Subject: Submission of Payment to the State Tax Commission of Hawaii Dear State Tax Commission of Hawaii, I hope this letter finds you in good health and high spirits. I am writing to fulfill my tax obligations by submitting the payment for the taxes owed to the State of Hawaii. First and foremost, I express my gratitude towards the State Tax Commission of Hawaii for its continuous efforts in ensuring the smooth functioning of tax collection and administration processes throughout the state. The commission's dedication towards maintaining transparency, accountability, and providing exceptional services to taxpayers deserves commendation. I am pleased to enclose my payment for the taxes owed for the tax year [insert tax year]. The enclosed payment includes the relevant interest and penalty charges, as applicable, to ensure compliance with the state's tax regulations. In compliance with Hawaii tax laws, I have also included the necessary accompanying documentation to support my payment. To streamline the processing of my payment, I have followed the guidelines provided by the State Tax Commission of Hawaii. The payment has been made via [insert preferred payment method, e.g., check, money order, electronic transfer]. I kindly request you to acknowledge receipt of this payment and notify me if any additional information or documentation is required. Moreover, I would like to express my utmost appreciation for the State Tax Commission's online portal, which has significantly simplified the tax payment process. The user-friendly interface, along with the secure transactional capabilities, has made it convenient for taxpayers like myself to fulfill their civic duty promptly and accurately. It is worth noting that the State Tax Commission of Hawaii has been proactive in protecting taxpayers' confidential information. The implementation of robust security measures ensures that sensitive data shared during the tax payment process remains protected, safeguarding both the taxpayers and the state’s interests. In conclusion, I take this opportunity to extend my gratitude to the State Tax Commission of Hawaii for its unwavering commitment to providing exceptional services and promoting tax compliance. I applaud your dedication to fostering an environment of trust and accountability between taxpayers and the state. Once again, please find enclosed the payment for the taxes owed for the tax year [insert tax year]. I trust that my contribution will contribute towards the continued development and progress of the state of Hawaii. Thank you for your attention to this matter. Should you require any further information or clarification, please do not hesitate to contact me at [insert contact information]. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] Types of Hawaii Sample Letters to State Tax Commission sending Payment: 1. Hawaii Sample Letter to State Tax Commission sending Payment (General): A letter that encompasses the overall purpose of submitting tax payment to the State Tax Commission of Hawaii, expressing gratitude, acknowledging tax law compliance, and mentioning the payment method. 2. Hawaii Sample Letter to State Tax Commission sending Payment (With Penalty/Interest Charges): A letter containing an additional section highlighting the inclusion of penalty and interest charges along with the tax payment, addressing any outstanding balance, and ensuring full compliance with Hawaii tax regulations. 3. Hawaii Sample Letter to State Tax Commission sending Payment (Online Payment): A letter emphasizing the convenience and user-friendliness of the State Tax Commission's online portal, appreciating the secure transactional capabilities, and acknowledging the use of the online portal for tax payment purposes. 4. Hawaii Sample Letter to State Tax Commission sending Payment (Confidentiality and Security): A letter highlighting the State Tax Commission's commitment to protecting taxpayers' confidential information, acknowledging the robust security measures implemented to safeguard sensitive data shared during tax payment.

Hawaii Sample Letter to State Tax Commission sending Payment

Description

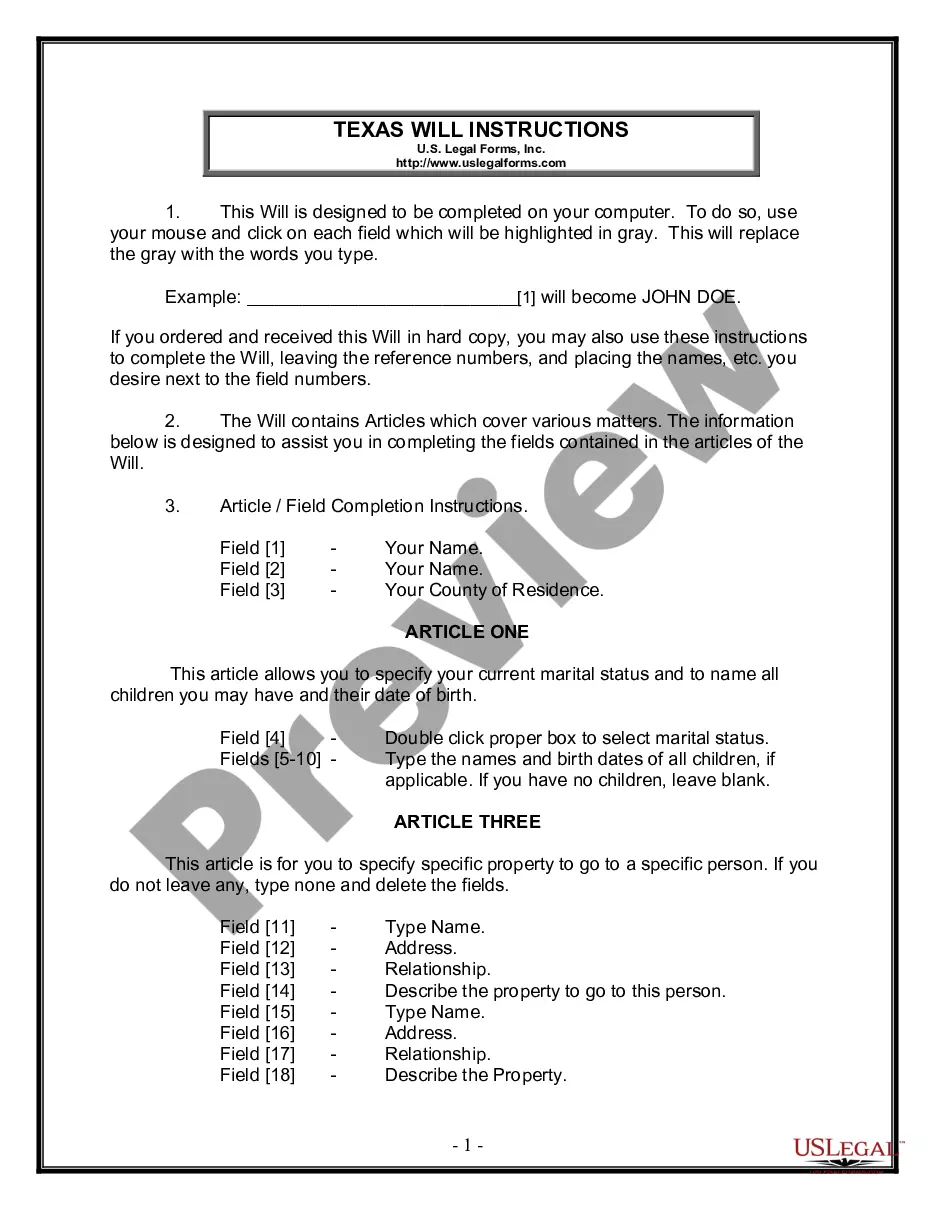

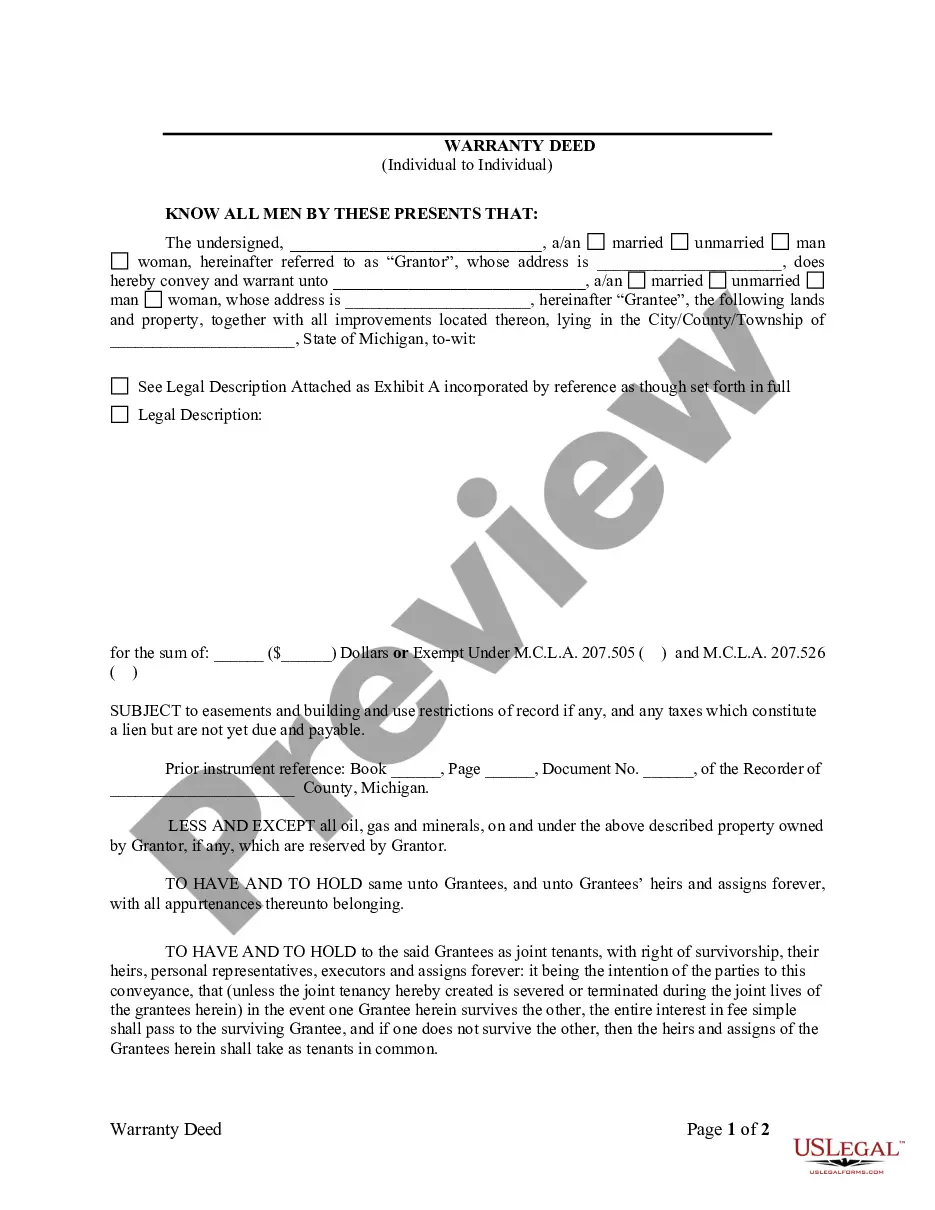

How to fill out Sample Letter To State Tax Commission Sending Payment?

If you wish to total, acquire, or print authorized file templates, use US Legal Forms, the most important collection of authorized kinds, which can be found on the Internet. Utilize the site`s basic and practical research to obtain the files you want. A variety of templates for business and individual uses are categorized by categories and claims, or key phrases. Use US Legal Forms to obtain the Hawaii Sample Letter to State Tax Commission sending Payment in a couple of mouse clicks.

When you are already a US Legal Forms buyer, log in to the accounts and click on the Download switch to have the Hawaii Sample Letter to State Tax Commission sending Payment. You can also gain access to kinds you in the past saved in the My Forms tab of your respective accounts.

If you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape to the proper metropolis/nation.

- Step 2. Take advantage of the Review solution to look through the form`s articles. Don`t overlook to read through the information.

- Step 3. When you are not satisfied together with the develop, make use of the Search area on top of the monitor to locate other types of your authorized develop design.

- Step 4. Upon having found the shape you want, click the Buy now switch. Pick the prices program you prefer and add your accreditations to register for an accounts.

- Step 5. Procedure the purchase. You can use your Мisa or Ьastercard or PayPal accounts to finish the purchase.

- Step 6. Find the structure of your authorized develop and acquire it in your device.

- Step 7. Full, edit and print or indication the Hawaii Sample Letter to State Tax Commission sending Payment.

Every authorized file design you acquire is the one you have permanently. You possess acces to every develop you saved with your acccount. Click the My Forms portion and choose a develop to print or acquire again.

Compete and acquire, and print the Hawaii Sample Letter to State Tax Commission sending Payment with US Legal Forms. There are millions of expert and express-particular kinds you can use for your personal business or individual requires.

Form popularity

FAQ

If you file Form BB-1 online at Hawaii Tax Online, hitax.hawaii.gov, you will receive your HI Tax ID in approximately 5-7 days. If you file Form BB-1 by mail or drop-off, you will receive your HI Tax ID in approximately 4-6 weeks.

Taxes, permits, and licenses can be filed and paid on Hawaii Tax Online. Filing taxes and making debit payments on HTO is free.

General Excise Tax The GET is a privilege tax imposed on business activity in the State of Hawaii. The tax is imposed on the gross income received by the person en- gaging in the business activity. The GET applies to nearly every form of business activity.

Forms G-45, G-49, and GEW-TA-RV-6 can be filed and payments made electronically through the State's Internet portal. For more information, go to tax.hawaii.gov/eservices/. The GET is a tax imposed on the gross income you receive from any business activity you have in Hawaii.

How do I make a payment? To make a tax payment on or before April 20, you can submit an electronic payment via Hawaii Tax Online (hitax.hawaii.gov) by selecting ?Make Payment? under the ?Quick Links? section with a payment type of ?Estimated Payment.?

If filing Form BB-1, attach the payment and Form VP-1 to the front of the Form BB-1 and mail to the address below. provided. ATTACH THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO ?HAWAII STATE TAX COLLECTOR.? Write the tax and filing types, and your Hawaii Tax I.D. Number on your check or money order.

You can use Hawaii Tax Online to make a payment (1) from your checking or saving account (free) or (2) using a credit or debit card payment (fees apply). You may also pay by Automated Clearing House (ACH) credit by following these instructions to work with your bank.

Office Location. 830 Punchbowl Street, Honolulu, HI 96813-5094. Open Hours. M-F: a.m. to p.m. Information. Contact Us. Policies. Terms of Use.