Hawaii Release of Garnishee is a court-ordered document that is required for a creditor to release funds from a debtor's bank or wage account. The creditor must obtain a court order from the court to be able to garnish or seize the debtor’s wages or bank account. The Hawaii Release of Garnishee form must then be filled out and submitted to the financial institution. The form requires the name of the debtor, creditor, court, and amount of money being released. There are two types of Hawaii Release of Garnishee forms: a Wage Garnishment Release and a Bank Account Garnishment Release. The Wage Garnishment Release is used when the creditor is seeking to release funds from the debtor’s wages, while the Bank Account Garnishment Release is used when the creditor is seeking to release funds from the debtor’s bank account.

Hawaii Release of Garnishee

Description

How to fill out Hawaii Release Of Garnishee?

How much time and resources do you typically spend on drafting formal documentation? There’s a better opportunity to get such forms than hiring legal experts or wasting hours browsing the web for a proper template. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, like the Hawaii Release of Garnishee.

To obtain and prepare an appropriate Hawaii Release of Garnishee template, follow these simple steps:

- Look through the form content to make sure it meets your state regulations. To do so, read the form description or utilize the Preview option.

- In case your legal template doesn’t meet your requirements, locate another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Hawaii Release of Garnishee. If not, proceed to the next steps.

- Click Buy now once you find the right document. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally reliable for that.

- Download your Hawaii Release of Garnishee on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously purchased documents that you safely store in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trustworthy web services. Sign up for us today!

Form popularity

FAQ

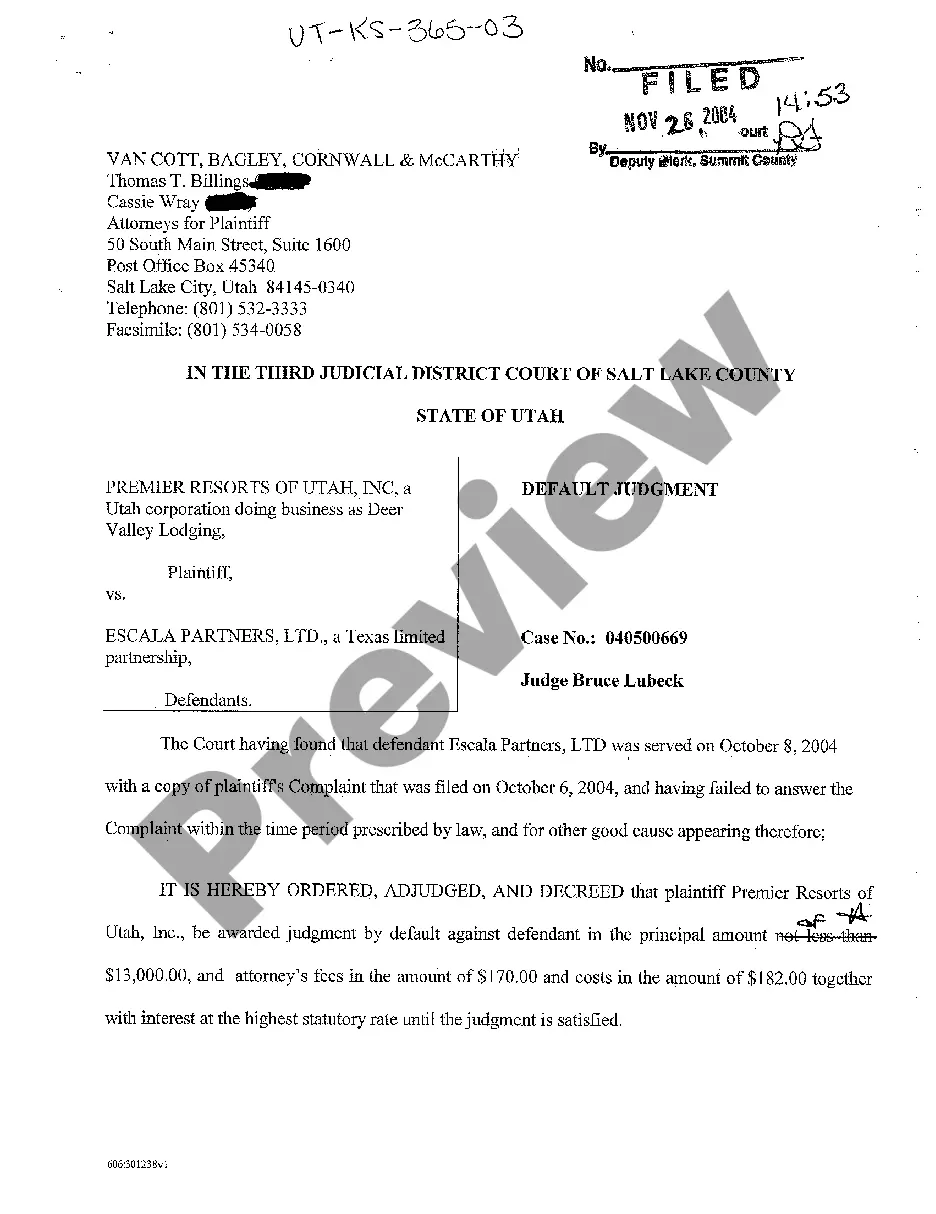

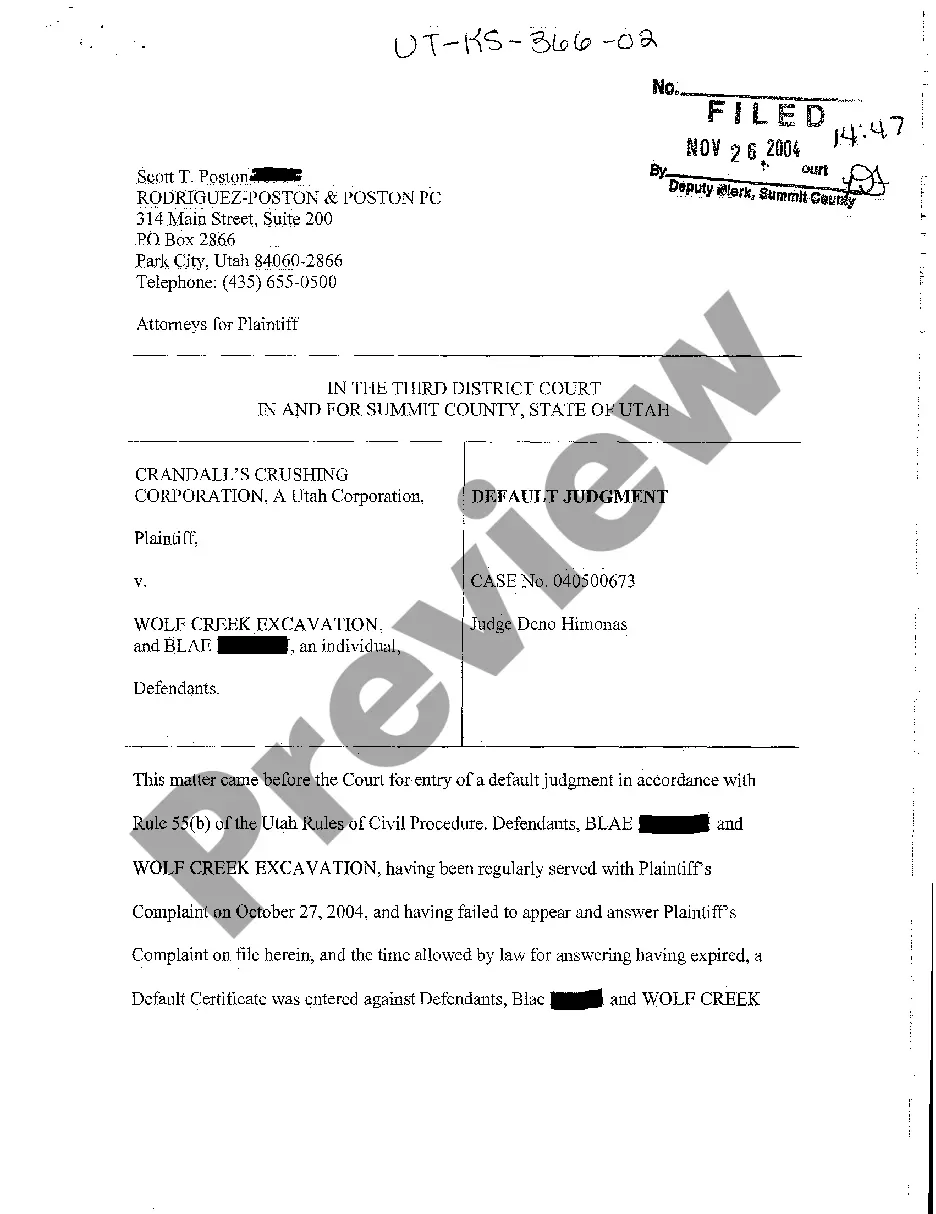

A default judgment (also known as judgment by default) is a ruling granted by a judge or court in favor of a plaintiff in the event that the defendant in a legal case fails to respond to a court summons or does not appear in court.

A default judgment is entered against a party who fails to respond to the allegations in a complaint. Only a defendant may file a motion for summary judgment. Voir dire is a process for presenting evidence in a case. An appellate court can reverse the decision of a trial court that erred.

A default judgment can be entered by a clerk or by a judge. In simple civil cases and where the defendant is neither a minor nor an incompetent person, the clerk, with an affidavit showing the amount due, can enter the judgment for that amount.

If the court is of the opinion that the defendant has been called in a proper manner, but has failed to appear (or to appear in the correct manner, e.g. not trough a lawyer), the court will declare the defendant to be in default of appearance.

Rule 55 - Default (a) Entry. When a party against whom a judgment for affirmative relief is sought has failed to plead or otherwise defend as provided by these rules and that fact is made to appear by affidavit or otherwise, the clerk shall enter the party's default.

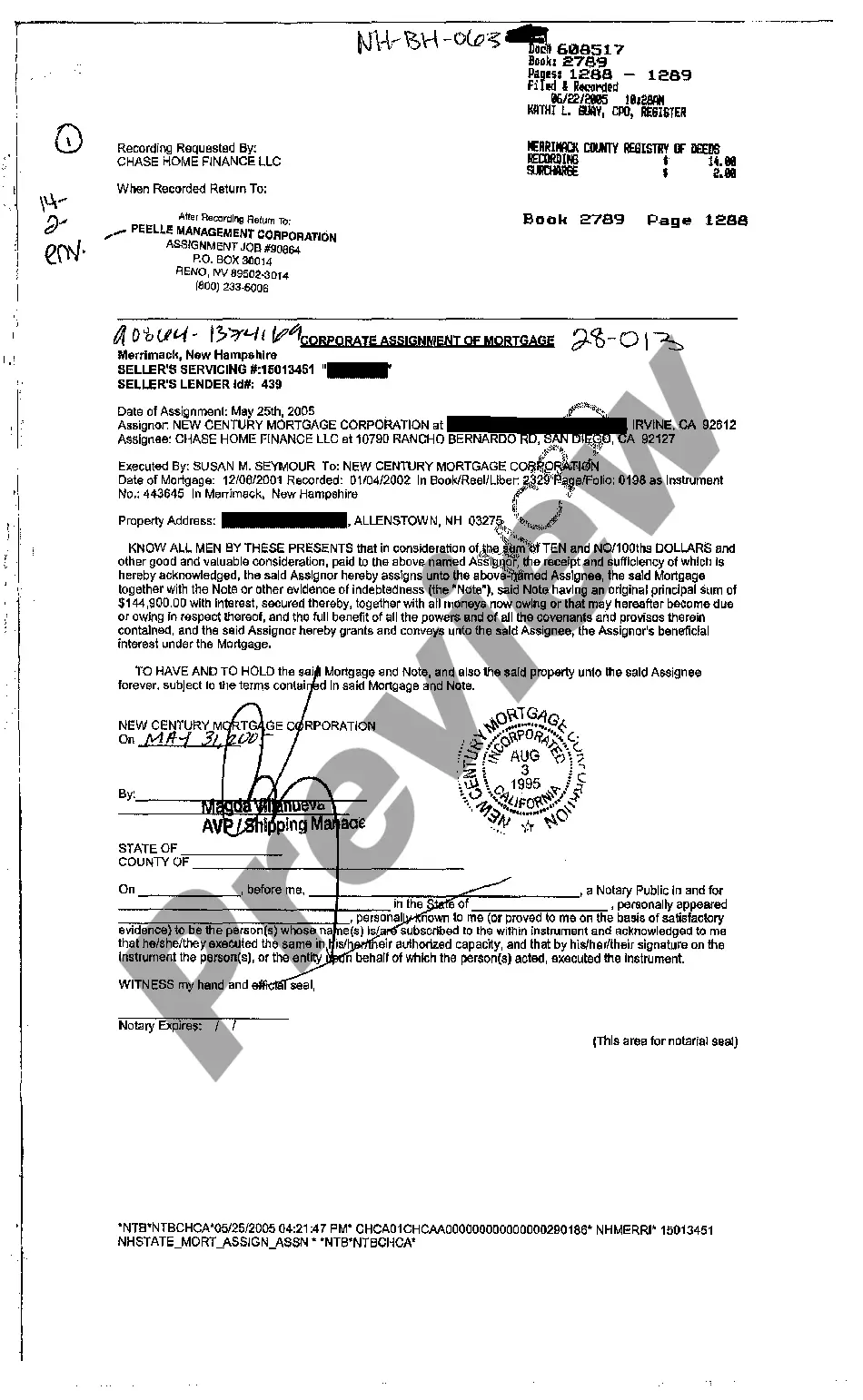

Under Hawaii's Wage Garnishment Laws: A 5% wage garnishment is withheld on the first $100 in disposable income for the month. A 10% wage garnishment is withheld on the next $100 in disposable income for the month. A 25% wage garnishment is withheld on all disposable income over $200 for the month.