Hawaii Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

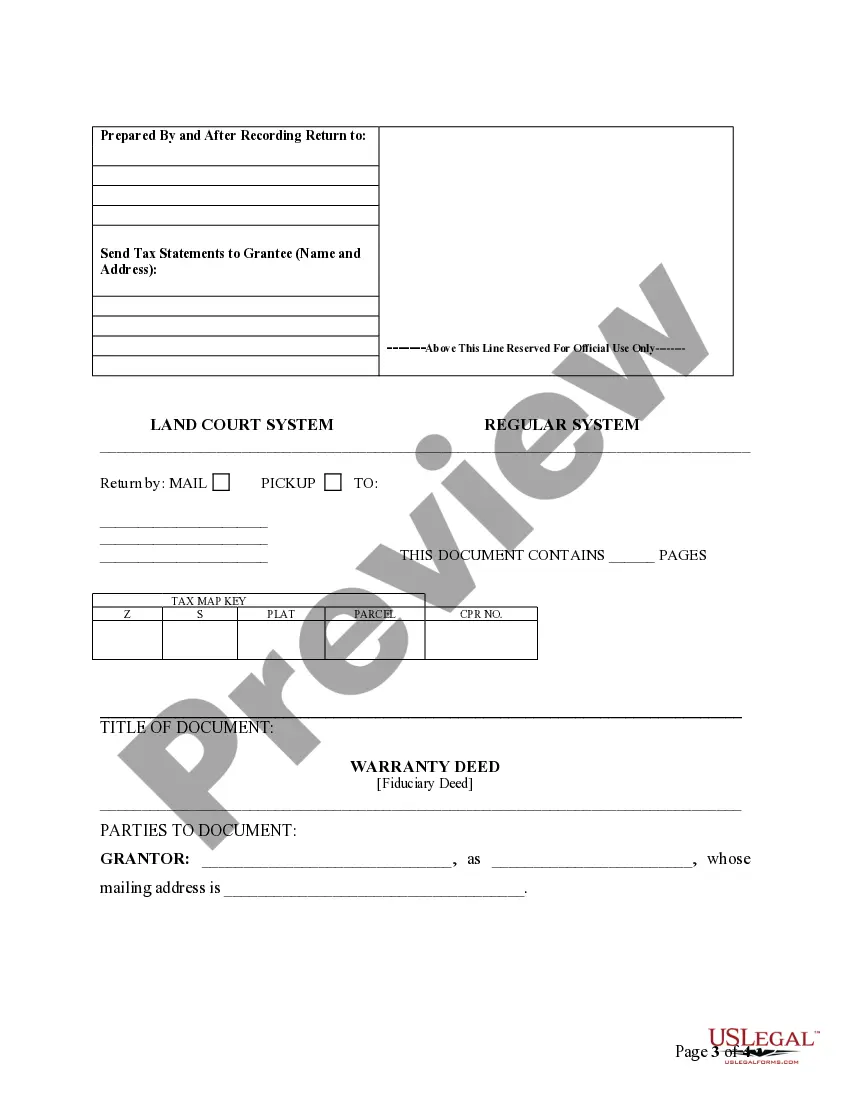

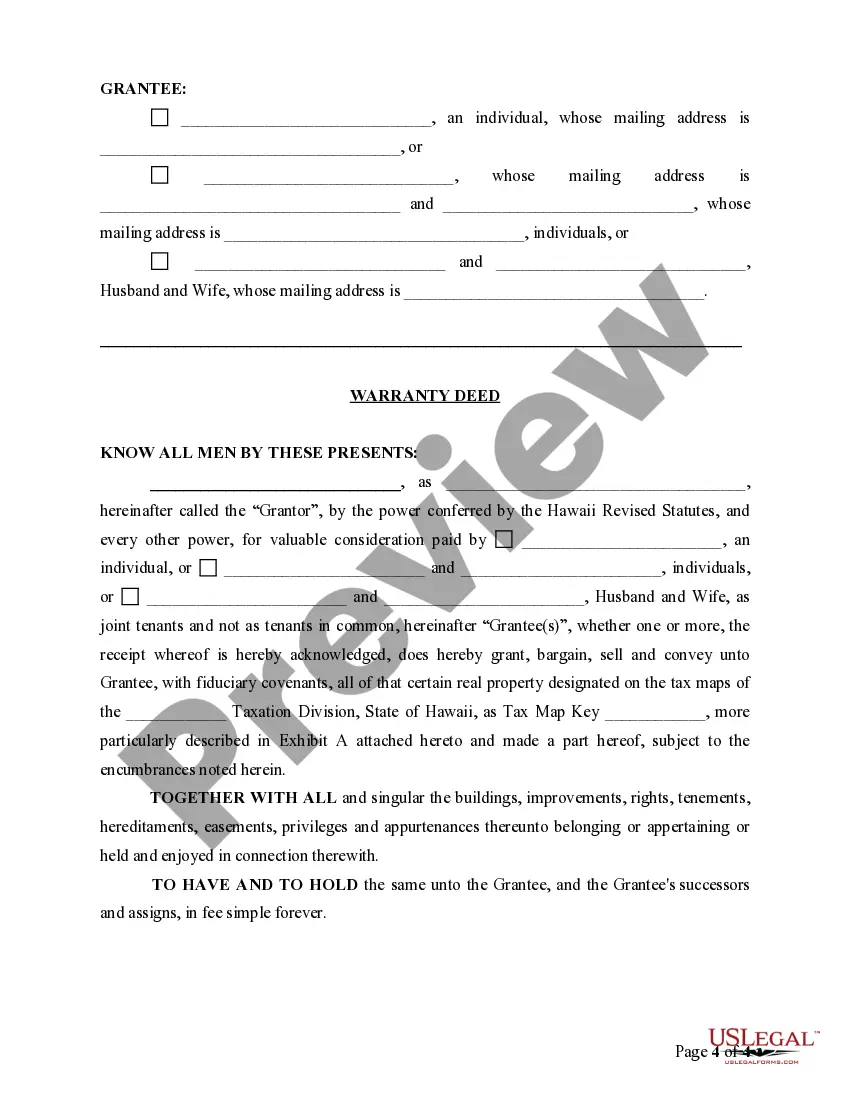

How to fill out Hawaii Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Among lots of free and paid examples that you get on the net, you can't be sure about their accuracy. For example, who created them or if they’re competent enough to take care of what you require these people to. Always keep calm and use US Legal Forms! Find Hawaii Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries templates developed by skilled legal representatives and prevent the high-priced and time-consuming procedure of looking for an attorney and then paying them to draft a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you’re seeking. You'll also be able to access all of your previously acquired samples in the My Forms menu.

If you are utilizing our platform for the first time, follow the tips below to get your Hawaii Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries with ease:

- Ensure that the file you find is valid where you live.

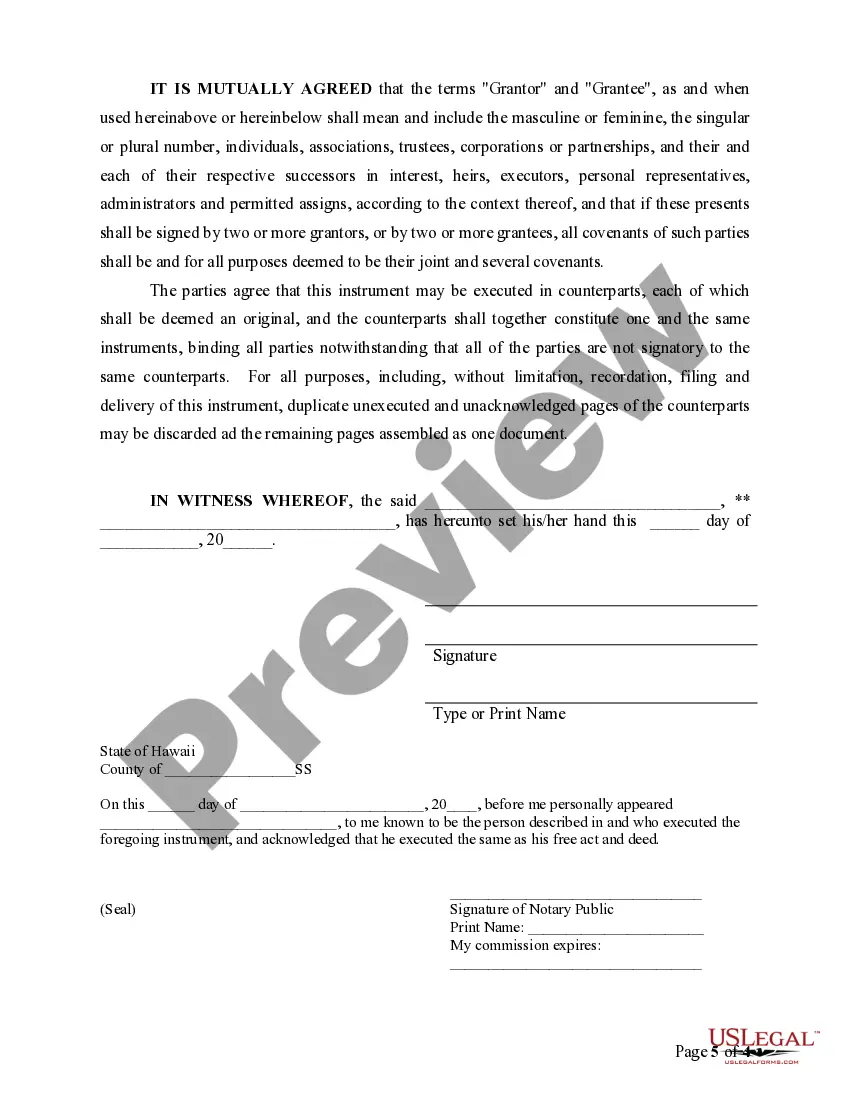

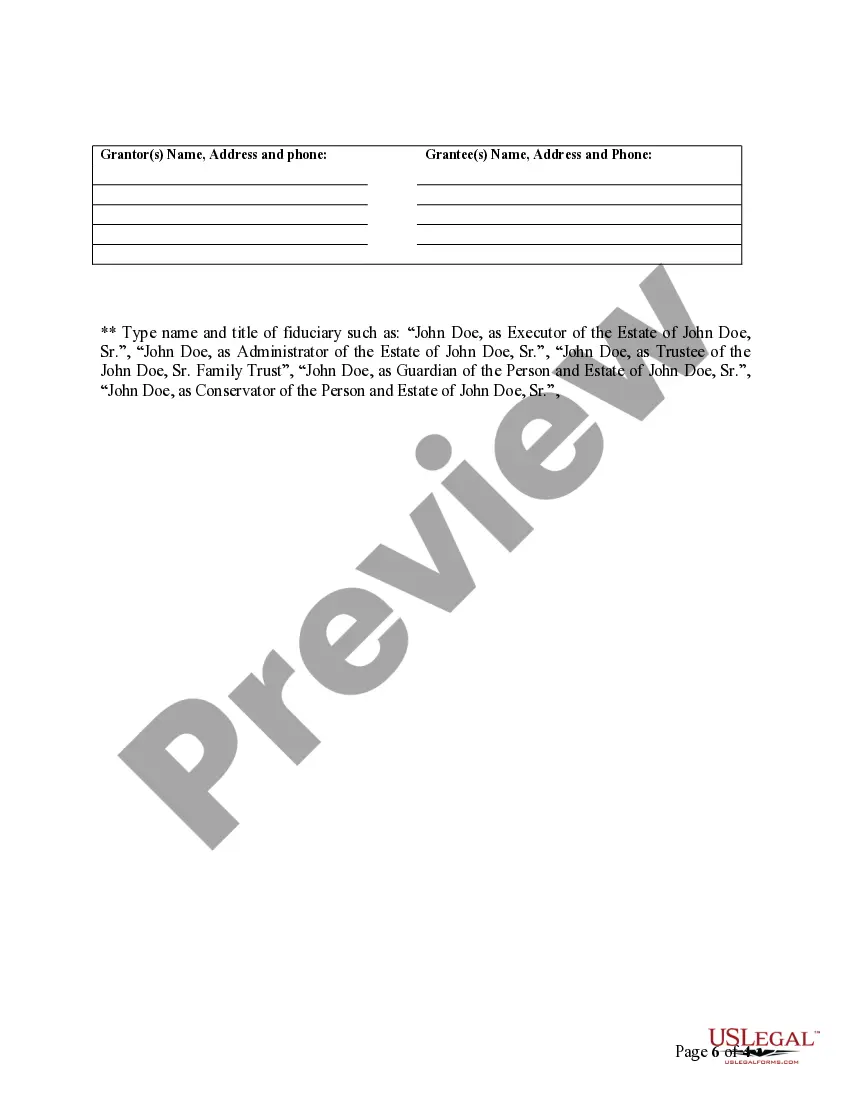

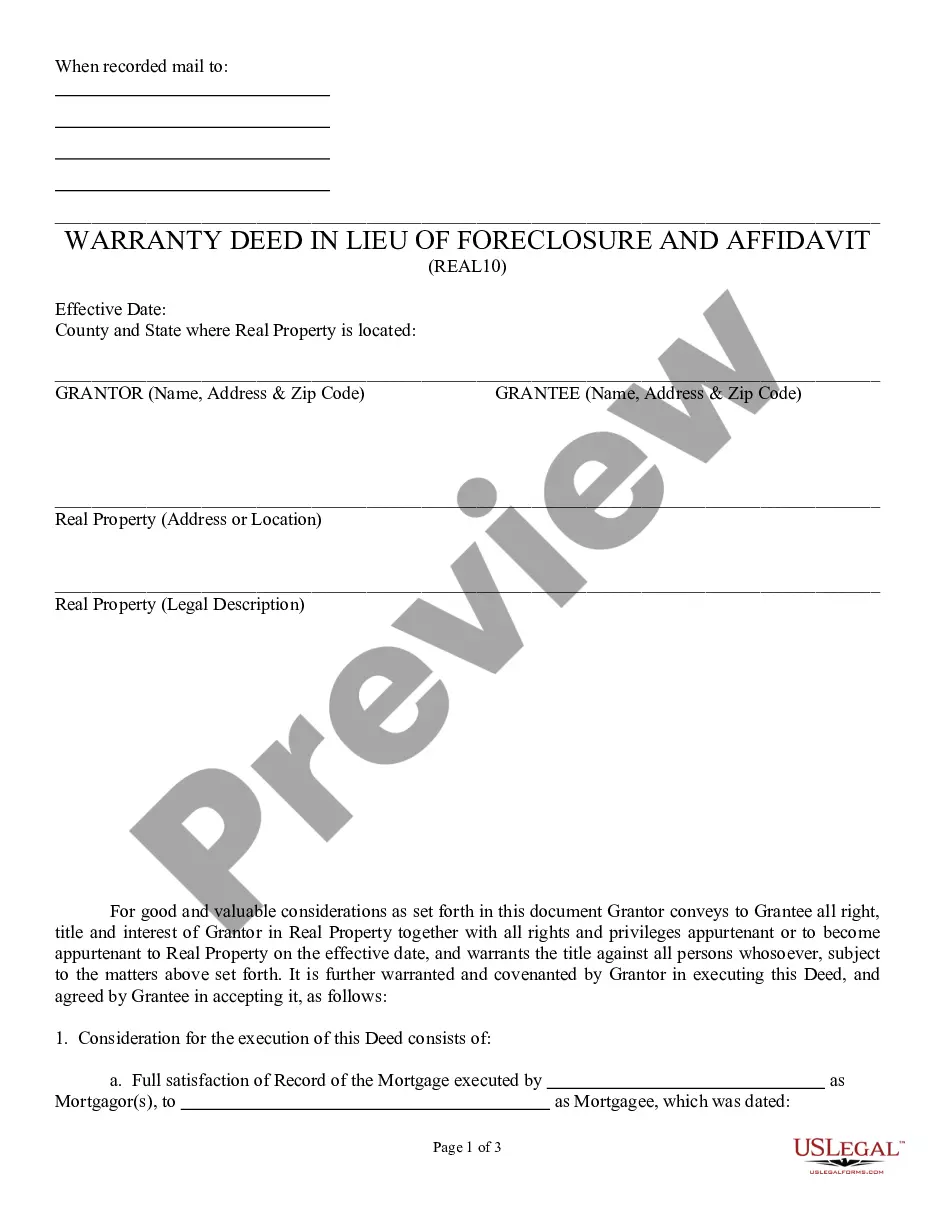

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or find another template utilizing the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

As soon as you have signed up and bought your subscription, you can use your Hawaii Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries as often as you need or for as long as it stays valid where you live. Edit it in your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

A trustee takes legal ownership of the assets held by a trust and assumes fiduciary responsibility for managing those assets and carrying out the purposes of the trust.

A trustee is a person who takes responsibility for managing money or assets that have been set aside in a trust for the benefit of someone else.Everything you do as a trustee must be done in the beneficiary's best interests.

The person who legally holds and manages the trust property is the "trustee." The person for whose benefit the trust is created and managed is the "beneficiary." The settlor, trustee, and beneficiary can be the same person or persons, they can be different persons or even multiple charitable organizations.

When a Trust owns a home the Trustee acts as the legal owner and makes all the management decisions, the beneficiaries only get the enjoyment partliving there (if that is allowed under the Trust terms).

It's quite common to be both a trustee and a beneficiary of a trust. The surviving spouse, for example, is almost always the successor trustee and beneficiary of a family trust. And it's quite common for one adult child to be the trustee and all the siblings to be beneficiaries of their parents' trusts.

A trustee is a person or firm that holds and administers property or assets for the benefit of a third party.Trustees are trusted to make decisions in the beneficiary's best interests and often have a fiduciary responsibility, meaning they act in the best interests of the trust beneficiaries to manage their assets.

Settlor, Grantor, Trust-maker, and Trustor The terms grantor, settlor, trust-maker, and trustor all mean the same thing for estate planning purposes. All refer to the person who creates a trust.In this case, all of the termssettlor, trustor, grantor, and trusteerefer to the same person.

In law a settlor is a person who settles property on trust law for the benefit of beneficiaries.The settlor may also be the trustee of the trust (where he declares that he holds his own property on trusts) or a third party may be the trustee (where he transfers the property to the trustee on trusts).

The trustor/grantor/settlor is the person who creates the trust. The trustee is the person who manages the assets in the trust.