Dear [Recipient's Name], I hope this letter finds you in good health. I am writing to request a Tax Clearance Letter for my business/organization [Business/Organization Name], as required by the tax authorities in Hawaii. I understand that this letter serves as proof that my business/organization has fulfilled all its tax obligations and has no outstanding tax liabilities in the state of Hawaii. As part of the process to obtain the Tax Clearance Letter, I kindly request your assistance in guiding me through the necessary steps and providing me with the required forms and documentation. I have visited the Hawaii Department of Taxation website and gathered some information, but I believe that your expertise in this matter would greatly simplify and expedite the process. To ensure a smooth procedure, I would like to highlight the specific details required for the Hawaii Sample Letter for Request for Tax Clearance Letter: 1. Subject: Please specify the subject line as "Request for Tax Clearance Letter." 2. Business/Organization Information: Provide the complete legal name, address, phone number, and Tax Identification Number (TIN) or Employer Identification Number (EIN) of your business/organization. 3. Contact Person: Please indicate the name, title, and direct contact information (phone number and email address) of the person who will be handling this request. 4. Purpose: State the reason for requesting the Tax Clearance Letter, such as closing the business/organization, selling the business/organization, or any other relevant purpose. 5. Attachments: Include a list of all the documents you believe are necessary to support your request, such as copies of tax returns, financial statements, and proof of payment for any outstanding taxes if applicable. It is my understanding that Hawaii offers different types of Tax Clearance Letters depending on the purpose of the request. If there are variations based on the purpose, please provide guidance on which specific type is appropriate for my situation. Additionally, if there are any additional forms or supporting documents required, please inform me accordingly. I kindly request your prompt attention to this matter, as I am hoping to receive the Tax Clearance Letter within [mention desired timeframe]. I understand that any delay may have implications on my business/organization's operations or the timely execution of my intended activities. Thank you for your cooperation and assistance in this matter. I appreciate your expertise and professional support throughout this process. Should you have any questions or require further information, please do not hesitate to reach out to me directly. Looking forward to a favorable response. Sincerely, [Your Name] [Your Title/Position] [Your Contact Information: Phone Number, Email Address]

Hawaii Sample Letter for Request for Tax Clearance Letter

Description

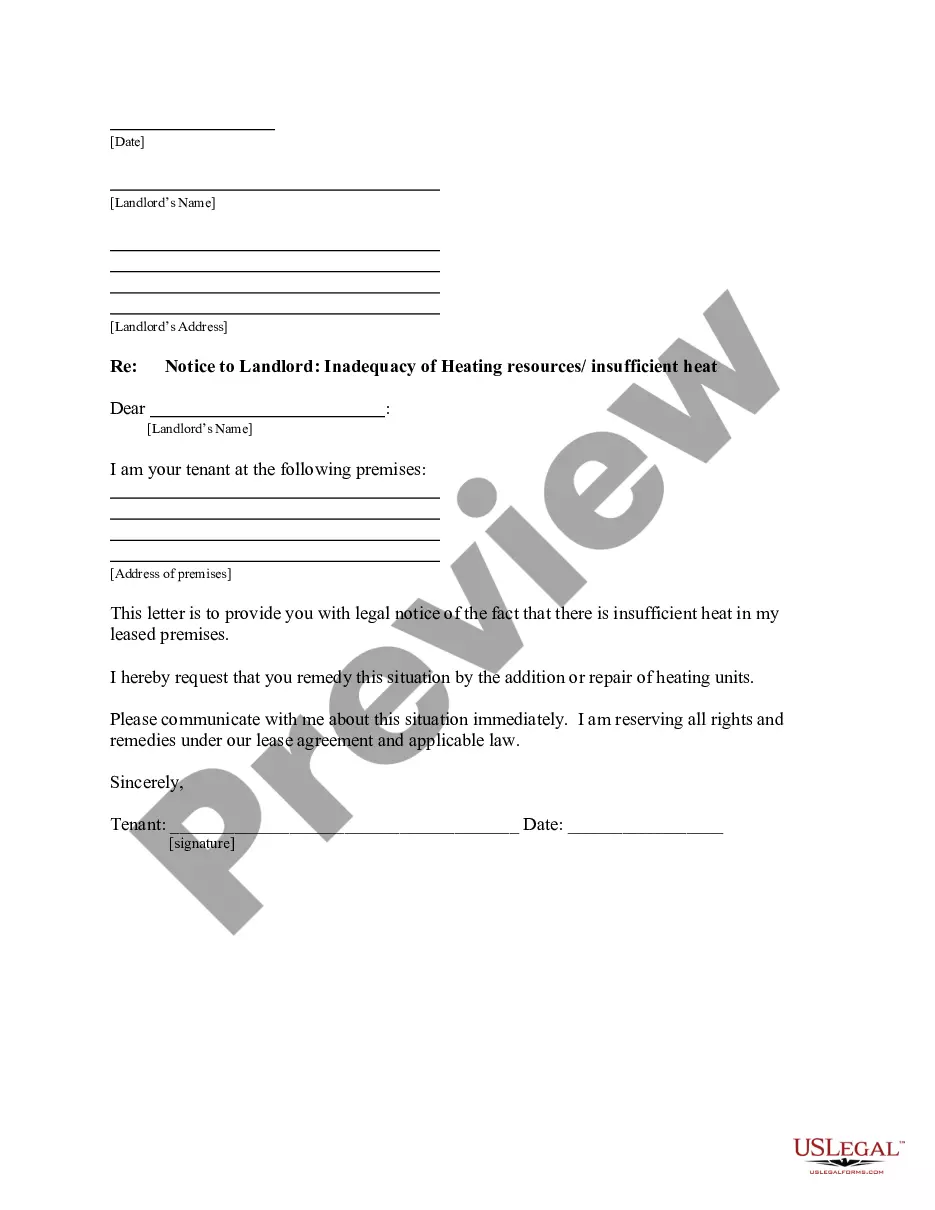

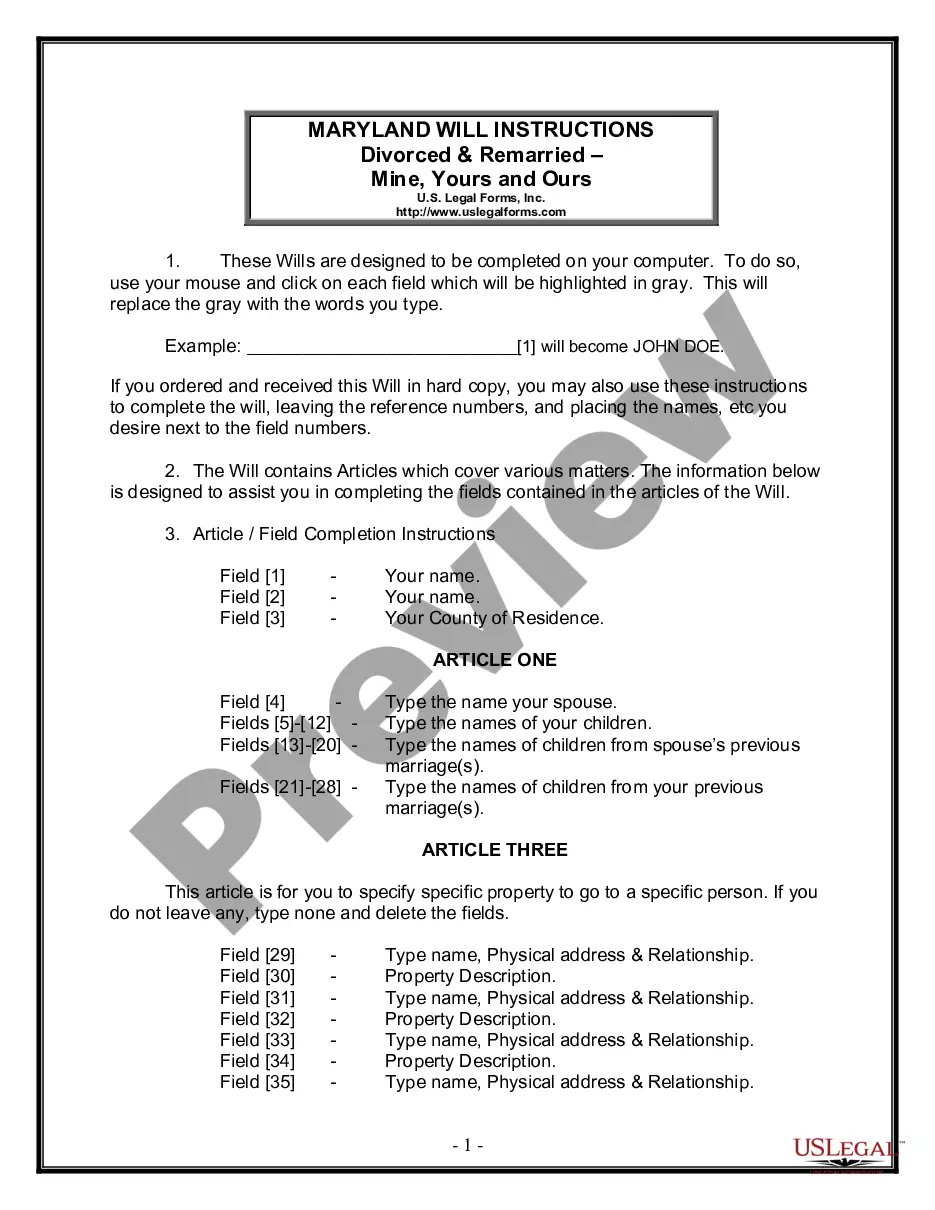

How to fill out Hawaii Sample Letter For Request For Tax Clearance Letter?

Are you in the situation in which you will need paperwork for either organization or specific reasons just about every working day? There are a lot of authorized document layouts available online, but getting ones you can depend on is not straightforward. US Legal Forms delivers thousands of type layouts, much like the Hawaii Sample Letter for Request for Tax Clearance Letter, that are created to meet federal and state needs.

If you are currently knowledgeable about US Legal Forms internet site and possess a merchant account, simply log in. After that, you can down load the Hawaii Sample Letter for Request for Tax Clearance Letter format.

If you do not offer an profile and need to start using US Legal Forms, abide by these steps:

- Discover the type you need and make sure it is for that right city/state.

- Take advantage of the Review option to review the form.

- See the description to actually have selected the correct type.

- In case the type is not what you are seeking, take advantage of the Research field to get the type that suits you and needs.

- When you find the right type, simply click Buy now.

- Opt for the costs strategy you would like, fill out the desired details to make your account, and purchase your order with your PayPal or credit card.

- Decide on a handy data file structure and down load your version.

Find all the document layouts you possess bought in the My Forms food list. You may get a extra version of Hawaii Sample Letter for Request for Tax Clearance Letter whenever, if possible. Just go through the necessary type to down load or produce the document format.

Use US Legal Forms, probably the most extensive variety of authorized types, to conserve some time and avoid faults. The services delivers appropriately made authorized document layouts that you can use for a range of reasons. Generate a merchant account on US Legal Forms and initiate producing your daily life a little easier.

Form popularity

FAQ

In general, you'll need to supply the following information to get a tax clearance certificate: the name, address, and phone number of the buyer and seller. a business address or addresses if multiple locations are involved. the date of sale. a bill of sale or purchase agreement for the business.

Most commonly, states issue clearance certificates, demonstrating that an individual is compliant with all taxes and other obligations as of the date of the certificate. Those seeking clearance certificates will have to request them from state authorities, usually the state's Department of Revenue.

To ask for a clearance certificate, you can submit the completed form TX19, Asking for a Clearance Certificate with the required documents which are listed on the form. The submission can be sent by mail, fax, or electronically via using the Submit Document feature within CRA Online Portals.

If filing Form BB-1, attach the payment and Form VP-1 to the front of the Form BB-1 and mail to the address below. provided. ATTACH THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO ?HAWAII STATE TAX COLLECTOR.? Write the tax and filing types, and your Hawaii Tax I.D. Number on your check or money order.

How do I apply for a tax clearance certificate? After signing in to your Hawaii Tax Online account, navigate to ?I Want To? then to ?Request a Tax Clearance Certificate? under ?Tax Clearance.? You can also download and print the tax clearance application, Form A-6, and submit in person, by fax, or by mail.

This form is used to obtain a State Tax Clearance. ? This form may be used to obtain a State or Federal Tax Clearance for the purpose of entering into contracts/submitting bids with and/or seeking final payment of contracts from state or county agencies in Hawaii.