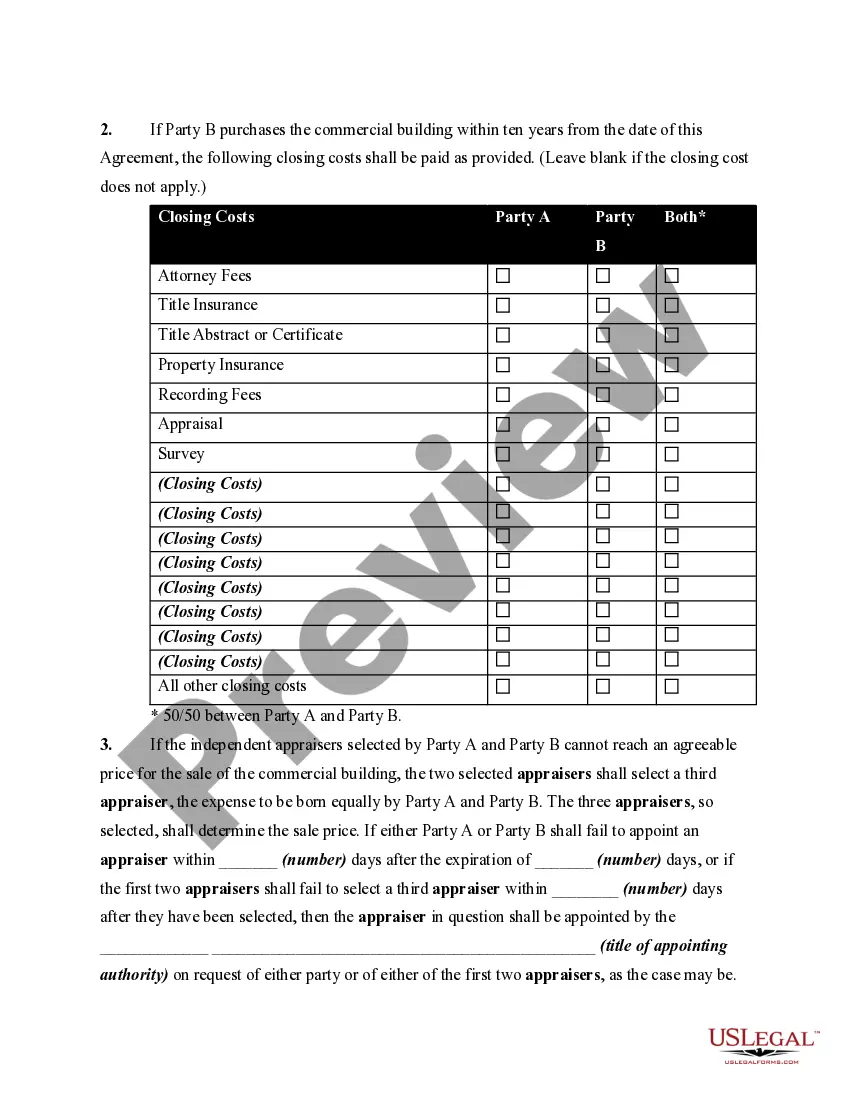

This Agreement between Partners for Future Sale of Commercial Building is used to provide for the future sale of a commercial building by giving one party the opportunity to purchase the commercial building any time in the next ten years from the date of this agreement, or by both parties agreeing to sell the commercial building outright to a third party and equally splitting the proceeds at the end of the ten-year period.

Hawaii Agreement between Partners for Future Sale of Commercial Building

Description

How to fill out Agreement Between Partners For Future Sale Of Commercial Building?

You can spend several hours on the web attempting to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

You can download or print the Hawaii Agreement between Partners for Future Sale of Commercial Building from your service.

Firstly, ensure that you have chosen the correct document template for the region/city of your choice. Review the form description to confirm you have selected the appropriate file. If available, use the Preview button to look over the document template as well.

- If you possess a US Legal Forms account, you can sign in and then click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Hawaii Agreement between Partners for Future Sale of Commercial Building.

- Every legal document template you acquire is yours forever.

- To obtain an additional copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

To create a simple partnership agreement, start by defining the partnership's purpose, duration, and contributions of each partner. The Hawaii Agreement between Partners for Future Sale of Commercial Building should clarify how decisions are made and outline the procedure for resolving disputes. Utilizing platforms like uslegalforms can simplify this process, ensuring that you cover all necessary details.

A simple business agreement should lay out the basic terms of the partnership, including partner names, business purpose, and financial obligations. When creating a Hawaii Agreement between Partners for Future Sale of Commercial Building, it’s important to include clear provisions for how the commercial building will be managed and sold. Keeping the language straightforward will help all parties understand their obligations.

To write a 50/50 partnership agreement, both partners should agree on their roles and contributions explicitly. The Hawaii Agreement between Partners for Future Sale of Commercial Building should include provisions for how profits, losses, and decision-making will be handled, ensuring that both parties have equal say in the partnership. Writing this agreement clearly can prevent future misunderstandings.

Splitting a business between partners requires open communication and an agreement that reflects both parties' contributions and expectations. In a Hawaii Agreement between Partners for Future Sale of Commercial Building, you should define how profits and liabilities are shared. It is prudent to consult legal advice to ensure fairness and compliance with applicable laws.

A Hawaii Agreement between Partners for Future Sale of Commercial Building should clearly outline the roles and responsibilities of each partner. It must specify the terms of the partnership, including profit sharing, decision-making processes, and exit strategies. Including a clause about the sale of the commercial building ensures all partners have a mutual understanding of future financial transactions.

To complete a partnership agreement, start by discussing terms openly with your partners, ensuring everyone is on the same page regarding the Hawaii Agreement between Partners for Future Sale of Commercial Building. You can draft the agreement by clearly stating the partnership name, contributions, and compensation for each partner. Once you finalize the details, it’s advisable to have all parties review and sign the agreement. Utilizing platforms like USLegalForms can provide templates and guidance to streamline this process, making it easier and more efficient.

A partnership agreement should outline the roles and responsibilities of each partner involved in the Hawaii Agreement between Partners for Future Sale of Commercial Building. Key elements to include are the partnership's purpose, terms of operation, distribution of profits, and procedures for resolving disputes. Additionally, it is important to specify how decisions will be made and what happens if a partner wants to exit the agreement. Clear communication within the agreement sets a strong foundation for a successful partnership.

In Hawaii, nonresident partners may face a withholding tax on their income distributed from the partnership. This tax rate typically stands at 7.25% on the distributive share of income. For partnerships engaged in a Hawaii Agreement between Partners for Future Sale of Commercial Building, understanding these withholding obligations is essential to maintain compliance and avoid penalties.

If a partnership does not have any gross income or necessary expenditures, it may not be required to file a tax return in Hawaii. However, if your partnership is part of a Hawaii Agreement between Partners for Future Sale of Commercial Building, you should consult with a tax advisor. Non-filing can lead to complications down the line, so always evaluate your situation thoroughly.

The contract for future sale is a legal agreement where parties commit to conduct a sale of goods or property at a designated time in the future. This contract plays a vital role in real estate and commercial transactions by providing clarity and security for both buyers and sellers. The Hawaii Agreement between Partners for Future Sale of Commercial Building is a pertinent example of this kind of arrangement.