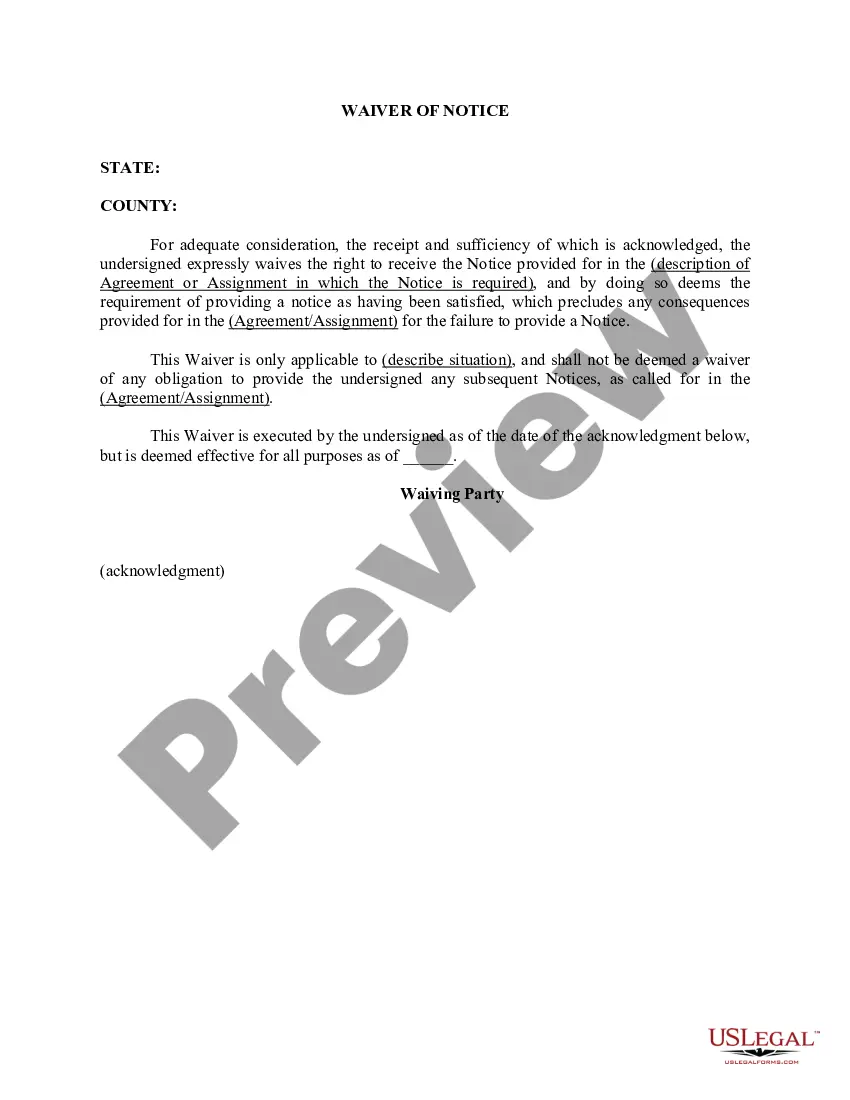

Generally, a debtor may demand a receipt for payment of an obligation. No particular form is necessary for a valid receipt. However, a receipt should recite all facts necessary to substantiate the tender and acceptance of payment.

Description: Hawaii Receipt for Payment of Salary or Wages is a document used to acknowledge the payment of salary or wages to an employee in the state of Hawaii. This receipt serves as proof that the employer has compensated the employee accurately and on time. Each Hawaii Receipt for Payment of Salary or Wages typically includes essential information, such as the employee's name, address, and social security number, along with the employer's details, including the company name, address, and Federal Employer Identification Number (VEIN). The date of payment and pay period covered are also stated in the receipt. Furthermore, this document lists the breakdown of the employee's earnings, including regular hourly rate or salary, overtime pay, bonuses, commissions, and any other types of compensation specified by the employment agreement or relevant labor laws. Each income component is itemized separately, enabling the employee to understand how their total payment is calculated. In addition to the income details, deductions such as taxes, social security contributions, healthcare premiums, retirement plan contributions, and any other authorized deductions are clearly mentioned. This transparency helps the employee understand the net amount they are receiving after deductions. There are various types of Hawaii Receipts for Payment of Salary or Wages, each catering to specific situations or arrangements. Some common types include: 1. Standard Payroll Receipt: This receipt is used for regular employees who receive a fixed salary or hourly wages. It encompasses all the necessary details mentioned above, providing a comprehensive overview of the employee's earnings and deductions. 2. Overtime Pay Receipt: When an employee is eligible for overtime compensation, this receipt is utilized to document the extra hours worked and the corresponding overtime pay. It includes a breakdown similar to the standard payroll receipt, specifically highlighting overtime hours, rate, and resulting payment. 3. Commission-based Pay Receipt: If an employee's compensation structure is primarily based on commission, this receipt focuses on tracking the sales or performance metrics that led to the commission payment. It outlines the specific commission rates, sales figures, and other applicable details. 4. Bonus or Incentive Receipt: When employees receive additional payments, such as performance bonuses or incentives, this receipt specifically outlines the nature of the payment and the criteria met to earn it. It ensures clarity regarding the bonus amount and any tax or deduction implications. Hawaii Receipt for Payment of Salary or Wages plays a crucial role in maintaining transparency and ensuring compliance with labor laws. It benefits both employers and employees by clearly documenting compensation details, facilitating accurate record-keeping, and resolving any disputes that may arise regarding salary or wage payments.