The Hawaii Charitable Remainder Inter Vivos Annuity Trust (CAT) is a type of legal charitable planning tool. It offers individuals the opportunity to make a significant charitable contribution while also providing themselves or their beneficiaries with an income stream. In a Hawaii Charitable Remainder Inter Vivos Annuity Trust, the individual (known as the donor) transfers assets, such as cash, real estate, or securities, into the trust. The trust is established for a specified term or for the lifetime of the donor, after which the remaining assets are distributed to the designated charitable organization(s). Key Features: 1. Income Stream: The donor or their beneficiaries receive a fixed annual income from the trust, which is predetermined when the trust is established. This income can be beneficial for those wishing to supplement their existing income or provide for loved ones. 2. Tax Advantages: By contributing to a Hawaii Charitable Remainder Inter Vivos Annuity Trust, donors may be eligible for a charitable income tax deduction in the year of the contribution. This deduction can help reduce their overall taxable income. 3. Charitable Legacy: The CAT allows individuals to make a lasting impact by supporting the charitable causes they care about. It ensures that their philanthropic goals continue even after their passing by providing ongoing support to the designated charities. Types of Hawaii Charitable Remainder Inter Vivos Annuity Trusts: 1. Standard CAT: This is the most common form of CAT, where the donor receives an annual fixed income based on a predetermined percentage of the initial trust's value. Whether the trust assets appreciate or decline, the income remains constant. 2. Net Income CAT: In this variant, the annual income distributed to the donor or beneficiaries is determined by the trust's net income. If the trust's income is less than the stated percentage, the income distribution will be reduced accordingly. However, the remaining income can be accumulated and distributed in later years when the trust generates more income. 3. Flip CAT: A Flip CAT starts as a Net Income CAT but can "flip" to become a Standard CAT at a predetermined triggering event, such as the sale of a specific asset. This conversion means the fixed income will be calculated based on the trust's initial value rather than its net income. It is especially useful when the initial asset produces little income but appreciates substantially upon its sale. 4. TIMEOUT: The Net Income with Makeup Charitable Remainder Unit rust (TIMEOUT) allows flexibility by providing a variable income stream. If the trust generates less income than the stated percentage, the underpayment can be made up in future years when the trust generates more income. This variation ensures a steady income flow, even if there are fluctuations in trust income. In summary, the Hawaii Charitable Remainder Inter Vivos Annuity Trust presents an attractive option for individuals looking to support charitable organizations, receive income, and potentially obtain tax benefits. Whether choosing a Standard CAT, Net Income CAT, Flip CAT, or TIMEOUT, donors can design their trusts to align with their charitable goals and financial circumstances.

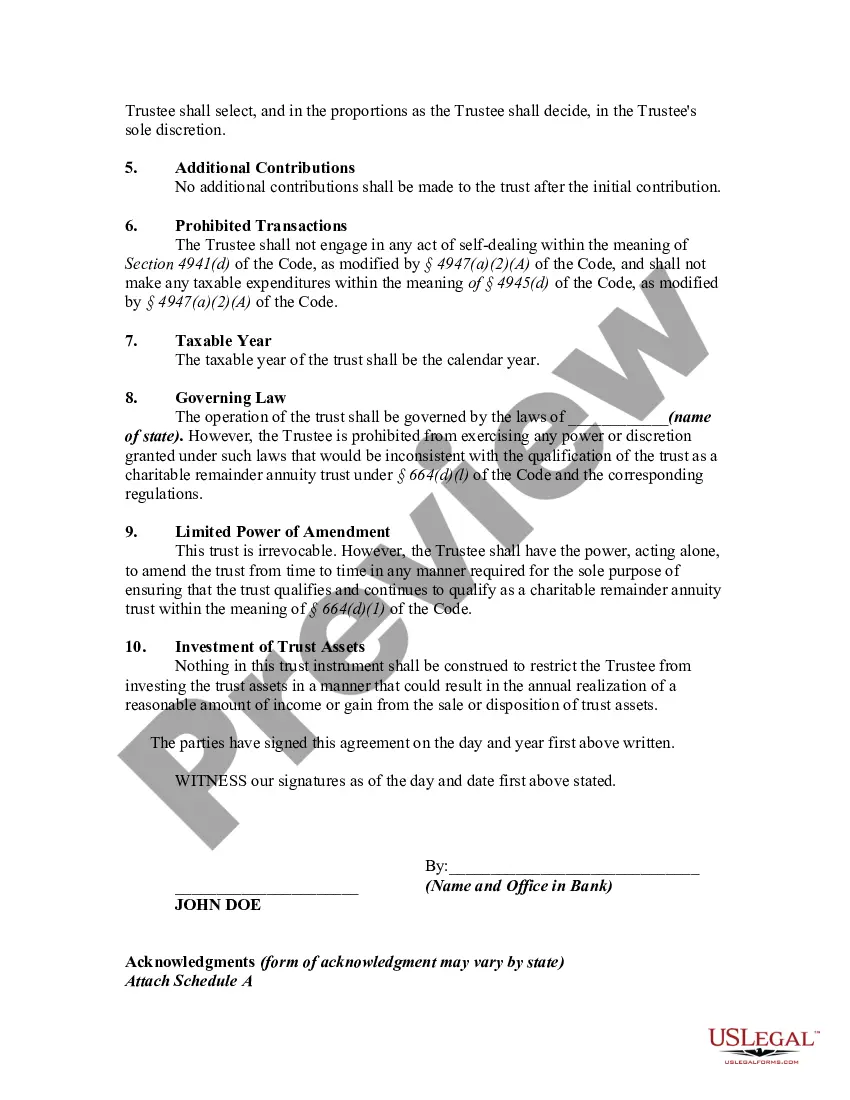

Hawaii Charitable Remainder Inter Vivos Annuity Trust

Description

How to fill out Hawaii Charitable Remainder Inter Vivos Annuity Trust?

Finding the right legitimate document web template might be a struggle. Of course, there are a variety of templates available online, but how will you obtain the legitimate form you need? Utilize the US Legal Forms web site. The services provides a large number of templates, including the Hawaii Charitable Remainder Inter Vivos Annuity Trust, that you can use for company and personal requires. All of the varieties are examined by experts and meet state and federal demands.

When you are currently authorized, log in to your bank account and click the Obtain key to get the Hawaii Charitable Remainder Inter Vivos Annuity Trust. Make use of bank account to check from the legitimate varieties you may have purchased in the past. Go to the My Forms tab of your respective bank account and get another copy from the document you need.

When you are a fresh consumer of US Legal Forms, here are basic instructions for you to stick to:

- Initially, make sure you have chosen the appropriate form for your area/county. It is possible to examine the shape using the Preview key and browse the shape information to make certain it is the right one for you.

- If the form is not going to meet your expectations, take advantage of the Seach area to find the appropriate form.

- When you are sure that the shape is acceptable, click on the Acquire now key to get the form.

- Opt for the prices prepare you would like and enter the necessary information. Create your bank account and buy an order using your PayPal bank account or bank card.

- Select the data file file format and obtain the legitimate document web template to your device.

- Complete, modify and printing and signal the attained Hawaii Charitable Remainder Inter Vivos Annuity Trust.

US Legal Forms will be the greatest collection of legitimate varieties for which you can see different document templates. Utilize the company to obtain appropriately-manufactured documents that stick to state demands.