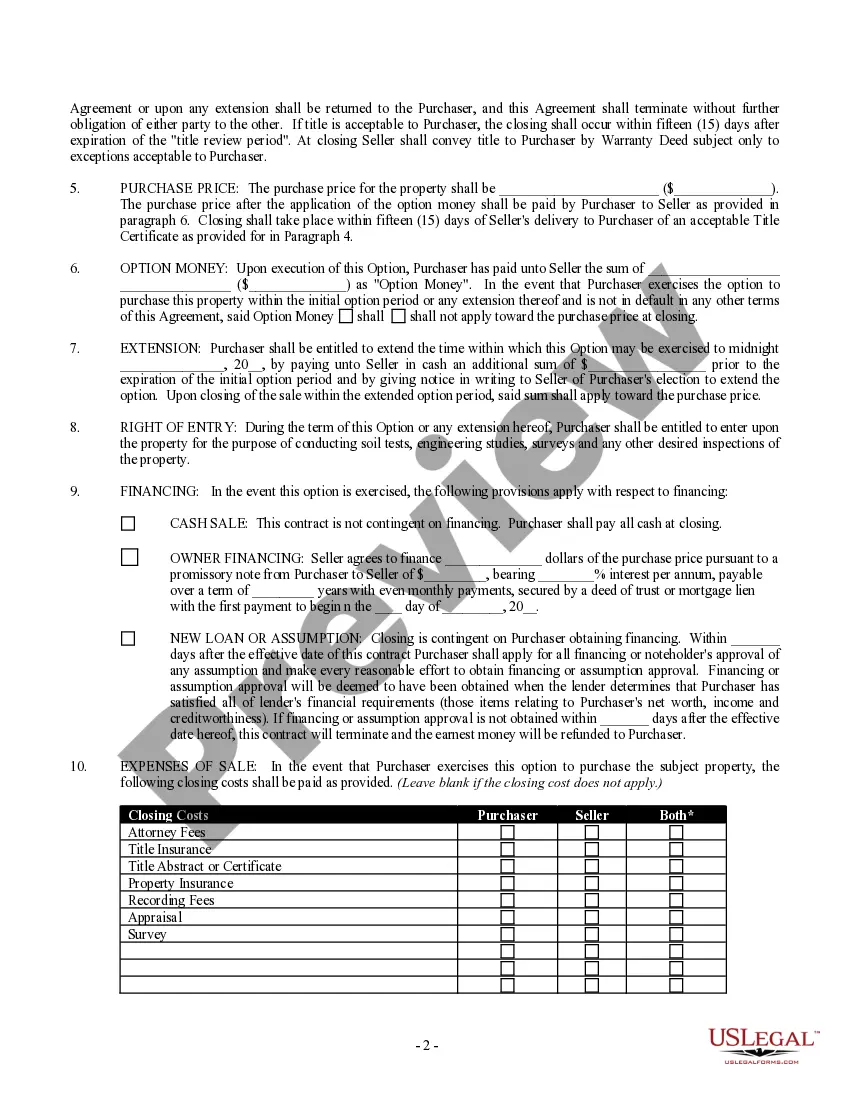

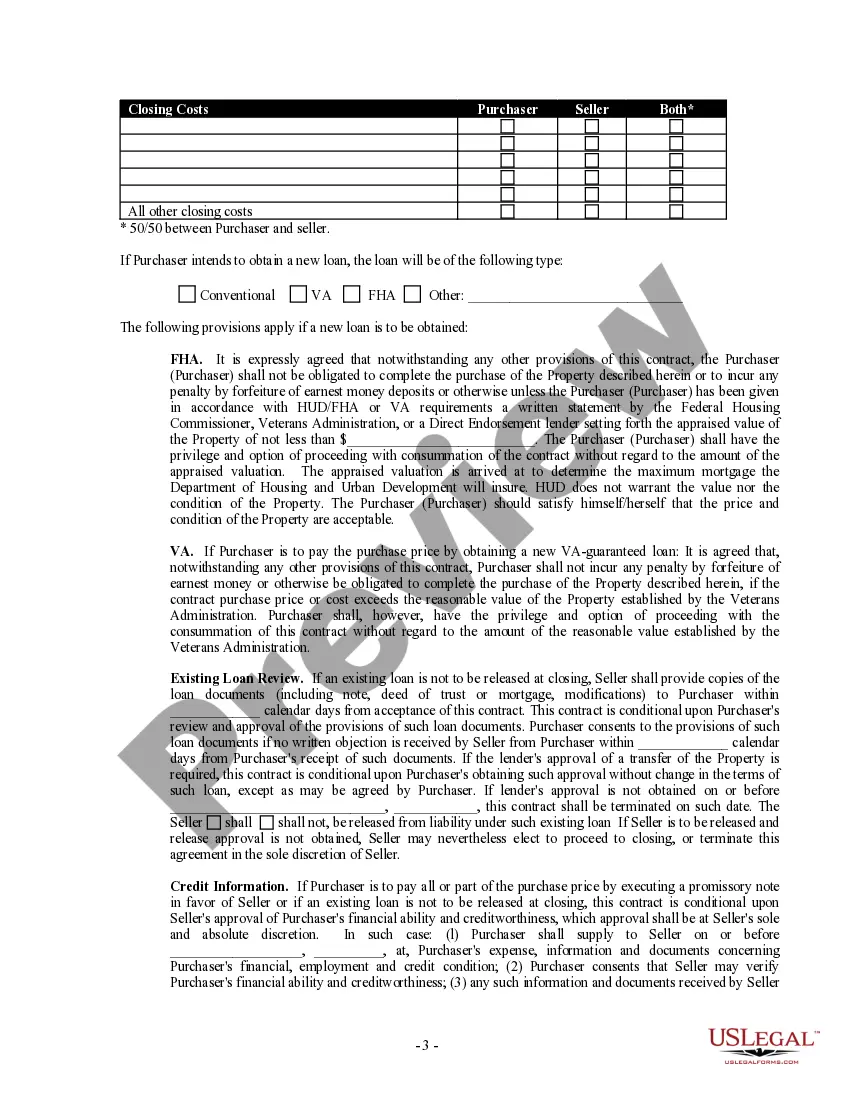

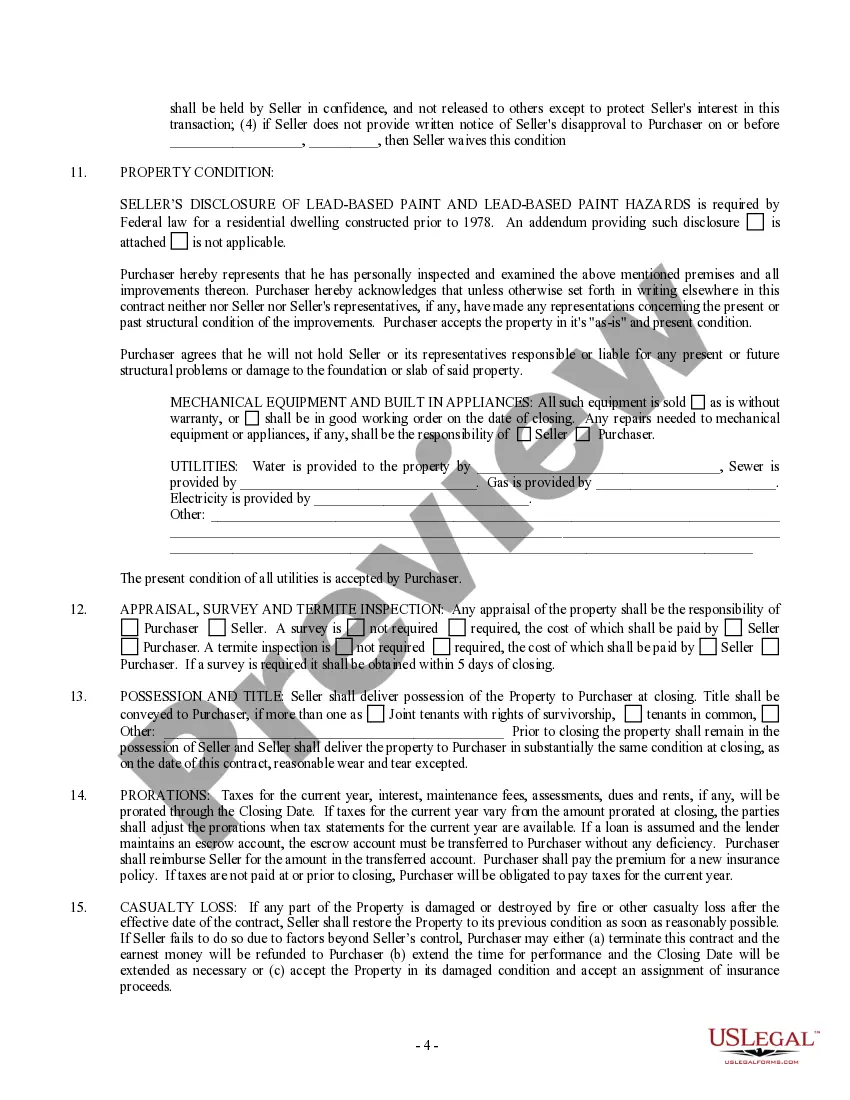

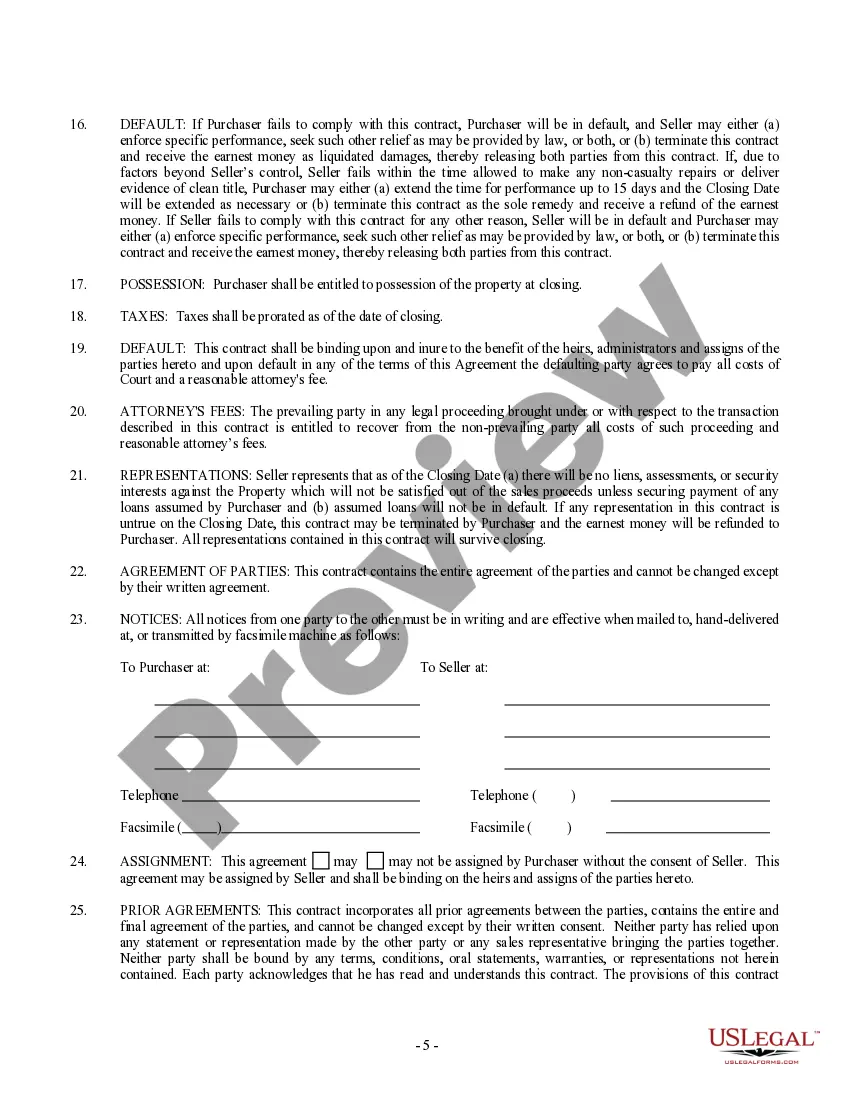

Hawaii Option for the Sale and Purchase of Real Estate — Residential Home is a legal agreement that allows potential buyers to secure the right to purchase a residential property within a specific period. It provides an opportunity for both buyers and sellers to assess the property before committing to a purchase. This option is particularly beneficial in a competitive real estate market like Hawaii, where finding the perfect home can be challenging due to high demand. The Hawaii Option for the Sale and Purchase of Real Estate — Residential Home offers flexibility to buyers who might need more time to arrange financing or complete due diligence. It begins with the buyer making a payment, known as an option fee, to the seller, granting them exclusive rights to purchase the property within a predetermined timeframe. During the agreed-upon period, which is typically 30 to 60 days, the buyer can conduct inspections, appraisals, and review necessary documents to ensure the property meets their requirements. If they find any issues that affect their decision to proceed with the purchase, they have the option to terminate the contract without losing their option fee. Upon completing their assessments and deciding to move forward with the purchase, the buyer exercises their option by providing written notice to the seller. At this point, the agreed-upon purchase price and other terms specified in the option contract come into effect. The option fee, paid initially, is usually credited towards the down payment or closing costs. Hawaii Option for the Sale and Purchase of Real Estate — Residential Home can be categorized into various types based on specific conditions or contingencies agreed upon by the buyer and seller. Some notable types include: 1. Inspection Contingency Option: This type of option allows the buyer to conduct a thorough inspection of the property, including structural assessments, pest inspections, or any other necessary inspections. It provides an opportunity to identify and negotiate repairs or address concerns before completing the purchase. 2. Financing Contingency Option: Buyers may opt for this type of option when they rely on obtaining a mortgage loan to finance the purchase. The option period allows the buyer to secure financing from a lender and ensure they can proceed with the transaction. 3. Title Contingency Option: This option grants the buyer the right to review the property's title history and address any potential title issues or concerns before completing the purchase. It ensures the buyer receives clear and marketable title to the property. 4. Appraisal Contingency Option: With this option, the buyer has the right to obtain an independent appraisal of the property to determine its fair market value. If the appraisal value comes in lower than the agreed-upon purchase price, the buyer can negotiate with the seller to adjust the price accordingly. In conclusion, the Hawaii Option for the Sale and Purchase of Real Estate — Residential Home provides a flexible and secure way for buyers to explore and evaluate properties in Hawaii's competitive real estate market. With different types of options available, buyers can tailor their agreements to specific contingencies, ensuring a smooth and informed home-buying process.

Hawaii Option For the Sale and Purchase of Real Estate - Residential Home

Description

How to fill out Hawaii Option For The Sale And Purchase Of Real Estate - Residential Home?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal template topics that you can download or print.

By using the site, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords.

You can find the latest forms like the Hawaii Option For the Sale and Purchase of Real Estate - Residential Home in seconds.

Check the description of the form to make certain it is the right one you need.

If the form does not meet your requirements, utilize the Research field at the top of the page to find the suitable one.

- If you already have a subscription, Log In and download the Hawaii Option For the Sale and Purchase of Real Estate - Residential Home from the US Legal Forms collection.

- The Obtain button will be visible on every form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are new to US Legal Forms, here are simple steps to assist you.

- Ensure you have selected the correct form for your locality/county.

- Use the Preview button to review the contents of the form.

Form popularity

FAQ

Finding your dream home in Hawaii is likely to be more challenging than it would be in any other state in the U.S. but don't think that means it can't be done. By choosing the right property, finding a local real estate agent and leveraging available incentives, this tricky home buying process can be made simpler.

Pros to BuyingAlthough purchase prices are high, the long-standing trend is that home values appreciate steadily year on year. The rental market is solid in Hawaii as well, so if you want to hold onto your asset to get better appreciation when you need to PCS out, your tenant will be paying down your mortgage.

5 Things to Know Before Buying Property in HawaiiLava Zones. The hazard zones from the lava flows are primarily based on frequency and location of prehistoric and historic eruptions.Use Local Bank Instead of Mainland Bank for Mortgage.Effect of Elevation on Comfort and Energy Costs.Expectations of Square Footage.

With the option-to-purchase route, the buyer pays the seller money for the exclusive right to purchase the property within a specified term (often six months to a year). The buyer and seller might agree to a purchase price at that time, or the buyer can agree to pay market value at the time their option is exercised.

An option to purchase is an agreement that gives a potential buyer (optionee) the right, but not the obligation, to buy property in the future. The optionee must decide by a certain time whether to exercise the option and thereafter by bound under the contract to purchase.

In Hawaii it's required for a real estate attorney to be part of every home sale. While your agent can make recommendations, remember you get to make the final decision.

Here are a few tips that can help you successfully find a home in Hawaii's highly competitive housing market.Get prequalified for a mortgage.Find the right real estate agent.Let people know you're looking for a home.Keep an open mind when shopping.Go big (to go home).Consider homes under your budget.More items...?

Hawaii Real Estate Buyers Not Using An Agent If you're a buyer, you need to consult with a Hawaii real estate attorney if you're not represented by a Hawaii real estate agent.

The basics: What is an option contract in real estate? In the simplest terms, a real-estate option contract is a uniquely designed agreement that's strictly between the seller and the buyer. In this agreement, a seller offers an option to the buyer to purchase property at a fixed price within a limited time frame.