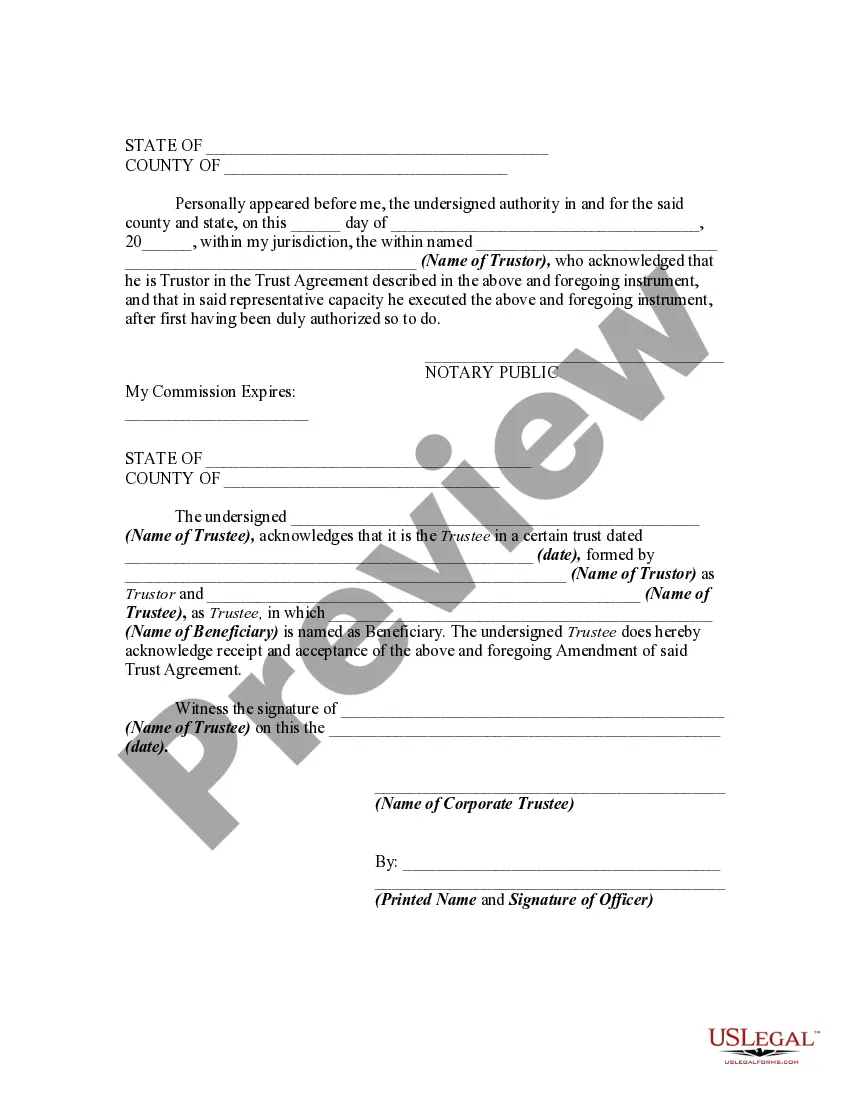

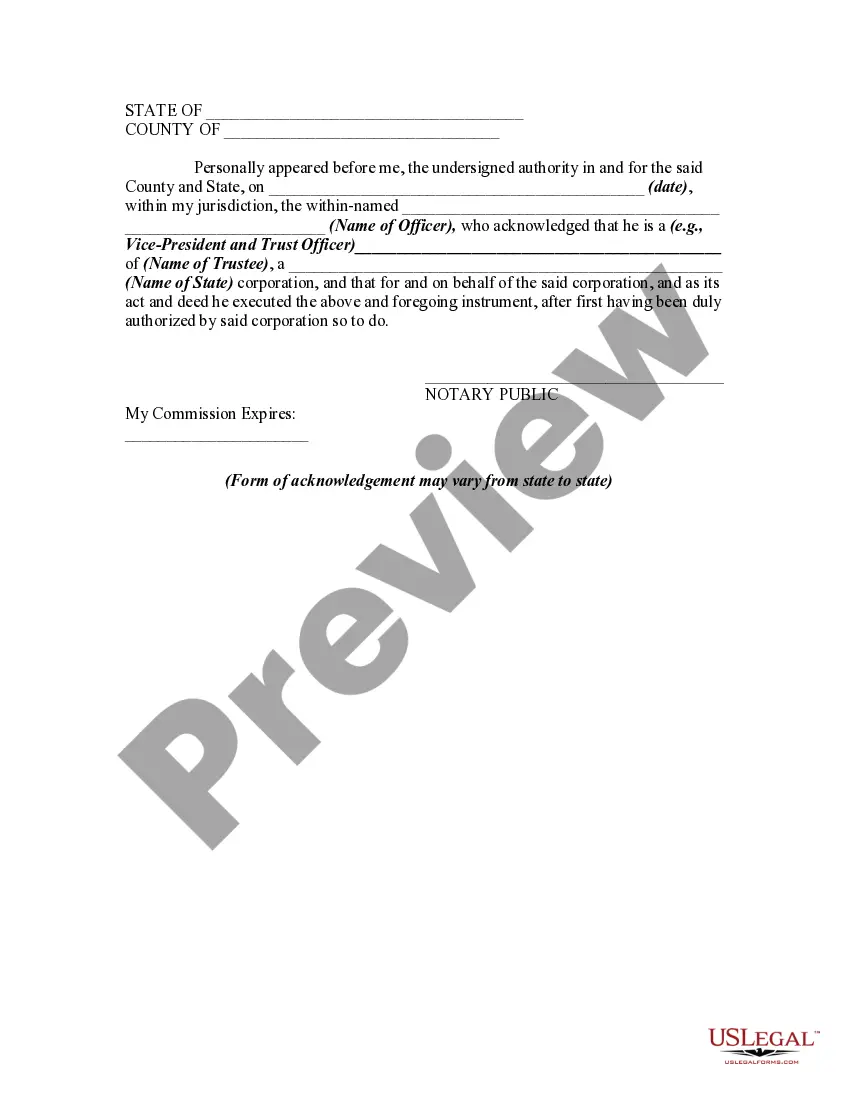

In this form, the trustor is amending the trust, pursuant to the power and authority he/she retained in the original trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Hawaii Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee is a legal document that allows for modifications to an existing trust. This amendment is specific to trusts that have been established in the state of Hawaii. The purpose of this amendment is to either cancel or add specific provisions or sections to the original Declaration of Trust. It is designed to ensure that the trust remains relevant and up-to-date with changing circumstances and the intentions of the trust settler. The amendment requires the consent of the trustee, who is the person or entity responsible for managing and administering the trust's assets. The consent of the trustee is necessary to make any changes to the trust document, ensuring that the trustee agrees to the modifications and is willing to carry out their duties accordingly. Key phrases: Hawaii Amendment of Declaration of Trust, Cancellation of Sections, Addition of Sections, Consent of Trustee, Trust Modification, Trust Amendment, Trustee's Consent, Trust Updating, Trust Management, Trust Administration. Additional types of Hawaii Amendments of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee may include: 1. Amendment to Change Beneficiary Designations: This type of amendment is used when changing the beneficiaries or altering their shares within the trust. 2. Amendment to Change Trustees: This amendment is utilized in situations where the settler wishes to modify the individuals or entities responsible for managing the trust's assets. 3. Amendment to Change Distribution Provisions: It involves altering the instructions regarding how assets are to be distributed to beneficiaries, potentially due to changes in circumstances or beneficiary needs. 4. Amendment to Change Trust Purpose: If the original trust purpose becomes obsolete or no longer serves the settler's intentions, this type of amendment is enacted to redefine the trust's objectives. 5. Amendment to Change Trust Powers: This amendment allows for modifications to the powers granted to the trustee, such as authority to invest in specific assets or make strategic decisions. These different types of amendments ensure flexibility and adaptability in the management of the trust, allowing it to align with the settler's wishes as circumstances change over time.The Hawaii Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee is a legal document that allows for modifications to an existing trust. This amendment is specific to trusts that have been established in the state of Hawaii. The purpose of this amendment is to either cancel or add specific provisions or sections to the original Declaration of Trust. It is designed to ensure that the trust remains relevant and up-to-date with changing circumstances and the intentions of the trust settler. The amendment requires the consent of the trustee, who is the person or entity responsible for managing and administering the trust's assets. The consent of the trustee is necessary to make any changes to the trust document, ensuring that the trustee agrees to the modifications and is willing to carry out their duties accordingly. Key phrases: Hawaii Amendment of Declaration of Trust, Cancellation of Sections, Addition of Sections, Consent of Trustee, Trust Modification, Trust Amendment, Trustee's Consent, Trust Updating, Trust Management, Trust Administration. Additional types of Hawaii Amendments of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee may include: 1. Amendment to Change Beneficiary Designations: This type of amendment is used when changing the beneficiaries or altering their shares within the trust. 2. Amendment to Change Trustees: This amendment is utilized in situations where the settler wishes to modify the individuals or entities responsible for managing the trust's assets. 3. Amendment to Change Distribution Provisions: It involves altering the instructions regarding how assets are to be distributed to beneficiaries, potentially due to changes in circumstances or beneficiary needs. 4. Amendment to Change Trust Purpose: If the original trust purpose becomes obsolete or no longer serves the settler's intentions, this type of amendment is enacted to redefine the trust's objectives. 5. Amendment to Change Trust Powers: This amendment allows for modifications to the powers granted to the trustee, such as authority to invest in specific assets or make strategic decisions. These different types of amendments ensure flexibility and adaptability in the management of the trust, allowing it to align with the settler's wishes as circumstances change over time.