Agreements among family members for the settlement of an intestate's estate will be upheld in the absence of fraud and when the rights of creditors are met. Intestate means that the decedent died without a valid will. The termination of any family controversy or the release of a reasonable, bona fide claim in an intestate estate have been held to be sufficient consideration for a family settlement.

Hawaii Agreement Between Heirs as to Division of Estate

Description

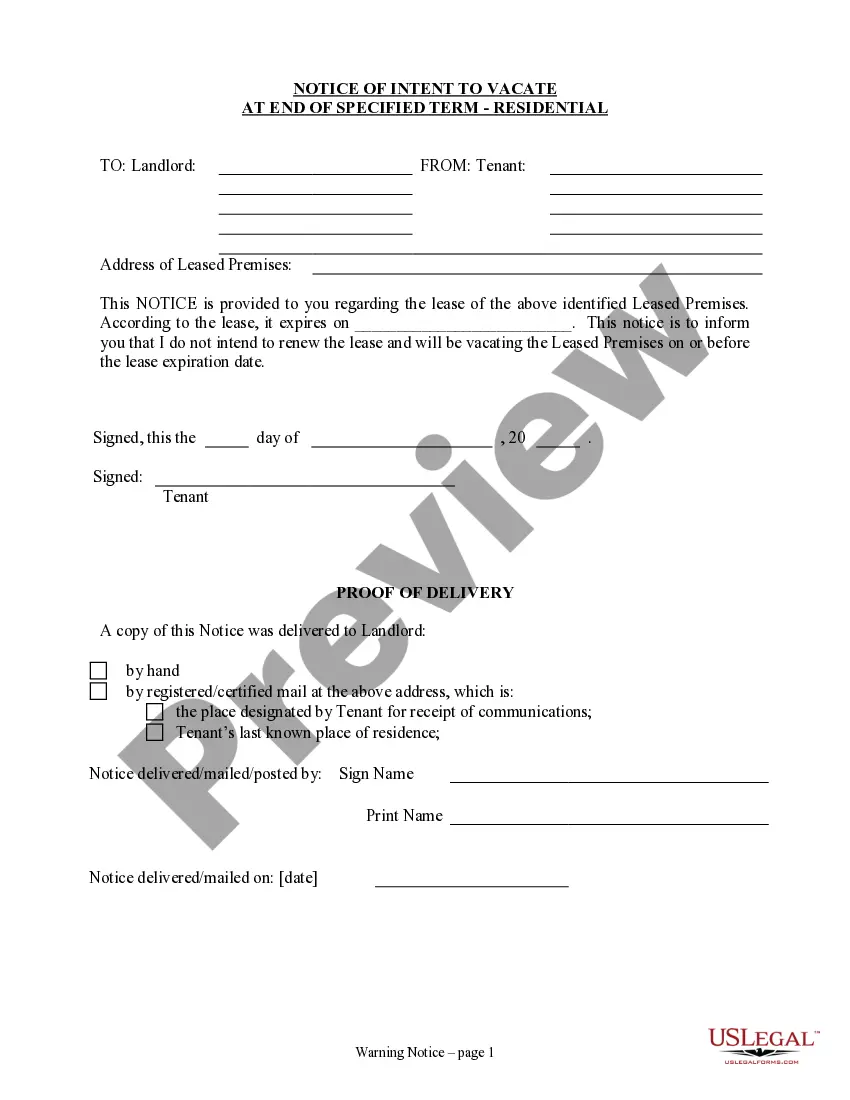

How to fill out Agreement Between Heirs As To Division Of Estate?

US Legal Forms - one of many biggest libraries of legal types in America - provides an array of legal papers web templates it is possible to down load or print. Making use of the internet site, you will get a large number of types for enterprise and individual functions, sorted by types, says, or keywords.You will discover the newest variations of types like the Hawaii Agreement Between Heirs as to Division of Estate in seconds.

If you currently have a monthly subscription, log in and down load Hawaii Agreement Between Heirs as to Division of Estate from your US Legal Forms collection. The Obtain button will show up on every develop you perspective. You have accessibility to all in the past downloaded types from the My Forms tab of the accounts.

If you wish to use US Legal Forms the first time, listed here are basic instructions to help you get began:

- Be sure to have selected the proper develop for the metropolis/state. Go through the Review button to check the form`s information. See the develop information to actually have chosen the proper develop.

- In the event the develop does not fit your needs, use the Look for field on top of the monitor to discover the one who does.

- If you are content with the form, affirm your choice by simply clicking the Buy now button. Then, select the costs strategy you like and offer your accreditations to register to have an accounts.

- Method the financial transaction. Make use of charge card or PayPal accounts to accomplish the financial transaction.

- Find the format and down load the form on your product.

- Make adjustments. Complete, modify and print and signal the downloaded Hawaii Agreement Between Heirs as to Division of Estate.

Every format you put into your bank account lacks an expiration particular date and is the one you have permanently. So, if you wish to down load or print an additional backup, just proceed to the My Forms section and click about the develop you require.

Get access to the Hawaii Agreement Between Heirs as to Division of Estate with US Legal Forms, the most considerable collection of legal papers web templates. Use a large number of expert and express-distinct web templates that satisfy your small business or individual needs and needs.

Form popularity

FAQ

If any party objects to the form of a proposed order, that person shall within 5 days serve upon the prevailing party and deliver to the court a statement of that party's objections and the reasons for failing to approve, if any, the form of the party's proposed order. Thereafter, the court shall settle the order.

A party may amend the party's pleading once as a matter of course at any time before a responsive pleading is served or, if the pleading is one to which no responsive pleading is permitted and the action has not been placed upon the trial calendar, the party may so amend it at any time within 20 days after it is served ...

17. Rule 17 - Withdrawal of Pleading (a) Procedure. A party may withdraw a petition or objection that has been scheduled for hearing by giving immediate notice of the withdrawal to the court and requesting that the hearing be stricken from the calendar.

Pursuant to §668 of Title 36 of the Hawaii Code, a co-owner may file a partition action with the circuit court in the county where the property is located. Both joint tenants and tenants in common have the right to pursue partition, which essentially terminates the co-owner relationship.

The petitioner shall serve notice on all known living heirs at law of the deceased and shall publish notice once a week for three consecutive weeks in a newspaper of general circulation in the circuit where the property is located, with the last date of publication no later than ten days prior to the date of the ...

Rule 20 of the Hawaii Probate Rules allows the probate court to assign a contested matter to the civil trial calendar in circuit court, where formal discovery can begin.

Probate in Hawaii is necessary when a person dies owning any real estate in his or her name alone, no matter how small the value of the real estate. Probate is also required when the total value of all ?personal property? owned in his or her name alone is worth more than $100,000.

The laws of intestate succession generally give your property to your heirs at law - your nearest family members. If you leave a spouse and children (or grandchildren), your property will usually be divided among them.