Hawaii Rental Lease Agreement for Business

Description

How to fill out Rental Lease Agreement For Business?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a vast selection of legal document templates that you can obtain or print.

By using the website, you will find thousands of forms for business and personal use, categorized by types, states, or keywords. You can access the latest forms such as the Hawaii Rental Lease Agreement for Business in no time.

If you already possess an account, Log In and download the Hawaii Rental Lease Agreement for Business from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your profile.

Process the payment. Use a credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Hawaii Rental Lease Agreement for Business. Every template you add to your account does not expire and is yours indefinitely. So, if you want to download or print an additional copy, simply go to the My documents section and click on the form you need. Access the Hawaii Rental Lease Agreement for Business with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure that you have selected the appropriate form for your region/state.

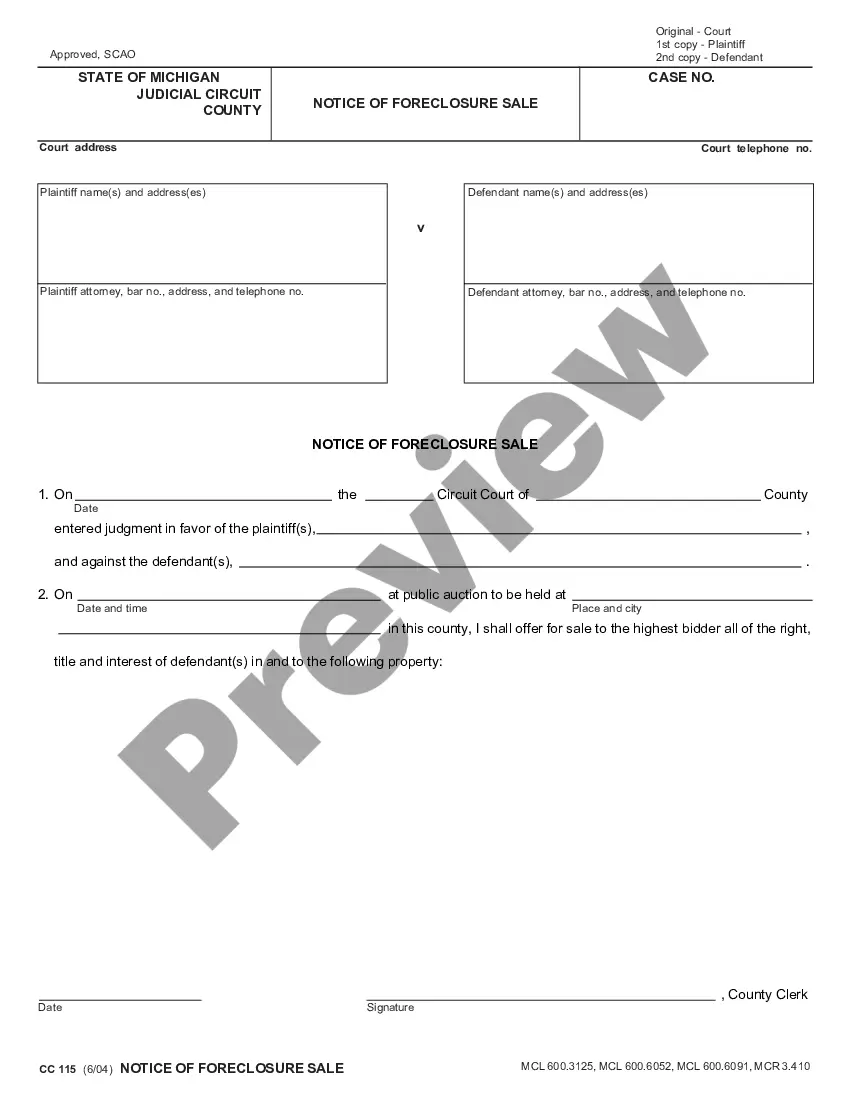

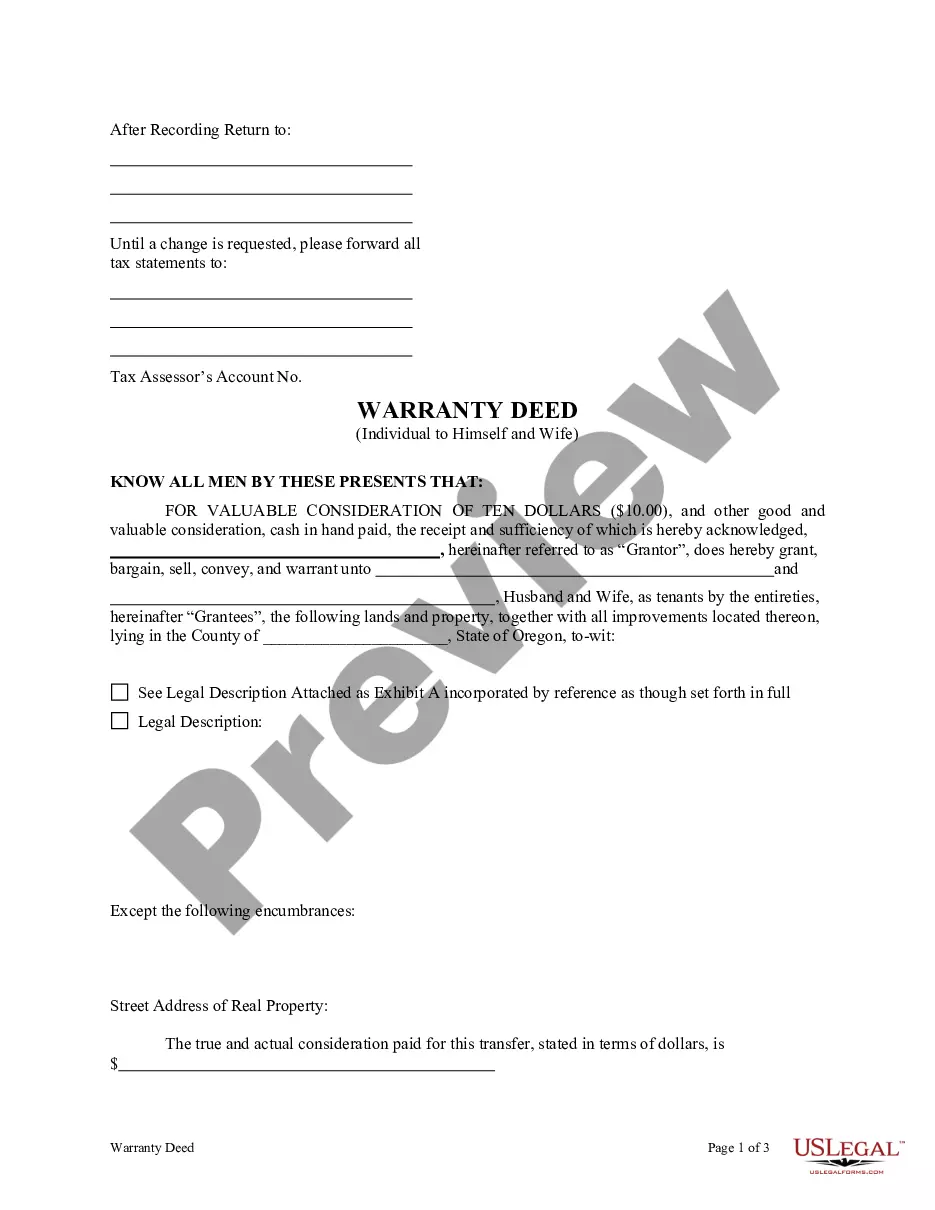

- Click on the Preview button to examine the form's contents.

- Review the form summary to confirm that you have selected the correct document.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Purchase now button.

- Next, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

An example of a short-term lease could be a retail space rented for three months during the holiday season. This arrangement allows businesses to benefit from increased traffic without being tied down for a lengthy period. Using a Hawaii Rental Lease Agreement for Business ensures that all terms are clearly defined, promoting a smooth transaction and mutual understanding.

To write a short-term lease, begin with the basic information, such as the names of the involved parties and the property address. Detail the rental amount, duration, and any other terms unique to the agreement. It is crucial to include clauses regarding security deposits and termination conditions. A Hawaii Rental Lease Agreement for Business can guide you through these essential components.

Writing a short lease requires clear and concise language that outlines the obligations of both parties. Start by defining the lease duration, rental amount, and payment terms. Including specifics like renewal options and maintenance responsibilities ensures that all parties understand their commitments. A solid Hawaii Rental Lease Agreement for Business will include these elements, making it easier to manage short-term rentals.

Recording a short-term lease involves documenting the agreement with local authorities, if required. Although some states may not mandate recording for short-term leases, it is advisable to keep a written record to clarify usage and terms. Utilizing a Hawaii Rental Lease Agreement for Business enables both parties to have clear reference points, reducing potential disputes in the future.

In the context of rental agreements, short-term typically refers to leases that last for less than 12 months. Many consider leases of one to six months as short-term. These agreements provide flexibility for businesses that may not want to commit to a long-term lease. A Hawaii Rental Lease Agreement for Business can be tailored to fit these timeframes.

tomonth lease agreement in Hawaii provides renters with flexibility, allowing them to occupy a rental property without a longterm commitment. Either party can terminate the lease with proper notice, typically 45 days. This type of lease allows business owners to adapt quickly to changing needs, making it a useful option covered in the Hawaii Rental Lease Agreement for Business.

When writing a business proposal for a lease, start by outlining your business needs clearly, including desired location, space requirements, and budget. Include a brief introduction about your business and its goals to add context. Utilize the Hawaii Rental Lease Agreement for Business as a guide to ensure all relevant clauses and conditions are addressed. A well-structured proposal demonstrates professionalism and enhances your chances of securing the lease.

Hawaii has no statewide cap on rent increases, but landlords must provide adequate notice to tenants before increasing rent. Generally, landlords will give a 30 or 45-day notice depending on the situation. Always refer back to your Hawaii Rental Lease Agreement for Business for specific terms, as individual agreements may impose their own limits on rent increases.

Month-to-month tenants in Hawaii enjoy certain rights, including the ability to receive proper notice before rent increases or lease termination. They have the right to a safe and habitable living environment, as landlords must maintain their properties. Furthermore, these rights are clearly stated in the Hawaii Rental Lease Agreement for Business. Knowing these rights can help tenants feel secure in their living arrangements.

Landlords in Hawaii cannot unlawfully evict tenants, such as changing locks without notice or removing tenant belongings. They cannot discriminate based on race, gender, or disability when selecting tenants. Additionally, landlords must respect tenants' rights to privacy as outlined in the Hawaii Rental Lease Agreement for Business. Understanding these limitations will help protect both parties in a lease agreement.