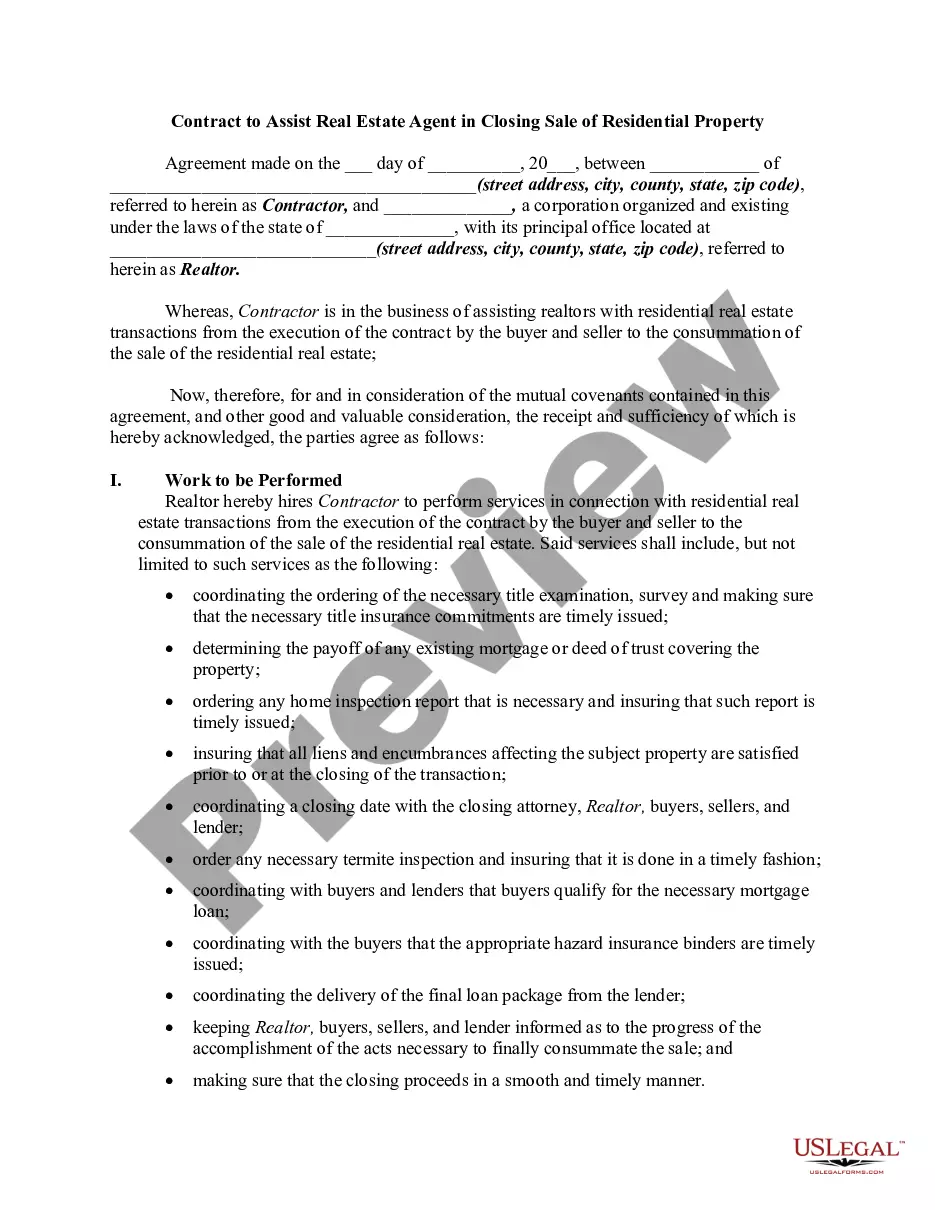

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Hawaii Change or Modification Agreement of Deed of Trust

Description

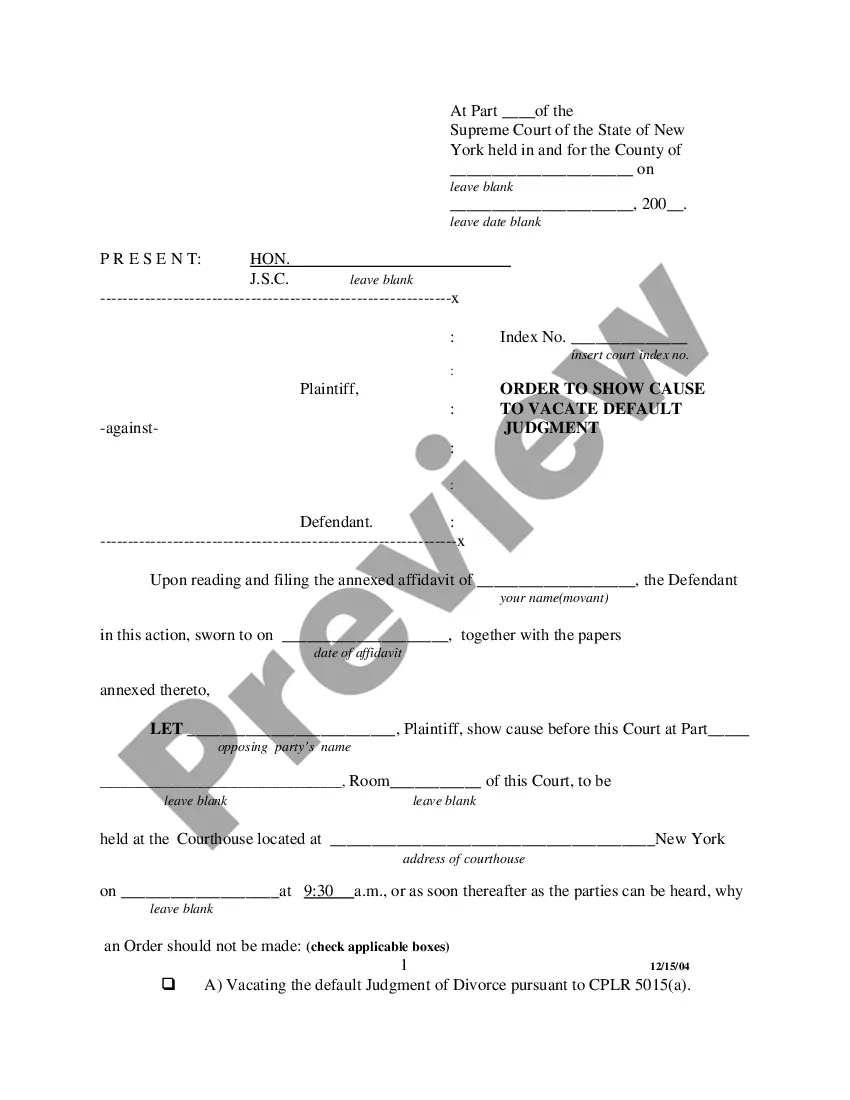

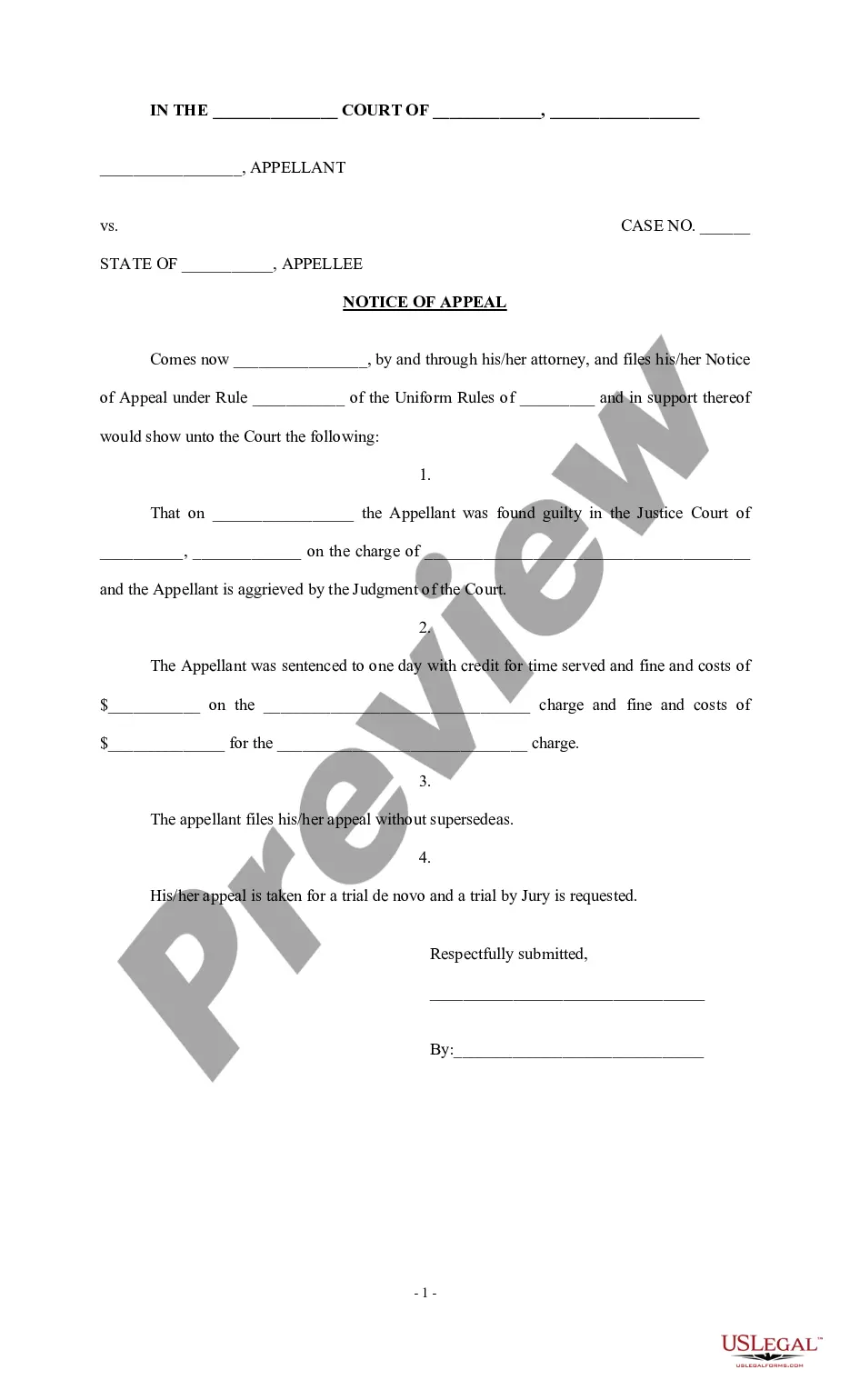

How to fill out Change Or Modification Agreement Of Deed Of Trust?

If you need to comprehensive, download, or produce authorized file themes, use US Legal Forms, the most important variety of authorized types, that can be found online. Use the site`s basic and practical look for to find the documents you need. Numerous themes for organization and individual functions are categorized by classes and says, or keywords and phrases. Use US Legal Forms to find the Hawaii Change or Modification Agreement of Deed of Trust in a couple of mouse clicks.

In case you are already a US Legal Forms buyer, log in in your bank account and click on the Download option to obtain the Hawaii Change or Modification Agreement of Deed of Trust. Also you can gain access to types you earlier delivered electronically within the My Forms tab of the bank account.

If you work with US Legal Forms the first time, follow the instructions listed below:

- Step 1. Ensure you have selected the form for your appropriate town/land.

- Step 2. Utilize the Preview option to check out the form`s content. Do not neglect to see the outline.

- Step 3. In case you are unsatisfied together with the type, use the Research discipline near the top of the screen to find other types from the authorized type format.

- Step 4. Once you have discovered the form you need, click the Get now option. Select the pricing plan you choose and include your qualifications to register for the bank account.

- Step 5. Procedure the deal. You should use your bank card or PayPal bank account to complete the deal.

- Step 6. Pick the format from the authorized type and download it on your own gadget.

- Step 7. Comprehensive, modify and produce or indication the Hawaii Change or Modification Agreement of Deed of Trust.

Each and every authorized file format you purchase is your own property permanently. You may have acces to each type you delivered electronically in your acccount. Go through the My Forms portion and choose a type to produce or download again.

Compete and download, and produce the Hawaii Change or Modification Agreement of Deed of Trust with US Legal Forms. There are thousands of expert and condition-distinct types you may use for your organization or individual requirements.

Form popularity

FAQ

The Deed of Variation may be used to vary the existing terms of a discretionary trust (sometimes called a family trust), a unit trust or a hybrid trust.

The trustee has the power to vary the trust. The trustee, by a deed of amendment, varies the terms of the trust deed to convert the discretionary trust to a fixed unit trust so that each beneficiary had a fixed entitlement in the trust.

Here are grounds upon which you can contest a trust in Hawaii. Lack of testamentary capacity ? This happens when the grantor does not have the mental competence to execute the trust, such as when they are suffering from dementia. Forgery ? A living trust can also be contested if it is established that it was forged.

Trusts are often used in financial planning or in connection with estates and cannot simply be amended once a trust deed has been executed. As trusts become more commonplace, we are seeing that, all too often, insufficient attention is paid to the detail of how to set one up which can lead to errors in the drafting.

By updating your family/ discretionary trust deeds, you'll actively safeguard against potential legal complications arising from outdated provisions. We are committed to optimising your family succession, asset protection, and trust estate planning strategy.

In the trust deed where there is no mention about amendment, the amendment has to be done with the permission of a civil court. Even the Civil Courts do not have unlimited powers of amendment. The Civil Courts permit amendment under the doctrine of Cy pres, which means the original intent of the settlor should prevail.

(c) The settlor may revoke or amend a revocable trust by substantial compliance with a method provided in the terms of the trust, including requiring a higher level of capacity to amend or revoke, or, if the terms of the trust do not provide a method of amendment or revocation, by any written and signed method ...

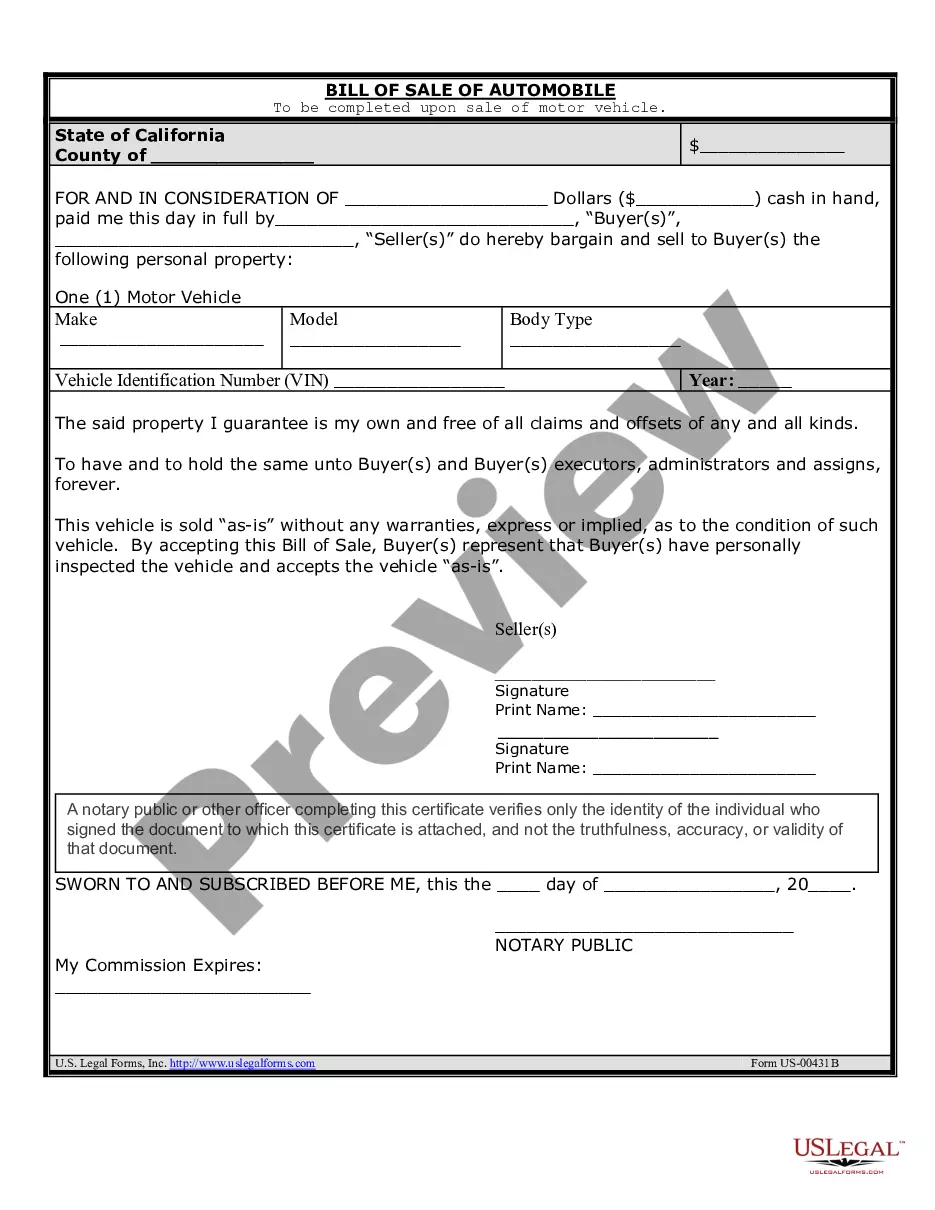

A trust deed note, being a negotiable instrument, may be sold and assigned to others, such as a trust deed investor.