Hawaii Sale and Leaseback Agreement for Commercial Building is a legal arrangement where the owner of a commercial property in Hawaii sells the property to a buyer and simultaneously leases it back from the buyer under specific terms and conditions. This agreement allows the property owner to free up capital while still retaining operational control and usage of the property. In a Hawaii Sale and Leaseback Agreement for Commercial Building, the property owner, also known as the seller-lessee, transfers ownership of the commercial building to the buyer, called the purchaser-lessor. The buyer then becomes the new legal owner of the property, while the seller-lessee becomes the tenant, paying lease payments to the purchaser-lessor for a defined period. By entering such an agreement, the property owner gains immediate access to capital which can be utilized for various purposes such as expansion, debt repayment, acquisitions, or investment opportunities. The sale aspect of the agreement allows the property owner to essentially convert the property's value into cash, while the leaseback part ensures that the seller-lessee can continue utilizing the property for their business operations. Different types of Hawaii Sale and Leaseback Agreements for Commercial Building may include: 1. Full Payout Leaseback: In this type of agreement, the lease payments made by the seller-lessee cover the entire purchase price of the property over the lease term. By the end of the lease term, the seller-lessee regains full ownership of the commercial building. 2. Partial Payout Leaseback: In this scenario, the lease payments made by the seller-lessee during the lease term cover only a portion of the purchase price of the property. At the end of the lease term, the seller-lessee retains ownership but still owes a residual payment to the purchaser-lessor. 3. Net Leaseback: With a net leaseback agreement, the seller-lessee is responsible for paying all property expenses, including taxes, insurance, and maintenance costs, in addition to the lease payments. This type of agreement shifts the burden of property management and associated costs to the seller-lessee while providing them with continued usage of the property. Hawaii Sale and Leaseback Agreements for Commercial Buildings offer flexibility to commercial property owners who wish to unlock the value of their real estate while maintaining control over their business operations. It is crucial for both parties to carefully negotiate the terms of the agreement, including lease duration, rental payments, and any potential buyout options, to ensure mutual benefits and a successful transaction.

Hawaii Sale and Leaseback Agreement for Commercial Building

Description

How to fill out Hawaii Sale And Leaseback Agreement For Commercial Building?

Are you presently in a location where you frequently require documents for either business or personal purposes.

There are numerous authentic document templates accessible online, but finding ones you can trust isn't straightforward.

US Legal Forms provides thousands of form templates, including the Hawaii Sale and Leaseback Agreement for Commercial Property, that are designed to meet state and federal regulations.

Once you find the appropriate form, click Get now.

Select the pricing plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Hawaii Sale and Leaseback Agreement for Commercial Property template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

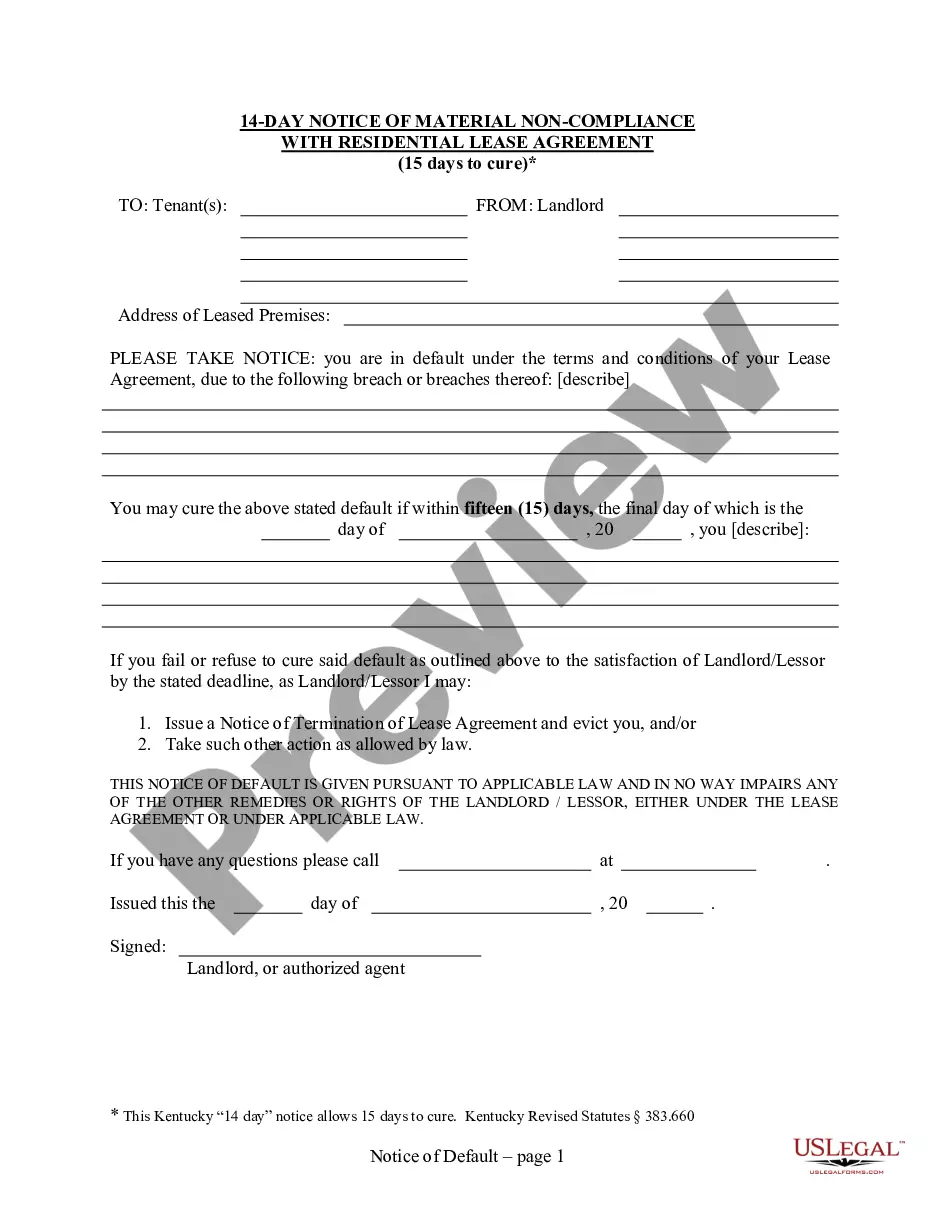

- Use the Preview button to review the form.

- Check the outline to confirm you have selected the right form.

- If the form isn't what you're looking for, utilize the Search section to find a form that suits your requirements.

Form popularity

FAQ

The point of a sale and leaseback is to optimize capital use while retaining property functionality. In the case of a Hawaii Sale and Leaseback Agreement for Commercial Building, businesses can obtain funds from the sale and subsequently lease the property. This strategic approach allows for growth, liquidity, and ongoing operational control.

The benefits of sale and leaseback include increased liquidity, decreased debt, and the ability to maintain property use. This arrangement, particularly in a Hawaii Sale and Leaseback Agreement for Commercial Building, empowers businesses to divest assets yet retain operational control. Such flexibility enhances financial strategy and operational efficiency.

Leasing can be more advantageous than buying because it often requires lower upfront costs and reduces financial risk. A Hawaii Sale and Leaseback Agreement for Commercial Building allows businesses to allocate funds elsewhere while enjoying property use. This flexibility can be critical for companies looking to adapt to changing market conditions.

A sale and leaseback offers several benefits, such as immediate capital access and reduced maintenance responsibilities. Businesses can reinvest the funds from the sale into their operations, which can lead to growth opportunities. Moreover, a Hawaii Sale and Leaseback Agreement for Commercial Building enables businesses to optimize their financial position while still using the property.

The right of use in a sale and leaseback arrangement allows the business seller to continue utilizing the property after the sale. This is essential in a Hawaii Sale and Leaseback Agreement for Commercial Building, as it helps maintain operational continuity. The seller's right to use the property is secured through the lease agreement.

When a leased property is sold, the lease typically remains in place, protecting the rights of the tenant. In the context of a Hawaii Sale and Leaseback Agreement for Commercial Building, the new owner steps into the role of landlord, maintaining the terms of the existing lease. This allows the tenant to continue their business operations uninterrupted.

A lease involves renting a property for a specific period, while a sale transfers ownership of the property from one party to another. In a Hawaii Sale and Leaseback Agreement for Commercial Building, the seller becomes a tenant after the sale. This means that although they no longer own the property, they retain operational control.

To write a simple agreement, start by identifying the parties involved and outlining the purpose of the agreement. Specify the terms and conditions clearly, focusing on what is expected from each party. Simple agreements are easier to understand and enforce, which can be particularly beneficial in cases like a Hawaii Sale and Leaseback Agreement for Commercial Buildings. Consider using resources like US Legal Forms to create a compliant document.

To write a commercial lease Letter of Intent (LOI), begin by stating the property location and your intent to lease. Clearly outline key terms including rent, duration, and potential tenant improvements. Providing a framework for negotiation, a well-crafted LOI can pave the way for a successful Hawaii Sale and Leaseback Agreement for Commercial Buildings. Always ensure both parties agree before finalizing any commitments.

Yes, Microsoft Word offers various templates that can assist you in drafting a rental agreement. However, these templates may not always cater specifically to your needs, particularly for a Hawaii Sale and Leaseback Agreement for Commercial Buildings. For precise and compliant documents, utilizing a platform like US Legal Forms can offer you comprehensive templates tailored to commercial leases.