This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

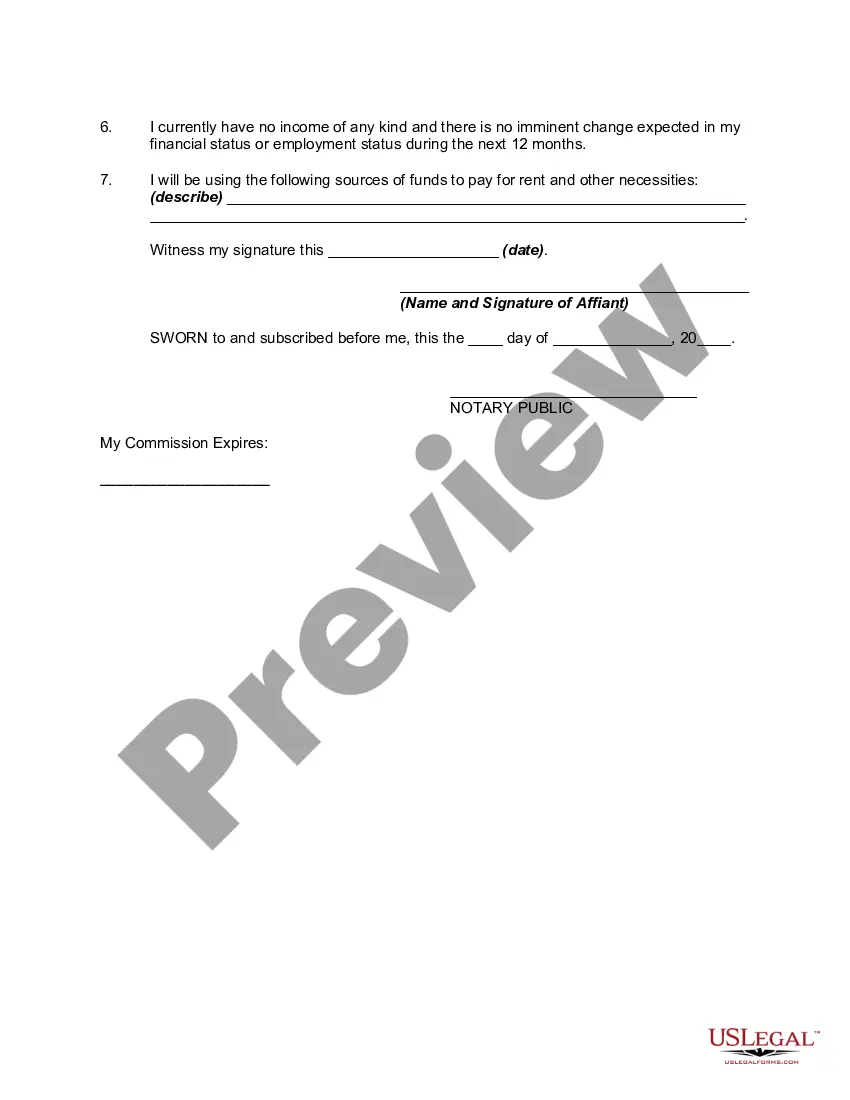

Title: Understanding Hawaii Affidavit or Proof of No Income Unemployedye— - Assets and Liabilities Keywords: Hawaii Affidavit, Proof of No Income, unemployed, assets, liabilities, income statement, financial declaration, income verification Introduction: The Hawaii Affidavit or Proof of No Income Unemployedye— - Assets and Liabilities is a legal document required by the state of Hawaii to verify an individual's financial situation when they have no income and limited assets. It serves as a declaration of one's financial status and is often used in various legal and administrative processes. In this article, we will delve into the details of this affidavit, its importance, and any different types it may have. 1. Purpose and Importance of Hawaii Affidavit or Proof of No Income: The primary function of the Hawaii Affidavit or Proof of No Income Unemployedye— - Assets and Liabilities is to provide an accurate and comprehensive picture of an individual's current financial status. It helps the state government, courts, or other relevant entities determine eligibility for benefits, exemptions, or financial assistance programs. Additionally, this affidavit prevents improper use of resources by authenticating an individual's inability to generate income at a given time. 2. Components of Hawaii Affidavit or Proof of No Income: While the exact format may vary, a typical Hawaii Affidavit or Proof of No Income Unemployedye— - Assets and Liabilities may include the following components: a. Personal Information: The affidavit begins with personal details such as name, address, contact information, and relevant identification numbers. b. Declaration of No Income: The individual explicitly states that they currently have no source of income, including employment, business earnings, or government benefits. c. Assets and Liabilities: It requires the individual to disclose their assets, such as real estate, vehicles, savings, investments, and liabilities such as loans, debts, or outstanding payments. d. Declarations Under Oath: The affidavit concludes with a section where the individual swears or affirms, under penalty of perjury, that the information provided is true and accurate to the best of their knowledge. 3. Different Types of Hawaii Affidavit or Proof of No Income: While there are no distinct types of this affidavit, it may be adapted or requested differently depending on the purpose or institution requiring it. a. Affidavit for Government Assistance: Individuals seeking government assistance, such as welfare benefits or healthcare subsidies, may be required to provide this affidavit as part of their application process. b. Affidavit for Legal Proceedings: In legal cases involving financial disputes or support obligations, such as child support or spousal support, individuals may need to submit this affidavit to demonstrate their current financial situation and lack of income. c. Financial Declaration for Bankruptcy: Those filing for bankruptcy in Hawaii might need to provide a similar document, referred to as a financial declaration or income statement, to disclose their income, assets, and liabilities to the bankruptcy court. Conclusion: The Hawaii Affidavit or Proof of No Income Unemployedye— - Assets and Liabilities acts as a vital document for individuals with no income and limited assets in the state of Hawaii. By providing accurate and verified financial information, it helps individuals secure necessary assistance or exemptions while preventing the misuse of resources. Understanding the purpose and components of this affidavit is crucial when navigating legal, administrative, or financial matters requiring proof of one's financial status.Title: Understanding Hawaii Affidavit or Proof of No Income Unemployedye— - Assets and Liabilities Keywords: Hawaii Affidavit, Proof of No Income, unemployed, assets, liabilities, income statement, financial declaration, income verification Introduction: The Hawaii Affidavit or Proof of No Income Unemployedye— - Assets and Liabilities is a legal document required by the state of Hawaii to verify an individual's financial situation when they have no income and limited assets. It serves as a declaration of one's financial status and is often used in various legal and administrative processes. In this article, we will delve into the details of this affidavit, its importance, and any different types it may have. 1. Purpose and Importance of Hawaii Affidavit or Proof of No Income: The primary function of the Hawaii Affidavit or Proof of No Income Unemployedye— - Assets and Liabilities is to provide an accurate and comprehensive picture of an individual's current financial status. It helps the state government, courts, or other relevant entities determine eligibility for benefits, exemptions, or financial assistance programs. Additionally, this affidavit prevents improper use of resources by authenticating an individual's inability to generate income at a given time. 2. Components of Hawaii Affidavit or Proof of No Income: While the exact format may vary, a typical Hawaii Affidavit or Proof of No Income Unemployedye— - Assets and Liabilities may include the following components: a. Personal Information: The affidavit begins with personal details such as name, address, contact information, and relevant identification numbers. b. Declaration of No Income: The individual explicitly states that they currently have no source of income, including employment, business earnings, or government benefits. c. Assets and Liabilities: It requires the individual to disclose their assets, such as real estate, vehicles, savings, investments, and liabilities such as loans, debts, or outstanding payments. d. Declarations Under Oath: The affidavit concludes with a section where the individual swears or affirms, under penalty of perjury, that the information provided is true and accurate to the best of their knowledge. 3. Different Types of Hawaii Affidavit or Proof of No Income: While there are no distinct types of this affidavit, it may be adapted or requested differently depending on the purpose or institution requiring it. a. Affidavit for Government Assistance: Individuals seeking government assistance, such as welfare benefits or healthcare subsidies, may be required to provide this affidavit as part of their application process. b. Affidavit for Legal Proceedings: In legal cases involving financial disputes or support obligations, such as child support or spousal support, individuals may need to submit this affidavit to demonstrate their current financial situation and lack of income. c. Financial Declaration for Bankruptcy: Those filing for bankruptcy in Hawaii might need to provide a similar document, referred to as a financial declaration or income statement, to disclose their income, assets, and liabilities to the bankruptcy court. Conclusion: The Hawaii Affidavit or Proof of No Income Unemployedye— - Assets and Liabilities acts as a vital document for individuals with no income and limited assets in the state of Hawaii. By providing accurate and verified financial information, it helps individuals secure necessary assistance or exemptions while preventing the misuse of resources. Understanding the purpose and components of this affidavit is crucial when navigating legal, administrative, or financial matters requiring proof of one's financial status.