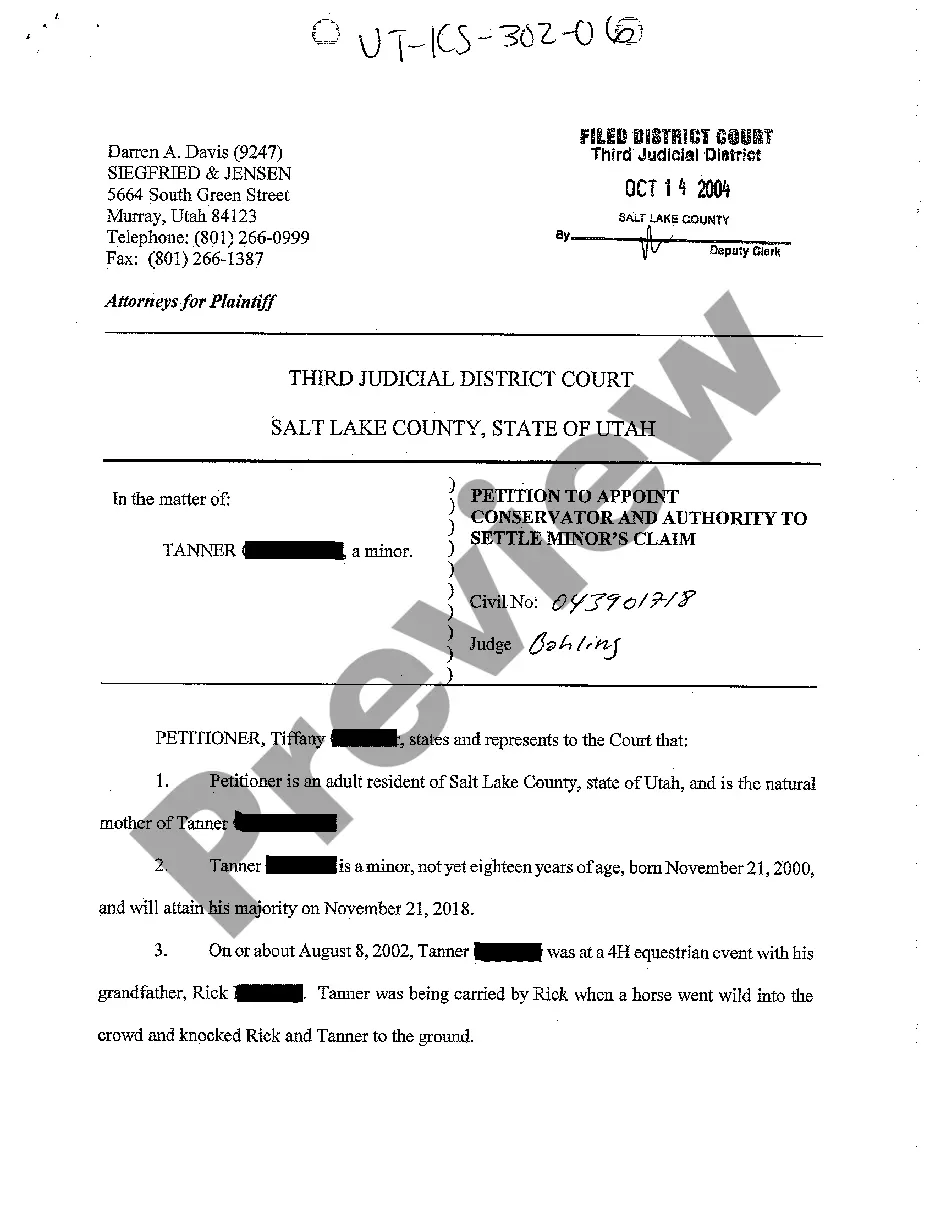

Hawaii Garnishee Disclosure is a process where a creditor can obtain an order from the court to garnish the wages of a debtor. The creditor can do this in order to collect money owed on a debt. The Garnishee Disclosure includes information on the wages, bank accounts, and other property of the debtor. There are two types of Hawaii Garnishee Disclosure: Voluntary Disclosure and Court Ordered Disclosure. Voluntary Disclosure is when the debtor voluntarily provides their financial information to the creditor, while Court Ordered Disclosure is when the court orders the debtor to provide their financial information as part of a garnishment order. In both cases, the creditor must provide the debtor with a detailed description of the information they are seeking. This includes the amount they are seeking, the time period the debt is from, the terms of the garnishment, and any other relevant information.

Hawaii Garnishee Disclosure

Description

How to fill out Hawaii Garnishee Disclosure?

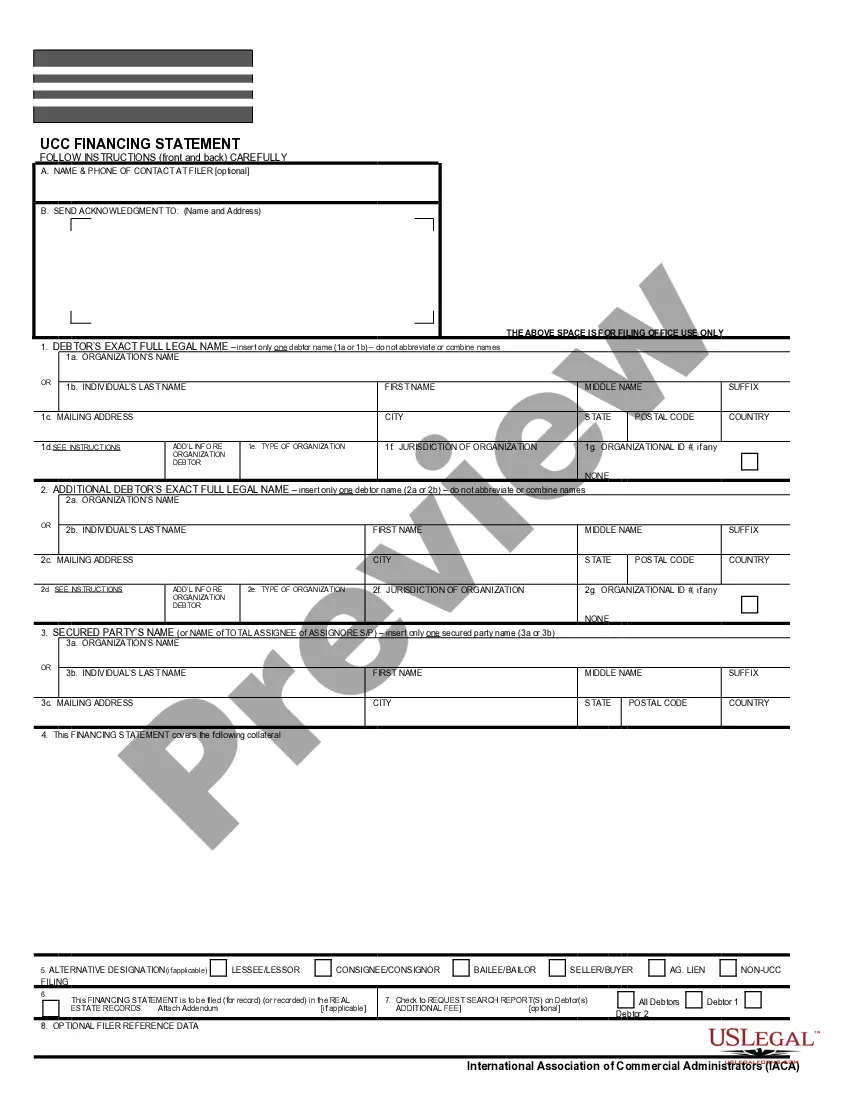

Working with legal paperwork requires attention, accuracy, and using properly-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Hawaii Garnishee Disclosure template from our library, you can be sure it complies with federal and state laws.

Dealing with our service is simple and quick. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to find your Hawaii Garnishee Disclosure within minutes:

- Remember to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative official template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Hawaii Garnishee Disclosure in the format you need. If it’s your first time with our service, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the Hawaii Garnishee Disclosure you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

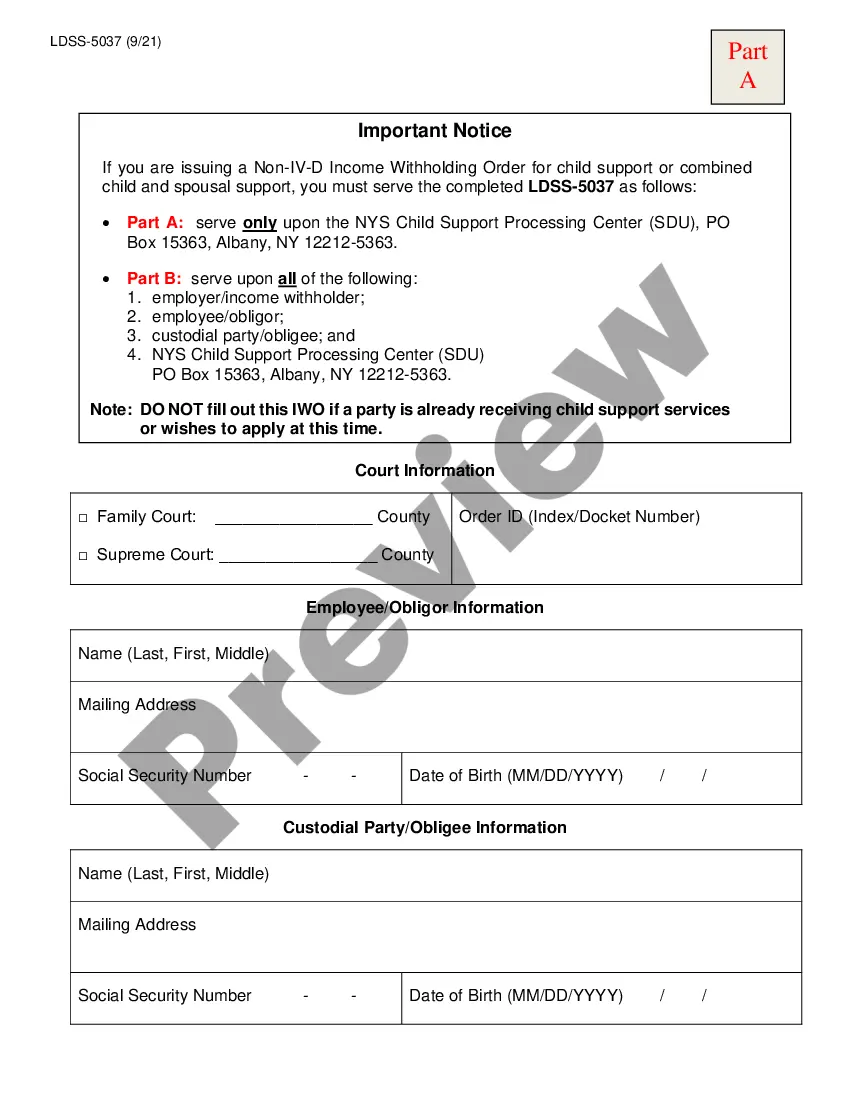

A periodic garnishment lets the plaintiff (creditor) take money from a source that pays you on a regular basis such as your earnings or income from rental properties. A ?garnishee? is a person who has control over some or all of the money that is paid to the defendant. For example, an employer could be a garnishee.

A wage garnishment is a legal procedure where a portion of a person's earnings is required to be withheld by an employer for the payment of a debt. In general, a creditor in Hawaii may garnish up to 25% of the disposable earnings.

There is a $6.00 processing fee per Request and Writ for Garnishment.

You file an objection by completing the form and filing it with the same court that signed the writ of garnishment. There is no cost for filing an objection except in probate court cases.

Under Hawaii's Wage Garnishment Laws: A 5% wage garnishment is withheld on the first $100 in disposable income for the month. A 10% wage garnishment is withheld on the next $100 in disposable income for the month. A 25% wage garnishment is withheld on all disposable income over $200 for the month.

Requesting a Garnishment Start a garnishment by filing a Request and Writ for Garnishment with the court that entered the judgment. The writ is a court order. It tells the garnishee to give you the money it holds for the debtor (like money in a bank account) or would have paid to the debtor (like a paycheck).

If the defendant does not pay the judgment as ordered, you will have to collect your money through an execution against property or a garnishment. To get an execution against property or garnishment, you will first need to know: Where the defendant lives and works.