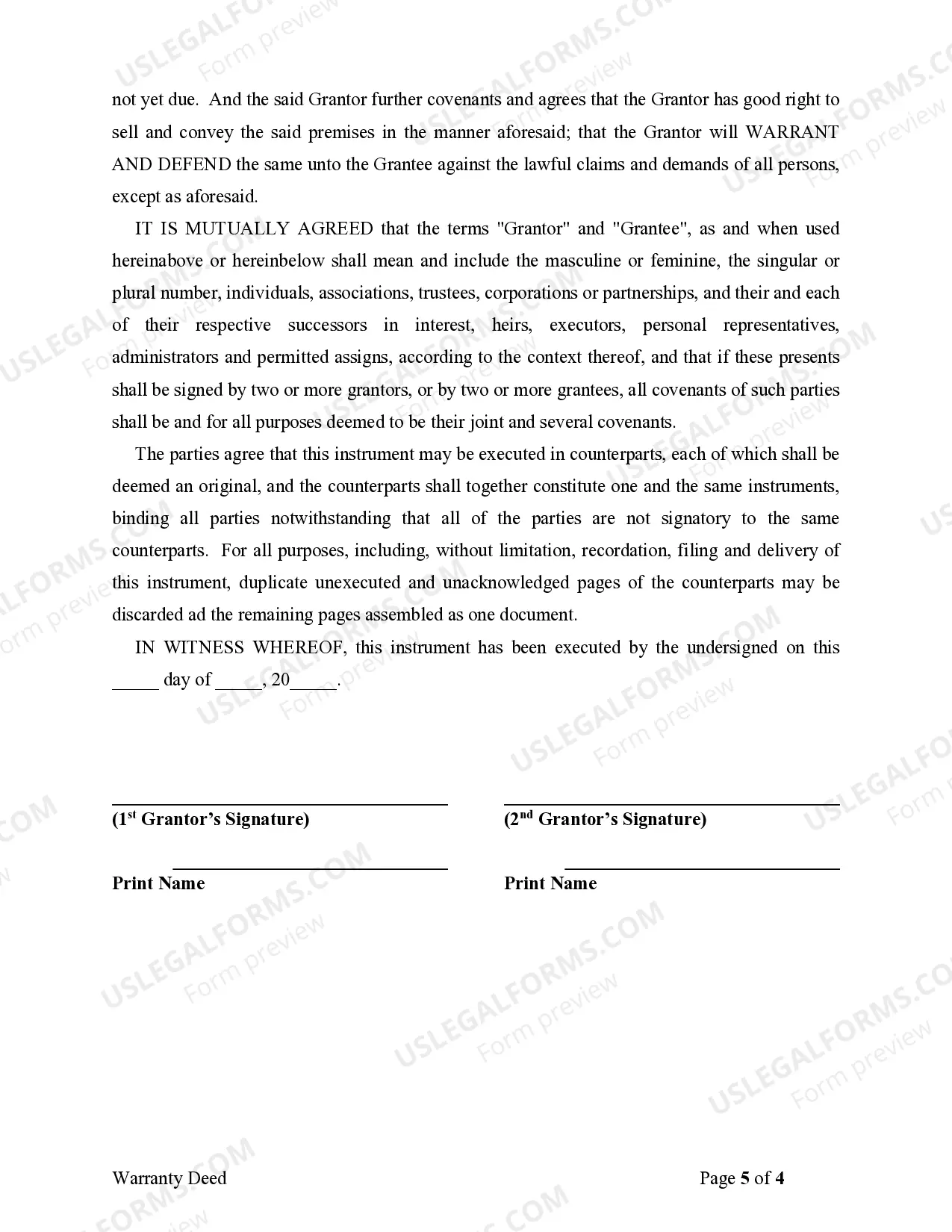

Hawaii Warranty Deed for Parents to Child with Reservation of Life Estate

Description Hawaii Life Estate Deed

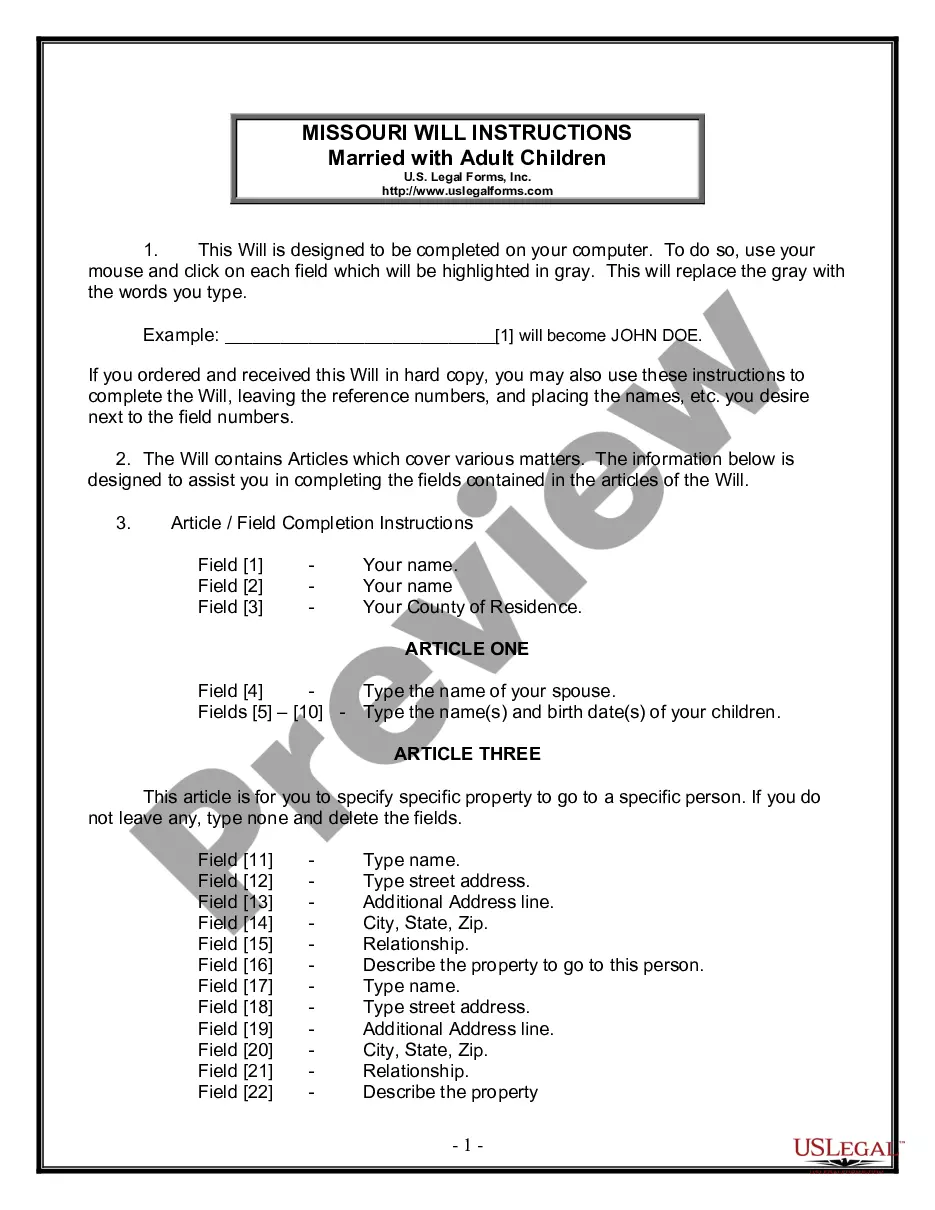

How to fill out Hawaii Warranty Deed For Parents To Child With Reservation Of Life Estate?

Among hundreds of paid and free templates that you’re able to find on the web, you can't be sure about their accuracy and reliability. For example, who created them or if they’re qualified enough to deal with what you need these people to. Keep relaxed and use US Legal Forms! Get Hawaii Warranty Deed for Parents to Child with Reservation of Life Estate templates made by skilled lawyers and prevent the high-priced and time-consuming process of looking for an attorney and after that paying them to draft a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the file you’re trying to find. You'll also be able to access all of your earlier downloaded templates in the My Forms menu.

If you are utilizing our website for the first time, follow the tips listed below to get your Hawaii Warranty Deed for Parents to Child with Reservation of Life Estate quick:

- Make sure that the document you see applies in the state where you live.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or find another template using the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you have signed up and paid for your subscription, you may use your Hawaii Warranty Deed for Parents to Child with Reservation of Life Estate as many times as you need or for as long as it remains active where you live. Change it in your preferred offline or online editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

Example of creation of a life estate: I grant to my mother, Molly McCree, the right to live in and/or receive rents from my real property, until her death, or I give my daughter, Sadie Hawkins, my real property, subject to a life estate to my mother, Molly McCree. This means a woman's mother, Molly, gets to live in

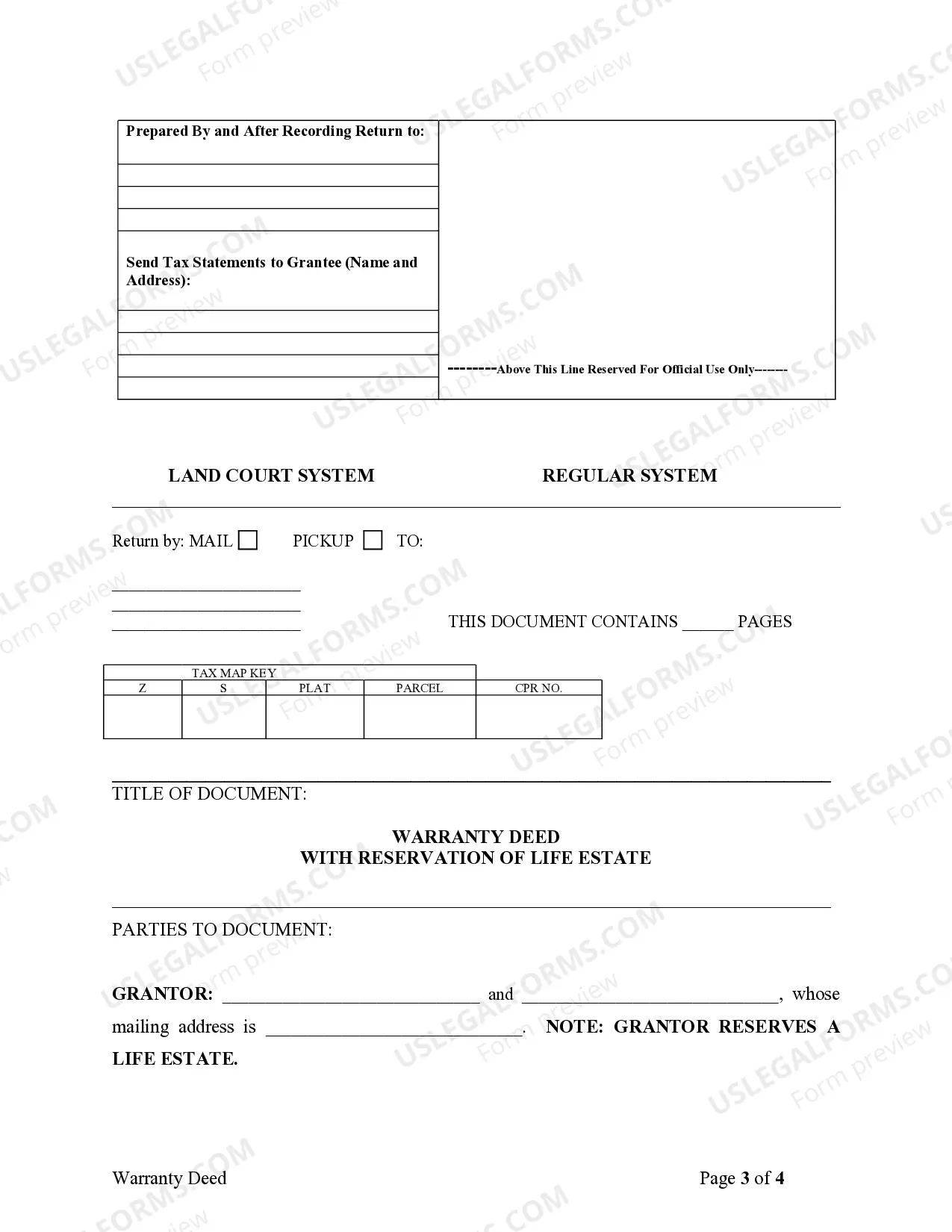

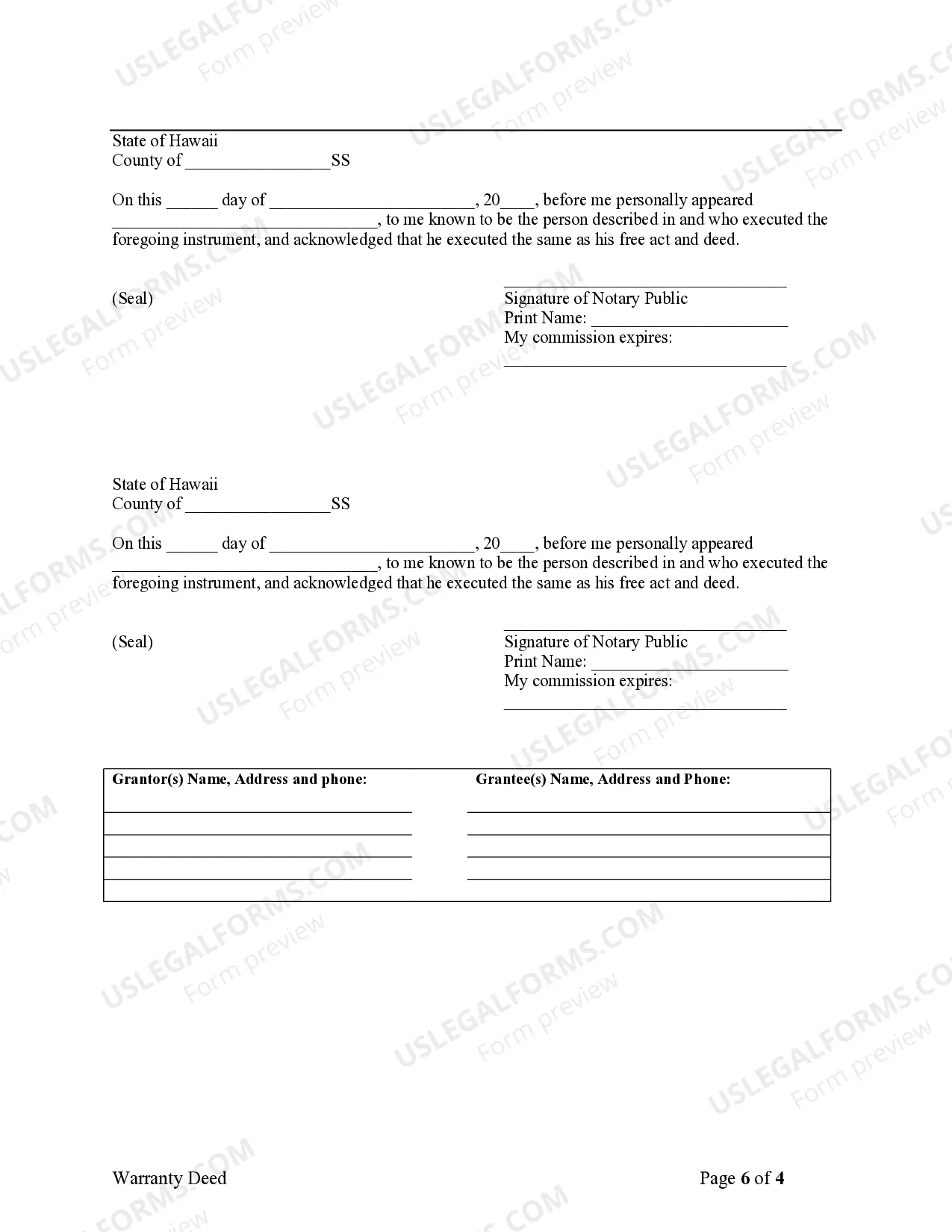

The date the deed was made; The name of the party granting the life estate and their address; The name of the grantee and their address; The address and a legal description of the property that is subject to the life estate;

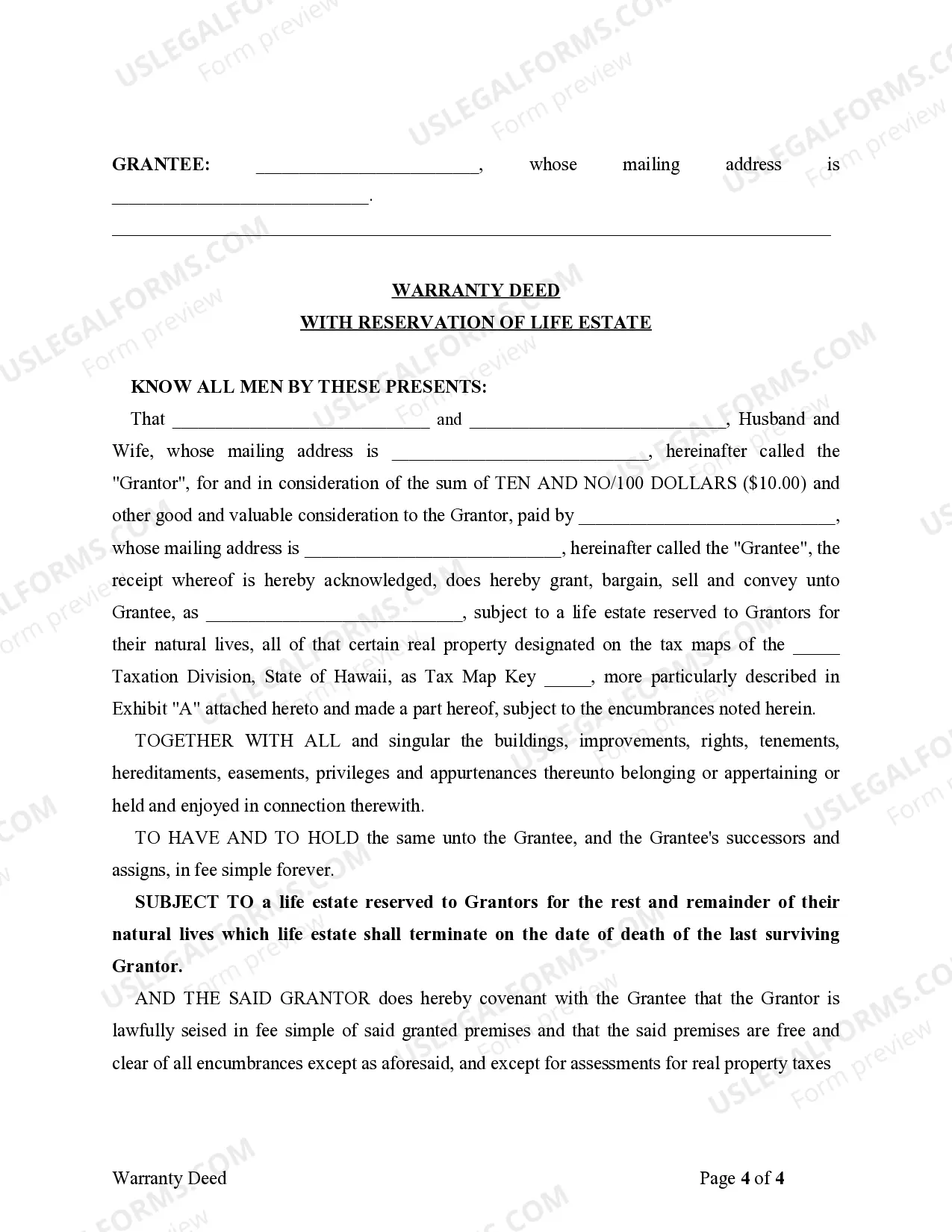

With a life estate deed, the remainderman's ownership interest vests when the deed is signed and delivered (or recorded in the public record). Accordingly, the children's ownership interest in the property vested upon their father signing the deed and recording it in the public records, or the year 2000.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

A life estate is an instant transfer, similar to life insurance, so probate is not required. Under Federal Estate Tax Code Section 2036, a life estate is a gift. This means that if the property is valued at more than $14,000, a gift tax must be paid.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

Simply put, a life estate is a legal arrangement to transfer property upon a person's death. One person (typically the giver) retains or is given an interest in the property for their lifetime.One of those consequences is that the person creating a life estate may unknowingly exceed their annual gift tax exemption.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.