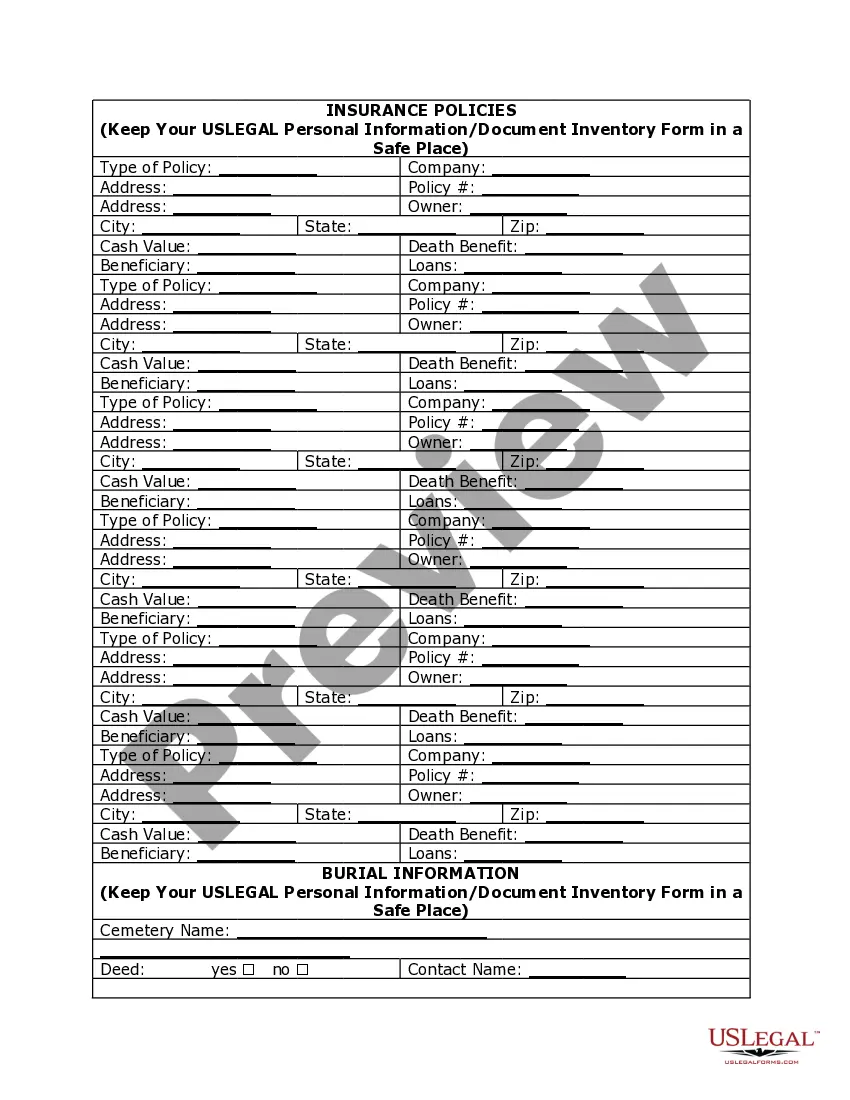

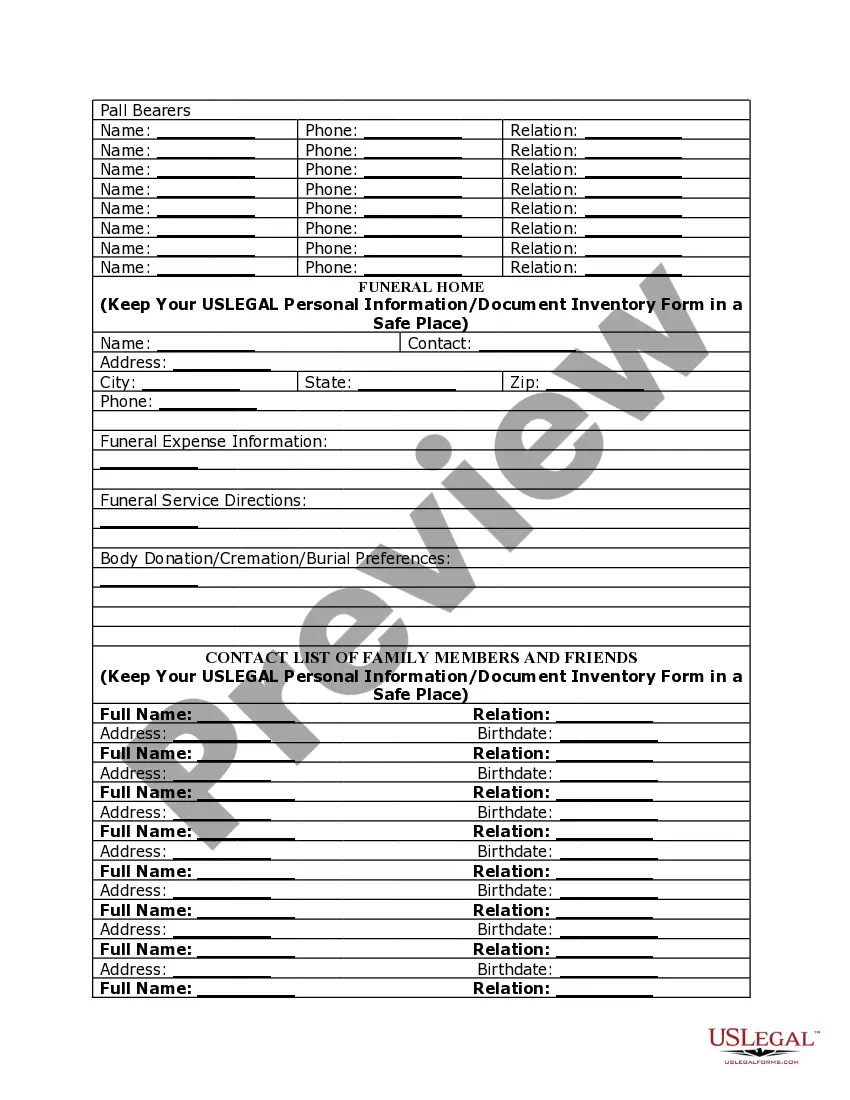

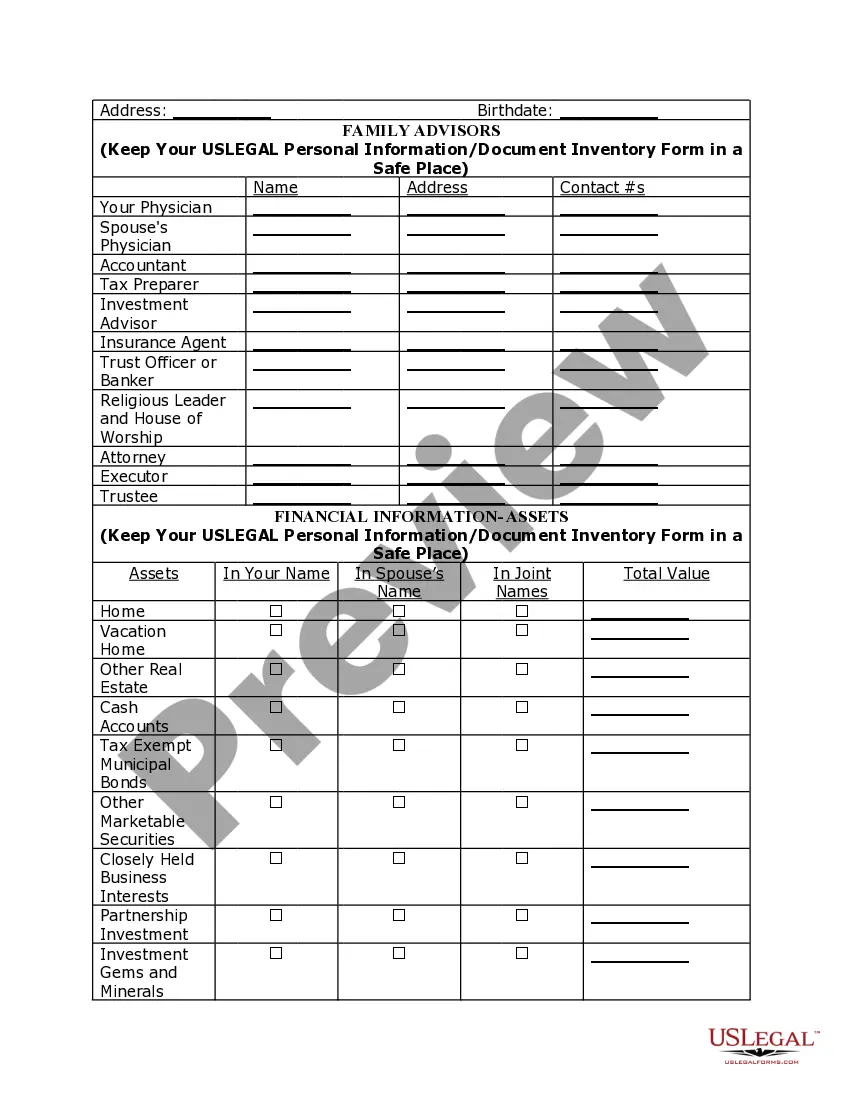

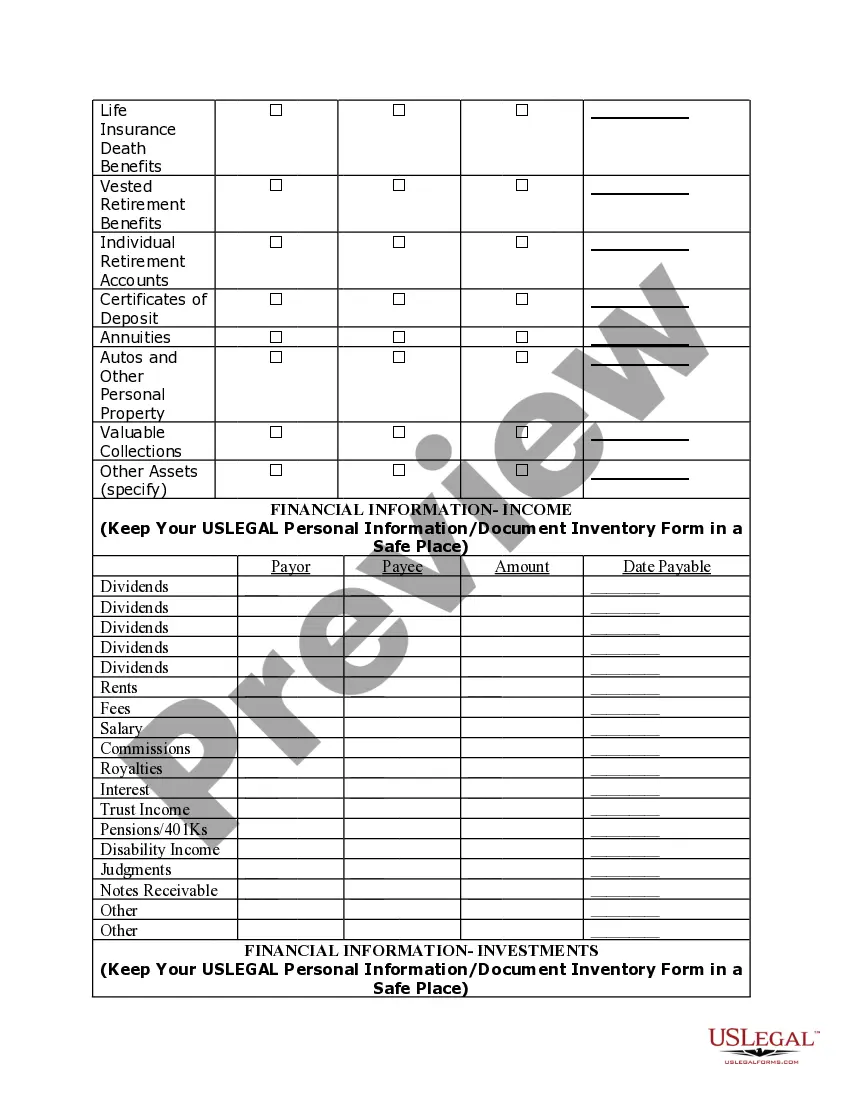

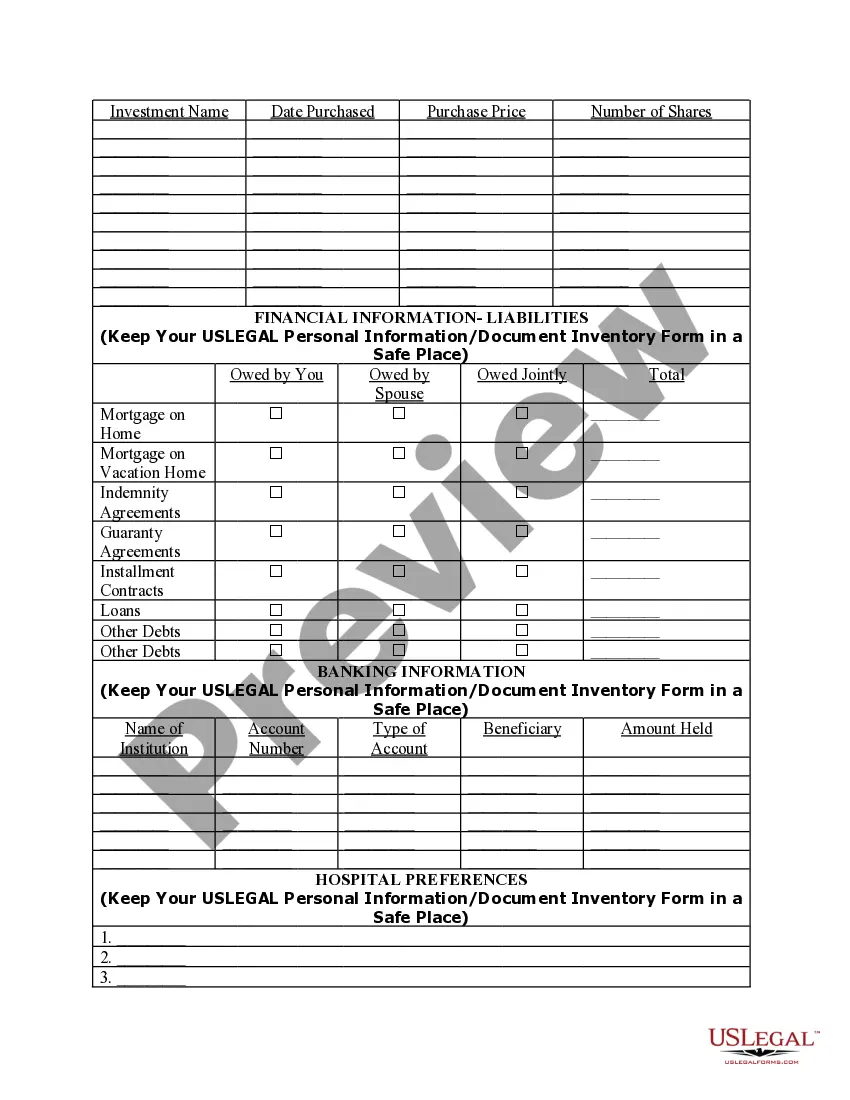

Hawaii Personal Planning Information and Document Inventory Worksheets - A Legal Life Document

Description

How to fill out Personal Planning Information And Document Inventory Worksheets - A Legal Life Document?

Selecting the finest authentic document template can be a challenge.

Of course, there are a multitude of templates available online, but how do you identify the genuine type you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Preview button and examine the form description to confirm that it is right for you. If the form does not meet your needs, use the Search box to find the appropriate form. Once you are certain that the form is suitable, click the Buy now button to acquire the form. Choose the pricing plan you desire and input the necessary details. Create your account and complete the transaction using your PayPal account or Visa or MasterCard. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Hawaii Personal Planning Information and Document Inventory Worksheets - A Legal Life Document. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Use the service to obtain professionally crafted documents that comply with state regulations.

- The service offers numerous templates, such as the Hawaii Personal Planning Information and Document Inventory Worksheets - A Legal Life Document, which you can utilize for business and personal needs.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Acquire button to obtain the Hawaii Personal Planning Information and Document Inventory Worksheets - A Legal Life Document.

- Use your account to search through the legal forms you have previously purchased.

- Go to the My documents tab of your account and get another copy of the document you need.

Form popularity

FAQ

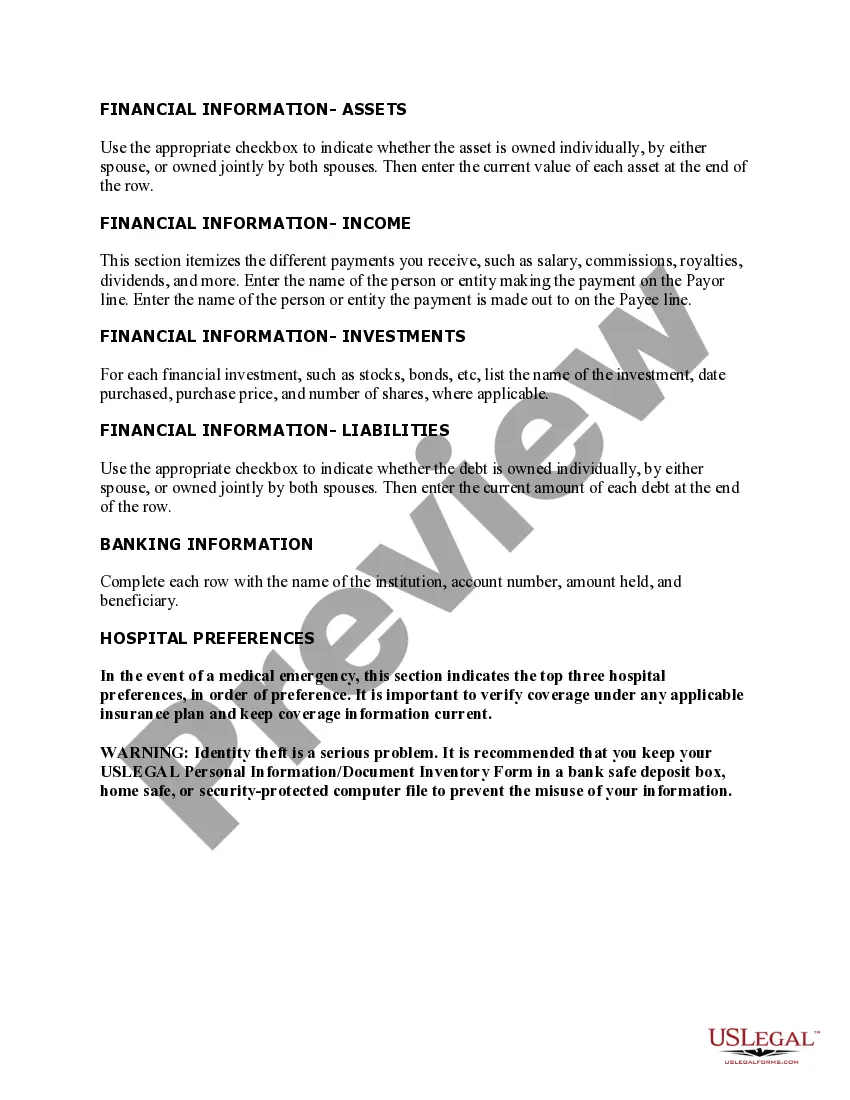

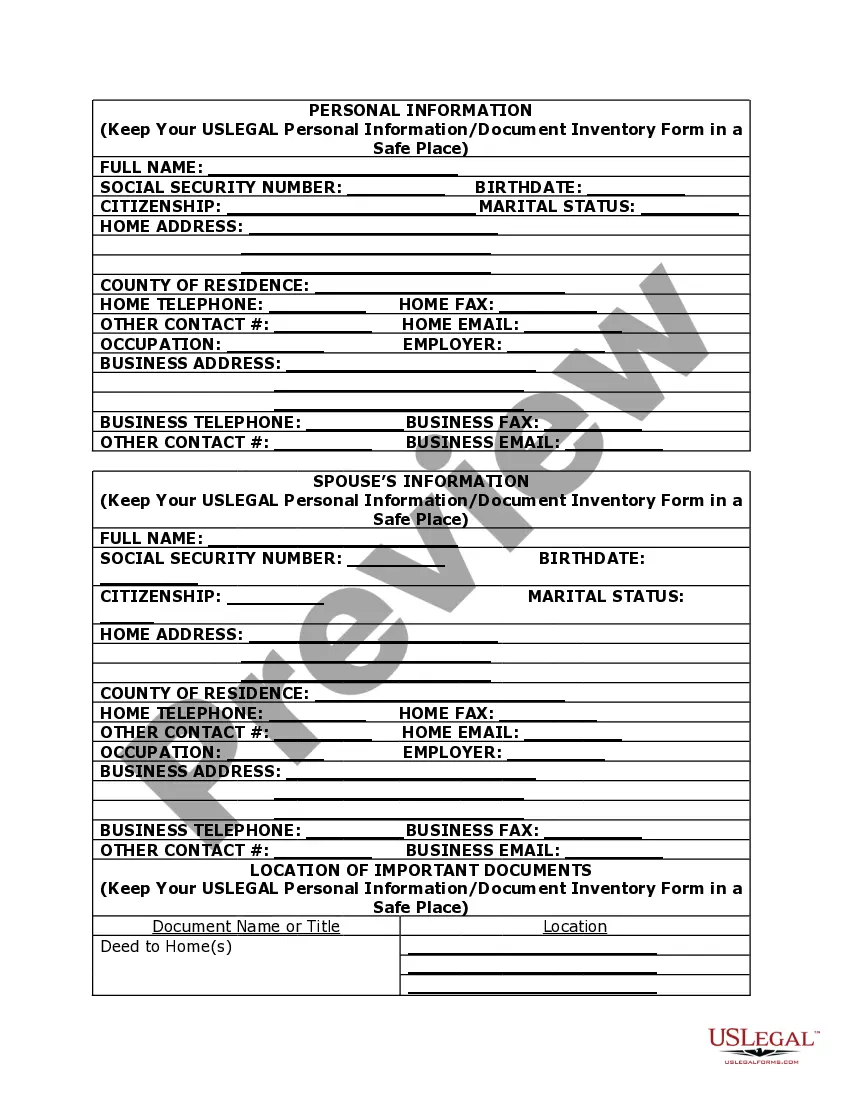

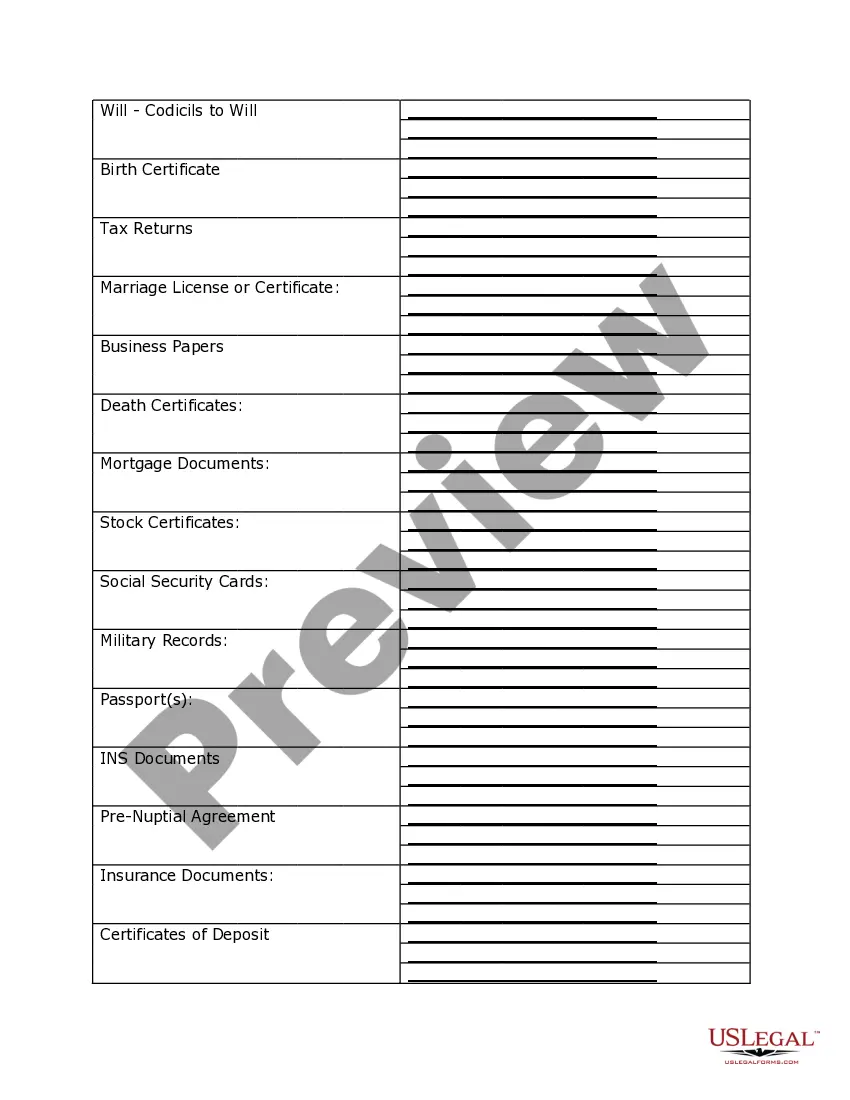

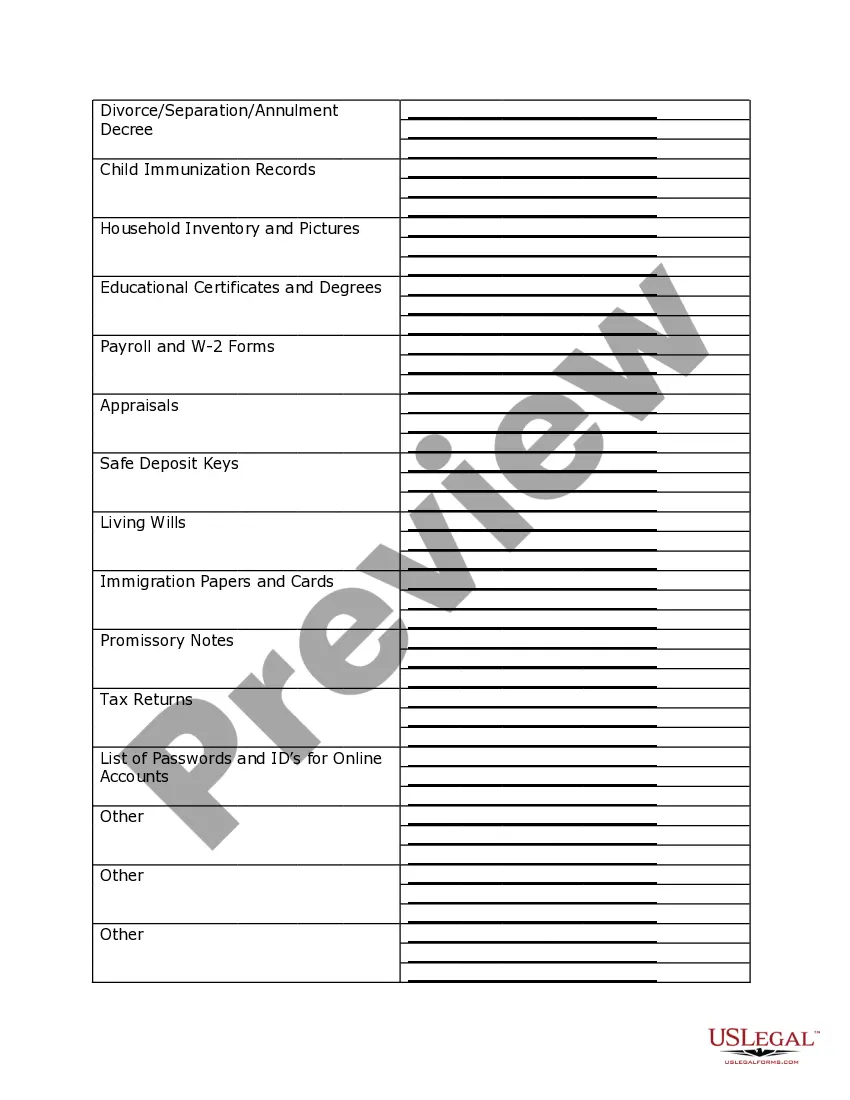

Filling out a personal financial statement form involves documenting your assets, liabilities, income, and expenses clearly and accurately. Start by listing all your financial information, including accounts, debts, and monthly expenses. It is important to provide comprehensive details to obtain an accurate picture of your finances. Utilizing the Hawaii Personal Planning Information and Document Inventory Worksheets - A Legal Life Document can make this task simpler and more organized.

You should mail your completed Hawaii form N-15 to the address indicated in the filing instructions, which varies based on whether you are expecting a refund or owe taxes. Confirm the latest mailing information on the Hawaii Department of Taxation’s website to ensure your form reaches its destination. Remember, proper documentation is crucial, which is why the Hawaii Personal Planning Information and Document Inventory Worksheets - A Legal Life Document is highly recommended.

To file an amended Hawaii tax return, you must use the appropriate amendment form corresponding to your original return. Carefully revise your initial submission to reflect any corrections or changes in your income or deductions. Ensure that you attach any required documents and resubmit it by the specified deadline. The Hawaii Personal Planning Information and Document Inventory Worksheets - A Legal Life Document can assist you in tracking these important revisions.

To file a Hawaii home exemption, you must complete the appropriate application form for your specific county. This application often requires documentation that proves your ownership and residence in the property. Submitting this form before the deadline is essential for reducing your property taxes. Using the Hawaii Personal Planning Information and Document Inventory Worksheets - A Legal Life Document can help streamline the process.

Individuals who earn income from Hawaii sources but do not reside in the state need to file a Hawaii nonresident return. This requirement applies to various professionals, businesses, and contractors. It's critical to meet these obligations to avoid penalties. Utilize the Hawaii Personal Planning Information and Document Inventory Worksheets - A Legal Life Document to keep track of your necessary filings.

The N11 form in Hawaii is used for nonresident individuals to report income from Hawaii sources and claim deductions. By filling out the N11, you ensure compliance with state tax regulations while potentially reducing your overall tax burden. This form works best when accompanied by the right documentation. For more information, refer to the Hawaii Personal Planning Information and Document Inventory Worksheets - A Legal Life Document for thorough guidance.

To file the Hawaii N-15, you need to gather your income documents and complete the form accurately. This form is designated for nonresidents, allowing them to report income earned in Hawaii. After completing the N-15, be sure to submit it to the appropriate address, as outlined in the instructions. For more assistance, consider using the Hawaii Personal Planning Information and Document Inventory Worksheets - A Legal Life Document to organize your financial details.