Hawaii Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

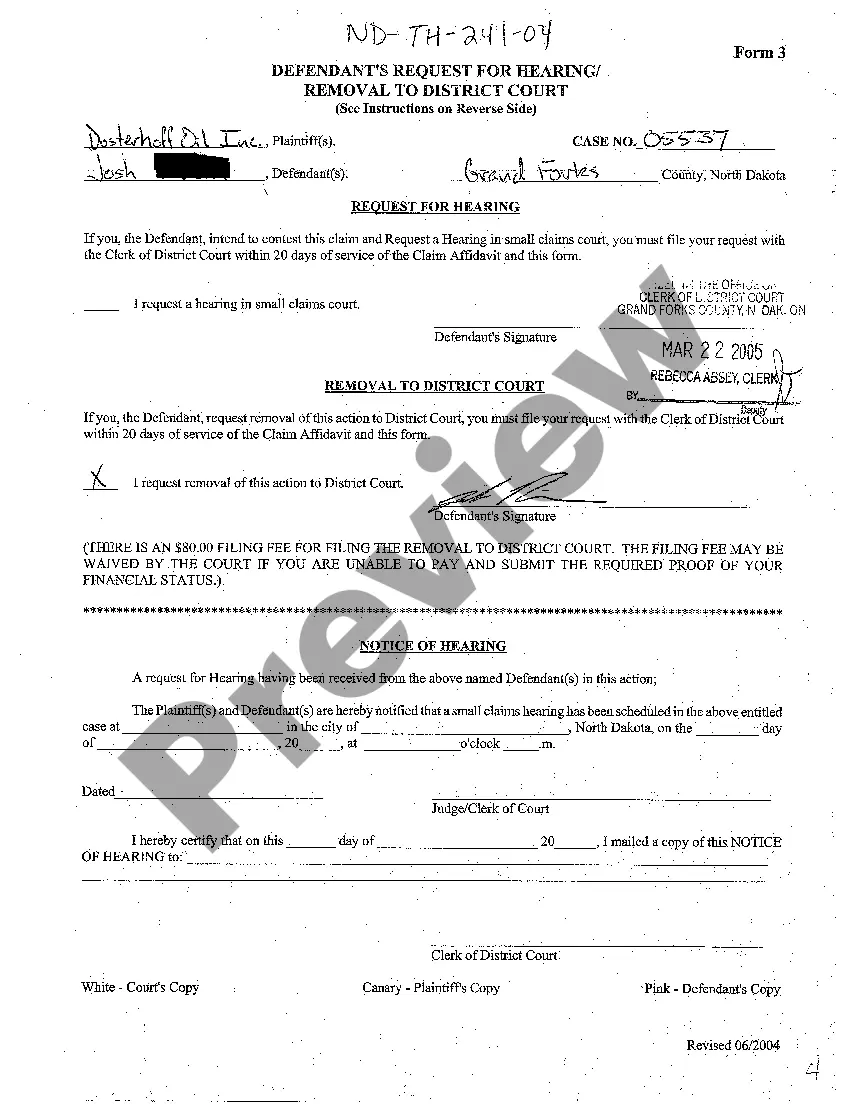

How to fill out Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

You might spend hours online searching for the appropriate legal document template that fulfills the federal and state requirements you need. US Legal Forms offers a vast array of legal forms that can be evaluated by experts. You can download or print the Hawaii Letter to Creditors Notifying Them of Identity Theft for New Accounts from the service.

If you already possess a US Legal Forms account, you can Log In and select the Download option. Then, you can complete, modify, print, or sign the Hawaii Letter to Creditors Notifying Them of Identity Theft for New Accounts. Every legal document template you purchase is yours permanently. To obtain another copy of any purchased form, navigate to the My documents tab and click on the relevant option.

If you are using the US Legal Forms website for the first time, follow the straightforward instructions below: First, ensure that you have selected the correct document template for the region/area of your choice. Review the form outline to confirm you have chosen the right form. If available, use the Review option to examine the document template as well.

Refrain from altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you wish to find another version of the form, use the Search field to locate the template that suits your needs and requirements.

- Once you have found the template you desire, click Get now to proceed.

- Choose the pricing plan you prefer, enter your credentials, and sign up for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to buy the legal form.

- Select the format of the document and download it to your device.

- Make changes to the document if necessary. You can complete, modify, sign, and print the Hawaii Letter to Creditors Notifying Them of Identity Theft for New Accounts.

- Download and print a vast array of document templates from the US Legal Forms website, which offers the most extensive selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

Under Hawaii law, a person commits the offense of Identity Theft if he/she transmits the personal information of another person by any oral statement, any written statement, or any statement conveyed by any electronic means with the intent to commit the offense of theft.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

You also may ask for proof of a claim of identity theft, such as an Identity Theft Report issued by the FTC or a police report. An FTC Identity Theft Report subjects the person filing the report to criminal penalties if the information is false, and businesses can treat it as they would a police report.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

If you have been a victim of identity theft, the Identity Theft Statement helps you notify financial institutions, credit card issuers and other companies that the identity theft occurred, tell them that you did not create the debt or charges, and give them information they need to begin an investigation.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.