A Hawaii Foreign Limited Partnership Annual Statement is a document that must be filed annually with the Hawaii Department of Taxation. It is required for any foreign limited partnership that is registered in Hawaii. The statement includes current information about the partnership such as its name, address, responsible party, and date of registration. It also includes details about the partners, such as the names of the general and limited partners, the partnership’s capital contributions, and the partnership’s income and expenses. Additionally, the statement must include a listing of all foreign limited partnerships that the partnership has a financial interest in and a list of all the foreign countries in which the partnership does business. There are two types of Hawaii Foreign Limited Partnership Annual Statements: the informational statement and the amended statement. The informational statement is used to update the Department of Taxation on the partner’s information, such as the names of the general and limited partners, the partnership’s capital contributions, and the partnership’s income and expenses. The amended statement is used when a partnership has changed information since its last filing, such as the names of the partners, the capital contributions, or the partnership’s income and expenses.

Hawaii Foreign Limited Partnership Annual Statement

Description

How to fill out Hawaii Foreign Limited Partnership Annual Statement?

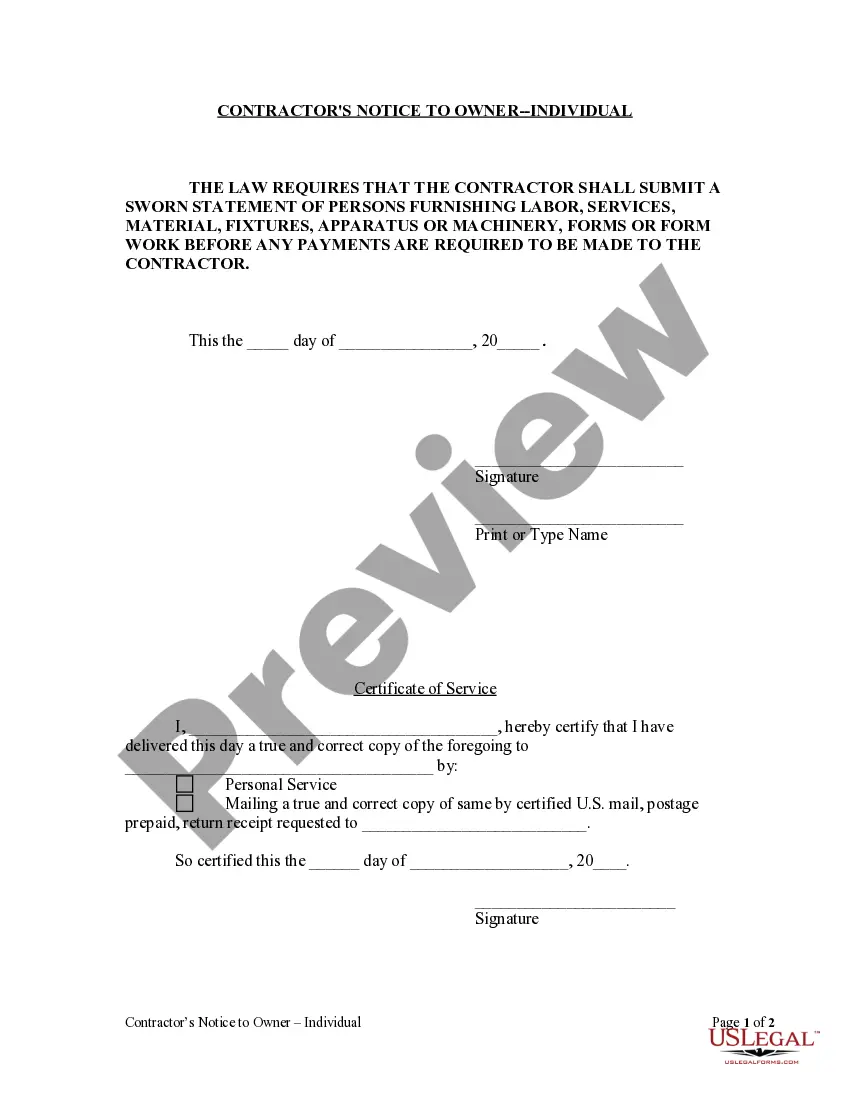

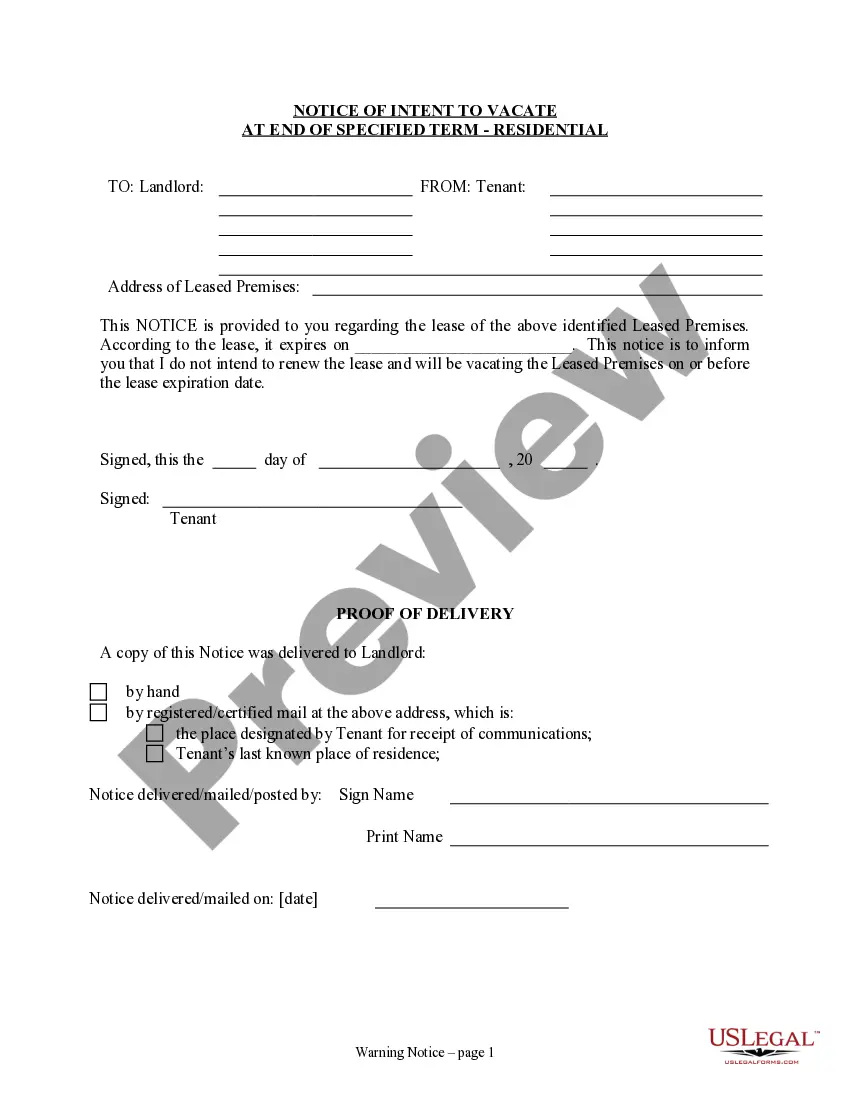

Working with legal paperwork requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Hawaii Foreign Limited Partnership Annual Statement template from our library, you can be certain it complies with federal and state regulations.

Working with our service is easy and quick. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to find your Hawaii Foreign Limited Partnership Annual Statement within minutes:

- Make sure to carefully examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another official blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Hawaii Foreign Limited Partnership Annual Statement in the format you prefer. If it’s your first experience with our service, click Buy now to proceed.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Hawaii Foreign Limited Partnership Annual Statement you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

A Foreign Limited Partnership is composed of one or more general partners and one or more limited partners. The general partners manage the business and share fully in its profits and losses. Limited partners share in the profits of the business, but their losses are limited to the extent of their investment.

Corporations, LLCs and partnerships registered in the State of Hawaii are required to file annual reports/statements with DCCA Business Registration Division. The annual report/statement provides the public with information on the registered business entity, and it does not include financial information.

Although it is not required, the state of Florida allows general partnerships to register with the state ? making it easier for such businesses to adequately represent themselves in public. A state registration allows the maintenance of a public record of the partnership's existence.

To register a Domestic General Partnership in Hawaii, you must file the Registration Statement for Partnership (Form GP-1), along with the appropriate filing fee(s) with the Department of Commerce and Consumer Affairs (DCCA), Business Registration Division. Registrations can be filed online, or by email, mail, or fax.

What is the Cost to File an Annual Report to the State of Hawaii? All businesses filing a report in Hawaii will pay the basic fee of $15, regardless if they are foreign or domestic.

A Limited Liability Company is a legal entity all its own, while a partnership is owned by two or more people who share legal responsibility of the business entity. In a partnership, the business does not possess a legal identity outside of the business owners.

A partnership is the relationship between two or more people to do trade or business. Each person contributes money, property, labor or skill, and shares in the profits and losses of the business.

To dissolve your Hawaii Corporation, file Form DC-13, Hawaii Articles of Dissolution with the Hawaii Department of Commerce and Consumer Affairs, Business Registration Division (BREG) by mail, fax, or in person. The articles of dissolution cannot be filed online.