Hawaii Schedule D: Creditors Who Hold Claims Secured By Property

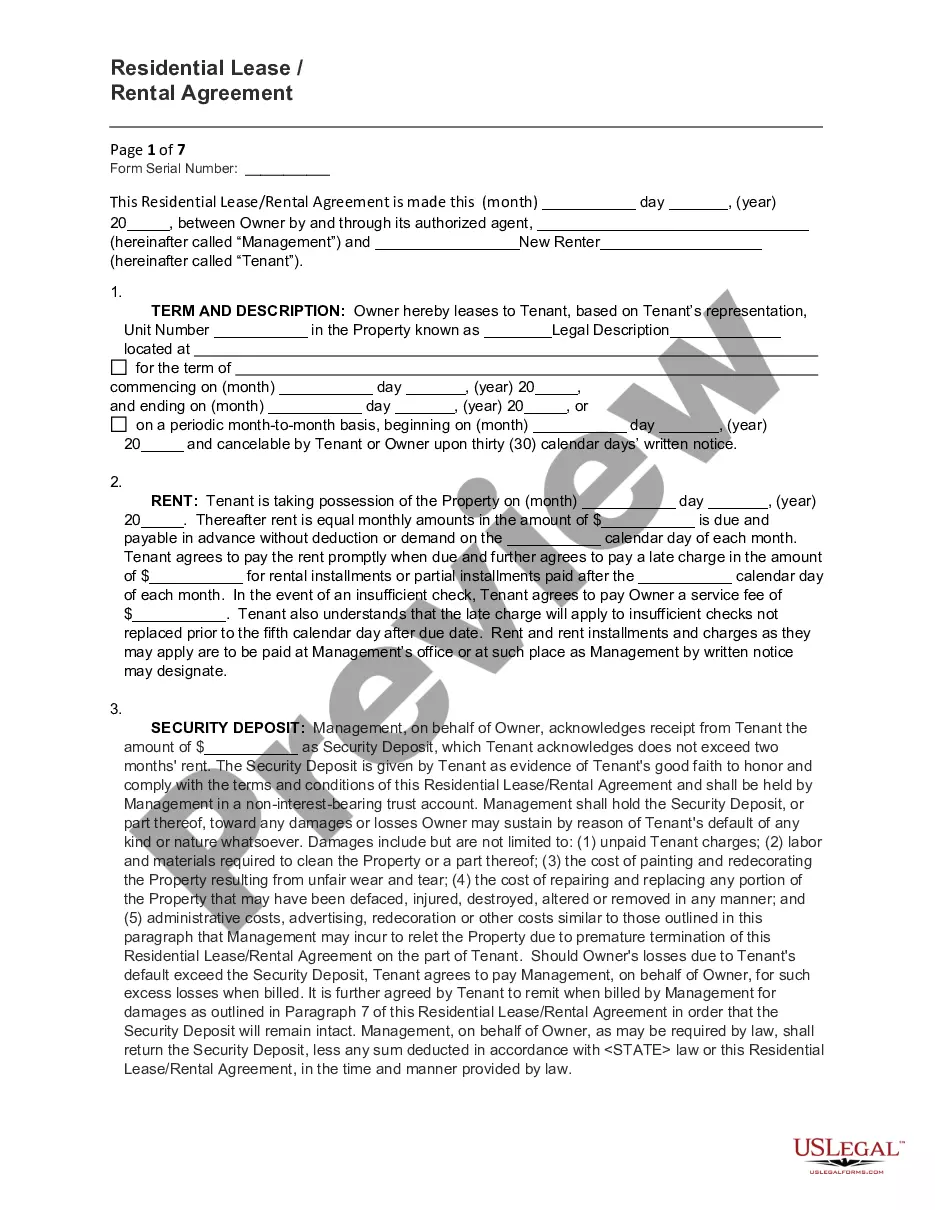

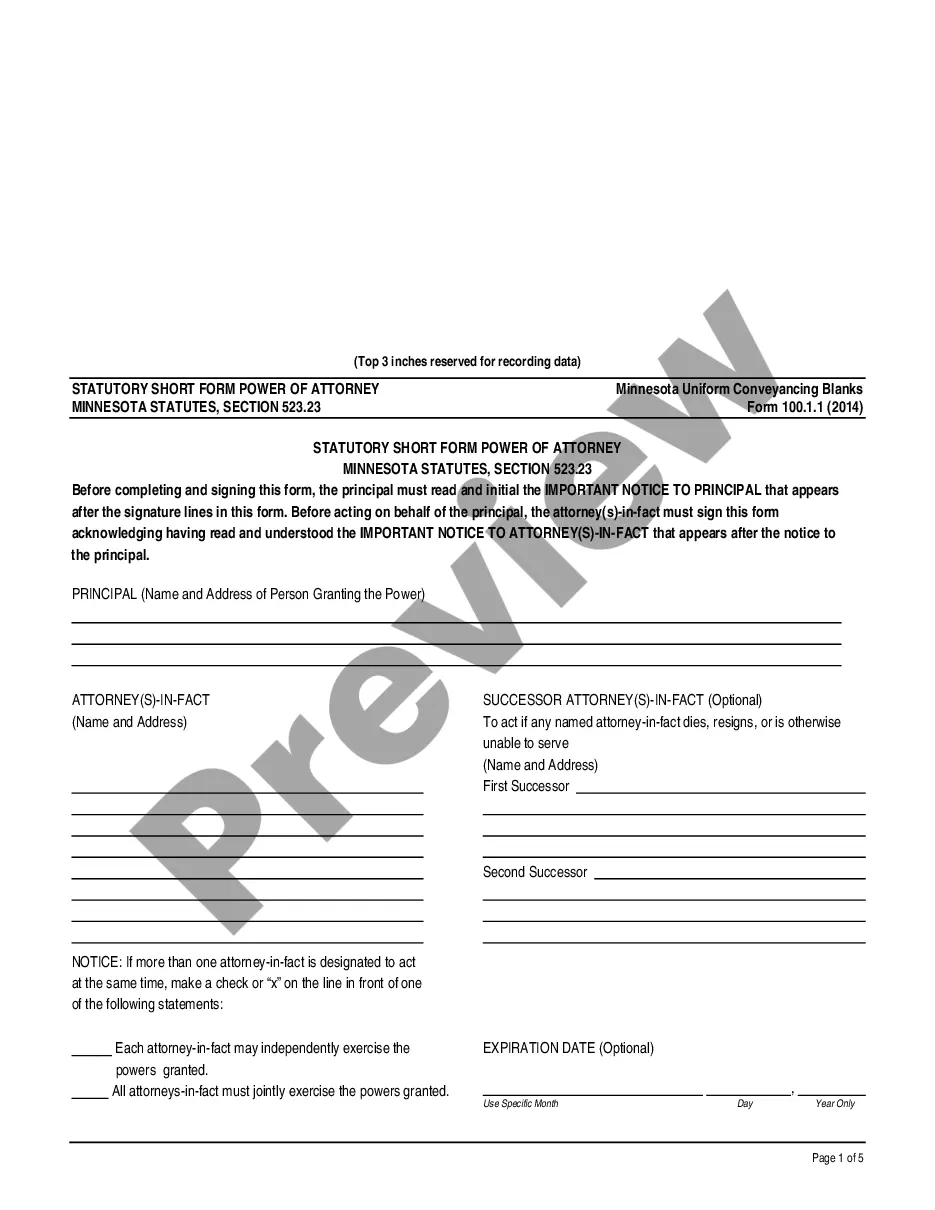

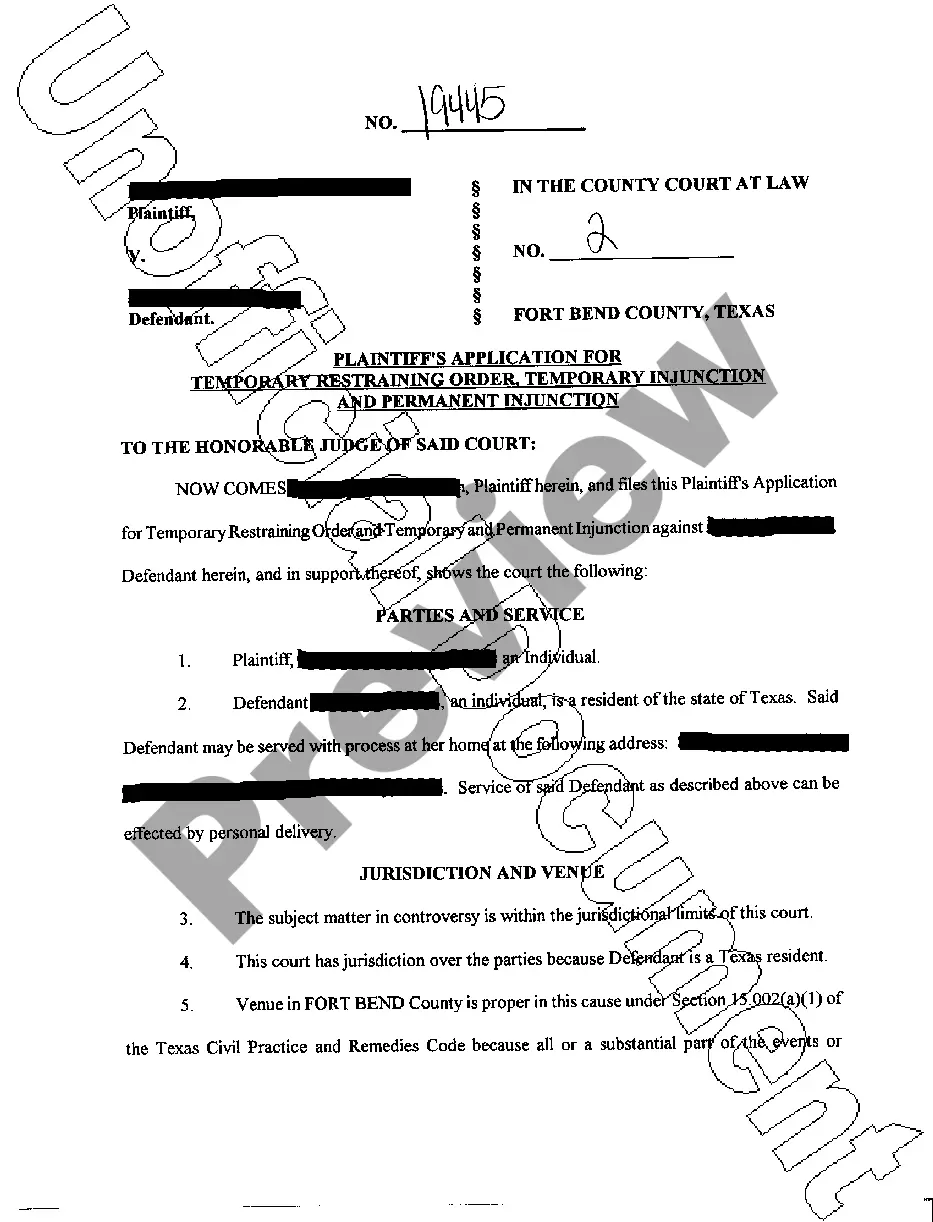

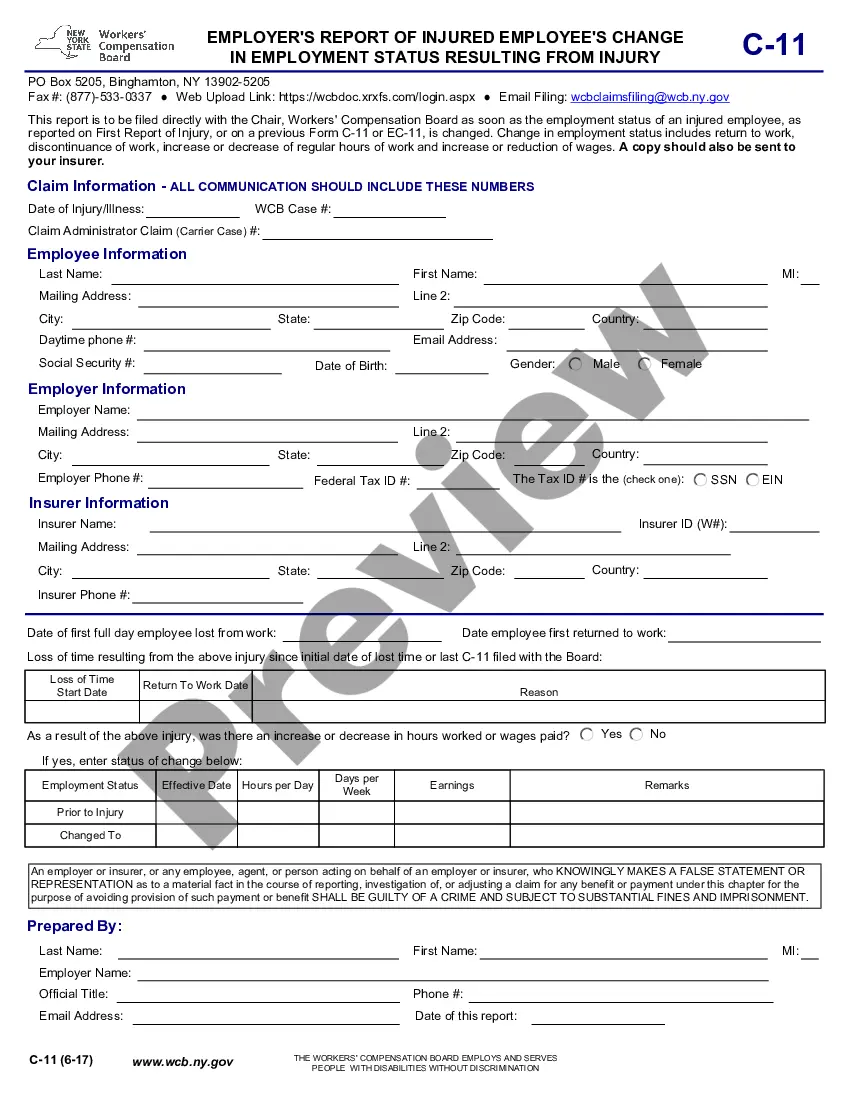

Description

How to fill out Hawaii Schedule D: Creditors Who Hold Claims Secured By Property?

If you’re looking for a way to appropriately prepare the Hawaii Schedule D: Creditors Who Hold Claims Secured By Property without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every personal and business scenario. Every piece of paperwork you find on our web service is designed in accordance with federal and state laws, so you can be certain that your documents are in order.

Adhere to these simple instructions on how to get the ready-to-use Hawaii Schedule D: Creditors Who Hold Claims Secured By Property:

- Make sure the document you see on the page corresponds with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and choose your state from the list to find another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Hawaii Schedule D: Creditors Who Hold Claims Secured By Property and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

What is an Unsecured Claim? Unsecured claims are the opposite of secured claims: There is no property to seize, repossess, or foreclose upon. Examples of unsecured claims are child support debt, alimony debt, credit card debt, tax debts, and personal loans.

Thus, the main difference between secured and unsecured claims is the existence (or absence) of collateral that serves as a backing to the underlying loan or debt in the event of a default or non-payment by the borrower.

Secured Creditors are creditors that hold a lien on its debtor's property, whether that property is real property or personal property. The lien gives the secured creditor an interest in its debtor's property that provides for the property to be sold to satisfy the debt in cases of default.

An unsecured claim is a liability for which there is no collateral. Instead, credit was extended solely based on the creditor's evaluation of the debtor's ability to pay.