Hawaii Donation or Gift to Charity of Personal Property refers to the act of transferring ownership of personal property such as furniture, artwork, clothing, vehicles, and other non-real estate items to a charitable organization or nonprofit entity in the state of Hawaii. This process is often done willingly and without any expectation of receiving compensation or other material benefits in return. Donating personal property to charity in Hawaii is a significant way for individuals or businesses to support causes they believe in, contribute to the local community, and potentially receive tax benefits. The donated items are used by the charitable organization to further its mission, sold to generate funds for their programs, or directly given to individuals or families in need. There are various types of donations or gifts to charity of personal property in Hawaii, each having its own specific purpose and method of transfer. Some common types of donations include: 1. General Personal Property Donations: This type involves donating a wide range of personal property, including household items, clothing, electronics, furniture, and kitchenware. 2. Vehicle Donations: Individuals can donate cars, trucks, motorcycles, boats, or any other motor vehicle to a charitable organization. These vehicles could be sold to generate funds for the organization, or used by the organization itself for transportation purposes. 3. Artwork and Collectibles Donations: Individuals with valuable artwork, antiques, collectibles, or rare items can donate them to charitable organizations. These items can be used by the organization for fundraising auctions or displayed at their facilities. 4. Real Estate Donations: While not personal property in the traditional sense, real estate can also be donated to charitable organizations. The organization can either keep the property for their own use or sell it to fund their programs. When making a donation, the donor typically needs to fill out a donation form provided by the charitable organization, providing details about the donated item(s), their value, and any relevant documentation or appraisal required. It is important for donors to gather proper documentation and consult a tax professional to maximize potential tax benefits associated with the donation. Overall, Hawaii Donation or Gift to Charity of Personal Property is a way for individuals and businesses to make a positive impact on the community by transferring their personal property assets to help further the mission of charitable organizations and potentially receive tax benefits for their generosity.

Hawaii Donation or Gift to Charity of Personal Property

Description

How to fill out Hawaii Donation Or Gift To Charity Of Personal Property?

If you desire to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the website’s user-friendly and convenient search feature to locate the documents you need.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase belongs to you permanently. You will have access to every form you downloaded within your account.

Visit the My documents section and choose a form to print or download again. Be proactive and download, and print the Hawaii Donation or Gift to Charity of Personal Property with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to access the Hawaii Donation or Gift to Charity of Personal Property in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Hawaii Donation or Gift to Charity of Personal Property.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

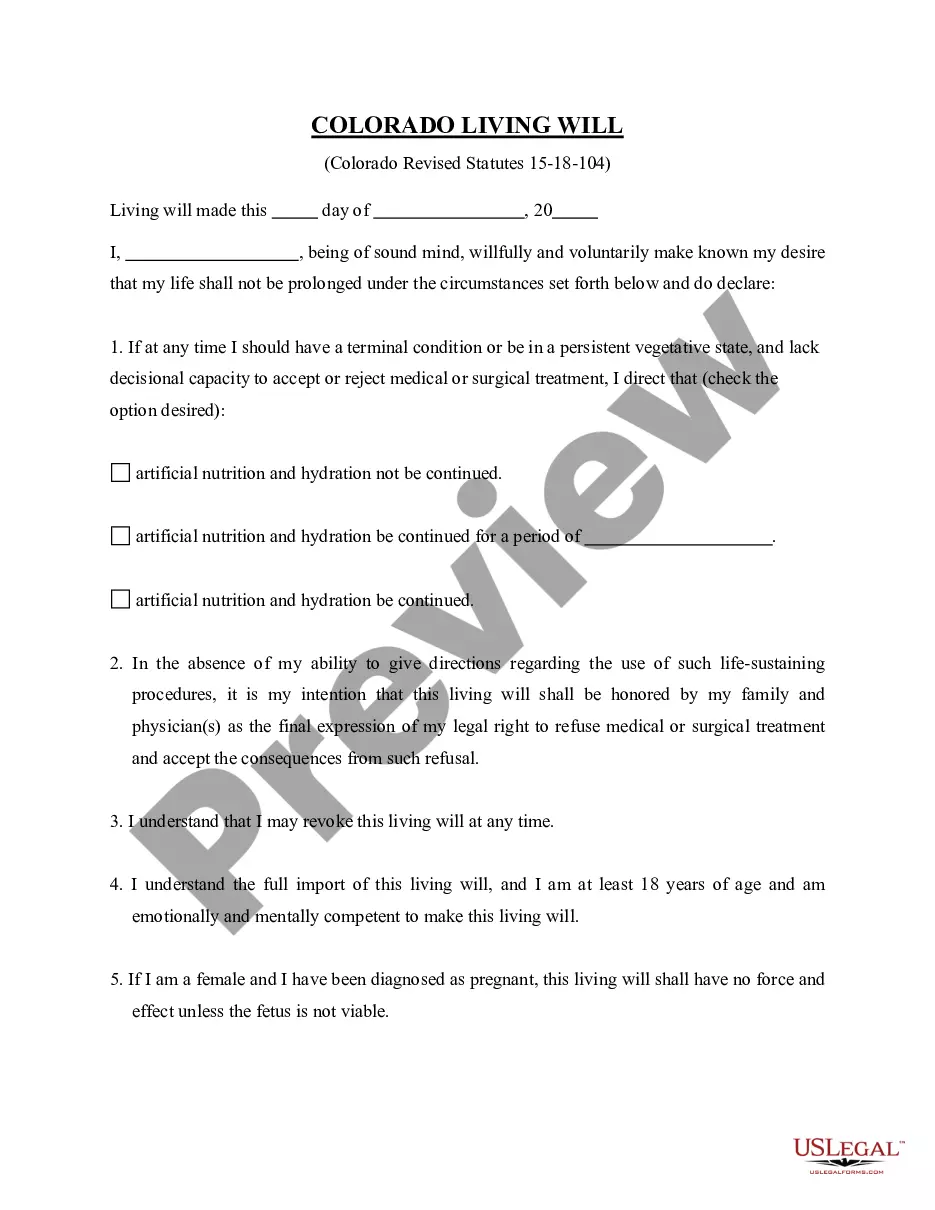

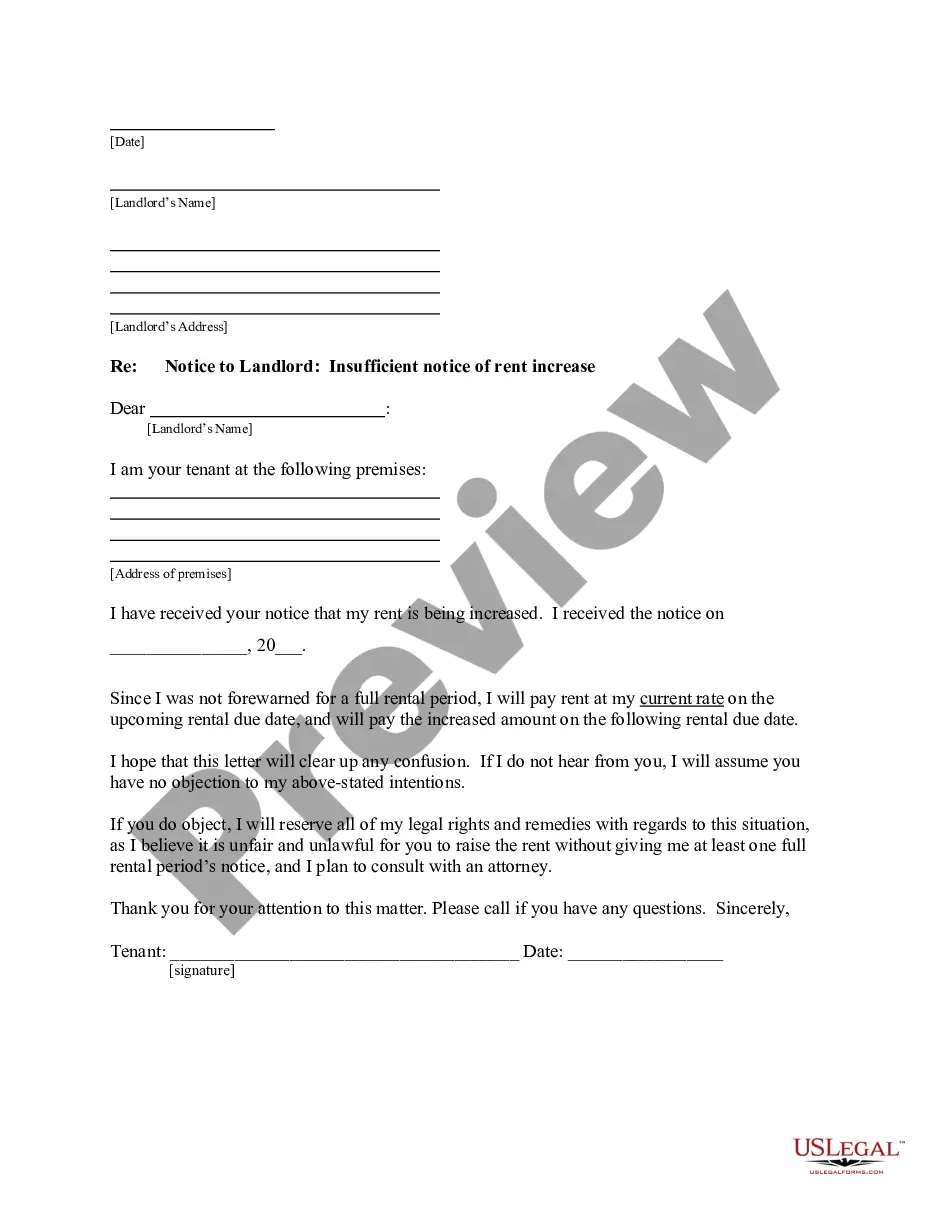

- Step 1. Ensure you have selected the form for your specific town/state.

- Step 2. Use the Review option to examine the form’s contents. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other examples of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Hawaii Donation or Gift to Charity of Personal Property.

Form popularity

FAQ

Generally, the IRS requires proof for any charitable donation, but the threshold varies. For small donations under $250, you typically need a written acknowledgment from the charity but may not need receipts. However, for your Hawaii Donation or Gift to Charity of Personal Property exceeding the threshold, retaining detailed documentation is essential.

The rules for deducting property donated to a charity involve ensuring the charity is qualified and properly valuing the property. For a Hawaii Donation or Gift to Charity of Personal Property, you can typically deduct the property's fair market value on the date of the donation. However, for donations exceeding $500, further forms and documentation are required to substantiate the claim.

To substantiate charitable donations, you need proof that includes receipts and letters from the charity acknowledging your contribution. For a Hawaii Donation or Gift to Charity of Personal Property, maintain these records securely, as they serve as evidence for your tax returns. The IRS specifies these requirements to ensure proper claiming of deductions.

For charitable donations, particularly for a Hawaii Donation or Gift to Charity of Personal Property, you must gather documentation like receipts, acknowledgment letters from the charity, and possibly a completed Form 8283 if the property exceeds a certain value. This paperwork verifies your donation and supports your ability to claim it as a deduction.

Yes, receipts are vital when claiming charitable donations on your tax return. For a proper Hawaii Donation or Gift to Charity of Personal Property, maintain receipts that detail what you donated and its value. This documentation supports your claim in case the IRS requests proof.

Gifting property to a charity involves several steps, starting with choosing a qualified organization for your Hawaii Donation or Gift to Charity of Personal Property. Next, assess the fair market value of the property, and gather the necessary documentation. Finally, complete any required paperwork that the charity provides to formalize the donation.

An IRS audit on charitable donations can arise for several reasons, such as claiming excessive deductions compared to your income. Additionally, inconsistencies in your documentation may raise red flags for the IRS. To minimize this risk, ensure that your Hawaii Donation or Gift to Charity of Personal Property is well-documented and reasonable.

When making a Hawaii Donation or Gift to Charity of Personal Property, you need specific documentation, such as receipts or statements from the charity. These documents should outline the item donated and its fair market value. It is essential to keep these records for your tax return.

To make a valid Hawaii Donation or Gift to Charity of Personal Property, your contributions must go to a qualified organization recognized by the IRS. Additionally, you should ensure that the donation is voluntary, and you do not receive anything in return. Keep in mind that proper documentation is essential for tax deductions.

To account for donated property effectively, first, determine the fair market value of your donation. When you make a Hawaii Donation or Gift to Charity of Personal Property, maintain thorough records and receipts. You can utilize platforms like US Legal Forms to guide you through the process and ensure proper documentation for your tax filings.

Interesting Questions

More info

Power Attorney Last Will Testament Living Will Law Firm Home Business Small Business Estate Trusts Estate Vault Other Name Your Own Deed Gift forms are simple and easily completed for your loved ones, you can use them for everything: Giving money to a family member, gifts or favors, or simply getting them something they want. If you need to give your loved ones a gift, you get an easy way to do this. These gift deeds allow you to give to any family member, as long as they are the named owner/s of the gift land. Many family members are concerned or embarrassed to give money without the permission of a named owner. The deed is a legal document that gives you the right to give a gift without giving someone the right to claim the gift. Give your loved ones money or something of value without someone claiming the gift because you can do it anonymously. Make sure to protect the gift so no one else, including the gift landholder, can ask for anything in return.