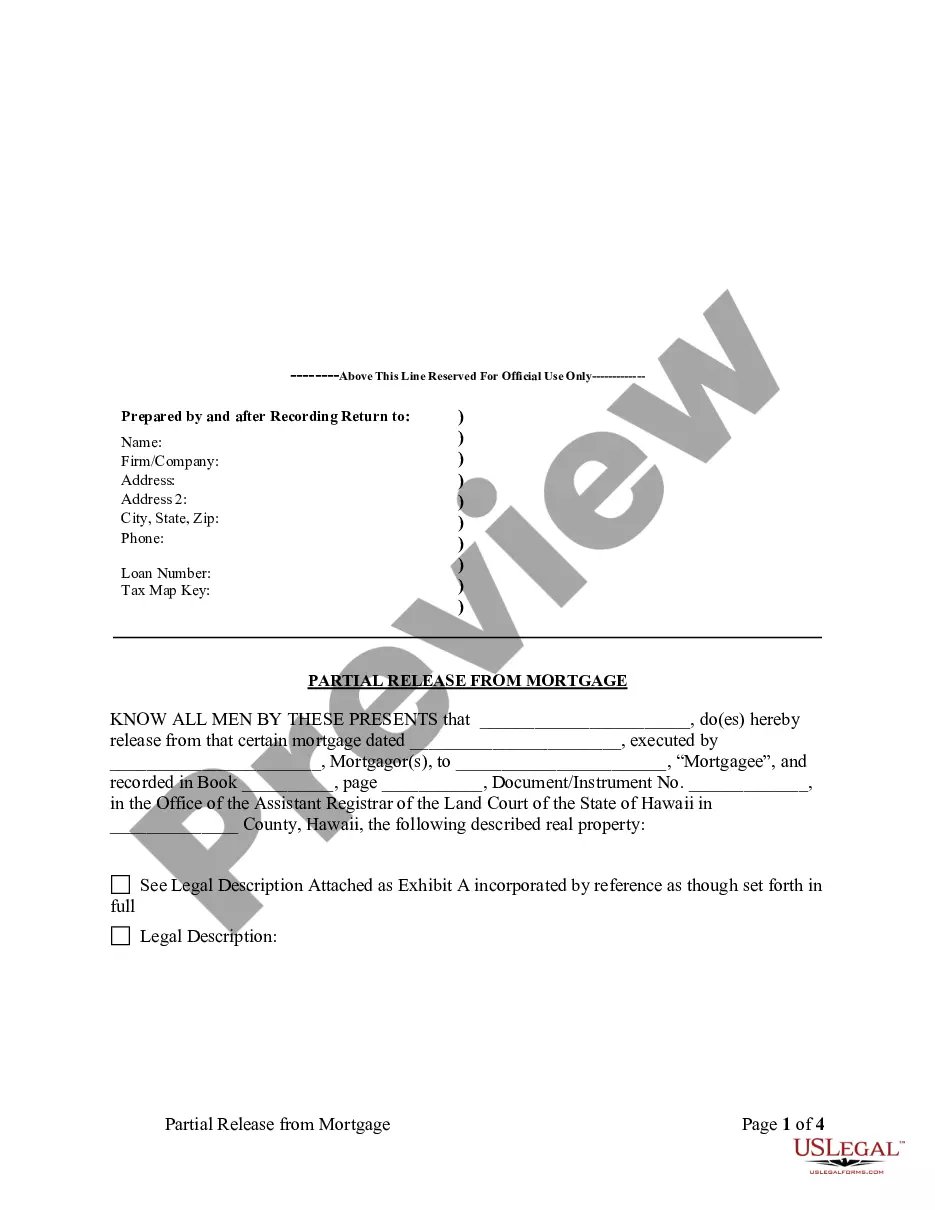

Hawaii Partial Release of Property From Mortgage for Corporation

Description What Is A Loan Release

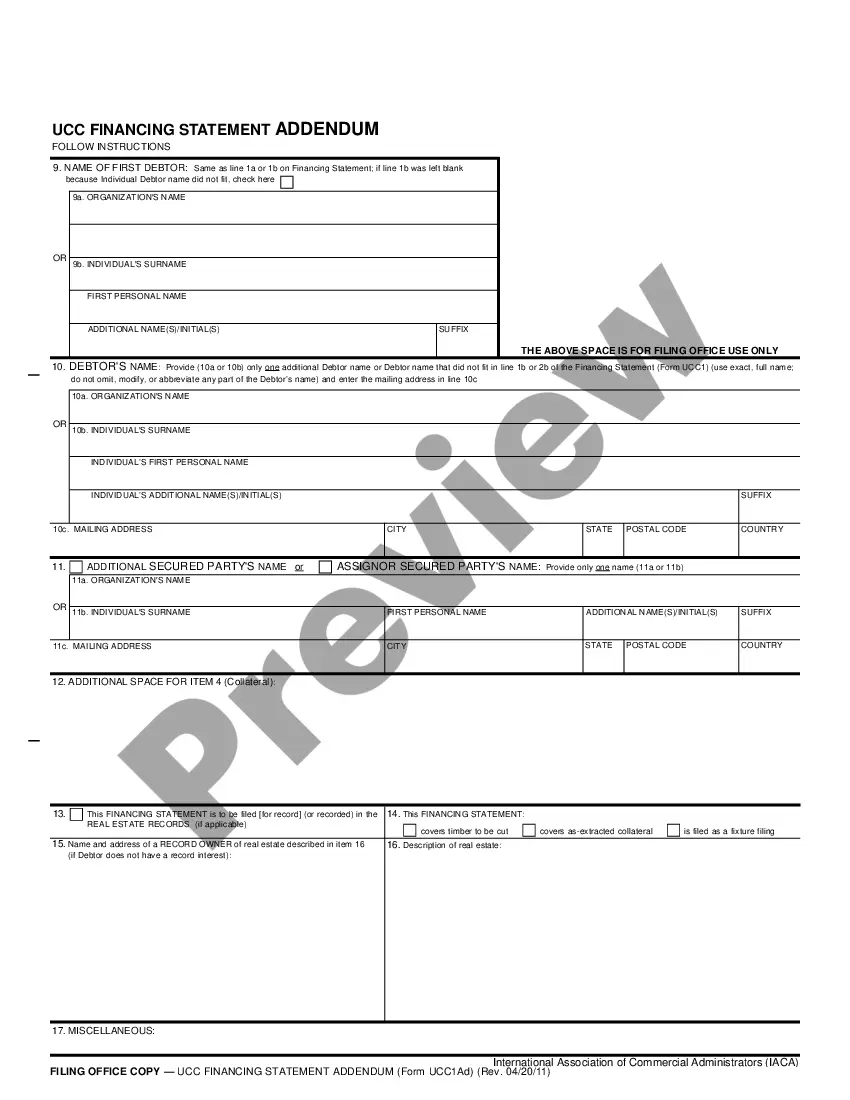

How to fill out Hawaii Partial Release Of Property From Mortgage For Corporation?

Get one of the most extensive library of authorized forms. US Legal Forms is a system to find any state-specific document in clicks, even Hawaii Partial Release of Property From Mortgage for Corporation samples. No reason to spend time of your time trying to find a court-admissible sample. Our accredited professionals ensure you receive updated samples every time.

To leverage the documents library, choose a subscription, and register your account. If you already registered it, just log in and click on Download button. The Hawaii Partial Release of Property From Mortgage for Corporation file will automatically get kept in the My Forms tab (a tab for all forms you download on US Legal Forms).

To create a new account, look at brief guidelines below:

- If you're going to utilize a state-specific sample, make sure you indicate the correct state.

- If it’s possible, go over the description to learn all of the nuances of the form.

- Take advantage of the Preview function if it’s offered to take a look at the document's information.

- If everything’s correct, click on Buy Now button.

- After selecting a pricing plan, create an account.

- Pay by credit card or PayPal.

- Save the document to your device by clicking on Download button.

That's all! You should submit the Hawaii Partial Release of Property From Mortgage for Corporation form and double-check it. To make sure that all things are correct, call your local legal counsel for help. Join and simply look through above 85,000 beneficial templates.

Form popularity

FAQ

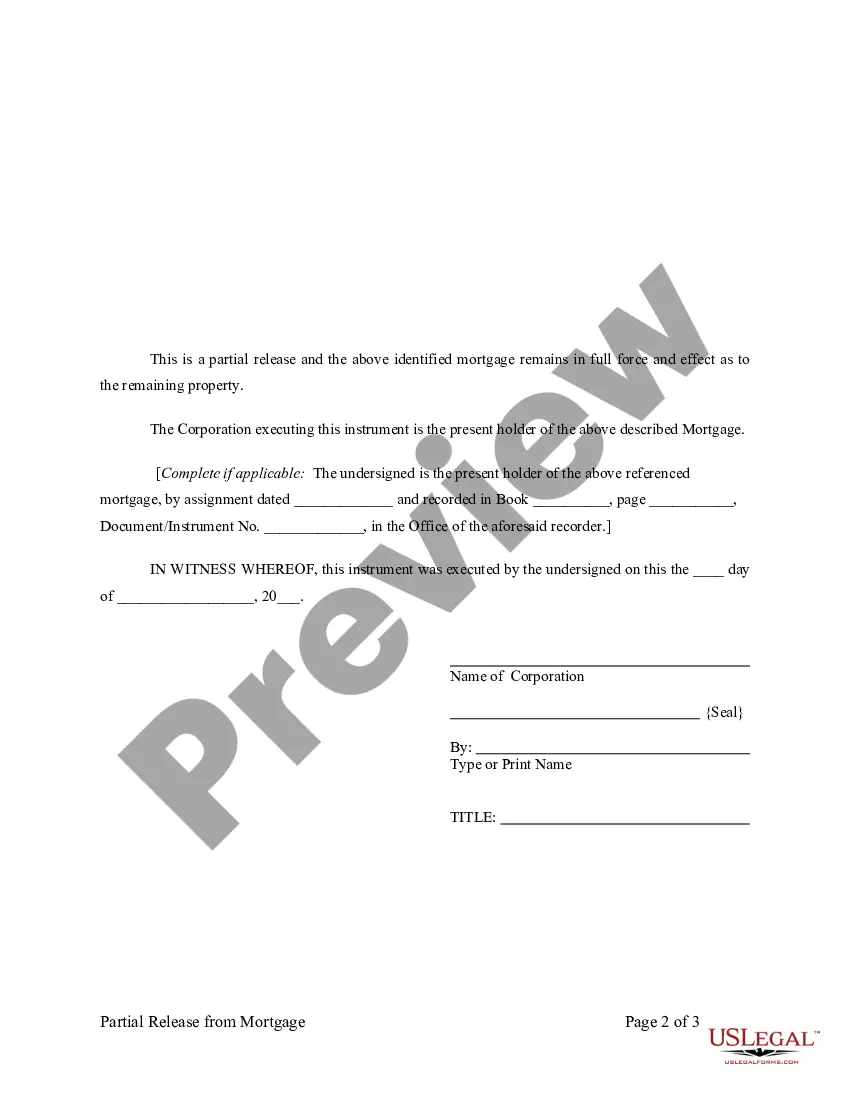

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

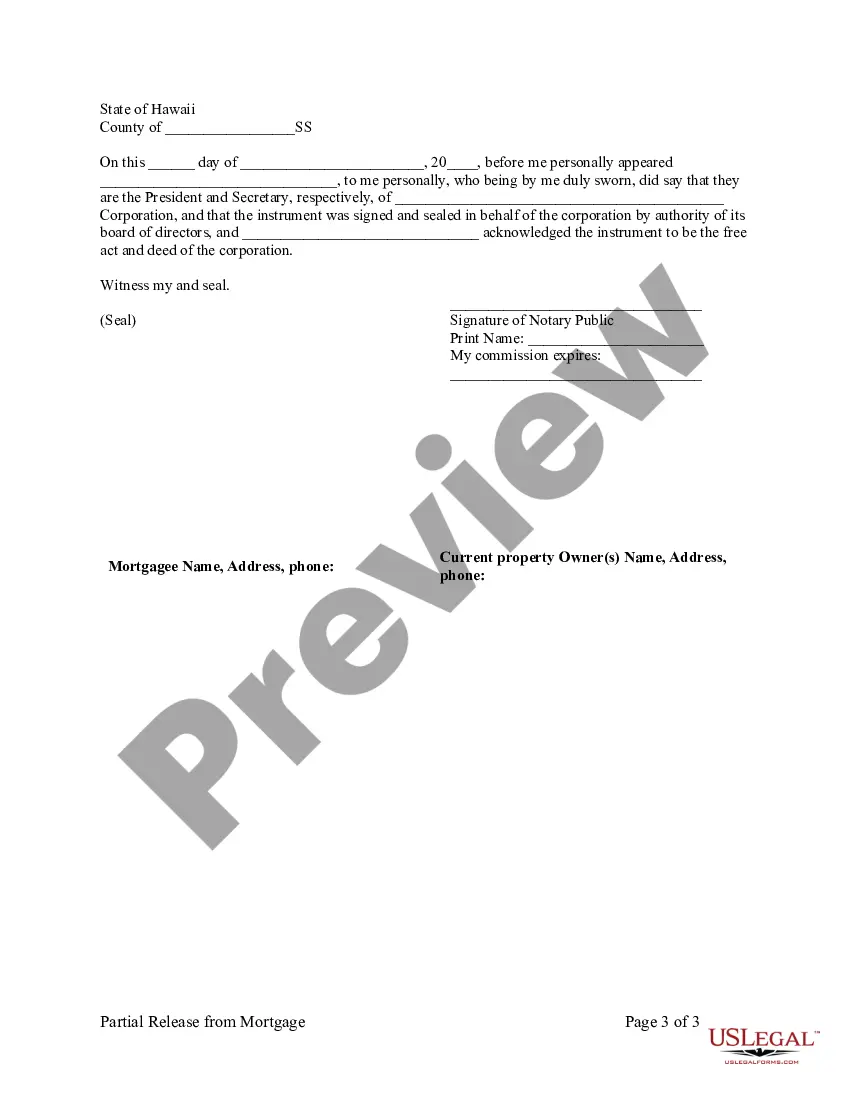

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

Take possession of all the papers. Get an NOC. Get your CIBIL report updated. Get the lien withdrawn. Get an encumbrance certificate.

Which situation would require a partial release? A borrower who wishes to sell a property that is part of a blanket mortgage(multiple properties and one mortgage loan) would need the lender to issue a partial release on the property being sold to release the lien and give the property a clean title.

A mortgage release usually takes around 90 days to complete, but this could be shorter or longer depending upon your specific situation.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.