Hawaii Shareholder Agreement to Sell Stock to Other Shareholder is a legally binding document that outlines the terms and conditions for the sale of company stocks between shareholders in the state of Hawaii. This agreement governs the transfer of shares from one shareholder (the "Seller") to another shareholder (the "Buyer") and helps ensure a fair and smooth transaction process. The Hawaii Shareholder Agreement to Sell Stock to Other Shareholder includes various key provisions such as the identification of the Seller and the Buyer, the number and type of shares to be transferred, the purchase price or valuation method, payment terms, and any conditions precedent to the sale. It may also include non-compete clauses, representations and warranties, indemnification provisions, and dispute resolution mechanisms to protect the interests of both parties. Different types of Hawaii Shareholder Agreements to Sell Stock to Other Shareholders may include: 1. General Sale Agreement: This type of agreement is a comprehensive document that covers all aspects of the stock sale between shareholders, including the terms and conditions, payment details, and any additional clauses specific to the transaction. 2. Stock Purchase Agreement: This agreement specifically focuses on the purchase of stocks by one shareholder from another, outlining the technicalities of the transfer, price negotiations, and any warranties or representations made by the Seller regarding the shares being sold. 3. Buy-Sell Agreement: Also known as a Shareholders' Buyout Agreement, this type of agreement provides a framework for shareholders to address potential events, such as death, disability, retirement, or voluntary departure, that trigger the sale of shares to other existing shareholders. It outlines the procedures and terms for the sale, ensuring a smooth transition of ownership. 4. Right of First Refusal Agreement: This agreement grants existing shareholders the first opportunity to purchase the shares being sold before they can be offered to external parties. If a shareholder plans to sell their shares, this type of agreement ensures that other shareholders have the option to acquire them on the same terms and conditions offered by a third party. Hawaii Shareholder Agreements to Sell Stock to Other Shareholder are essential for maintaining transparency, fairness, and the orderly transfer of ownership in Hawaii-based companies. It is advisable for shareholders to consult with legal professionals to draft or review such agreements to ensure compliance with state laws and the specific needs of the company.

Hawaii Shareholder Agreement to Sell Stock to Other Shareholder

Description

How to fill out Hawaii Shareholder Agreement To Sell Stock To Other Shareholder?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse array of legal document templates that you can download or print.

By utilizing the website, you can find thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of documents such as the Hawaii Shareholder Agreement to Sell Stock to Other Shareholder in just moments.

If you're a subscriber, Log In and download the Hawaii Shareholder Agreement to Sell Stock to Other Shareholder from the US Legal Forms library. The Download option will be available for every document you view. You can access all your previously saved documents in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the document onto your device.Edit. Fill out, modify, print, and sign the downloaded Hawaii Shareholder Agreement to Sell Stock to Other Shareholder.Every document you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and select the document you need.Access the Hawaii Shareholder Agreement to Sell Stock to Other Shareholder with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- To get started with US Legal Forms for the first time, here are some simple steps.

- Make sure you have selected the correct document for your city/county.

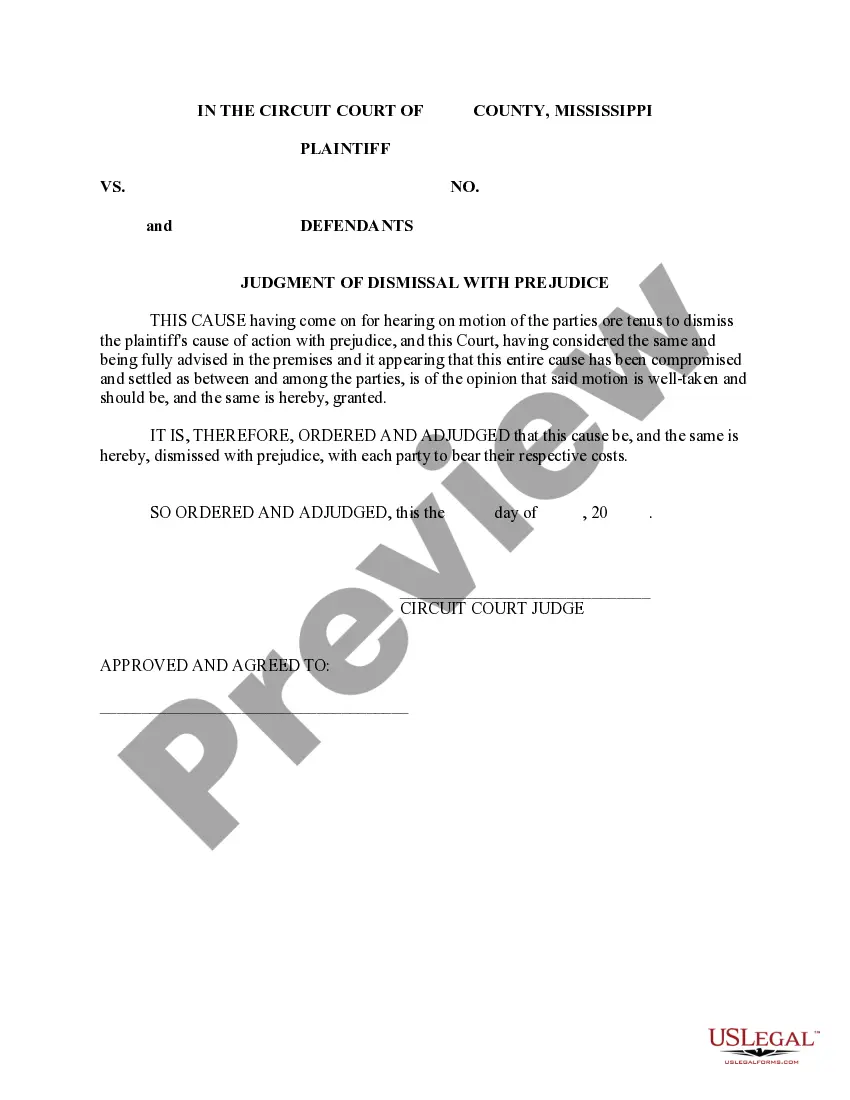

- Click the Preview option to check the form’s details.

- Review the description of the document to ensure it is what you need.

- If the document does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the document, confirm your choice by clicking the Download now button.

- Then, select the pricing plan you wish to choose and enter your details to sign up for an account.

Form popularity

FAQ

Typically, a Hawaii Shareholder Agreement to Sell Stock to Other Shareholder requires the agreement of all parties involved to ensure fairness and compliance with the stipulated terms. However, the specifics can vary based on the company’s governing documents and state laws. Engaging all shareholders in the process promotes transparency and trust, which are essential for effective collaboration. It is advisable to consult legal resources or platforms, like US Legal Forms, to draft agreements that meet your business needs.

A Hawaii Shareholder Agreement to Sell Stock to Other Shareholder outlines the rights and responsibilities of shareholders in business operations. In contrast, a buy-sell agreement specifically governs the process for buying and selling shares among shareholders. While both documents serve to protect shareholder interests, the shareholder agreement generally covers broader topics, while the buy-sell agreement focuses specifically on share transfers. Understanding these differences is crucial for effective business management.

Illinois does allow composite tax returns for pass-through entities. This means that multiple shareholders can file a single return, simplifying the process. While this is an Illinois-specific rule, understanding similar provisions in your Hawaii Shareholder Agreement to Sell Stock to Other Shareholder can help ensure compliance across states. Always consult with a tax advisor to navigate your responsibilities.

Hawaii does not allow a Net Operating Loss (NOL) carryback for tax purposes. Instead, NOLs can be carried forward to offset future taxable income. If your situation involves a Hawaii Shareholder Agreement to Sell Stock to Other Shareholder, consider how your financial structure may impact your NOL strategy going forward. Staying informed will help you optimize your tax outcomes.

Yes, residents can claim tax back in Hawaii under certain circumstances. If you have overpaid your taxes, you may be eligible for a tax refund. Additionally, if your Hawaii Shareholder Agreement to Sell Stock to Other Shareholder has specific provisions related to taxes, it may affect your overall tax situation. Consult with a tax professional to navigate these claims effectively.

Hawaii does allow composite returns for non-resident shareholders of S corporations, simplifying tax obligations. If you're forming a Hawaii Shareholder Agreement to Sell Stock to Other Shareholder, this option can streamline the process, enabling you to focus on the strategic aspects of your transaction.

Yes, Hawaii recognizes S corporations, allowing businesses to avoid double taxation while passing income directly to shareholders. When drafting a Hawaii Shareholder Agreement to Sell Stock to Other Shareholder, understanding your corporate structure helps clarify tax obligations and benefits.

In Hawaii, the Section 179 limit closely aligns with the federal limit, which is $1,160,000 for 2023. This deduction can provide significant tax relief, especially if you are executing a Hawaii Shareholder Agreement to Sell Stock to Other Shareholder and looking for ways to optimize your taxable income.

G 45 is a tax form used for quarterly estimated income tax for individuals in Hawaii, while G 49 is related to business income. Understanding these forms is crucial if you are in the process of negotiating a Hawaii Shareholder Agreement to Sell Stock to Other Shareholder, as they can influence your tax strategy.

Currently, there are no indications that Section 179 will be eliminated in 2024, but tax laws can change. If you're engaging in a Hawaii Shareholder Agreement to Sell Stock to Other Shareholder, staying informed about potential legislative updates can be beneficial for your financial outlook.

Interesting Questions

More info

Revocable Living Trust Estate Vault Revocable Will Power Linda is a resident of British Columbia. Her interest in shares of Carpe Diem Technology Corp is directed only in the case of her death. All investments in shares in Carpe Diem Technology Corp shall be held in accordance with Canadian securities laws. All investments in Carpe Diem Technology Corp shall be deemed assets for the purpose of the Canada Pension Plan. The shares of Carpe Diem Technologies Corp issued in this offering are to be registered under the Canada Business Corporations Act, unless such registration is waived under the Securities Act or unless that Act is contravened. This offering is subject to applicable registration provisions under the U.S. Securities Act of 1933 and the U.S. Securities Exchange Act of 1934. We are not offering in this offering pursuant to a public offering proclamation or an exemption from registration in the United States.