Hawaii Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act

Description

How to fill out Designation Of Successor Custodian By Donor Pursuant To The Uniform Transfers To Minors Act?

You can invest several hours online looking for the legitimate record format that suits the federal and state specifications you need. US Legal Forms supplies thousands of legitimate forms that are evaluated by specialists. It is simple to down load or print out the Hawaii Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act from my service.

If you have a US Legal Forms accounts, you may log in and click the Down load button. After that, you may comprehensive, modify, print out, or signal the Hawaii Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act. Every legitimate record format you buy is your own property eternally. To acquire yet another copy for any purchased develop, visit the My Forms tab and click the corresponding button.

Should you use the US Legal Forms website the first time, keep to the easy recommendations listed below:

- Very first, make sure that you have chosen the proper record format for your county/town of your choosing. Look at the develop outline to make sure you have picked the correct develop. If readily available, take advantage of the Review button to appear throughout the record format as well.

- If you want to get yet another variation in the develop, take advantage of the Search industry to get the format that meets your needs and specifications.

- Once you have identified the format you want, simply click Acquire now to carry on.

- Pick the rates prepare you want, enter your qualifications, and sign up for a merchant account on US Legal Forms.

- Complete the financial transaction. You can use your Visa or Mastercard or PayPal accounts to fund the legitimate develop.

- Pick the file format in the record and down load it to the gadget.

- Make adjustments to the record if needed. You can comprehensive, modify and signal and print out Hawaii Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act.

Down load and print out thousands of record layouts making use of the US Legal Forms site, which provides the largest variety of legitimate forms. Use skilled and status-particular layouts to deal with your company or specific requirements.

Form popularity

FAQ

UTMA allows the property to be gifted to a minor without establishing a formal trust. The donor or a custodian manages the property for the minor's benefit until the minor reaches a certain age. Once the child reaches a specified age set by the state, the child will have full control over the property.

TO WHOSE ESTATE DOES THE CUSTODIAL ACCOUNT BELONG? Custodial accounts are part of the minor's estate in the event of the minor's or custodian's death prior to the minor attaining distribution age unless you, as the donor who established the custodial account, are also the custodian.

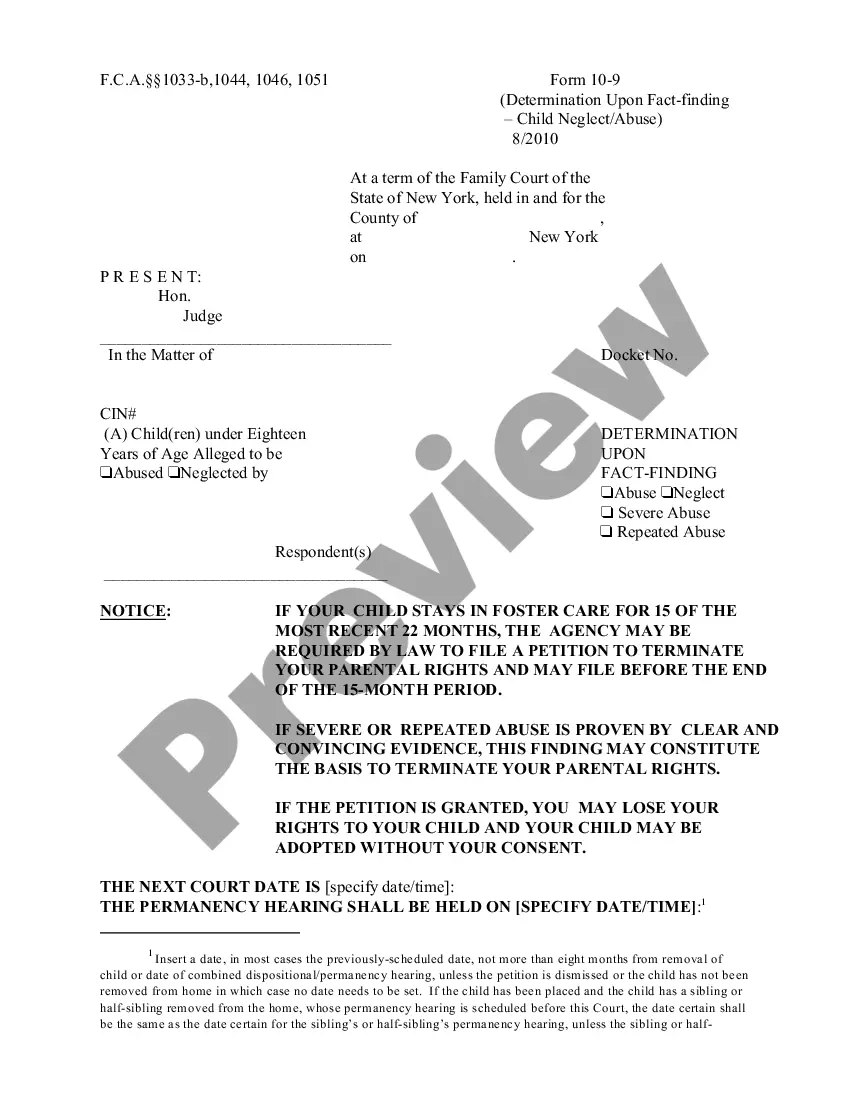

Form used to designate a successor custodian for either an UGMA or UTMA account in the event that the original custodian resigns, dies, is incapacitated or is removed as custodian.

Form used to designate a successor custodian for either an UGMA or UTMA account in the event that the original custodian resigns, dies, is incapacitated or is removed as custodian.

Once the minor on a UGMA/UTMA account reaches the applicable state's age of termination, the custodian or the former minor may transfer the shares in the account(s) to the former minor's sole name. Instructions are acceptable from either the custodian or the former minor.

The Uniform Gifts to Minors Act provides a way to transfer financial assets to a minor without the time-consuming and expensive establishment of a formal trust. A UGMA account is managed by an adult custodian until the minor beneficiary comes of age, at which point they assume control of the account.

If a donor acting as the custodian dies before the account terminates, the account value will be included in the donor's estate for estate tax purposes. If a minor dies before the age of majority, a custodial account is considered part of the minor's estate and is distributed ing to state law.

A custodian must open the account and manage the assets on behalf of the minor, but the assets in the account are the property of the minor. Custodians are typically parents, but technically can be anyone. Only one custodian and minor are allowed per custodial account.