A Hawaii Corporate Resolution for an Economic Injury Disaster Loan (IDL) is a legal document that outlines the decisions made by a corporation or company in Hawaii regarding the application and management of an IDL loan offered by the Small Business Administration (SBA). This resolution is usually prepared by the corporation's board of directors or authorized officers and serves as evidence of the corporation's approval and commitment to receiving and utilizing the loan funds for economic recovery and stability following a disaster or significant financial harm. The Hawaii Corporate Resolution for IDL Loan typically includes important details such as the corporation's legal name, address, and tax identification number. It may also specify the loan amount requested, describe the purpose of the loan (covering working capital, operational expenses, or other eligible uses), and discuss the repayment terms and conditions outlined by the SBA. Furthermore, the resolution often designates one or more individuals within the corporation who have the authority to complete and submit the loan application on behalf of the company. These individuals may also be granted the power to sign any necessary agreements or documents related to the loan. Different types of Hawaii Corporate Resolutions for IDL Loans may be categorized based on their intended usage or specific corporate circumstances. For example: 1. General Corporate Resolution: This type of resolution provides a broad overview of the corporation's decision to apply for an IDL loan and outlines the authorized individuals responsible for the loan application process. 2. Specific-Purpose Corporate Resolution: In cases where the IDL loan is sought for a specific purpose, such as rebuilding after a natural disaster or funding a particular project, this resolution outlines the purpose and includes any relevant project details. 3. Emergency Corporate Resolution: If a corporation faces a sudden financial crisis or unforeseen economic damage, this resolution expresses the urgent need for an IDL loan and highlights the reasons for seeking immediate financial support. 4. Multiple Signatory Corporate Resolution: In larger corporations or organizations, this resolution may be needed to specify multiple authorized signatories who can act on behalf of the corporation during the loan application and management process. It is important to consult with legal professionals or experienced advisors to ensure the accuracy and compliance of the Hawaii Corporate Resolution for IDL Loan, as it represents the corporation's commitment to loan obligations and adherence to necessary legal requirements.

Hawaii Corporate Resolution for EIDL Loan

Description

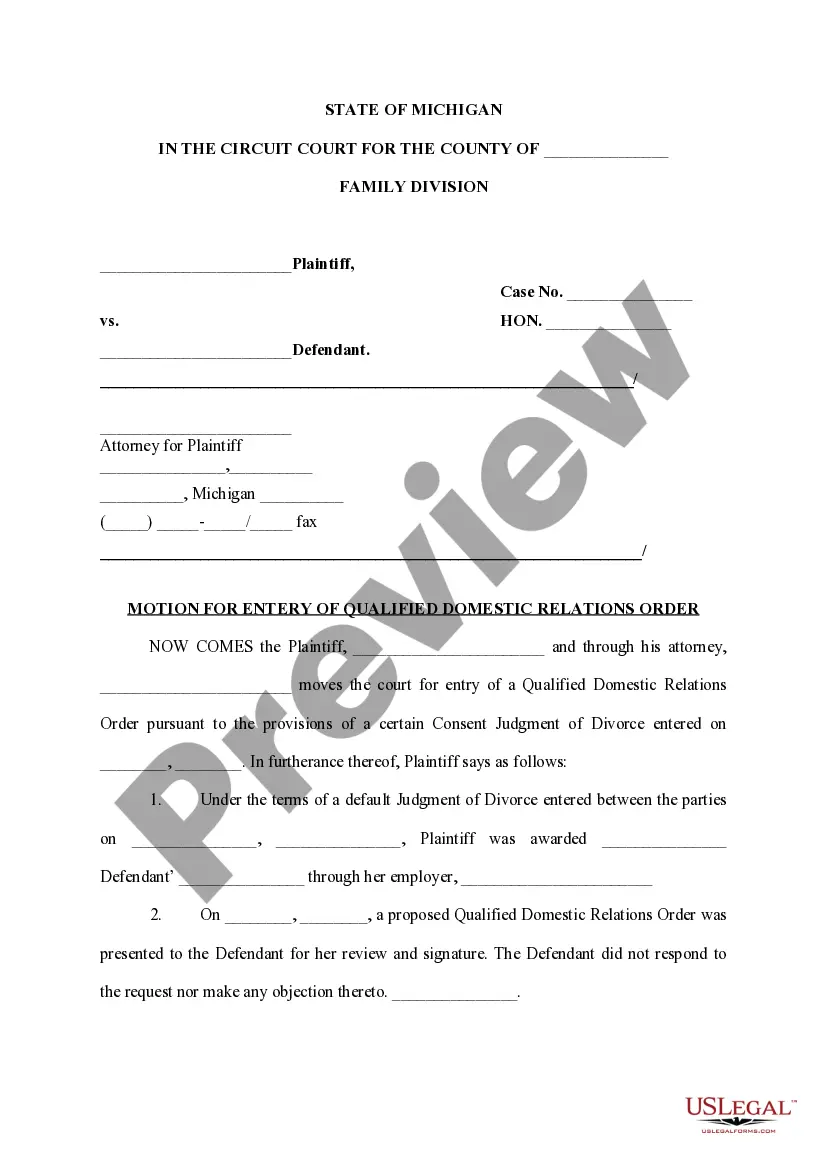

How to fill out Hawaii Corporate Resolution For EIDL Loan?

Selecting the appropriate legal document template can be challenging.

Naturally, there are numerous templates accessible online, but how do you obtain the legal forms you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Hawaii Corporate Resolution for EIDL Loan, suitable for both business and personal use.

You can view the form using the Preview button and read the form description to confirm it is the right fit for you.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Hawaii Corporate Resolution for EIDL Loan.

- Use your account to search for the legal documents you have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the required document.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your locality/state.

Form popularity

FAQ

The Small Business Administration will determine whether you qualify for forgiveness for some or all your EIDL Advance (up to $15,000 across both Advances). Those deemed potentially eligible will receive an email from the SBA with instructions to apply for forgiveness of the Advance(s).

Yes, the short answer is that both regular and COVID-19 EIDL loans do need to be repaid. However, the SBA has offered a deferred repayment schedule for some terms. Additionally, some EIDL advances are structured as grants that don't need to be paid back.

SBA Form 160, Resolution of Board of Directors is a form issued by the Small Business Administration (SBA) and filed with SBA Business Expansion loans - including Direct, Guaranteed, or Participation loans.

Program overview Applicants for the COVID-19 Economic Injury Disaster Loan (EIDL) may have been eligible to receive up to $15,000 in funding from SBA that did not need to be repaid. These "advances" are similar to a grant, but without the typical requirements that come with a U.S. government grant.

EIDL Loan Forgiveness. EIDL loans cannot be forgiven. EIDL loans do have a deferment period, however. Loans made during the 2020 calendar year have a 24-month deferment window from the date of the note.

EIDL Loan Forgiveness. EIDL loans cannot be forgiven. EIDL loans do have a deferment period, however. Loans made during the 2020 calendar year have a 24-month deferment window from the date of the note.

SBA Form 160, Resolution of Board of Directors is a form issued by the Small Business Administration (SBA) and filed with SBA Business Expansion loans - including Direct, Guaranteed, or Participation loans.

The resolution of board of directors is the convenient form that satisfies this requirement. The completed form signifies that the board of directors is aware of the fact that the finances are requested, of the exact sum, and has authorized the organization indicated in the document to receive funds.

The SBA or your lender will take legal action: If you are not able to repay any money within a certain amount of time, the SBA will go through your business (and possibly your personal) finances. If they can identify money that can be used to repay the loan, they may start legal proceedings.

Interesting Questions

More info

Corporation Limited Liability Partnership Professional Corporation Nonprofit Corporation Sole Proprietorship Partnership Compare Entity Types Corporate Board of Directors A board of directors is the highest decision-making body in any company. It makes policy decisions, which can affect, either directly or indirectly, a company's financial or operations. Boards are typically made up of individuals, who can include individuals of various disciplines, such as lawyers, financial experts, public officials, and even members of large public or private companies. Boards consist of many non-public members, and a company can have several board members, each of whose decision-making power is relatively small. Corporations and other business entities usually establish and maintain their own corporate structure, which includes membership in the United States, Canada, or in a number of other countries.