Title: Understanding Hawaii UCC-1 for Personal Credit: A Comprehensive Overview Introduction: In Hawaii, UCC-1 refers to the Uniform Commercial Code-1 financing statement utilized to establish a creditor's security interest in personal property. This detailed description dives into the concept of Hawaii UCC-1 for personal credit, highlighting its purpose, requirements, filing process, and potential variations. Keywords: Hawaii, UCC-1, personal credit, financing statement, creditor, security interest, variations. 1. Purpose of Hawaii UCC-1 for Personal Credit: The main aim of the Hawaii UCC-1 for personal credit is to provide a systematic way for creditors to assert their legal rights over personal property belonging to a debtor. It establishes a means of notifying other parties about a creditor's financial claim, enabling lenders to enforce their rights and secure repayment. 2. Requirements for Filing Hawaii UCC-1: To establish a valid Hawaii UCC-1 for personal credit, certain requirements must be met: — Identification: The full legal names of both the debtor and the creditor must be provided. — Description of Collateral: A thorough description of the personal property being used as collateral must be included. — Signatures: Both the debtor and creditor must sign the UCC-1 form. — Filing Fee: Hawaii mandates a filing fee, which varies depending on the collateral's value or the number of pages in the filing. 3. Filing Process and Location: To file a Hawaii UCC-1 for personal credit, debtors and creditors must follow these steps: — Completion: Accurately fill out the UCC-1 form, ensuring it meets the state's requirements. — Filing: Submit the completed form to the Hawaii Department of Commerce and Consumer Affairs (CCA) for processing. — Public Record: Once filed, the UCC-1 is considered a public record accessible to interested parties through the CCA online database. 4. Common Variations of Hawaii UCC-1: While the UCC-1 form itself does not have specific variations, certain circumstances may require additional considerations, including: — Continuation Statements: Creditors must periodically file continuation statements to extend the UCC-1's effectiveness beyond its initial five-year term. — Amendments: Changes to the initial UCC-1 statement, such as modifications to the collateral description, require filing an amendment. — Terminations: Once a debt is repaid or the claim is no longer valid, a termination statement must be filed to remove the UCC-1 from public records. In conclusion, the Hawaii UCC-1 for personal credit acts as a fundamental instrument for creditors to protect their financial interests in personal property. By adhering to the required guidelines and following the filing process, lenders can establish a legally recognized security interest in the debtor's collateral, ensuring they have a right to repayment. Understanding the purpose, requirements, filing process, and potential variations related to Hawaii UCC-1 is crucial for both creditors and debtors alike. Keywords: Hawaii UCC-1, personal credit, financing statement, creditor, security interest, variations, filing process, collateral description, continuation statement, amendment, termination statement.

Hawaii UCC-1 for Personal Credit

Description

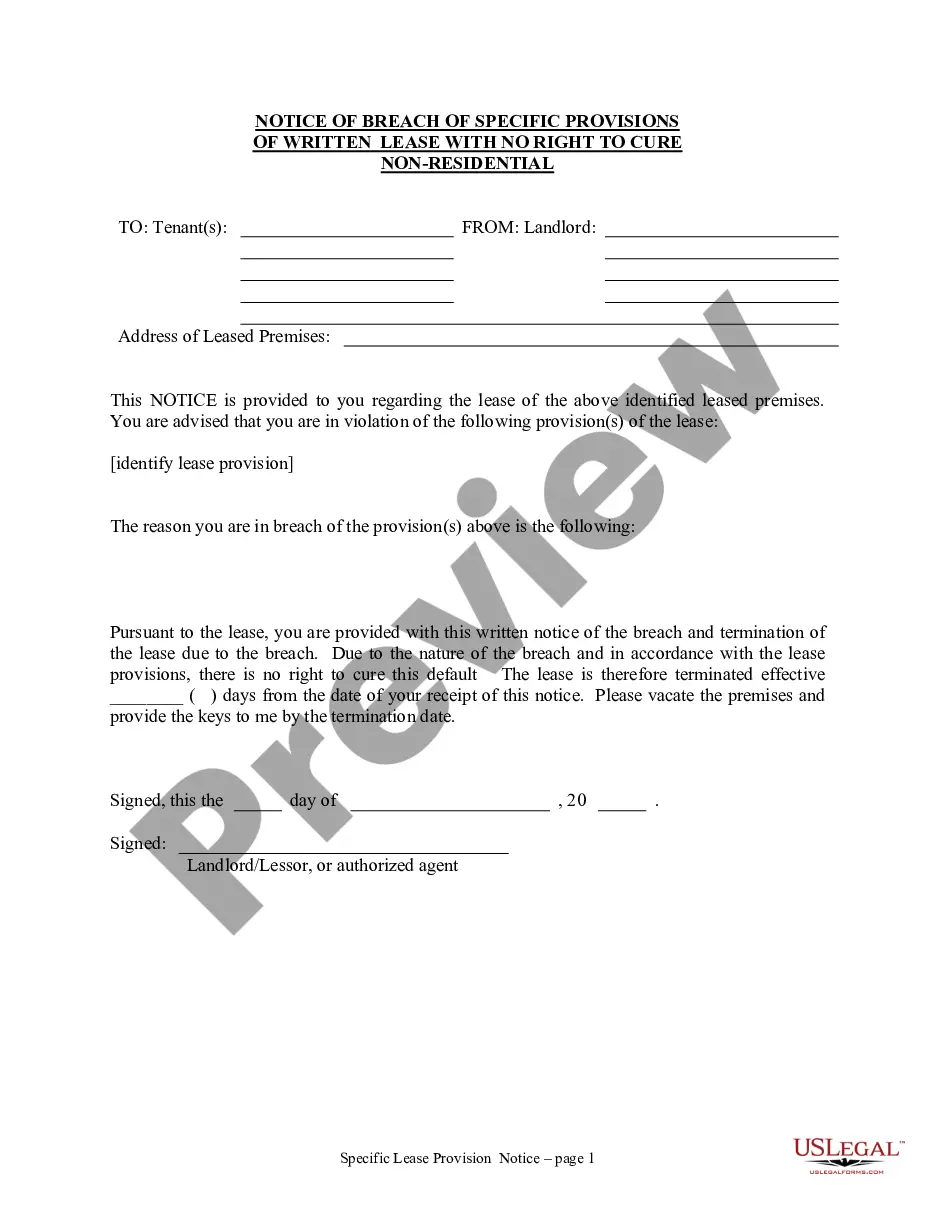

How to fill out Hawaii UCC-1 For Personal Credit?

If you have to comprehensive, obtain, or print out legal record web templates, use US Legal Forms, the biggest assortment of legal types, that can be found on the web. Use the site`s simple and easy practical lookup to discover the files you need. Various web templates for enterprise and personal uses are categorized by groups and states, or search phrases. Use US Legal Forms to discover the Hawaii UCC-1 for Personal Credit in just a few clicks.

Should you be already a US Legal Forms consumer, log in to the account and click on the Acquire switch to find the Hawaii UCC-1 for Personal Credit. You can also entry types you in the past delivered electronically in the My Forms tab of your own account.

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Make sure you have chosen the shape to the appropriate metropolis/region.

- Step 2. Take advantage of the Review choice to look through the form`s content material. Do not neglect to learn the description.

- Step 3. Should you be unsatisfied using the kind, utilize the Search field on top of the screen to find other versions of the legal kind web template.

- Step 4. Once you have located the shape you need, click the Buy now switch. Select the rates prepare you prefer and add your references to sign up to have an account.

- Step 5. Approach the purchase. You can use your bank card or PayPal account to perform the purchase.

- Step 6. Find the formatting of the legal kind and obtain it on the system.

- Step 7. Full, change and print out or signal the Hawaii UCC-1 for Personal Credit.

Each legal record web template you get is your own eternally. You may have acces to every single kind you delivered electronically within your acccount. Click the My Forms portion and pick a kind to print out or obtain once again.

Be competitive and obtain, and print out the Hawaii UCC-1 for Personal Credit with US Legal Forms. There are millions of professional and state-certain types you can utilize for your enterprise or personal demands.