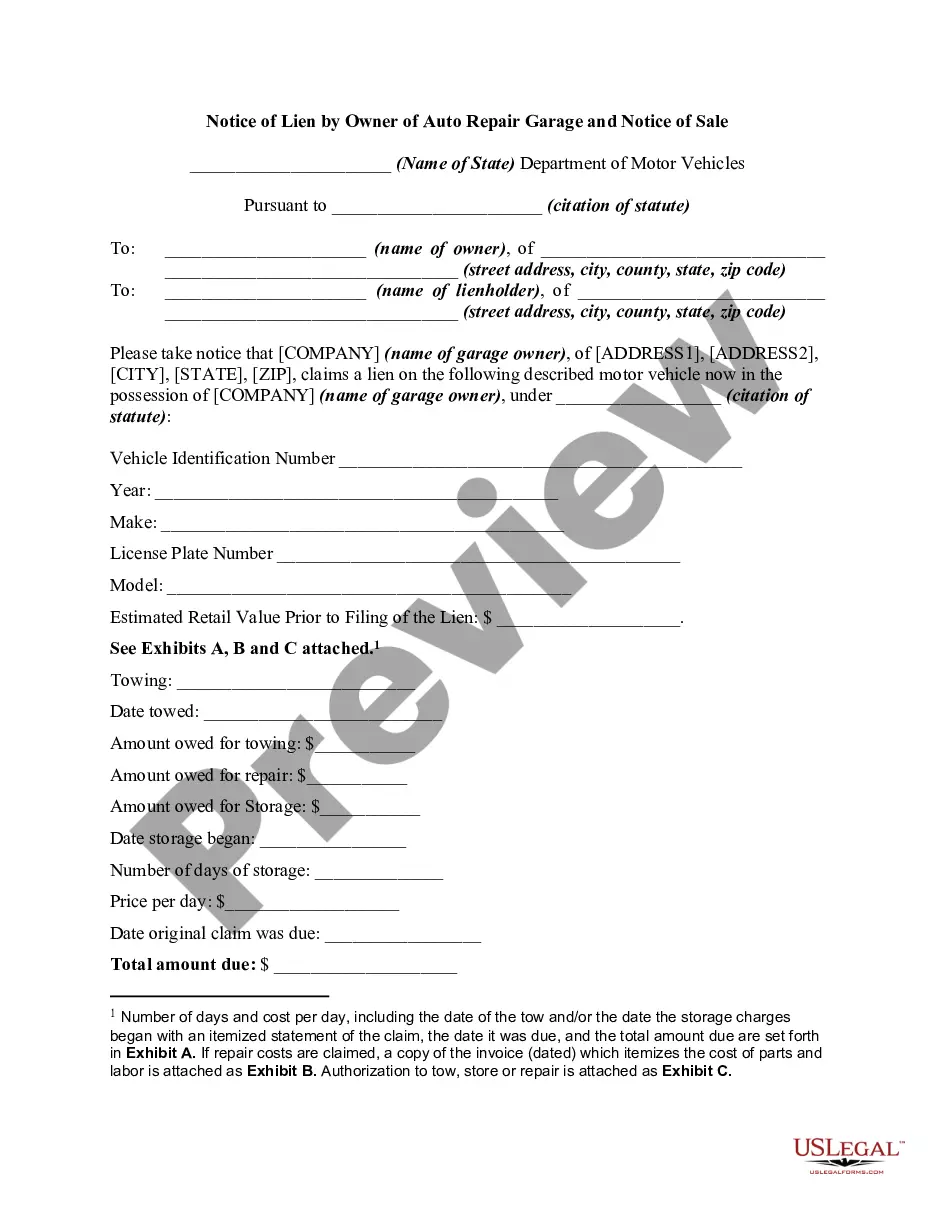

A common-law lien is the right of one person to retain in his possession property that belongs to another until a debt or claim secured by that property is satisfied. It pertains exclusively to personal property. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hawaii Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien

Description

How to fill out Notice Of Lien And Of Sale Of Personal Property Pursuant To Non-Statutory Lien?

You may spend time online searching for the legal papers design that suits the state and federal needs you will need. US Legal Forms provides a huge number of legal kinds that happen to be examined by specialists. You can actually down load or produce the Hawaii Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien from our assistance.

If you currently have a US Legal Forms accounts, you can log in and click on the Obtain button. Following that, you can full, edit, produce, or indication the Hawaii Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien. Every legal papers design you get is the one you have eternally. To have one more copy of the obtained kind, go to the My Forms tab and click on the related button.

If you use the US Legal Forms website for the first time, keep to the easy directions under:

- Initial, ensure that you have selected the right papers design for the area/area that you pick. Read the kind explanation to make sure you have selected the right kind. If offered, utilize the Preview button to look from the papers design also.

- In order to discover one more version of the kind, utilize the Lookup discipline to get the design that suits you and needs.

- Upon having discovered the design you desire, click on Get now to proceed.

- Pick the prices prepare you desire, key in your qualifications, and register for a merchant account on US Legal Forms.

- Total the deal. You should use your charge card or PayPal accounts to fund the legal kind.

- Pick the file format of the papers and down load it for your system.

- Make modifications for your papers if required. You may full, edit and indication and produce Hawaii Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien.

Obtain and produce a huge number of papers themes making use of the US Legal Forms website, that offers the most important collection of legal kinds. Use skilled and express-specific themes to tackle your business or personal requires.

Form popularity

FAQ

After demand and refusal of the amount due or upon neglect to pay same upon demand, the lien may be enforced by action filed in the circuit court of the circuit in which the property is situated.

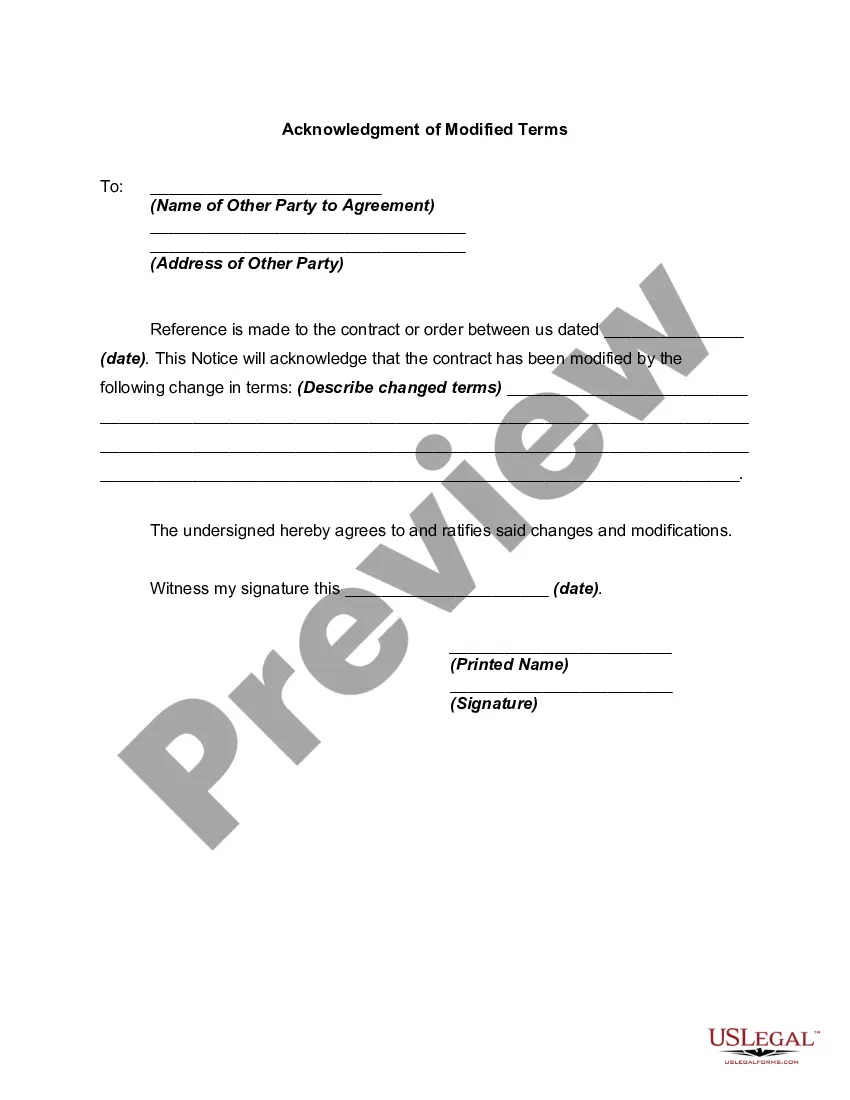

A lien that is not tied to a specific piece of real estate is called a...? General lien.

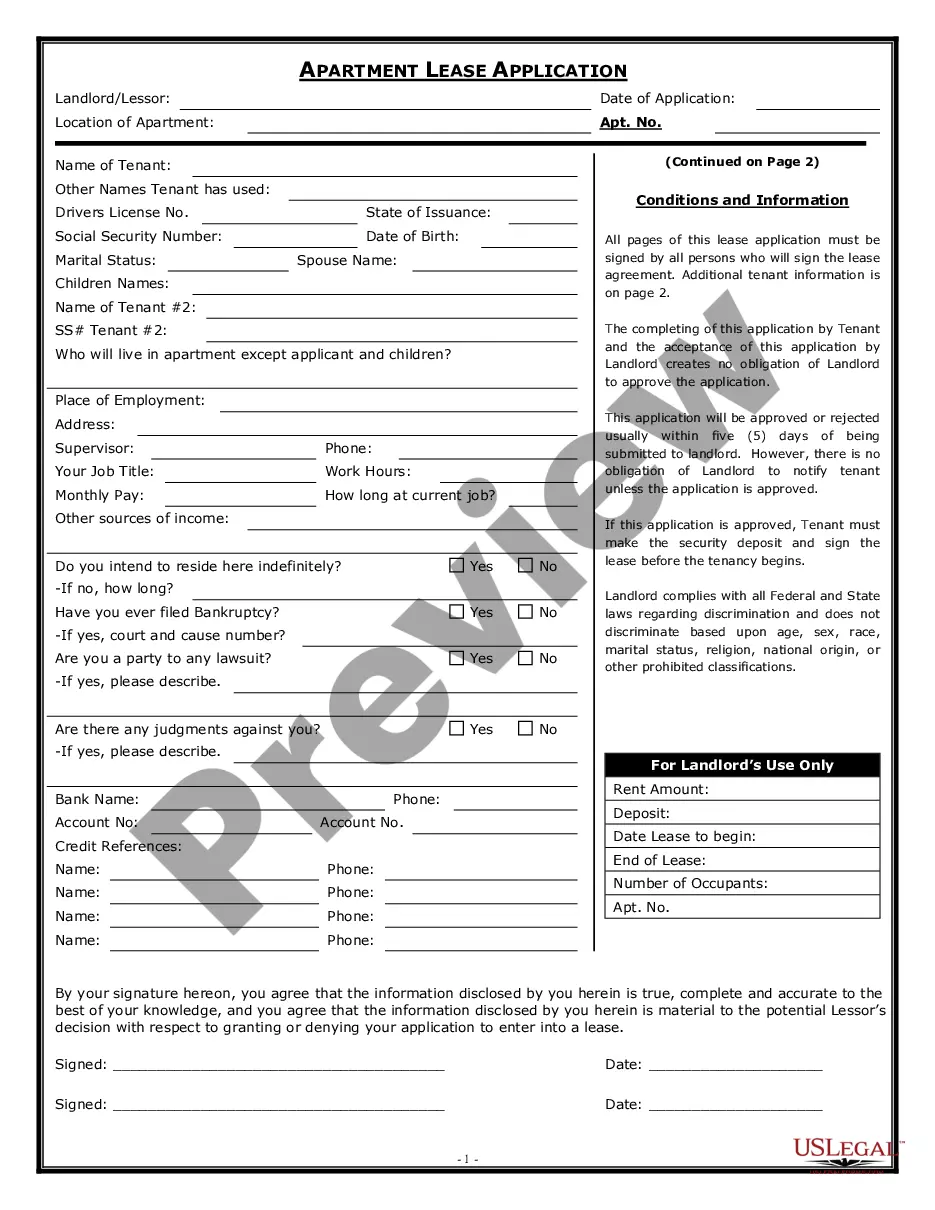

Contact the filing entity directly for detailed information regarding the lien. (For example, contact the Internal Revenue Service and/or Hawaii Department of Taxation for unpaid tax liens.)

Involuntary Lien: A lien imposed against property without consent of the owner. Taxes, special assessments, federal income tax liens, and State tax liens are examples of involuntary liens.

An attachment lien is an involuntary lien placed against the property to prevent the owner from selling the property during an ongoing legal matter. Attachment liens can be used to prevent an owner from selling during a divorce or bankruptcy proceeding, for example.

General lien: Lien attaches to all of debtor's real or personal property. Example: judgment lien. Specific lien: Lien attaches only to a specific piece of real property. Example: mortgage.

General Lien ? A claim against some or all of a debtor's property; any property may be sold to satisfy the debt. Specific Lien ? A claim against a specific piece of property; only that individual property may be used to collect against the debt.

Any unpaid state tax, penalty, and interest constitute a lien upon all of the delinquent taxpayer's property and rights to property. A lien may be foreclosed in a court proceeding or by seizure and sale of property. See ¶89-174 and ¶89-176.