Hawaii Triple Net Lease for Industrial Property

Description

How to fill out Triple Net Lease For Industrial Property?

Are you presently in a situation where you need documents for occasional business or personal reasons nearly every day.

There are numerous legal document templates accessible online, but finding reliable ones isn't easy.

US Legal Forms offers thousands of form templates, such as the Hawaii Triple Net Lease for Industrial Property, that are designed to comply with federal and state requirements.

If you find the appropriate form, click Get now.

Choose the pricing plan you prefer, provide the required information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Hawaii Triple Net Lease for Industrial Property template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/area.

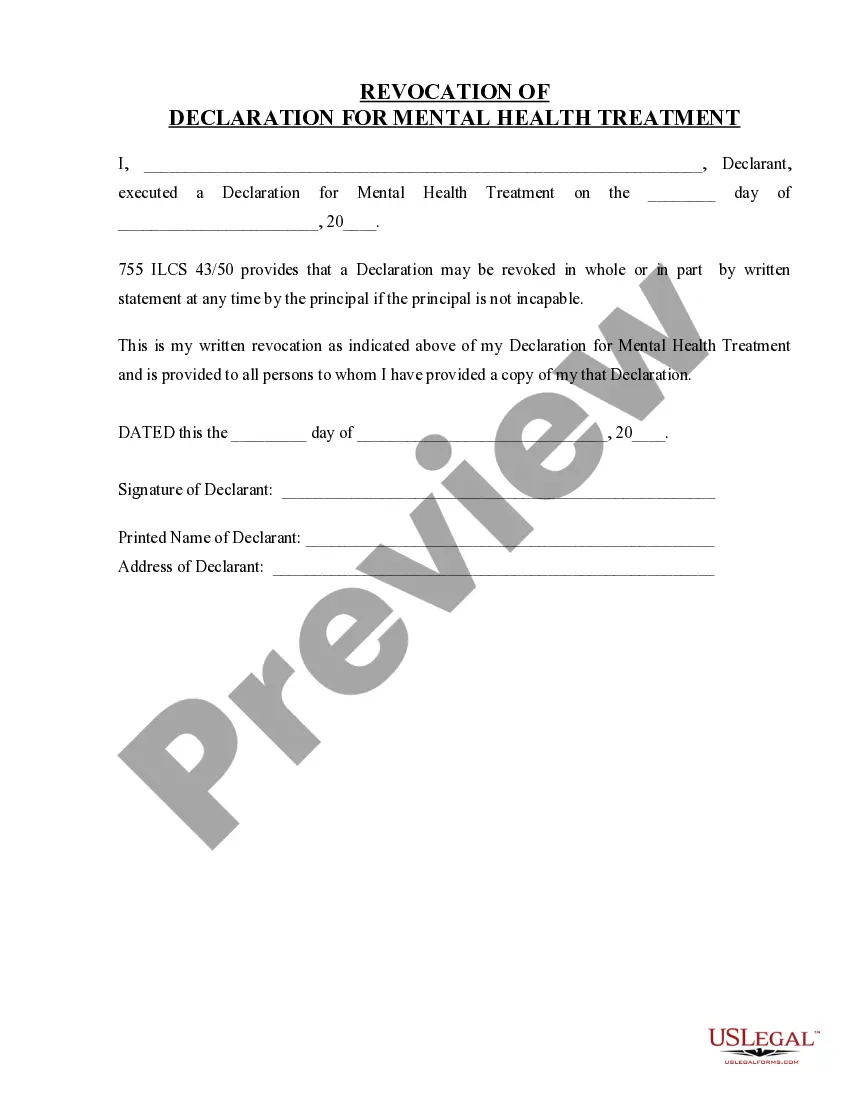

- Use the Review button to inspect the form.

- Check the details to confirm you have selected the correct form.

- If the form isn't what you're looking for, utilize the Search field to find the form that meets your needs.

Form popularity

FAQ

To get approved for a Hawaii Triple Net Lease for Industrial Property, you must demonstrate your capability to meet the lease requirements. This usually includes having a good credit rating, making a substantial down payment, and providing proof of income. Additionally, potential tenants often need to present financial statements or tax returns for better clarity. Using resources like US Legal Forms can streamline your application process and help you gather the needed paperwork efficiently.

Calculating commercial rent under a Hawaii Triple Net Lease for Industrial Property involves considering the base rent plus additional expenses. These expenses typically include property taxes, insurance, and maintenance costs, all of which are passed onto the tenant. To find the total rent amount, you simply add these expenses to the base rent. Utilizing platforms like US Legal Forms can help streamline this process, providing templates and guidelines for calculating your rent effectively.

In the realm of commercial real estate, industrial properties are often the prime candidates for a Hawaii Triple Net Lease for Industrial Property. These leases shift most property expenses to the tenant, including insurance, taxes, and maintenance. This arrangement is appealing for landlords, as it helps stabilize their income. Therefore, if you are considering investing in industrial real estate in Hawaii, a triple net lease might be a beneficial option.

To enter into a triple net lease, you should first identify suitable industrial properties in Hawaii that offer this leasing option. Engage with real estate brokers knowledgeable about the Hawaii Triple Net Lease for Industrial Property to find agreements that meet your needs. Make sure to review the lease terms thoroughly and consult legal advice if necessary. Our platform, uslegalforms, can assist in providing the necessary lease documents to streamline your entry into this market.

A triple net lease, commonly referred to as NNN, shifts the responsibility of property expenses to the tenant. This includes property taxes, insurance, and maintenance costs, allowing the landlord to receive a more predictable income. When considering a Hawaii Triple Net Lease for Industrial Property, it is crucial to understand these obligations, as they can significantly impact your overall expenses. Understanding this agreement benefits tenants and landlords alike.

When calculating commercial rent under a Hawaii Triple Net Lease for Industrial Property, landlords generally take the base rent and add the estimated costs of taxes, insurance, and maintenance. This total ensures that the landlord covers all expenses associated with the property. By accurately forecasting these costs, both parties can negotiate a fair rate, making the lease arrangement more beneficial. For precise calculations, consider using resources from USLegalForms that can assist you effectively.

To structure a Hawaii Triple Net Lease for Industrial Property, start by outlining the base rent and specifying the additional expenses the tenant will cover. Typically, these expenses include property taxes, insurance, and maintenance costs. Clearly defining these parameters helps both parties understand their responsibilities and fosters a smooth leasing experience. Using a legal platform like USLegalForms can provide templates and guidance tailored to your specific needs.