Hawaii Letter of Credit is a financial instrument widely used in international trade transactions that offers a secure form of payment for exporters and importers. It serves as a guarantee from a bank or financial institution in Hawaii to pay the exporter upon the successful completion of specific contractual obligations. A Hawaii Letter of Credit acts as a binding agreement between the issuing bank in Hawaii (often called the "issuer") and the beneficiary (usually the exporter or seller). The letter outlines the terms and conditions that must be met for the payment to be triggered. In essence, it eliminates the risks associated with international trade by ensuring that the exporter will receive payment as long as they comply with the agreed-upon terms. There are various types of Hawaii Letters of Credit, each tailored to suit different trade scenarios. Some common types include: 1. Revocable Letter of Credit: This type of letter can be amended or canceled by the issuing bank without prior notification to the beneficiary. It offers the least amount of security and is seldom used in international trade transactions. 2. Irrevocable Letter of Credit: This is the most common and widely accepted type of Hawaii Letter of Credit. It cannot be altered or canceled without the consent of all parties involved. It provides a higher level of security for both exporters and importers. 3. Standby Letter of Credit: This type of Hawaii Letter of Credit serves as a backup for contractual obligations if the buyer fails to fulfill their payment obligations. It ensures that the exporter or seller receives payment if the buyer defaults. 4. Confirmed Letter of Credit: In this scenario, a second bank (often located in the beneficiary's country) adds its confirmation to the letter, providing an additional layer of security. This type of letter reassures the exporter that the issuing bank will honor the payment even if it faces financial difficulties. 5. Transferable Letter of Credit: This type allows the beneficiary to transfer the credit to another party, typically a supplier or subcontractor involved in the transaction. It facilitates complex transactions involving multiple parties. Hawaii Letters of Credit play a crucial role in facilitating international trade by mitigating the risks associated with cross-border transactions. They provide confidence to both exporters and importers, ensuring smoother business operations and fostering economic growth.

Hawaii Letter of Credit

Description

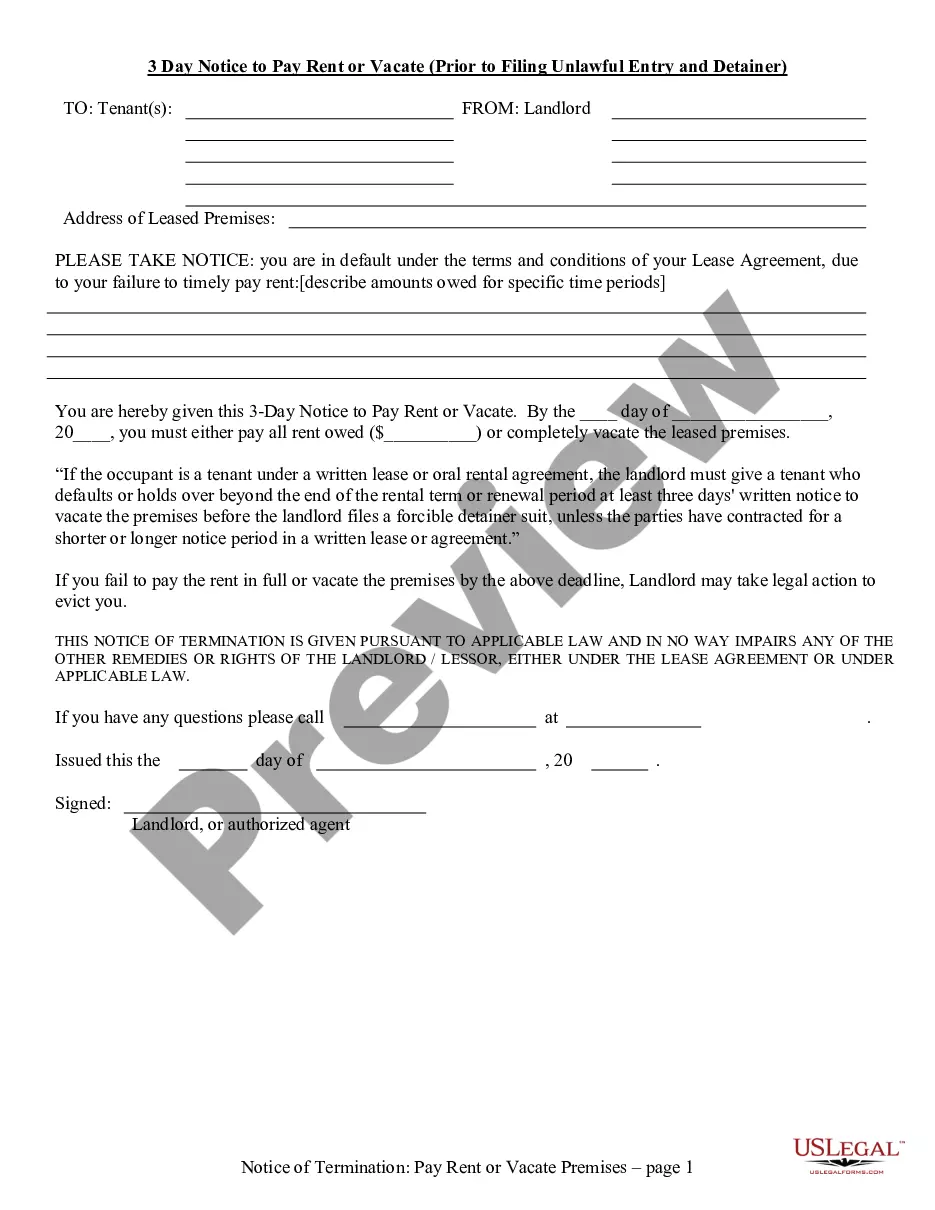

How to fill out Hawaii Letter Of Credit?

You can spend hrs on the Internet attempting to find the authorized file design that suits the federal and state demands you need. US Legal Forms gives a huge number of authorized kinds that are examined by specialists. It is simple to obtain or print out the Hawaii Letter of Credit from our service.

If you currently have a US Legal Forms profile, it is possible to log in and then click the Download switch. After that, it is possible to comprehensive, modify, print out, or signal the Hawaii Letter of Credit. Every single authorized file design you buy is your own permanently. To get yet another version associated with a bought type, visit the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms web site for the first time, keep to the basic directions under:

- First, ensure that you have selected the right file design for the state/area that you pick. Look at the type outline to ensure you have picked out the right type. If readily available, utilize the Preview switch to check from the file design at the same time.

- If you want to find yet another model of your type, utilize the Search field to obtain the design that fits your needs and demands.

- When you have found the design you desire, just click Purchase now to continue.

- Pick the pricing prepare you desire, enter your credentials, and sign up for a merchant account on US Legal Forms.

- Full the purchase. You should use your charge card or PayPal profile to fund the authorized type.

- Pick the formatting of your file and obtain it in your system.

- Make alterations in your file if required. You can comprehensive, modify and signal and print out Hawaii Letter of Credit.

Download and print out a huge number of file web templates making use of the US Legal Forms web site, that provides the most important variety of authorized kinds. Use specialist and condition-particular web templates to deal with your business or specific needs.

Form popularity

FAQ

A standby letter of credit (SLOC) reassures another party during a business transaction. The SLOC guarantees that a bank will financially back the buyer in the event that they can't complete their sales agreement. A SLOC can offer protection for the selling party in the event of a bankruptcy.

A Standby Letter of Credit (SBLC / SLOC) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be made even if their client cannot fulfill the payment. It is a payment of last resort from the bank, and ideally, is never meant to be used.

How It Works Obtain a SBLC. In order to monetize an SBLC, the client must first obtain the SBLC from a bank. ... Find a lender. ... Negotiate terms. ... Sign an agreement. ... Provide the SBLC to the lender. ... Repay the loan or fulfill the terms of the sale.

One of the main risks is that the applicant might lose the SBLC amount if the beneficiary makes a wrongful or fraudulent demand on the bank. This could happen if the beneficiary misinterprets or breaches the contract, or if there is a disagreement or dispute over the performance or quality of the goods or services.

How an SBLC Works. The process of obtaining an SBLC is similar to a loan application process. The process starts when the buyer applies for an SBLC at a commercial bank. The bank will perform its due diligence on the buyer to assess its creditworthiness, based on past credit history and the most recent credit report.