The "look through" trust can affords long term IRA deferrals and special protection or tax benefits for the family. But, as with all specialized tools, you must use it only in the right situation. If the IRA participant names a trust as beneficiary, and the trust meets certain requirements, for purposes of calculating minimum distributions after death, one can "look through" the trust and treat the trust beneficiary as the designated beneficiary of the IRA. You can then use the beneficiary's life expectancy to calculate minimum distributions. Were it not for this "look through" rule, the IRA or plan assets would have to be paid out over a much shorter period after the owner's death, thereby losing long term deferral.

Hawaii Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account

Description

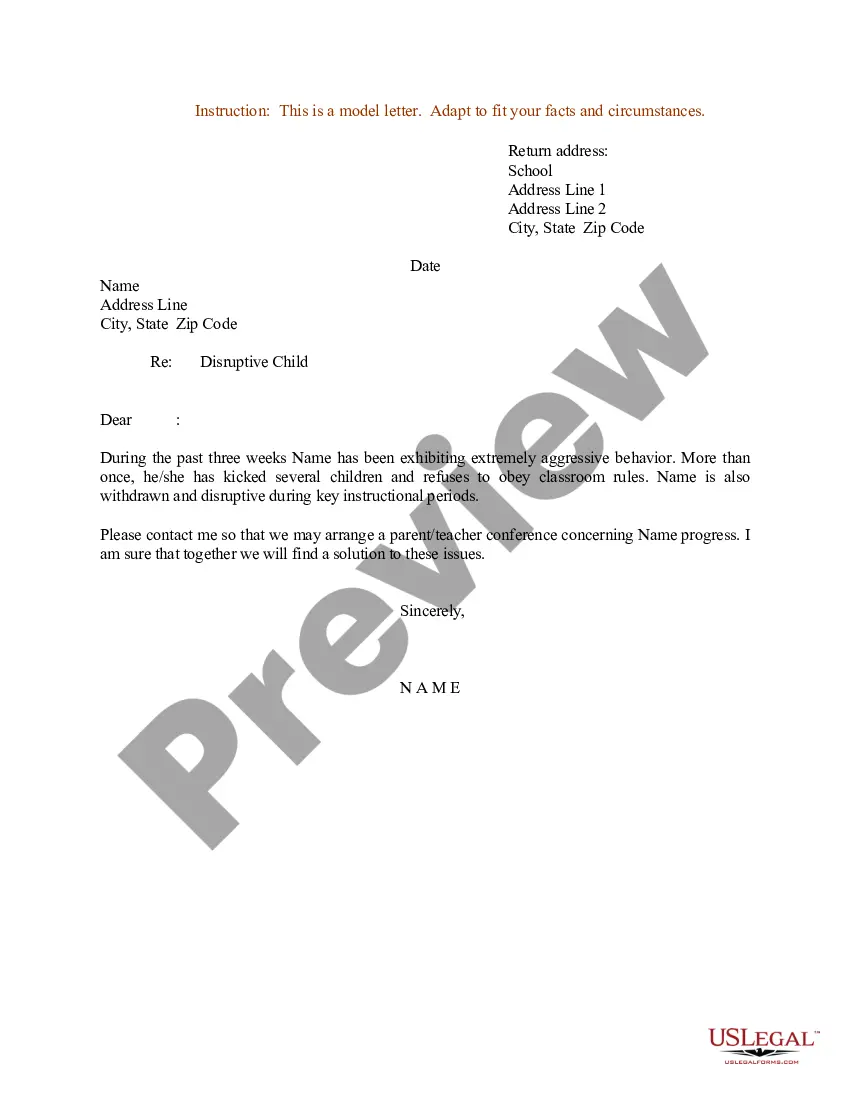

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

Are you presently in the location where you require documents for either business or personal reasons nearly every day.

There are numerous legal document templates accessible online, yet finding ones you can trust is not easy.

US Legal Forms offers a wide variety of template documents, such as the Hawaii Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, which are designed to meet federal and state requirements.

Once you find the correct document, click Buy now.

Choose the pricing plan you prefer, fill in the necessary information to set up your account, and complete the purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Hawaii Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and confirm it is for the correct city/state.

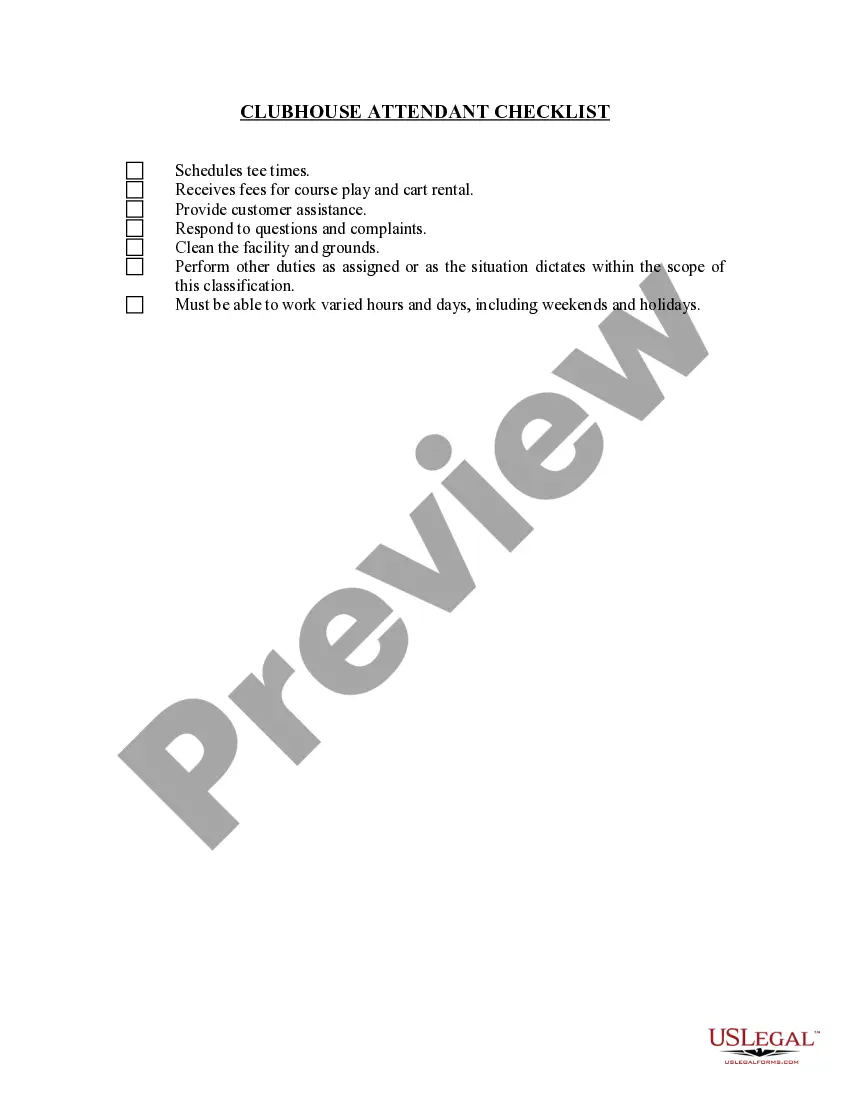

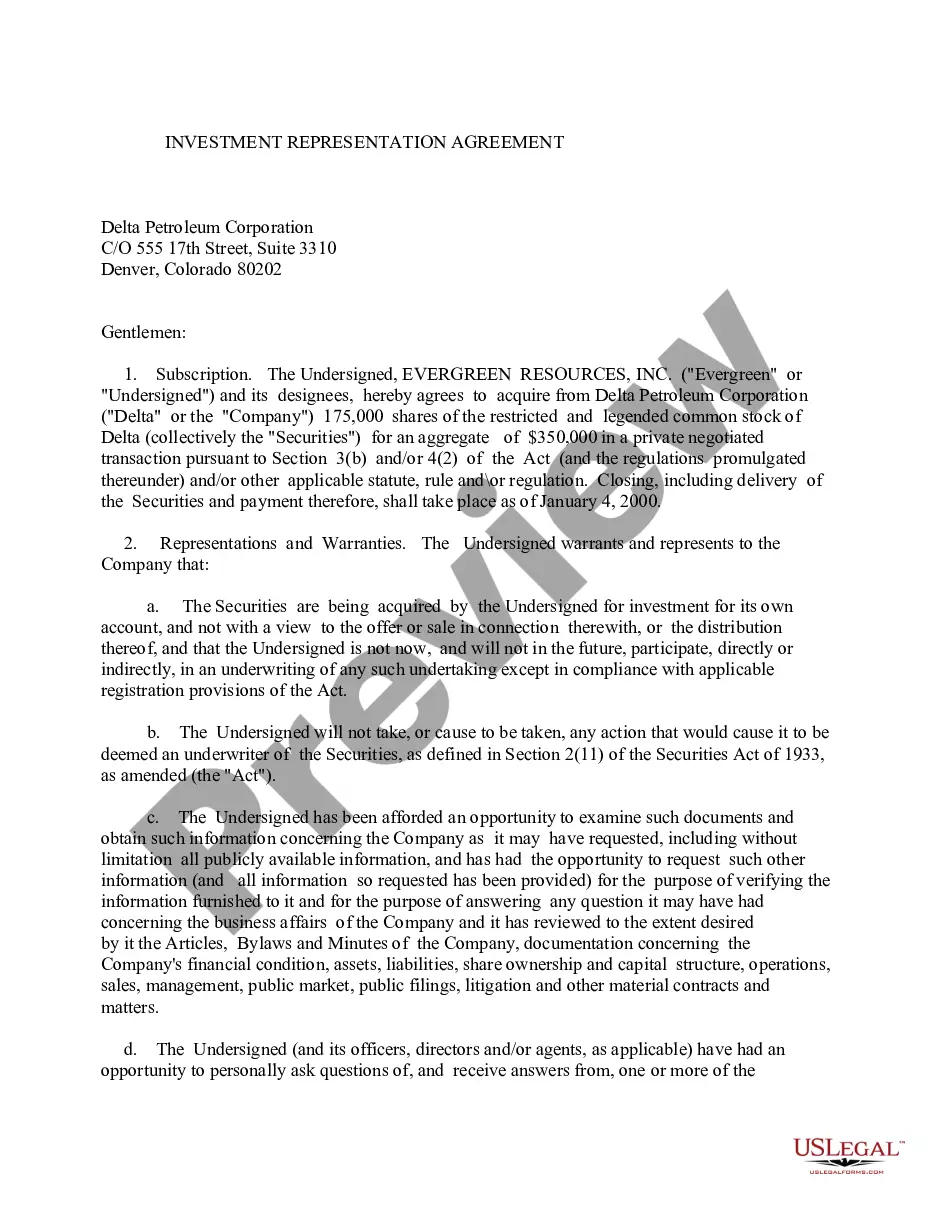

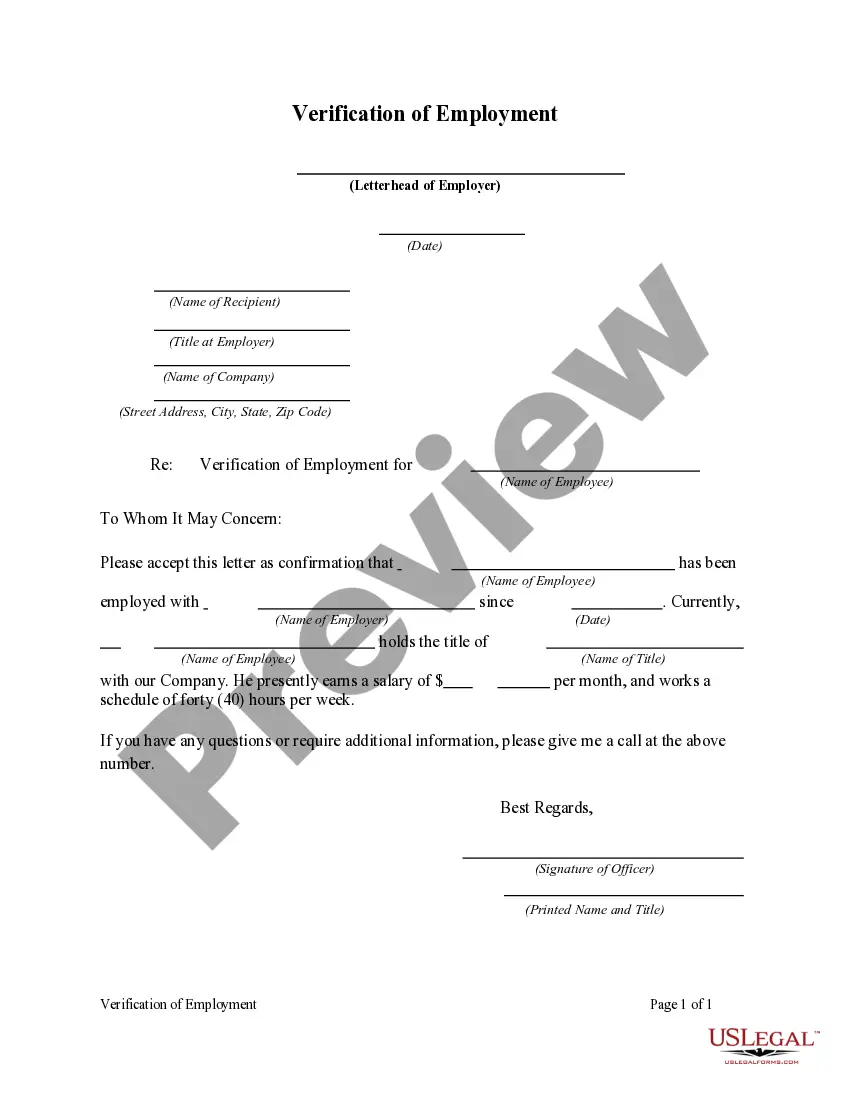

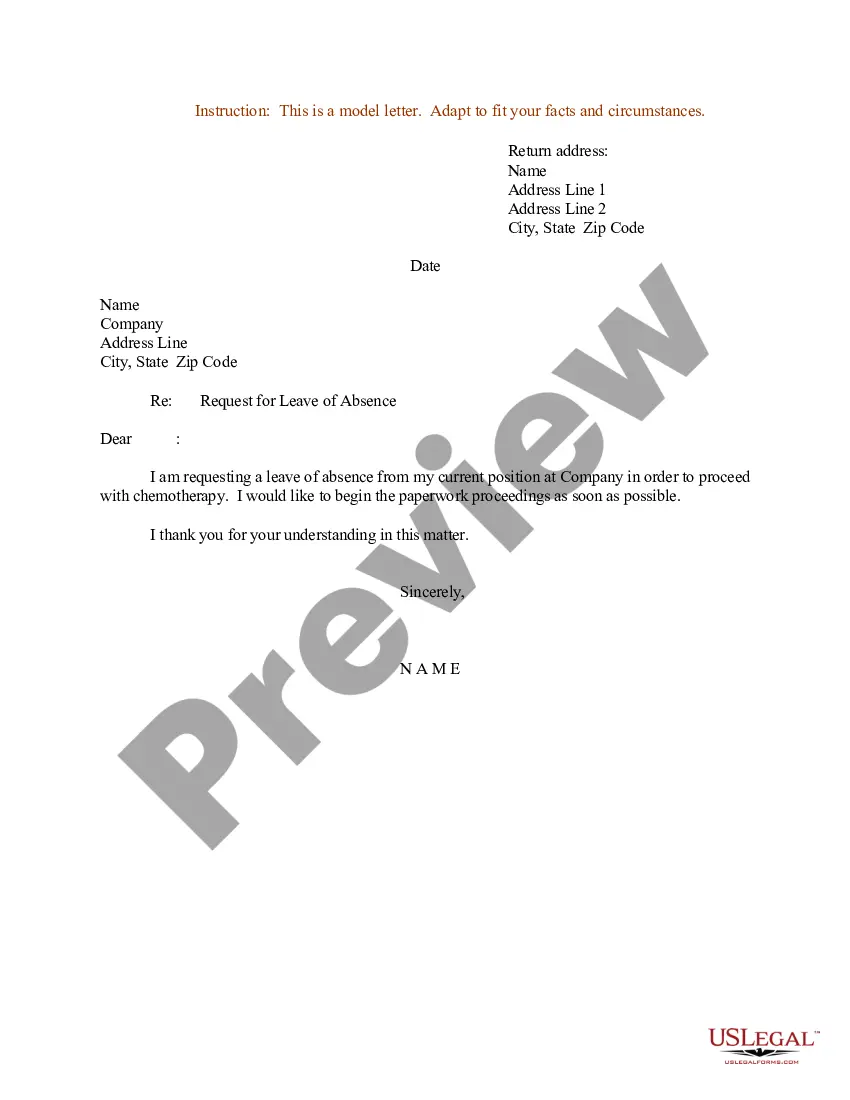

- Use the Review option to examine the form.

- Check the details to ensure you have selected the right document.

- If the document isn’t what you want, use the Research field to find the document that meets your needs and specifications.

Form popularity

FAQ

Yes, a trust can serve as the beneficiary of a retirement account, offering unique benefits. Implementing a Hawaii Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can help in managing distributions and mitigating estate taxes. This setup provides a structured way to pass assets to your heirs while adhering to regulations. It is wise to consult experts to maximize the benefits of this arrangement.

You can place retirement accounts in an irrevocable trust, but it requires careful planning. The Hawaii Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account must meet various criteria to ensure tax advantages are preserved. Transferring a retirement account to such a trust can provide benefits for your heirs, like controlled distributions. However, it's advisable to seek professional guidance to navigate the complexities of these arrangements.

Yes, a trust can be an eligible designated beneficiary under specific conditions. When set up correctly, a Hawaii Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can benefit the trust's beneficiaries. This structure allows for efficient distribution of retirement assets while potentially reducing tax liabilities. It's essential to consult with a financial advisor to ensure compliance with IRS regulations.

Yes, you can designate a Hawaii Irrevocable Trust as the beneficiary of your Individual Retirement Account (IRA). This option allows the trust to inherit the account upon your passing, potentially providing benefits such as asset protection and tax advantages for your beneficiaries. However, it's essential to understand the implications and requirements involved in this process. For personalized guidance, consider exploring US Legal Forms, where you can find resources to set up an irrevocable trust effectively.

Naming a trust as a beneficiary can be beneficial, as it offers protection and control over how assets are disbursed. A Hawaii Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can be particularly useful in managing complex family situations. Ultimately, it's essential to weigh the pros and cons while considering your long-term financial strategy.

One key disadvantage is that naming a trust as a beneficiary can complicate the distribution process and lead to higher administrative costs. If you select a Hawaii Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, make sure you're aware of the associated tax implications and potential delays. Balancing these factors will help you make a sound decision for your estate.

Naming your trust as the beneficiary of your IRA offers advantages such as controlled fund distribution and potential tax benefits. A Hawaii Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can provide these benefits, but it requires careful planning. Assess your financial goals and family needs to make an informed decision.

Yes, an irrevocable trust can be a beneficiary of an IRA, allowing for structured management of the account's distribution. When you select a Hawaii Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, you enable specific guidelines on how the funds are allocated. Consulting a financial advisor about this choice can help clarify its benefits.

The beneficiary of an individual retirement account is the individual or entity designated to receive the account's assets upon your death. If you choose a Hawaii Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, the trust itself becomes the recipient. This choice can facilitate smoother asset management and distribution to your heirs.

Filling out a beneficiary designation typically involves providing the name of the trust, its address, and tax identification number. If you aim to choose a Hawaii Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, ensure you have accurate documentation ready. This clarity will help avoid complications during the transfer of funds after your passing.