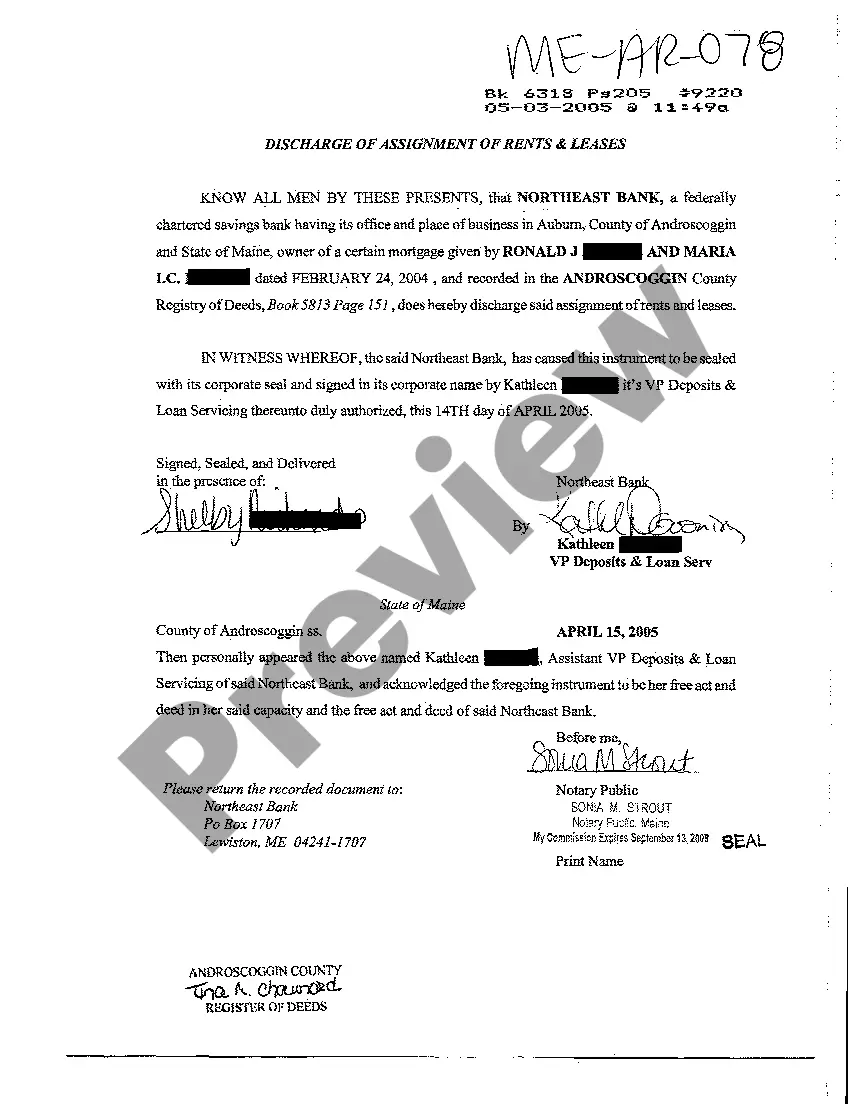

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state regulations and are verified by our experts. So if you need to fill out Hawaii Declaration of Judgment Creditor For Garnishment of Wages, our service is the perfect place to download it.

Getting your Hawaii Declaration of Judgment Creditor For Garnishment of Wages from our service is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they locate the proper template. Later, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a brief guideline for you:

- Document compliance verification. You should attentively examine the content of the form you want and make sure whether it satisfies your needs and fulfills your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab on the top of the page until you find an appropriate template, and click Buy Now once you see the one you need.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Hawaii Declaration of Judgment Creditor For Garnishment of Wages and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to obtain any formal document quickly and easily whenever you need to, and keep your paperwork in order!

In order to garnish your property, the creditor must first file a lawsuit and obtain a judgment against you. A judgment creditor can execute upon a judgment debtor's wages, real property, bank account, or cash box.You must deliver a copy of these completed forms to the garnishee, the judgment debtor, and any creditors who have asked you to notify them. A wage garnishment is any legal or equitable procedure through which some portion of a person's earnings is required to be withheld for the payment of a debt. Remedies Code, writ of garnishment, writ of execution, or other post judgment order is issued, the receiver or judgment creditor must serve. The judgment creditor serves a writ of execution on the garnishee; or. • The judgment debtor authorizes the release of the garnished earnings to the judgment. The judgment creditor serves a writ of execution on the garnishee; or. • The judgment debtor authorizes the release of the garnished earnings to the judgment. If you win your case, the money the court awards you is called the judgment.