The Hawaii Bill of Transfer to a Trust, also known as the Hawaii Trust Deed or Hawaii Trust Transfer Deed, is a legal document used to transfer real estate property into a trust. This document allows individuals in Hawaii to establish and fund a trust by transferring ownership of their property to the trust. By utilizing a Bill of Transfer to a Trust, individuals can effectively avoid probate, ensure privacy, and control the distribution of their property upon their death or incapacity. This document creates a legally binding transfer of property rights from the granter (property owner) to the trustee (the person in charge of managing the trust). There are several types of Hawaii Bill of Transfer to a Trust that individuals can consider, depending on their specific needs: 1. Revocable Living Trust: This is the most common type of trust used in Hawaii. It allows the granter to maintain control over the trust assets during their lifetime while also providing for the seamless transfer of the property to the beneficiaries upon the granter's death. The revocable nature of this trust allows for modifications or complete revocation by the granter if desired. 2. Irrevocable Trust: This type of trust cannot be altered or revoked once established, providing more asset protection and potential tax benefits. The granter transfers ownership of the property permanently to the trust, effectively removing it from their estate. This type of trust is often utilized for estate planning purposes. 3. Testamentary Trust: Rather than being established during the lifetime of the granter, a testamentary trust is created through the granter's will. Upon the granter's death, the property is transferred into the trust and managed by the appointed trustee according to the granter's instructions. 4. Special Needs Trust: This trust is designed to provide for the financial needs of individuals with disabilities without disqualifying them from various government benefits. It allows the granter to set aside funds to supplement the beneficiary's needs while ensuring their eligibility for programs such as Medicaid. 5. Charitable Trust: The purpose of this trust is to benefit charitable organizations or causes. The granter can transfer their property to the trust, and the trustee is responsible for managing the assets and distributing income to the designated charities. When considering a Hawaii Bill of Transfer to a Trust, it is crucial to seek the guidance of a qualified attorney or estate planner to ensure the document properly reflects the granter's intentions and adheres to applicable laws and regulations in Hawaii.

Hawaii Bill of Transfer to a Trust

Description

How to fill out Hawaii Bill Of Transfer To A Trust?

Finding the appropriate legal document template can be challenging.

Of course, there are numerous designs available online, but how can you obtain the legal form you need.

Use the US Legal Forms website. The service offers a vast array of templates, including the Hawaii Bill of Transfer to a Trust, which can be utilized for both business and personal requirements.

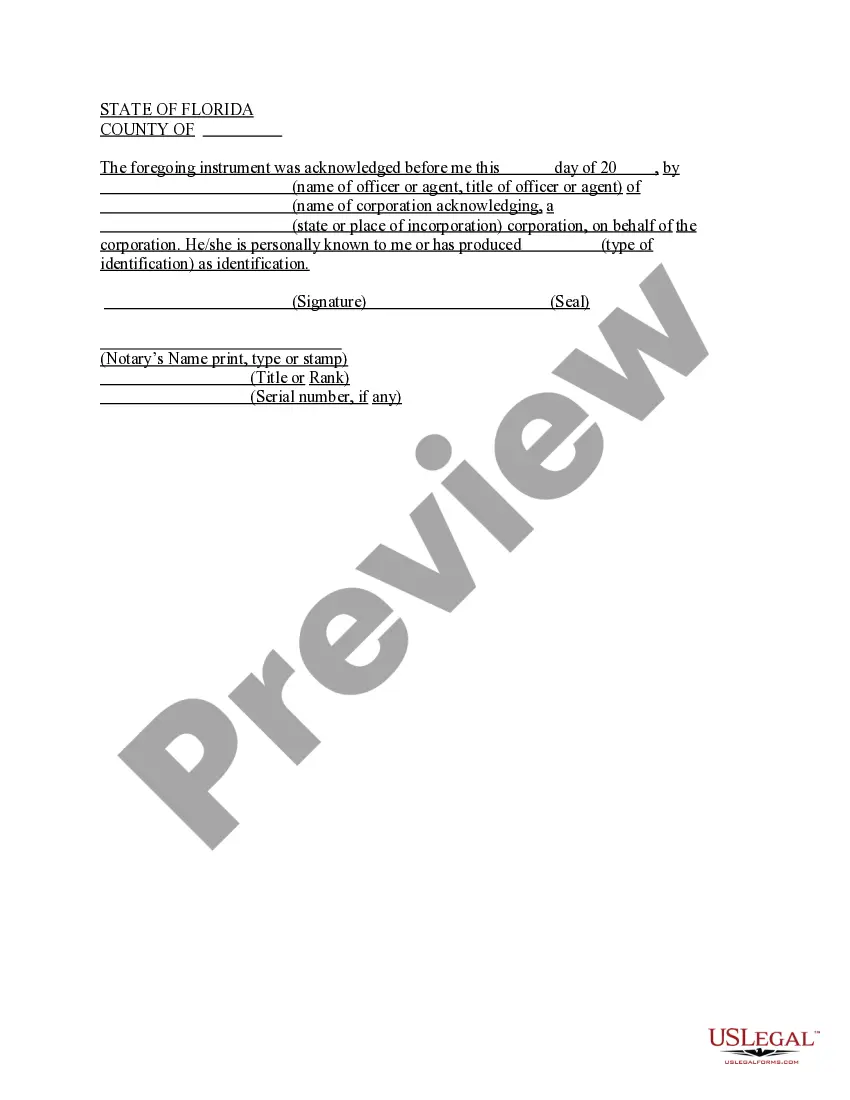

You can view the form using the Preview button and read the form description to confirm it is the right one for you.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, sign in to your account and then click the Download button to access the Hawaii Bill of Transfer to a Trust.

- Use your account to search for the legal forms you have purchased previously.

- Go to the My documents section of your account to obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

- First, ensure you have selected the correct document for your locality.

Form popularity

FAQ

Choosing between transfer on death and establishing a trust often depends on your financial goals and needs. The Hawaii Bill of Transfer to a Trust offers flexibility in estate planning, potentially avoiding probate and streamlining asset distribution. A trust may provide more control over asset management than a simple transfer on death. Engaging with resources like US Legal Forms can help you make the best choice tailored to your unique situation.

To transfer assets between trusts, you typically need to initiate a formal process outlined in the trust agreement. The Hawaii Bill of Transfer to a Trust can serve as a vital document in this transition, documenting the assets being moved. Make sure the terms of both trusts allow such transfers and seek guidance if necessary. Platforms like US Legal Forms can provide the necessary templates to facilitate this transfer smoothly.

Transferring assets from a trust can have tax implications, but it often depends on individual circumstances. Generally, the Hawaii Bill of Transfer to a Trust can help clarify whether a specific transfer triggers taxes. It’s essential to consult with a tax professional to understand your situation fully. Utilizing forms from a reliable service like US Legal Forms can ensure you're compliant with tax laws during this process.

Whether your parents should put their assets in a trust depends on their financial situation and goals. Trusts can offer benefits such as avoiding probate and protecting assets from creditors, but they also require careful consideration. The Hawaii Bill of Transfer to a Trust can guide them through the process, ensuring their wishes are followed effectively.

A potential downfall of having a trust is the complexity it adds to estate planning and the possible requirement for ongoing management. This complexity could lead to higher costs if professional help is needed. However, using the Hawaii Bill of Transfer to a Trust can provide clarity in administration and peace of mind for your family.

To transfer assets into a trust, you first identify the assets you wish to include. Then, you execute the appropriate documents, such as the Hawaii Bill of Transfer to a Trust, to formally transfer ownership. It's advisable to consult with a legal expert to ensure all steps are accurately completed.

The bill of transfer for a trust is a legal document that facilitates the transfer of assets into the trust. It ensures that the trust's terms are followed and that the assets are managed according to the grantor's wishes. Understanding the details of the Hawaii Bill of Transfer to a Trust is essential to ensure a smooth transition.

To transfer ownership of a property in Hawaii, you’ll need to prepare and file a deed with the Bureau of Conveyances. This involves completing the necessary documents and ensuring they meet state requirements. Utilizing the Hawaii Bill of Transfer to a Trust can streamline this process if you're placing property into a trust.

The risks of a trust fund include potential mismanagement by the trustee, who may not act in the beneficiaries' best interests. Additionally, if you do not clearly define the terms, beneficiaries can face legal challenges. It's important to use a reliable process, like the Hawaii Bill of Transfer to a Trust, to ensure clarity and proper administration.

The prerequisites for a trust include having a settlor who creates the trust, a clear purpose for the trust, and a trustee to manage it. You’ll also need identifiable assets that can be included, which is where a Hawaii Bill of Transfer to a Trust can be beneficial. Drafting a comprehensive trust document ensures all elements are covered. Seeking assistance from professionals ensures all prerequisites are met seamlessly.

Interesting Questions

More info

Business Plan Inheritance transfer trust Inheritance transfer trust and its methods are the most reliable transfer trust methods by having a long term beneficiary and by allowing you to easily transfer assets to the person or persons you desire. The methods of inheritance transfer trust depend on the type of trust the owner of the trust. 1. Inheritance transfer trust: To inherit assets, the transfer of ownership of the property can be conducted from one individual to another. The transfer may be legal or illegal. To transfer assets from one individual to another, a legal transfer is necessary. This type of transfer trust can be useful to the deceased individual when he or she will be able to receive inheritance proceeds from the transfer. Most often, a family member or other person of legal authority will handle this task.