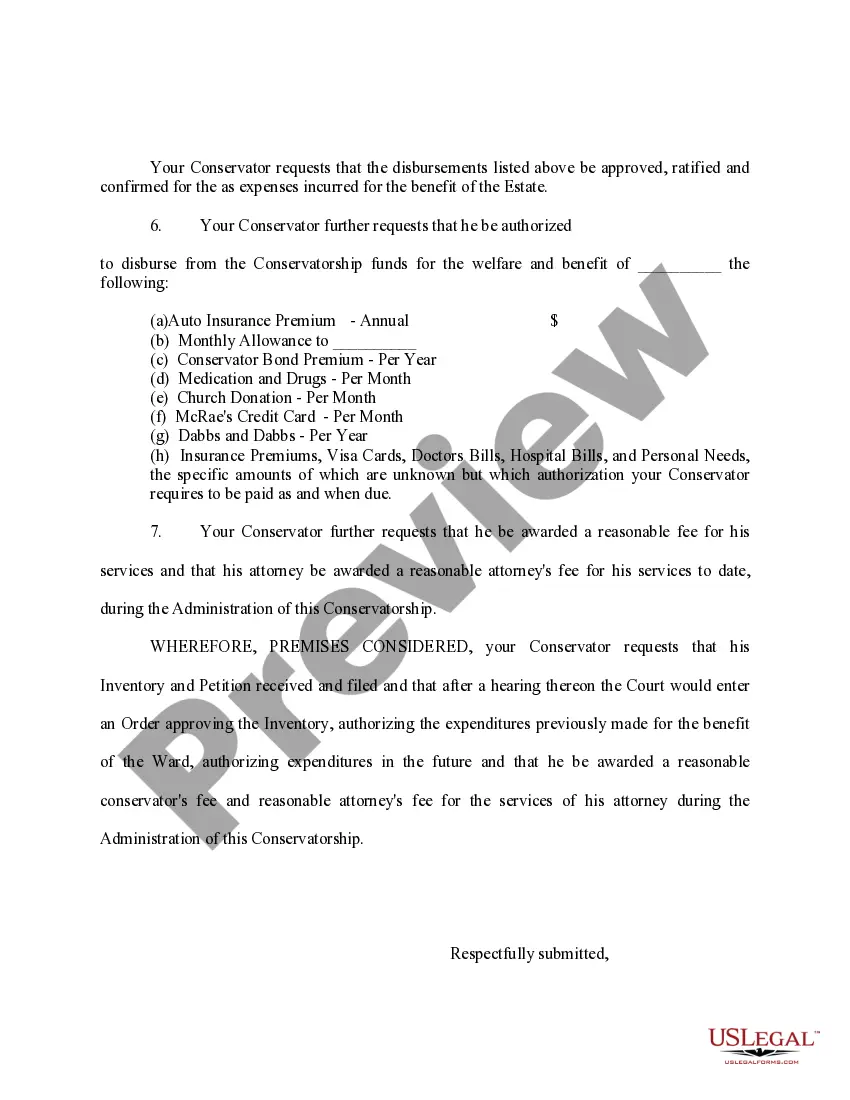

Title: Understanding Hawaii Inventory, Petition to Approve Expenses and Monthly Allowances, and Other Relief Requests Keyword: Hawaii Inventory Introduction: Hawaii Inventory refers to an essential legal document that serves as an inventory of someone's assets, typically an estate. It is commonly filed in a probate court to provide an accurate overview of the deceased individual's tangible and intangible property, including real estate, personal items, and financial holdings. This inventory is crucial for estate planning, probate proceedings, and ensuring the fair distribution of assets among beneficiaries. Types of Hawaii Inventory: 1. Standard Hawaii Inventory: This is the typical inventory filed in a probate court, itemizing a deceased person's assets and liabilities in Hawaii. It details their real estate holdings, personal property, bank accounts, investments, debts, and any other financial resources. This inventory ensures the transparent administration of the estate and helps in calculating estate taxes and distribute shares for heirs and beneficiaries. 2. Hawaii Inventory for Business Entities: In cases where the deceased owned or co-owned a business, a Hawaii Inventory specifically tailored for business entities is required. This inventory includes additional information related to the business such as corporate assets, stock ownership, business partnerships, patents, copyrights, and other intellectual properties. 3. Hawaii Inventory for Trust Accounts: When a living trust exists, a Hawaii Inventory specific to the trust account must be prepared. This inventory outlines the trust's assets, liabilities, and provides detailed information on the trust's beneficiaries and trustees. It helps trustees in managing and distributing assets as per the trust's directions. Keyword: Petition to Approve Expenses and Monthly Allowances Introduction: A Petition to Approve Expenses and Monthly Allowances is a legal request filed with a relevant court or probate division to seek approval for financial disbursements from an estate or trust. These expenses and allowances are typically required for the ongoing maintenance of the estate, trust, or the well-being of beneficiaries. Such petitions ensure proper financial management and safeguard the interests of the estate or trust's beneficiaries. Types of Petition to Approve Expenses and Monthly Allowances: 1. Estate Petition to Approve Expenses: In the case of a deceased person's estate, this petition outlines the necessary expenses for the estate's administration. It may include funeral and burial costs, legal fees, executor compensation, estate taxes, property maintenance, and other essential expenses incurred during the probate process. 2. Trust Petition to Approve Monthly Allowances: For living trusts, this petition is filed to request a monthly allowance or financial support for beneficiaries or trust settlers. The allowance covers expenses such as education, healthcare, housing, and general living costs. It ensures that the intended beneficiaries have access to the funds they require while maintaining proper oversight and control. Keyword: Other Relief Introduction: The term "Other Relief" typically encompasses various legal requests filed in conjunction with the primary inventory or petition. These requests seek additional actions or resolutions necessary for accomplishing specific goals or addressing unique circumstances. The nature and specifics of the "Other Relief" sought can vary depending on the situation, and it is crucial to consult with legal professionals for proper guidance. Examples of Other Relief Requested: 1. Request for Mediation: In cases where disputes arise among beneficiaries, creditors, or other interested parties, the petitioner may request mediation as an alternative resolution mechanism. Mediation is a non-adversarial process facilitated by a neutral third-party mediator, aiming to reach a mutually agreeable settlement and alleviate the need for costly litigation. 2. Distribution Acceleration: In certain instances, beneficiaries may face financial hardships or immediate needs requiring expedited distribution of their share from the estate or trust. A request for distribution acceleration can be filed, outlining the reasons and circumstances justifying an early or partial distribution. Conclusion: Understanding Hawaii Inventory, Petition to Approve Expenses and Monthly Allowances, and Other Relief requests are crucial for individuals involved in estate planning and probate processes. By providing a comprehensive overview of assets, managing expenses, and addressing unique circumstances, these processes ensure the fair and efficient distribution of assets while protecting the interests of beneficiaries and heirs.

Hawaii Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief

Description

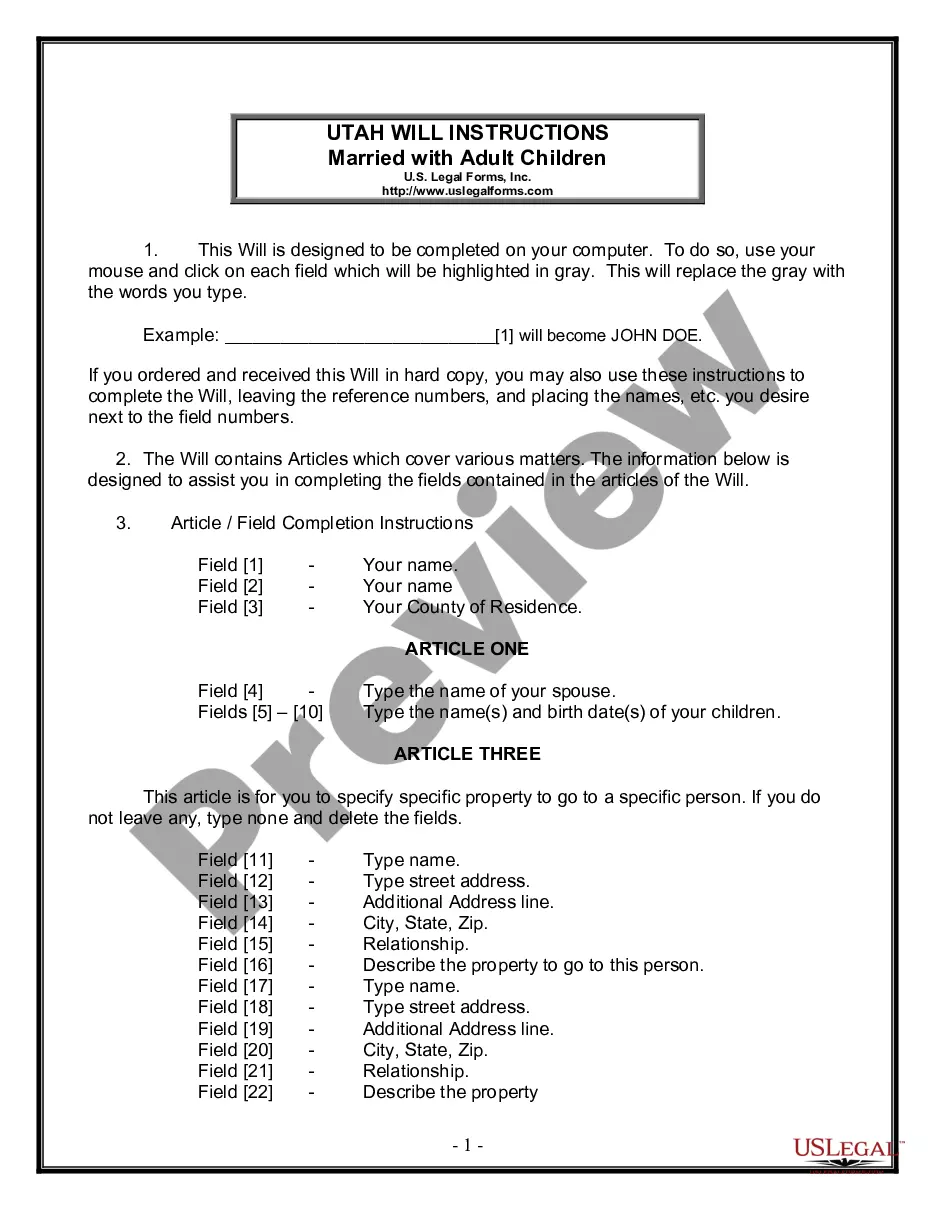

How to fill out Hawaii Inventory, Petition To Approve Expenses And Monthly Allowances, And For Other Relief?

Are you inside a placement where you require documents for possibly organization or specific uses nearly every day time? There are plenty of lawful record layouts available online, but getting kinds you can depend on is not simple. US Legal Forms provides 1000s of kind layouts, just like the Hawaii Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief, which can be published to satisfy state and federal specifications.

In case you are presently familiar with US Legal Forms internet site and also have an account, just log in. Afterward, you are able to download the Hawaii Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief design.

Should you not provide an account and need to begin using US Legal Forms, follow these steps:

- Find the kind you need and ensure it is for the right city/state.

- Take advantage of the Review button to analyze the form.

- See the description to actually have chosen the right kind.

- In case the kind is not what you are seeking, take advantage of the Lookup field to get the kind that fits your needs and specifications.

- Whenever you get the right kind, click on Acquire now.

- Opt for the pricing program you want, fill in the specified info to generate your money, and pay for the transaction making use of your PayPal or bank card.

- Choose a convenient paper formatting and download your copy.

Locate all of the record layouts you might have purchased in the My Forms food selection. You can obtain a more copy of Hawaii Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief anytime, if required. Just click the essential kind to download or print the record design.

Use US Legal Forms, one of the most extensive collection of lawful types, to conserve efforts and prevent blunders. The support provides appropriately produced lawful record layouts which can be used for an array of uses. Produce an account on US Legal Forms and initiate generating your lifestyle a little easier.

Form popularity

FAQ

Rule 126 - Trust Proceedings (a) Petition. A trustee or interested person shall commence any proceeding relating to a trust by filing a petition complying with Rule 3.

A Revocable Living Trust A trust can be a great mechanism to avoid probate and is the recommended method. While there are some upfront fees for creating a trust, the fees are typically much less than probate costs. Generally, you, as trustee, retain control of the assets held within the trust during your lifetime.

All the fees and the final, total cost can average anywhere between three to seven percent of the estate's value for a basic, simple probate. This price can swing drastically upwards if an estate is extremely complex, or if there are extenuating circumstances or delays of any kind.

Probate in Hawaii is necessary when a person dies owning any real estate in his or her name alone, no matter how small the value of the real estate. Probate is also required when the total value of all ?personal property? owned in his or her name alone is worth more than $100,000.

R. 44. Effective upon approval by the court, an attorney may withdraw as counsel in matters pending before the court by filing a Withdrawal of Counsel and Substitution of Counsel, if any, signed by the client, evidencing the client's agreement to the withdrawal.

For small estates, Hawaii probate court can be managed by using an affidavit, but this only works when assets total less than $100,000. If this is an option, all an inheritor would have to do is fill out a simple affidavit.

Rule 50 - Initial Pleadings (a) Case Numbers. The clerk shall assign a P. No. to each probate case matter directly related to the administration of a deceased's estate. Each party presenting a document regarding the same administration of the estate of that deceased shall use the same P.

If any party objects to the form of a proposed order, that person shall within 5 days serve upon the prevailing party and deliver to the court a statement of that party's objections and the reasons for failing to approve, if any, the form of the party's proposed order. Thereafter, the court shall settle the order.