Title: Hawaii Lease of Business Premises — Real Estate Rental: A Comprehensive Guide Introduction: Entering into a Hawaii Lease of Business Premises is an essential step for entrepreneurs and corporations seeking to establish a physical presence in the beautiful state of Hawaii. This detailed description aims to provide you with valuable insights into the various types of Hawaii Lease of Business Premises — Real Estate Rentals available, along with the necessary information you need to make an informed decision. Keywords: Hawaii, lease, business premises, real estate rental, entrepreneurs, corporations, physical presence, types. 1. Commercial Lease Rental: Commercial lease rental in Hawaii refers to the leasing of non-residential properties, such as office spaces, retail stores, warehouses, and industrial facilities. These leases typically involve long-term agreements and may require negotiations on terms such as rent, duration, and maintenance responsibilities. Keywords: commercial lease, non-residential properties, office spaces, retail stores, warehouses, industrial facilities, long-term agreement, negotiations, rent, maintenance. 2. Retail Lease Rental: Retail lease rental in Hawaii focuses specifically on businesses operating in the retail sector. This type of lease typically involves properties located in shopping malls, strip centers, or stand-alone retail buildings. It may include provisions related to display requirements, signage, and common area maintenance fees. Keywords: retail lease, shopping malls, strip centers, stand-alone retail buildings, display requirements, signage, common area maintenance fees. 3. Office Lease Rental: Office lease rental in Hawaii caters to businesses seeking spaces primarily for administrative, professional, or corporate purposes. These leases generally involve properties located in commercial office buildings or business parks, offering amenities such as parking facilities, shared conference rooms, and access to high-speed internet connections. Keywords: office lease, administrative, professional, corporate, commercial office buildings, business parks, parking facilities, shared conference rooms, high-speed internet connections. 4. Industrial Lease Rental: Industrial lease rental in Hawaii targets businesses involved in manufacturing, warehousing, and distribution. These leases typically cover large industrial facilities, storage spaces, or production areas. Industry-specific requirements such as zoning restrictions, loading dock access, and utility provisions may be included in these agreements. Keywords: industrial lease, manufacturing, warehousing, distribution, industrial facilities, storage spaces, production areas, zoning restrictions, loading dock access, utilities. Important Considerations: 1. Lease Term: Hawaii offers both short-term and long-term lease options, allowing businesses to choose the most suitable duration for their specific needs. 2. Rental Cost: The cost of leasing business premises in Hawaii depends on factors like location, size, and condition of the property. 3. Zoning Regulations: It is crucial to understand the local zoning regulations to ensure the leased premises align with the intended business activities. 4. Maintenance and Repairs: The responsibilities for property maintenance and repairs should be clearly outlined in the lease agreement. Conclusion: Whether you require a commercial, retail, office, or industrial premises, understanding the different types of Hawaii Lease of Business Premises — Real Estate Rentals is crucial in securing the right space for your business. Pay close attention to the specific requirements, lease terms, rental costs, and other considerations before signing any agreements. By doing so, you can establish a successful business venture in the breathtaking islands of Hawaii.

Hawaii Lease of Business Premises - Real Estate Rental

Description

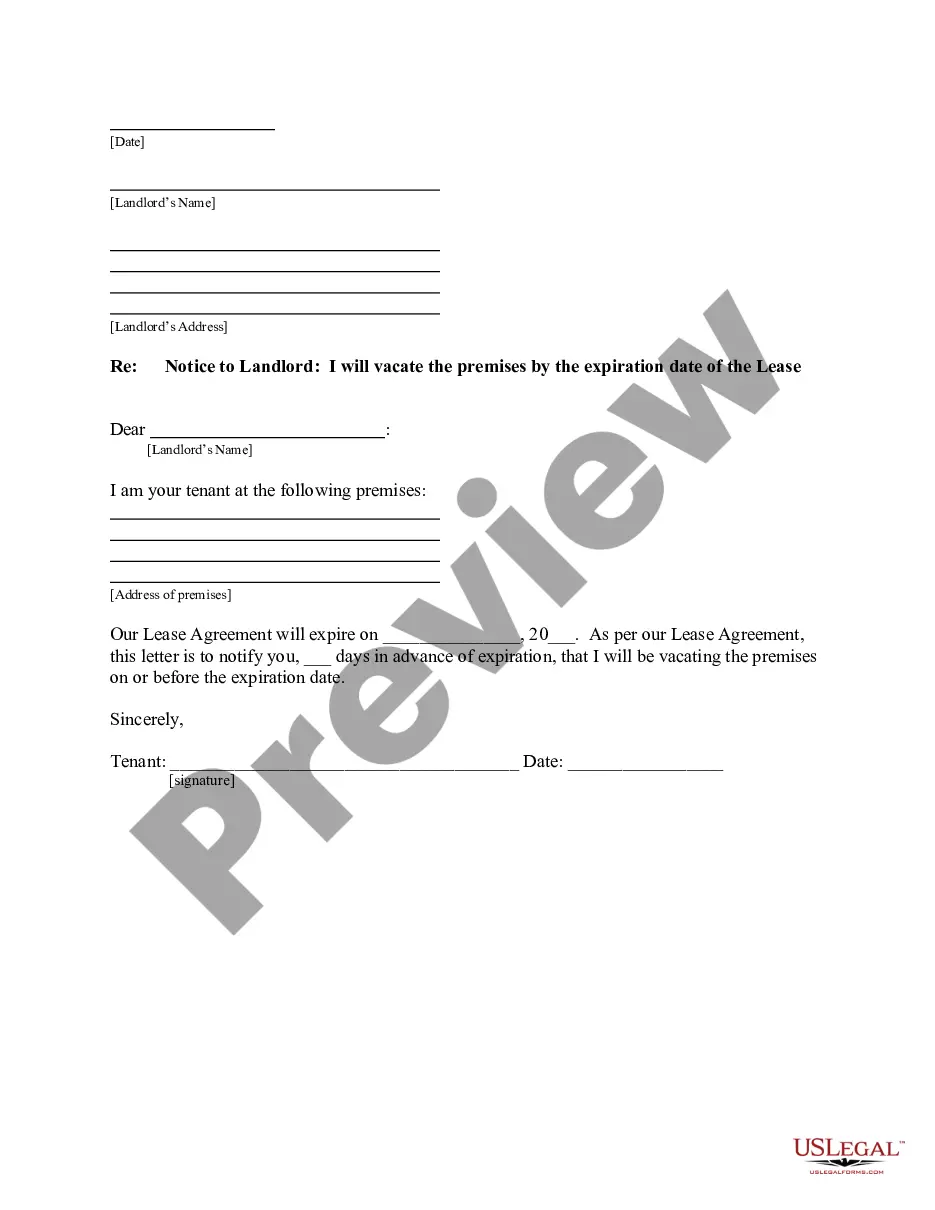

How to fill out Hawaii Lease Of Business Premises - Real Estate Rental?

Locating the appropriate legal document template may pose a challenge.

Naturally, numerous templates can be found online, but how can you identify the legal document you require.

Utilize the US Legal Forms website. The service offers an extensive array of templates, including the Hawaii Lease of Business Premises - Real Estate Rental, suitable for both business and personal needs.

You can browse the form using the Preview option and read the form description to confirm it is suitable for you.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are already registered, sign in to your account and click on the Get button to obtain the Hawaii Lease of Business Premises - Real Estate Rental.

- Use your account to search through the legal documents you have obtained previously.

- Visit the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions for you to follow.

- First, ensure you have selected the correct form for your specific region/area.

Form popularity

FAQ

The standard for leases in Hawaii typically includes specific elements like payment terms, duration, and maintenance responsibilities. Each lease must abide by state laws to be enforceable, ensuring fairness for both landlords and tenants. For those engaging in a Hawaii Lease of Business Premises - Real Estate Rental, using a trustworthy tool like uslegalforms can simplify the leasing process and help generate compliant agreements tailored to your needs.

The 99-year lease in Hawaii is a long-term land leasing agreement that allows individuals or businesses to use land for an extended period. This type of lease provides stability and often has fixed terms that can enhance investment opportunities. Understanding a 99-year lease is vital when considering a Hawaii Lease of Business Premises - Real Estate Rental, as it defines your long-term rights to the property.

Yes, it is possible to Airbnb a leasehold property in Hawaii, but it often requires obtaining the necessary permits and adhering to local regulations. Many leasehold agreements have restrictions on short-term rentals, so it is crucial to review your lease carefully. Engaging with an experienced resource like uslegalforms can help you navigate the requirements for a Hawaii Lease of Business Premises - Real Estate Rental and set up your short-term rental legally.

A normal lease in Hawaii typically refers to a rental agreement that defines the terms and conditions for occupying a property. This agreement outlines the duration of the lease, rent amount, and responsibilities of both parties. When considering a Hawaii Lease of Business Premises - Real Estate Rental, ensure that your lease covers all pertinent details to avoid misunderstandings in the future.

In Hawaii, the 30-day rental law indicates that if a rental agreement lasts for 30 days or more, it is considered a long-term lease. This involves specific regulations that protect both landlords and tenants. Understanding these regulations is essential for anyone entering a Hawaii Lease of Business Premises - Real Estate Rental. By knowing your rights and obligations, you can create a more secure rental agreement.

The minimum term for a commercial lease in Hawaii is usually one year, although it can vary based on the property and agreement between parties. A longer lease term can provide stability for both tenants and landlords. When engaging in the Hawaii Lease of Business Premises - Real Estate Rental, having clear terms can benefit all parties involved.

You can manage your own rental property in Hawaii, provided you adhere to the relevant laws and regulations. Self-management can save costs and give you more control over your property. However, if you're unfamiliar with the Hawaii Lease of Business Premises - Real Estate Rental, using a platform like US Legal Forms can help simplify the management process.

Yes, rental income is taxable in Hawaii, and landlords must report this income on their state tax returns. Additionally, Hawaii has its own set of tax laws that property owners should be aware of when engaging in the Hawaii Lease of Business Premises - Real Estate Rental. Staying informed about tax obligations can help you avoid unexpected liabilities.

Hawaii has a mixed reputation when it comes to being landlord-friendly. While property owners have certain rights and can enforce lease agreements, tenants also have protections under state laws. Understanding the balance is crucial when engaging in the Hawaii Lease of Business Premises - Real Estate Rental.

In Hawaii, property owners do not need a specific landlord license; however, they must comply with local rental and land-use regulations. It is advisable to familiarize yourself with the requirements related to the Hawaii Lease of Business Premises - Real Estate Rental to ensure compliance. Proper knowledge helps you avoid potential legal issues.

Interesting Questions

More info

How to buy land What is a commercial building lease? Business leases are used by professionals when purchasing new buildings or leases for new businesses. They're typically paid within 30 days of acceptance. Before you decide on an arrangement, you should do your research.