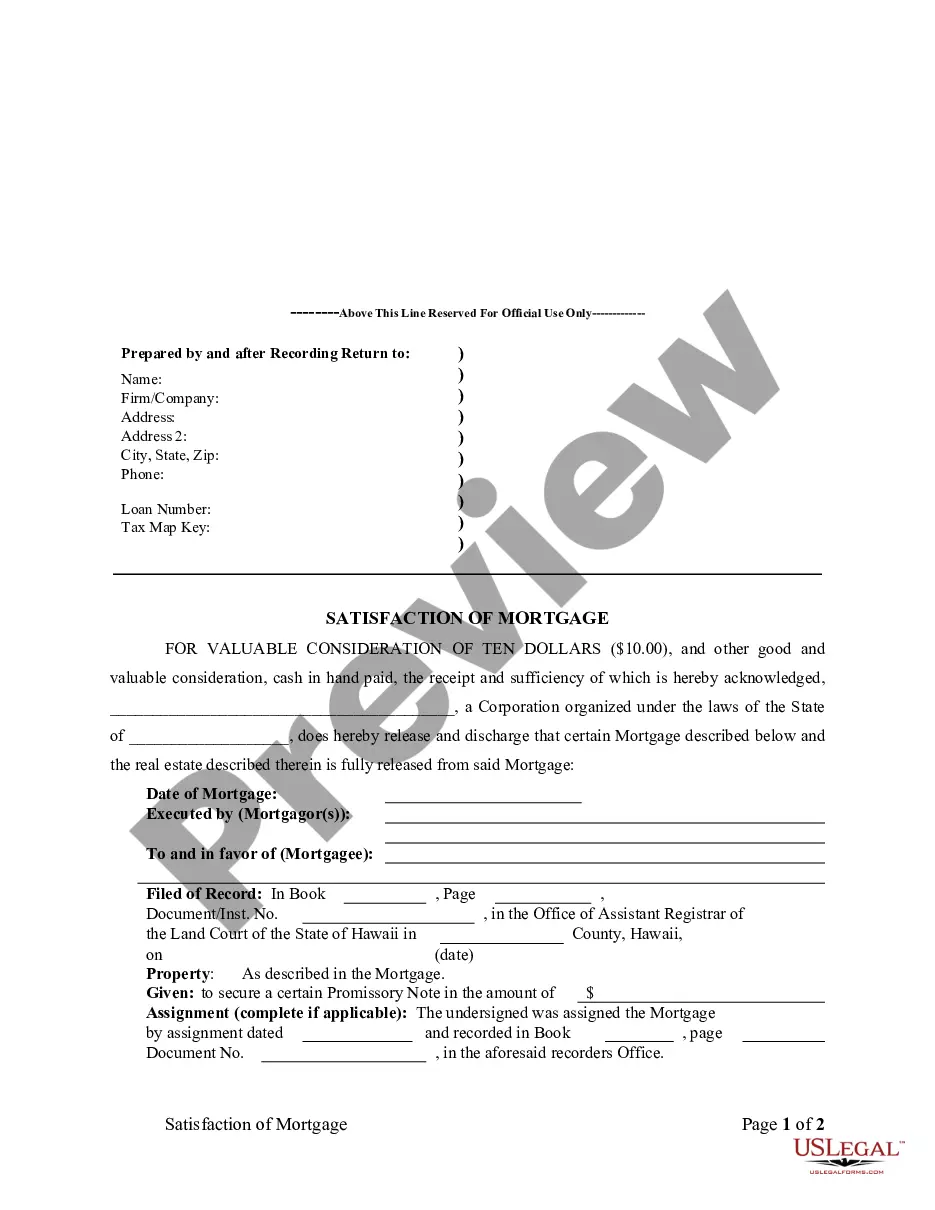

Hawaii Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

How to fill out Hawaii Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

Access the most extensive collection of authorized documents.

US Legal Forms is essentially a platform where you can discover any form specific to your state in just a few clicks, including templates for Hawaii Satisfaction, Release, or Cancellation of Mortgage by Corporation.

No need to waste hours searching for a court-acceptable example. Our qualified professionals guarantee that you receive current templates consistently.

After selecting a pricing plan, register your account. Pay using a credit card or PayPal. Download the document to your device by clicking on the Download button. That’s it! You simply need to complete the Hawaii Satisfaction, Release or Cancellation of Mortgage by Corporation form and verify it. To ensure everything is accurate, consult your local legal advisor for assistance. Register and easily browse over 85,000 valuable documents.

- To utilize the document library, choose a subscription and create an account.

- If you have registered, just Log In and then click Download.

- The Hawaii Satisfaction, Release or Cancellation of Mortgage by Corporation template will swiftly be stored in the My documents section (a section for all documents you download from US Legal Forms).

- To set up a new account, adhere to the simple instructions outlined below.

- If you need to use a form specific to a state, make sure to specify the correct state.

- If feasible, read the description to grasp all the details of the document.

- Utilize the Preview option if it’s offered to examine the document's details.

- If everything appears correct, hit the Buy Now button.

Form popularity

FAQ

A lien release on a mortgage is a legal document that officially removes the lender’s claim on a property. This occurs when the borrower has satisfied their mortgage obligations, confirming that they own the property outright. In Hawaii, this release is important as it protects property rights and avoids future disputes.

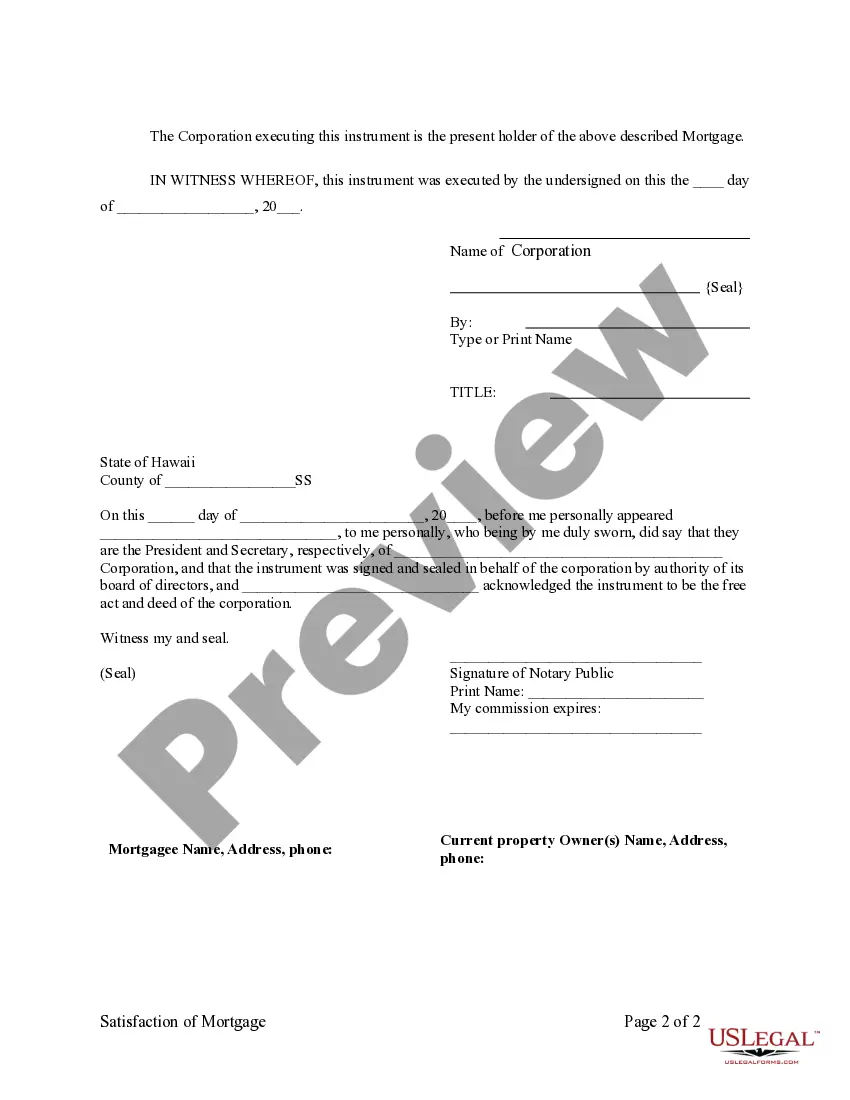

To complete a satisfaction of mortgage, first gather the correct forms available from your lender or a professional service. Ensure all details are accurately filled, then sign and have it notarized if necessary. Submit the completed document to your local office while confirming it is recorded, assuring your property title reflects the change.

The time it takes to receive a mortgage satisfaction letter can vary based on the lender and local recording office. Generally, it may take a few weeks after the final payment is made for the letter to be processed. To expedite this, ensure that all payments are up to date and consider following up with your lender or using trusted services like USLegalForms.

To complete a satisfaction of a mortgage, you need to obtain the appropriate form, typically provided by your state or financial institution. Fill in the required details, such as the mortgage information and property details. Once completed, you must sign the form and submit it to your local recording office, ensuring a recorded copy is returned to you. Utilizing platforms like USLegalForms can simplify this process.

Yes, a satisfaction of mortgage typically requires notarization to ensure its validity in Hawaii. Having the document notarized adds a layer of legal authenticity, which helps protect the interests of all parties involved. Notarization confirms that the signatures are genuine and that the terms of the release are understood. Therefore, it is wise to seek legal documents that include comprehensive notary instructions, like those available on US Legal Forms.

To record a release of a mortgage in Hawaii, first, prepare the release document accurately with all required details. Next, submit the document to the local county recorder's office where the property is located. This filing creates a public record confirming that the mortgage has been satisfied, which is essential for any future property transactions. For assistance, consider using US Legal Forms to simplify the recording process.

Typically, the grantee on a satisfaction of a mortgage is the homeowner or borrower who took out the mortgage. This person receives the release confirming that the mortgage obligation has been fulfilled. Understanding the role of the grantee is essential for homeowners in Hawaii, especially when preparing to sell or refinance the property. Accurate documentation can simplify future transactions.

The primary difference between satisfaction and release lies in the context in which they are used. Satisfaction indicates full repayment of the mortgage, while a release might pertain to a broader range of circumstances, including a discharge from the mortgage contract. Understanding these terms is beneficial for homeowners, especially when discussing the Hawaii Satisfaction, Release or Cancellation of Mortgage by Corporation. For guidance, consider utilizing uslegalforms, which provides resources to streamline your process.