Hawaii Extend Time to File Complaint Objecting to Discharge or to Determine Dischargeability, or Motion to Dismiss (Stipulation)

Description

How to fill out Hawaii Extend Time To File Complaint Objecting To Discharge Or To Determine Dischargeability, Or Motion To Dismiss (Stipulation)?

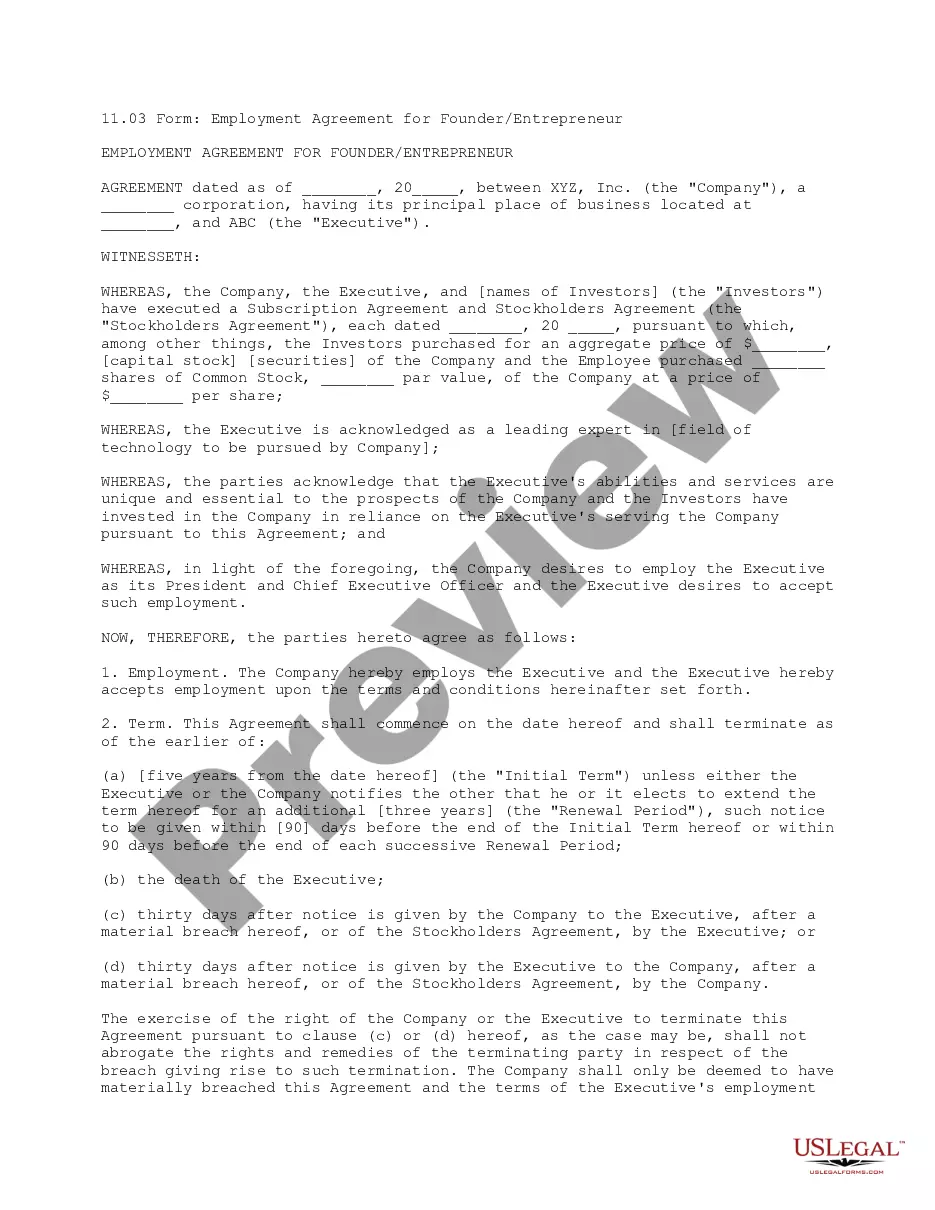

Dealing with legal documentation requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Hawaii Extend Time to File Complaint Objecting to Discharge or to Determine Dischargeability, or Motion to Dismiss (Stipulation) template from our service, you can be sure it meets federal and state laws.

Dealing with our service is simple and fast. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to find your Hawaii Extend Time to File Complaint Objecting to Discharge or to Determine Dischargeability, or Motion to Dismiss (Stipulation) within minutes:

- Make sure to carefully look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Hawaii Extend Time to File Complaint Objecting to Discharge or to Determine Dischargeability, or Motion to Dismiss (Stipulation) in the format you prefer. If it’s your first experience with our website, click Buy now to proceed.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to submit it electronically.

All documents are created for multi-usage, like the Hawaii Extend Time to File Complaint Objecting to Discharge or to Determine Dischargeability, or Motion to Dismiss (Stipulation) you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

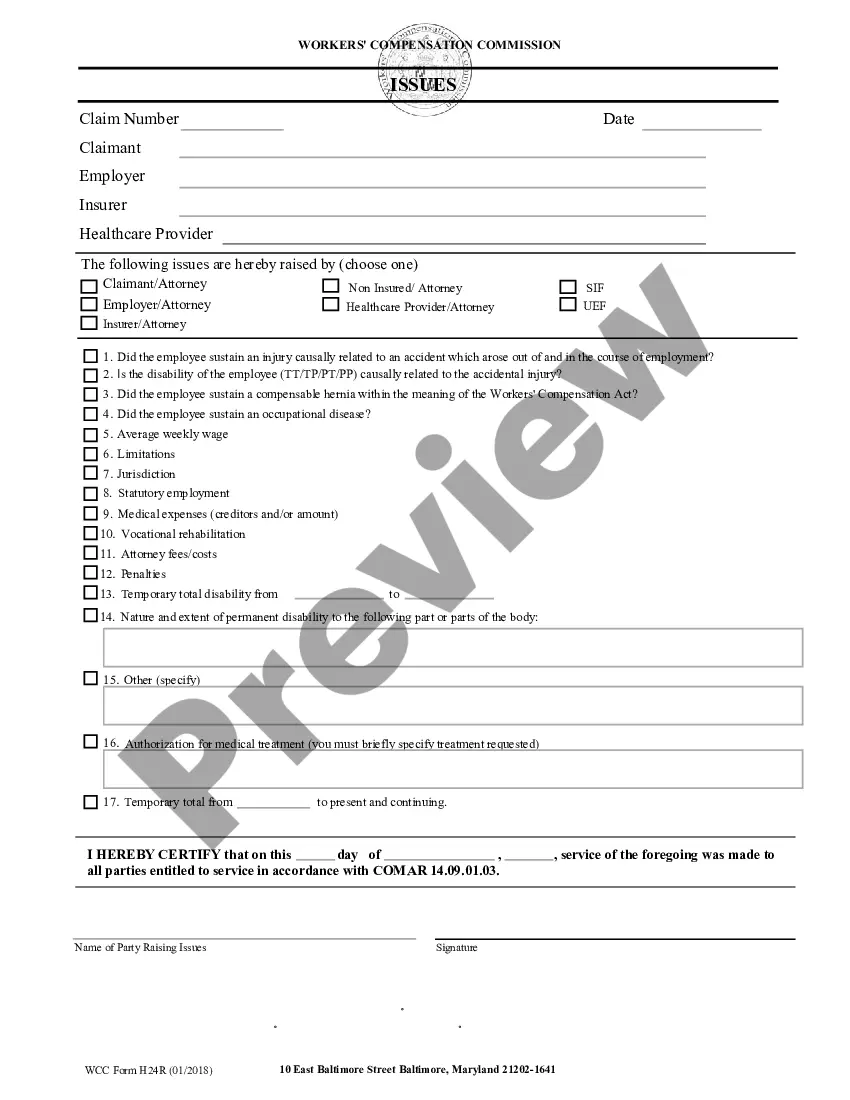

The bankruptcy court has exclusive jurisdiction to determine dischargeability of these debts.

A discharge releases a debtor from personal liability of certain debts known as dischargeable debts, and prevents the creditors owed those debts from taking any action against the debtor or the debtor's property to collect the debts.

Under Federal Rules of Bankruptcy Procedure Rule 4004, a trustee or creditors have sixty (60) days after the first date set for the 341(a) Meeting of Creditors to file a complaint objecting to discharge.

A complaint to determine the dischargeability of a debt under §523(c) shall be filed no later than 60 days after the first date set for the meeting of creditors under §341(a). The court shall give all creditors no less than 30 days' notice of the time so fixed in the manner provided in Rule 2002.

The debt was incurred through fraud, false pretenses, or misrepresentation, such as a person taking on debt with no intent of paying it back. The debt is a credit card debt that was used to pay a nondischargeable debt. The bankruptcy petition was fraudulent or filed to abuse creditors.

Determination of Dischargeability of a Debt. (a) Persons Entitled To File Complaint. A debtor or any creditor may file a complaint to obtain a determination of the dischargeability of any debt.