Description: The Hawaii Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a legally binding document that outlines the terms and conditions for the sale and purchase of a business owned by a sole proprietor in the state of Hawaii. This agreement is specifically designed to address situations where the purchase price is contingent upon the completion of an audit of the business's financial records. This type of agreement is typically used when a buyer is interested in acquiring a sole proprietorship business but wants to ensure the accuracy of the financial information provided by the seller. The agreement includes provisions that allow the buyer to conduct a thorough review and audit of the business's financial records before finalizing the purchase price. The Hawaii Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit covers various essential aspects of the sale, including the identification of the parties involved, the purchase price, and the details of the audit process. It also highlights the obligations and warranties of both the seller and the buyer, as well as any post-closing requirements and dispute resolution mechanisms. Various types of the Hawaii Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit may include: 1. Standard Agreement: The standard agreement is the most common type of agreement used in this context. It establishes the general framework for the sale and purchase of the sole proprietorship business, with specific provisions related to the audit process and purchase price adjustment. 2. Asset Purchase Agreement: An asset purchase agreement focuses on the sale and acquisition of the business's assets rather than the entity itself. This type of agreement is often used when the buyer only intends to purchase specific assets and assume related liabilities, rather than acquiring the entire business entity. 3. Stock Purchase Agreement: A stock purchase agreement is utilized when the buyer intends to purchase all the shares and ownership interests in the sole proprietorship business. This agreement transfers the ownership of the business entity, including its assets, liabilities, and contracts, to the buyer as a result of the stock purchase. 4. Escrow Agreement: An escrow agreement is used to facilitate the sale and protect the interests of both parties involved. It establishes an escrow account where the purchase price is held until the completion of the audit process. This ensures that the funds are available to adjust the purchase price based on the audit results. In conclusion, the Hawaii Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a comprehensive legal document that provides a transparent framework for the purchase of a sole proprietorship business in Hawaii. Its provisions safeguard the interests of both the buyer and seller while ensuring the accuracy and fairness of the purchase price through an audit process.

Hawaii Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Purchase Price Contingent On Audit?

Are you currently in a circumstance where you need documents for either business or personal purposes almost all the time.

There is an abundance of legal document templates accessible online, but locating trustworthy ones can be challenging.

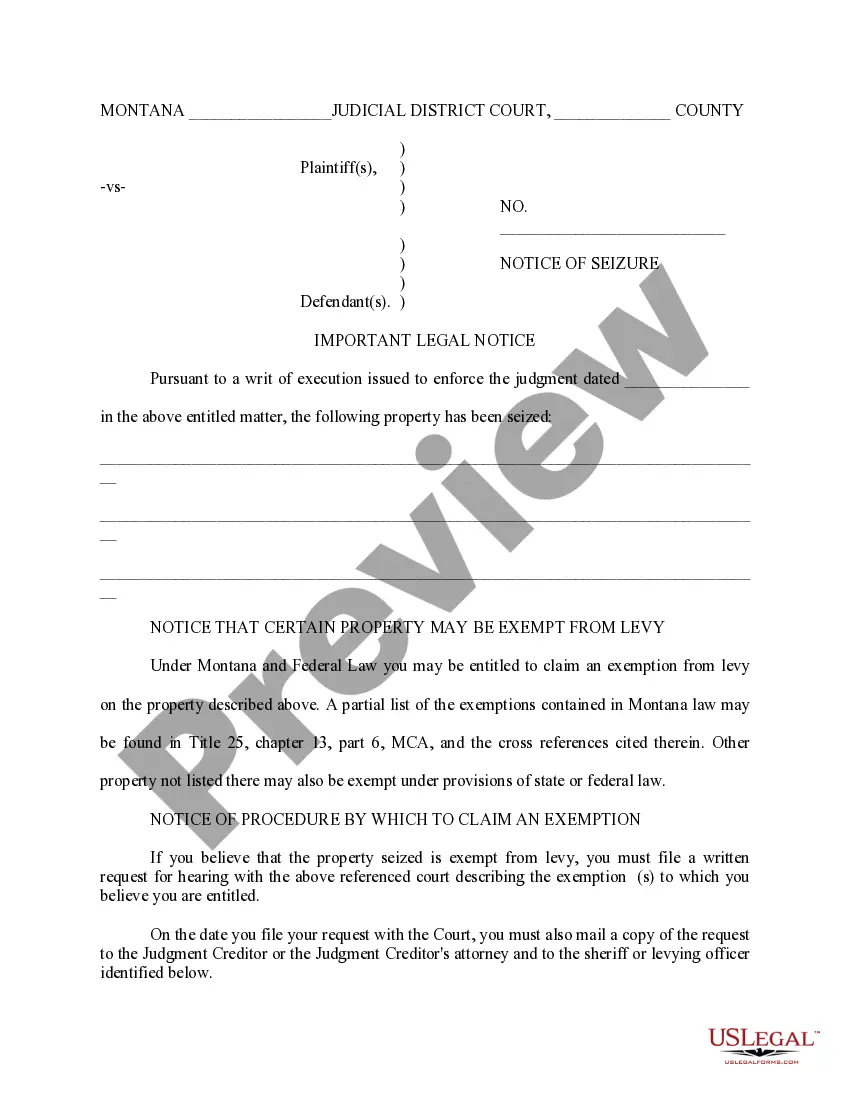

US Legal Forms offers thousands of form templates, such as the Hawaii Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit, designed to comply with federal and state regulations.

Once you find the appropriate form, click Acquire now.

Choose the pricing plan you wish, provide the necessary details to create your account, and complete the payment using your PayPal or credit card. Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- From there, you can download the Hawaii Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Read the description to ensure you have selected the correct template.

- If the form isn’t what you seek, use the Search field to find the template that meets your needs and criteria.

Form popularity

FAQ

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...

What Should Be Included in a Sales Agreement?A detailed description of the goods or services for sale.The total payment due, along with the time and manner of payment.The responsible party for delivering the goods, along with the date and time of delivery.More items...

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

An Agreement of Purchase and Sale is a written contract between a seller and a buyer for the purchase and sale of a particular property. In the Agreement, the buyer agrees to purchase the property for a certain price, provided that a number of terms and conditions are satisfied.

The most important sections include:Offer & closing dates.Legal names of the buyer(s) & seller(s)Property address, frontage, and legal description.Offer price & deposit amount.Irrevocable date for when the offer is good until.Chattels & fixtures included and not included in the sale.Rental items included in the sale.More items...

How to Fill Out a Residential Purchase AgreementPlace the name(s) of the seller(s) on the contract.Write the date of the offer on the agreement.Add the purchase price to the contract.Include a request for the seller to provide a clear title and deed for the property.More items...

Your guide to filling out a sale and purchase agreementRun the contract past your solicitor.Are there any cross outs in the general terms of sale?Check to make sure there have been no extra conditions inserted in the further terms of sale.Read and sign any addendums the contract has.OIA (overseas investment act) form.More items...?

How to Fill Out a Residential Purchase AgreementPlace the name(s) of the seller(s) on the contract.Write the date of the offer on the agreement.Add the purchase price to the contract.Include a request for the seller to provide a clear title and deed for the property.More items...

First and foremost, a purchase agreement must outline the property at stake. It should include the exact address of the property and a clear legal description. Additionally, the contract should include the identity of the seller and the buyer or buyers.

Interesting Questions

More info

It's an honor to be able to do a little for Debut, which I'm always pleased to do. It's my pleasure to present below some of Debut's writings related to Bitcoin, from his recent article What is Bitcoin? “ For The Economist. In this post, Debut explains the difference between Bitcoin, its underlying technology and a Bitcoin (a new kind of cryptocurrency) a hybrid currency that is based on several existing currencies of disparate origins, such as the US dollar, British pound, Swiss franc, euro, and Yuan. This is the first of the two articles I present below. I am writing this post, of course, following Debut's blog post Why Does Bitcoin Exchange Rates Matter? “ Which was published on January 18, 2014, about two and a half years ago. If we were to look at the rate of increase over time, the price of a 1 BTC on January 18, 2014, is equal to 2,000,000,000 USD, whereas it was equal to 100 USD, one year earlier; 2 BTC at that time was worth 100 USD.