Hawaii General Form of Lease of Warehouse to Warehouseman

Description

How to fill out General Form Of Lease Of Warehouse To Warehouseman?

If you require to compute, acquire, or print authentic document templates, utilize US Legal Forms, the most extensive selection of authentic forms available on the web.

Take advantage of the site's straightforward and user-friendly search to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After identifying the form you want, click the Get now button. Choose your desired pricing plan and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to find the Hawaii General Form of Lease of Warehouse to Warehouseman with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to obtain the Hawaii General Form of Lease of Warehouse to Warehouseman.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/region.

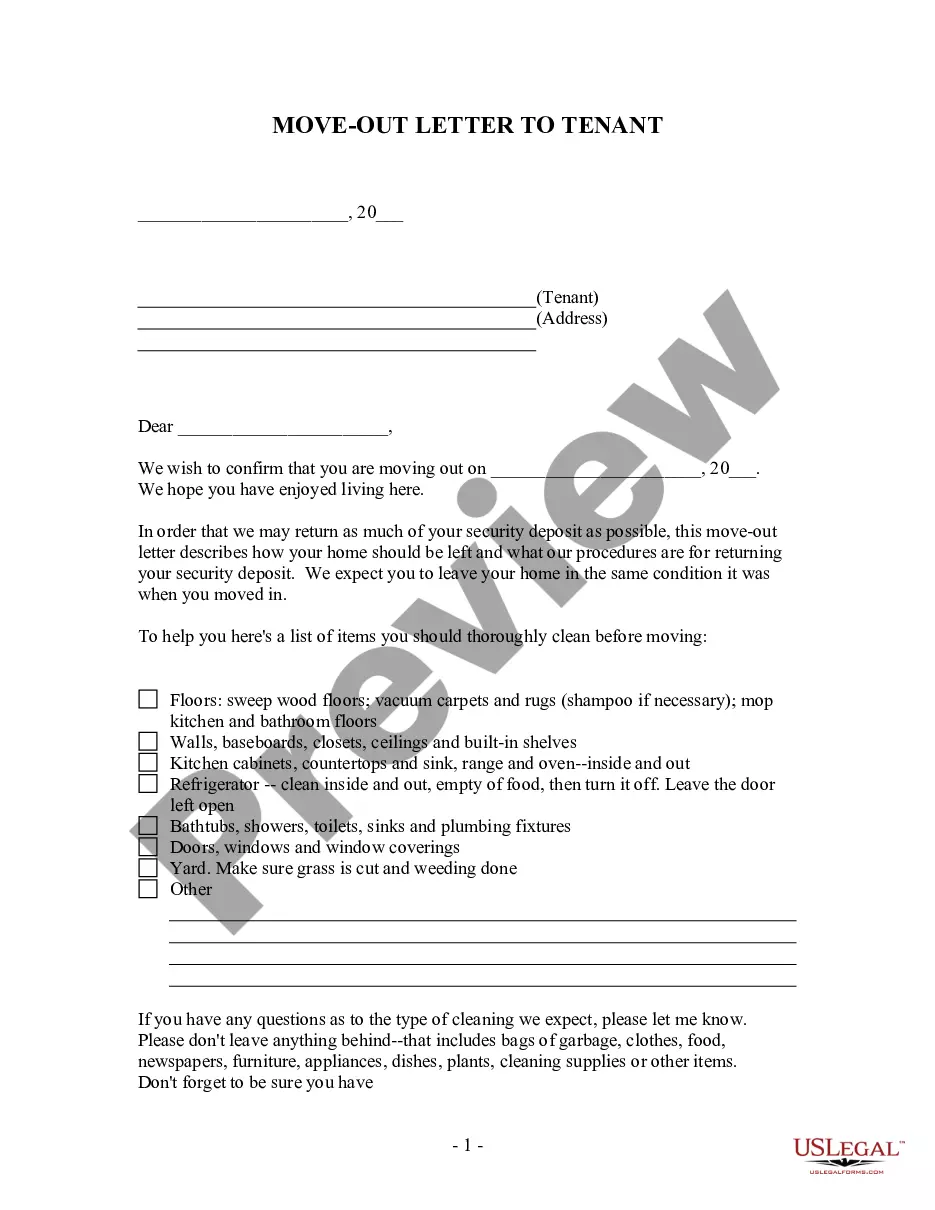

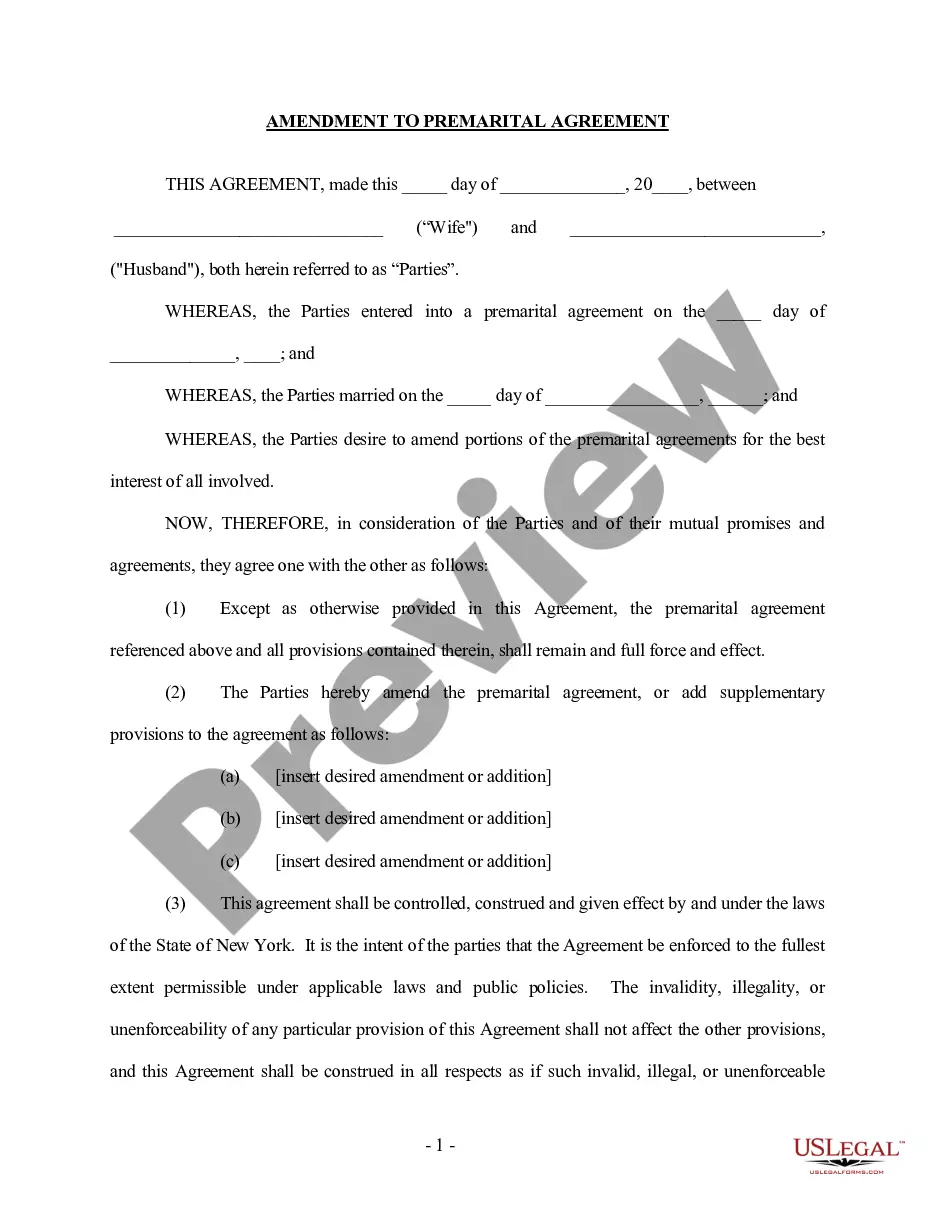

- Step 2. Use the Preview option to review the form's details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the display to find other versions of the legal form template.

Form popularity

FAQ

The Hawaii tax G-49 form is an annual income tax return for corporations and partnerships in the state. It documents the entity's taxable income and helps calculate the appropriate tax due. Filing this form is crucial for businesses operating in Hawaii, including those that utilize rental agreements such as the Hawaii General Form of Lease of Warehouse to Warehouseman. Compliance ensures lawful operations and avoids penalties.

Form 1099-G in Hawaii is a tax form used to report certain types of government payments, such as unemployment compensation or state tax refunds. It informs recipients of any income they may need to include on their tax return. Understanding this form is essential for accurate tax filing and compliance with state tax laws. Business owners utilizing the Hawaii General Form of Lease of Warehouse to Warehouseman should be aware of any related income reporting requirements.

A month to month lease agreement in Hawaii is a rental contract that automatically renews each month without a fixed end date. Tenants and landlords can terminate this lease with proper notice, making it flexible for both parties. This type of lease is useful for those who need short-term accommodation and want the ease of not committing to a long-term arrangement. For warehousing needs, it can align well with the terms outlined in the Hawaii General Form of Lease of Warehouse to Warehouseman.

Yes, if your business engages in taxable activities, you typically must file both the G45 and G49 forms. The G45 reports your estimated general excise and use taxes, while the G49 summarizes your activity for the year. Filing both forms ensures compliance and provides a clearer financial picture for your business.

Yes, you can file your Hawaii state tax online through the Hawaii Department of Taxation's e-filing system. This convenient method allows you to submit necessary forms electronically, including the G-49. Using online portals often results in faster processing times and improved accuracy.

To file the G49 form in Hawaii online, you need to create an account on the Hawaii Department of Taxation's website. After securely logging in, follow the online prompts to input your business data and submit the form. Making this process digital saves time and helps maintain accurate records.

The BB 1 form in Hawaii is a business registration application, required for new and existing businesses to operate legally. This form collects essential information about your business, including its nature and scope. Completing this form correctly ensures you can legally conduct business and allows you to access state resources.

To file the Hawaii G-49 form, gather your business records that include income and sales data. After completing the form, you can file it either electronically or through traditional mail. Consulting with a tax professional can also simplify the process and help you maximize deductions related to your lease agreements.

The G-49 tax form in Hawaii is a required document for businesses to report their general excise tax and use tax. Essentially, it serves as a summary of your tax liabilities and transactions over a period. Filing this form accurately helps ensure compliance with state law and prevents penalties on your business.

Form G 17 Hawaii is a document used by warehousemen and lessors for the legal rental agreements denoted as the Hawaii General Form of Lease of Warehouse to Warehouseman. This form outlines the rights and responsibilities of both parties involved in the leasing arrangement. Creating clear terms in this form can help avoid potential disputes during the lease period.