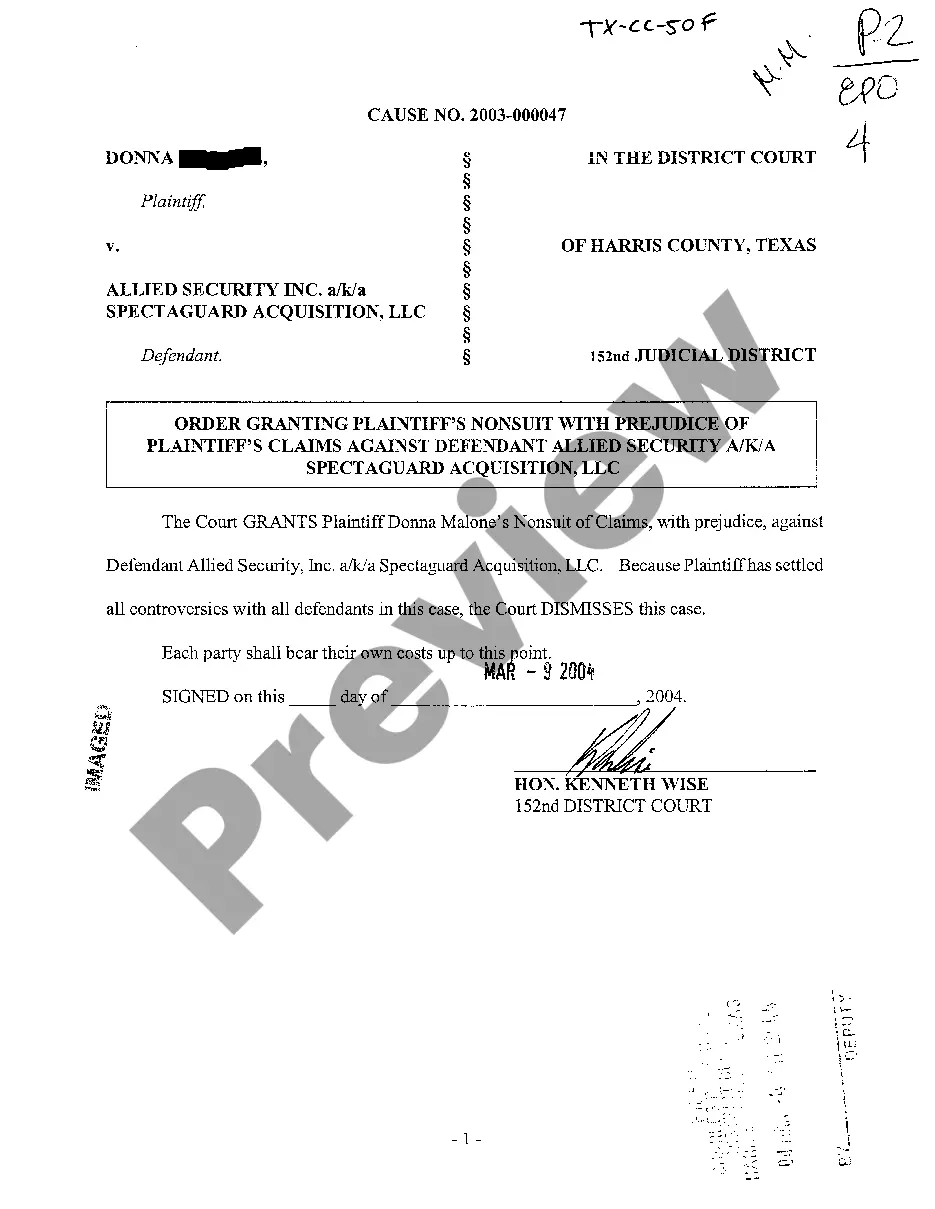

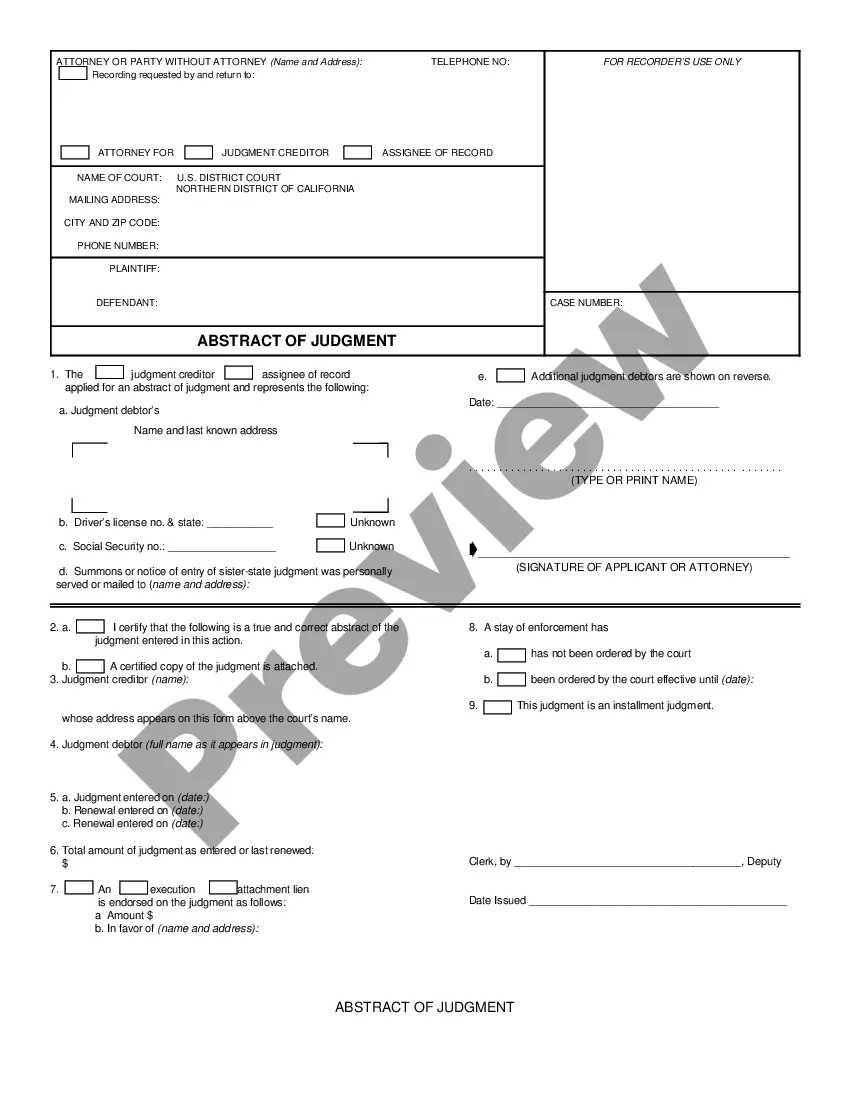

The Hawaii Notice to Debtor of Authority Granted to Agent to Receive Payment is a legal document that serves as a notification to a debtor about the authorization granted to an agent or third party to receive payments on behalf of the creditor. This notice is an important mechanism for creditors to ensure the smooth collection of debts and to inform debtors of the agent's authority. The notice contains relevant information such as the name of the creditor, the debtor, and the agent or third party authorized to receive payments. It also includes details about the debt, including the amount owed and any specific terms or conditions associated with the payment. The purpose of this notice is to formally notify the debtor about the creditor's decision to grant the agent the authority to receive payments. It serves as a means to prevent any confusion or disputes regarding payment arrangements and provides the debtor with instructions on how and where to make payments. In addition, the notice may specify the duration of the agent's authority, outlining if it is a one-time authorization or ongoing until further notice. It may also include information about the limitations or restrictions on the agent's authority, such as the types of payments the agent can receive or any specific conditions for accepting payments. Different types of Hawaii Notice to Debtor of Authority Granted to Agent to Receive Payment may include variations depending on the nature of the debt or specific requirements of the creditor. For example, there may be separate notices for different types of debt, such as consumer debt, commercial debt, or mortgage debt. Each notice would contain the necessary information relevant to the specific type of debt and the terms of the agent's authority. Overall, the Hawaii Notice to Debtor of Authority Granted to Agent to Receive Payment is a crucial document that ensures clear communication between creditors, debtors, and authorized agents. It helps streamline the payment process, minimize errors or misunderstandings, and maintain a professional and transparent relationship between the parties involved.

Hawaii Notice to Debtor of Authority Granted to Agent to Receive Payment

Description

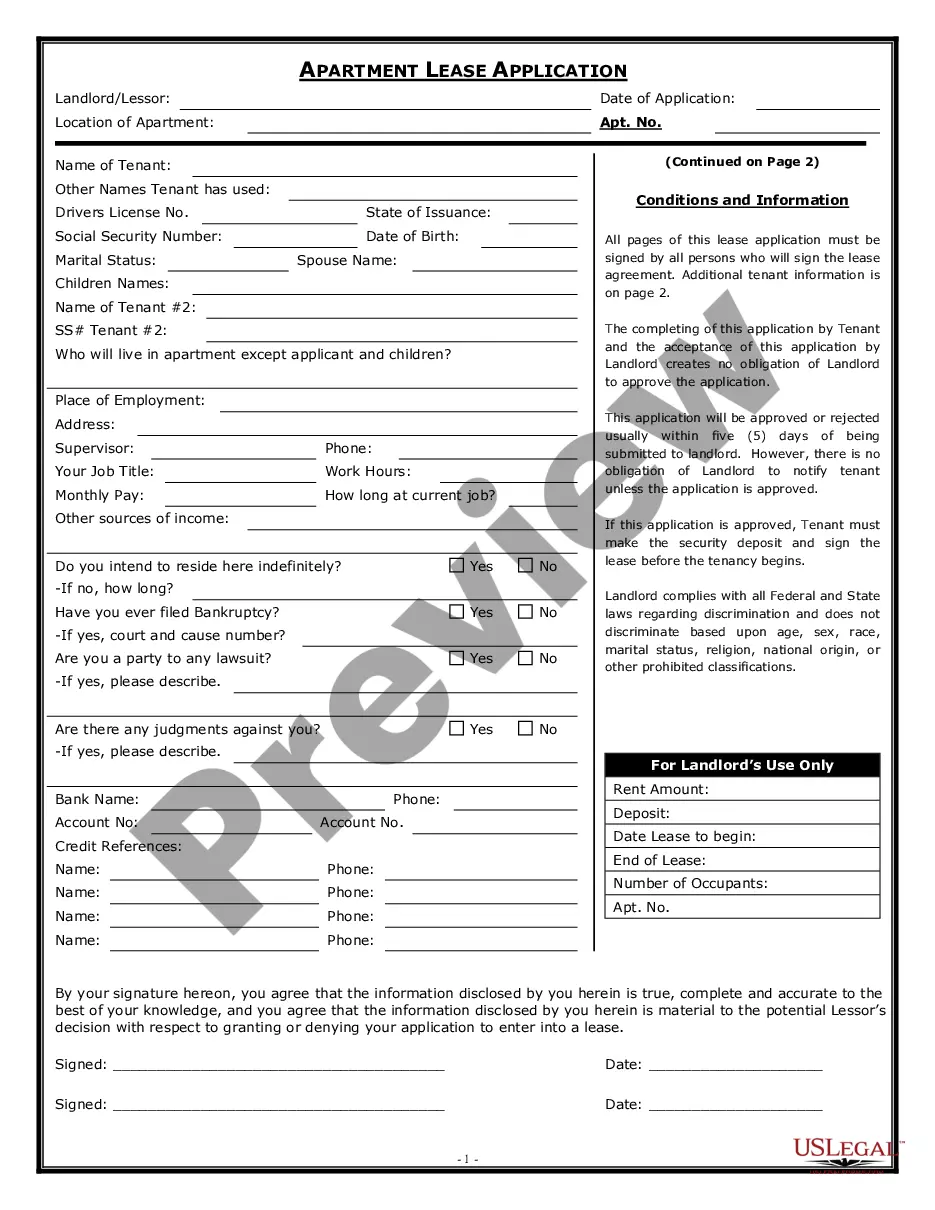

How to fill out Hawaii Notice To Debtor Of Authority Granted To Agent To Receive Payment?

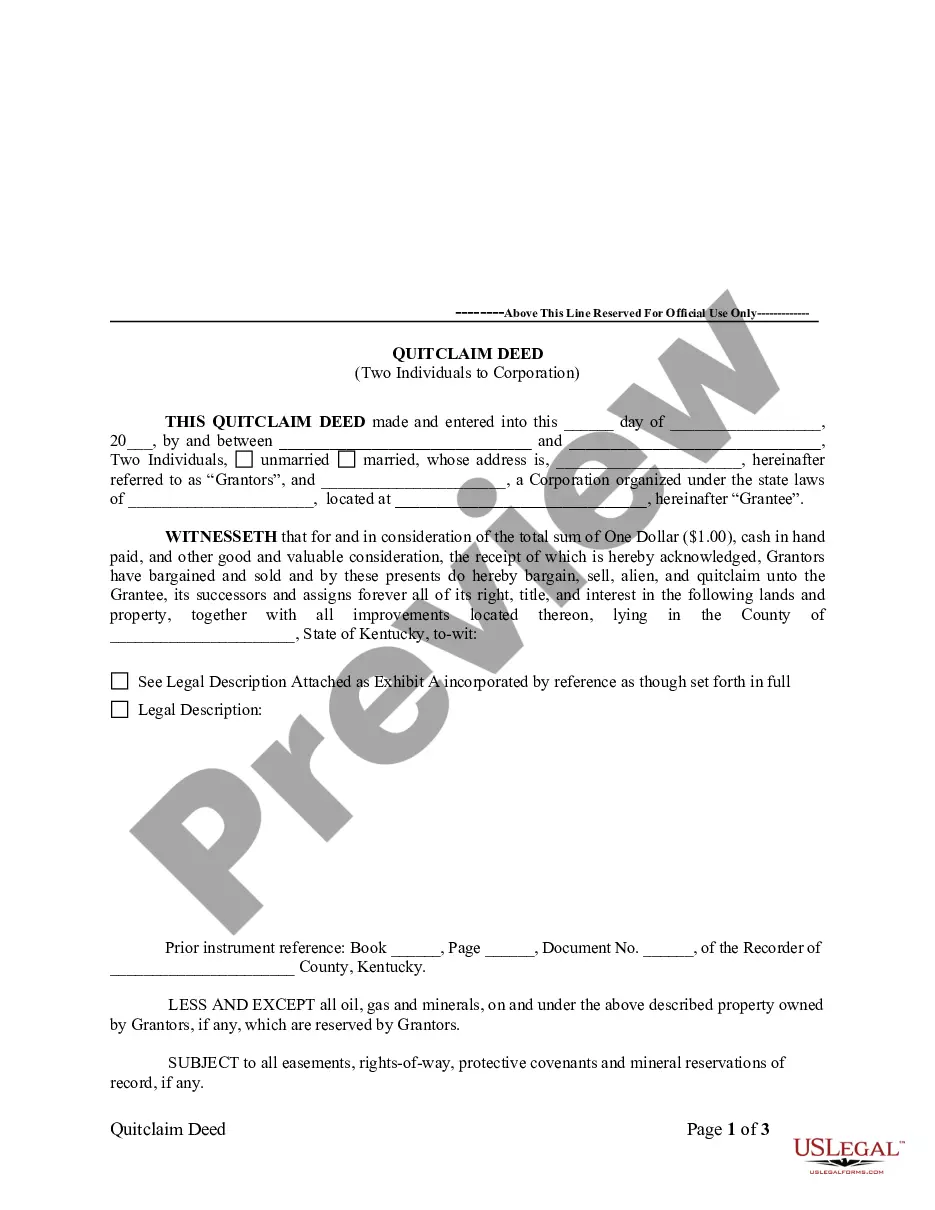

Selecting the appropriate legal document template can be a challenge. Certainly, there are many templates available online, but how do you locate the exact legal form you require? Make use of the US Legal Forms website.

The platform offers thousands of templates, such as the Hawaii Notice to Debtor of Authority Granted to Agent to Receive Payment, which you can utilize for both business and personal purposes. All forms are verified by professionals and adhere to federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to find the Hawaii Notice to Debtor of Authority Granted to Agent to Receive Payment. Use your account to browse through the legal forms you have previously obtained. Visit the My documents section of your account to download another copy of the document you need.

Finally, complete, edit, print, and sign the acquired Hawaii Notice to Debtor of Authority Granted to Agent to Receive Payment. US Legal Forms is indeed the largest repository of legal documents where you can discover numerous document templates. Utilize the service to obtain professionally-crafted documents that adhere to state standards.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your city/region. You can review the form using the Review button and read the form description to make sure it is appropriate for you.

- If the form does not meet your needs, use the Search field to find the correct form.

- Once you are confident that the form is suitable, click the Get now button to obtain the form.

- Choose the pricing plan you prefer and enter the required information. Create your account and complete your order using your PayPal account or Visa or Mastercard.

- Select the file format and download the legal document template to your device.

Form popularity

More info

Select IDs, addresses, phone numbers and email addresses of insurance agents in your local area.